Basket trading is an investment approach where an investor trades a group of securities in a single transaction. This "basket" can include stocks, commodities, and other financial instruments grouped based on a specific theme or strategy. The concept of basket trading allows investors to manage multiple securities as one, potentially reducing transaction costs and simplifying portfolio management. Compared to single-asset trading, basket trading offers the advantage of diversification. By holding multiple securities, investors can spread their risk across various instruments rather than betting on a single stock or commodity. On the other hand, trading a single asset may provide the potential for higher returns if the specific asset performs exceptionally well. Basket trading lies somewhere between individual stock trading and index fund investing, allowing customization and diversification. Basket trading originated in the early 1990s as a strategy for institutional investors to manage large volumes of securities efficiently. The adoption of advanced technology, including electronic trading platforms and algorithms, has made it possible for individual investors to engage in basket trading. Over time, basket trading has evolved to include various financial products, such as exchange-traded funds (ETFs), mutual funds, and index funds, which inherently are baskets of individual securities. Basket trades can be used to achieve a number of different objectives, such as: Basket trades can be a complex and risky investment strategy. It is important to understand the risks involved before entering into a basket trade. A basket trade is a financial transaction in which a trader simultaneously buys or sells a group of assets, such as stocks, bonds, or currencies. The components of a basket trade can vary depending on the specific strategy being employed, but they typically include: The execution of a basket trade can be complex due to the sheer number of assets involved. Two primary strategies are used: the 'block' method and the 'slice' method. In the block method, the entire basket is traded at once, ensuring a single price for all assets. This strategy is beneficial for speed but can suffer from potential price slippage. The slice method, on the other hand, breaks the basket into smaller parts that are traded sequentially. This approach may achieve a better overall price but at the cost of increased execution time. In the world of basket trading, brokers play a significant role as they provide the platforms and tools needed to execute these trades. Brokers offer pre-built baskets, allow customers to create their baskets, and provide algorithms and other technological aids to manage the execution of these trades. The primary benefit of basket trading lies in its ability to offer diversification. By investing in a broad range of assets, an investor can spread risk across multiple securities. This approach can help to mitigate the impact of a poor-performing asset on the overall portfolio. Basket trading simplifies portfolio management by grouping multiple assets into one. It helps to reduce the administrative task of tracking each individual security and facilitates more efficient rebalancing of the portfolio. Basket trading allows investors to tailor their investment strategy. For instance, one can create a basket of securities focused on a specific sector or theme or even replicate the composition of an index. The task of selecting and managing a diverse range of securities can be complex. It requires a sound understanding of different asset classes, their correlations, and the potential impact on the basket’s performance. While basket trading can limit losses through diversification, it may also cap extraordinary gains. The performance of a single standout asset can be diluted by other assets within the basket. While basket trading can potentially save on transaction costs, investors should be aware of other costs, such as the expense ratios for ETFs or mutual funds and any fees charged by brokers for the creation or trading of customized baskets. Basket trading plays a pivotal role in asset allocation—a key component of portfolio management. Through basket trading, investors can easily shift their exposure between different asset classes, sectors, or themes based on their investment goals, risk tolerance, and market outlook. Basket trading also allows investors to manage their market exposure more effectively. For instance, by trading a basket that tracks a specific market index, investors can quickly increase or decrease their exposure to the overall market. The quantity of securities within a basket plays a significant role in determining the pricing of a basket trade. The higher the number of securities, the more diverse and potentially less risky the basket can be. However, managing a larger basket can be more complex and may have higher associated costs, affecting the overall pricing of the basket trade. The individual prices of the securities contained within the basket also considerably influence the basket trade's pricing. The price of each security reflects its value in the market, and when combined, these prices give the total value of the basket. More expensive securities will result in a higher-priced basket, and vice versa. The weightage or proportion of each security within the basket also impacts the basket trade's pricing. If higher-weighted securities increase in price, the basket's overall price will increase even if the prices of other securities remain stable or decrease. Thus, the way securities are distributed within the basket, and their individual price changes, directly impact the pricing of the basket trade. The transactional costs related to buying or selling securities can add to the price of a basket trade. These costs can include brokerage fees, taxes, and other transaction charges. Therefore, even if two baskets have the same securities, differences in transaction costs can lead to differences in their overall prices. Market liquidity refers to how quickly and easily securities can be bought or sold in the market without impacting their price. When market liquidity is high, securities can be traded with minimal impact on their prices. In contrast, when liquidity is low, large trades can significantly move the prices. Therefore, market liquidity can substantially influence the pricing of a basket trade. The strategy used to execute the basket trade also affects its pricing. Some strategies prioritize speed and may lead to higher costs due to price slippage, while others might prioritize price control, taking a long time but reducing the cost impact. Depending on the chosen strategy, the pricing of a basket trade can vary significantly. Institutional investors and brokers often use sophisticated algorithms to calculate the optimal price for a basket trade. These algorithms consider all the influencing factors, try to minimize the cost and avoid causing significant market impact. Retail investors typically rely on their brokers or ETF pricing, which is determined by the market supply and demand for the ETF shares. In the United States, basket trading falls under the regulatory oversight of the Securities and Exchange Commission (SEC). The SEC rules aim to ensure fair trading practices and protect investors from potential fraud or manipulation. Specific regulations can apply based on the nature of the basket trade, such as those governing mutual funds and ETFs. Globally, different jurisdictions have their regulations for basket trading, often overseen by their financial regulatory authorities. Despite the differences in specifics, these regulations generally aim to ensure transparency, protect investors, and maintain market stability. Basket trading is a unique investment approach that enables an investor to trade a diversified group of securities in a single transaction. This method offers a distinct balance between managing individual securities and broad-based funds, providing flexibility to align investments with specific strategies. The core concept behind basket trading is to leverage diversification, minimizing the risk linked to the performance of a single security while capitalizing on the potential growth of a sector or theme. Understanding the intricacies of basket trading, including its benefits, drawbacks, execution strategies, and regulatory frameworks, is critical for effectively utilizing this tool in the financial landscape. As technology continues to reshape the investment sphere, basket trading's relevance is anticipated to surge, providing an innovative path for institutional and retail investors to navigate the ever-evolving financial markets.Definition of Basket Trade

History and Evolution of Basket Trade

Objectives in Basket Trades

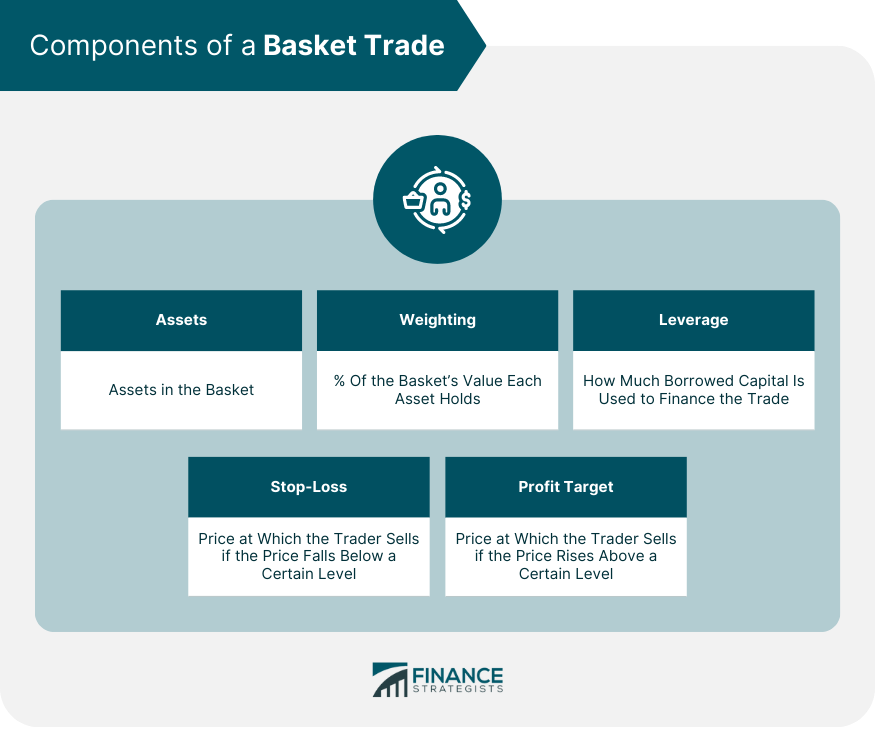

Components of a Basket Trade

Basket Trade Execution

Execution Methods and Strategies

Role of Brokers

Pros of Basket Trade

Diversification

Efficient Portfolio Management

Customized Investment Strategy

Cons of Basket Trade

Potential Complexity

Limited Extraordinary Gains

Cost Considerations

Basket Trade in Portfolio Management

Role in Asset Allocation

Managing Market Exposure

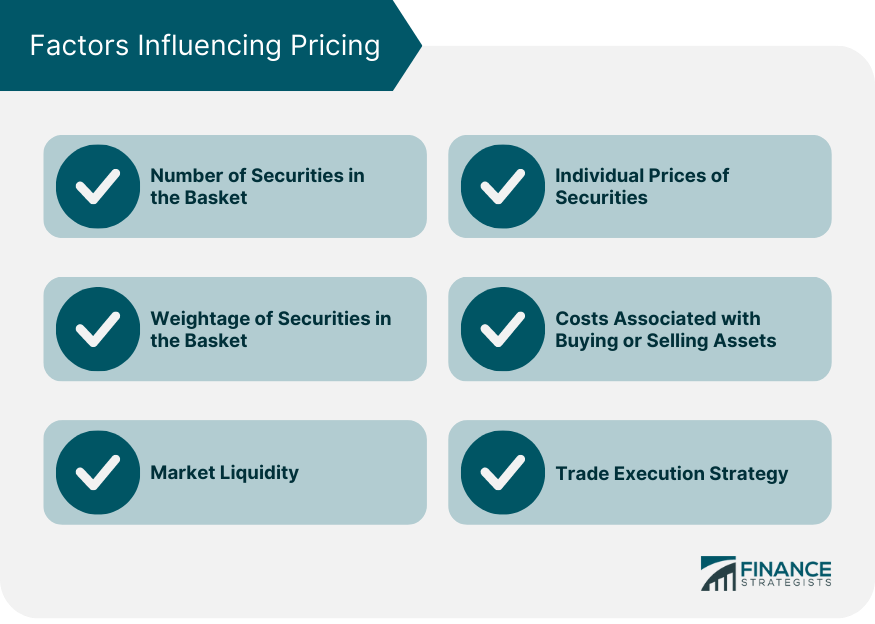

Factors Influencing Basket Trade Pricing

Number of Securities in the Basket

Individual Prices of Securities

Weightage of Securities in the Basket

Costs Associated with Buying or Selling Assets

Market Liquidity

Trade Execution Strategy

Regulatory Framework for Basket Trade

Securities and Exchange Commission (SEC) Regulations

International Standards and Regulations

Final Thoughts

Basket Trade FAQs

Basket trading is an investment strategy where an investor trades a group of diverse securities as a single unit or "basket." This allows for efficient management of multiple securities, potentially reducing transaction costs and offering diversification benefits.

Unlike individual asset trading, where an investor focuses on a single stock or commodity, basket trading allows an investor to spread their risk across a range of securities. It lies between individual stock trading and index fund investing, providing a balance of customization and diversification.

ETFs inherently are baskets of assets. They can track a specific index, sector, or theme, and by investing in an ETF, an investor indirectly engages in basket trading, gaining exposure to a diverse range of securities represented by the ETF.

The main advantages of basket trading include diversification benefits and the mitigation of risk. However, it can be more complex than individual asset trading due to the number of securities involved. Also, while it can buffer against extreme losses, it may limit the potential for extraordinary gains.

With the ongoing advancements in technology and the growing popularity of thematic and passive investing, basket trading is predicted to become more prevalent in the future. It provides an efficient and flexible path for investors to manage diversified portfolios and align with their investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.