A well-planned retirement strategy is essential for ensuring a comfortable and secure retirement. The Retirement Bucket Strategy is a popular method for managing retirement assets, offering several advantages in terms of flexibility and risk management. The Retirement Bucket Strategy is an approach to organizing retirement assets into separate buckets based on the time horizon and risk profile. It helps retirees manage their investments and withdrawal strategies effectively. A sound retirement strategy provides financial security and peace of mind during retirement. It helps retirees meet their income needs and achieve their financial goals while mitigating various risks. A Retirement Bucket Strategy is a popular approach for managing finances during retirement. It is designed to strike a balance between preserving wealth and generating income by dividing retirement assets into three distinct buckets: short-term, intermediate-term, and long-term. The short-term bucket is dedicated to highly liquid assets, such as cash, money market accounts, and short-term certificates of deposit (CDs). This bucket plays a crucial role in addressing the retiree's immediate expenses, such as day-to-day living costs, unexpected medical bills, and other emergencies. The primary purpose of the short-term bucket is to provide easy access to funds without exposing the retiree to significant market risks. It is typically recommended to hold 1-2 years' worth of living expenses in this bucket to ensure sufficient liquidity in case of unforeseen circumstances. The intermediate-term bucket includes conservative investments like bonds, fixed income securities, and bond funds. These investments offer more moderate levels of risk compared to equities and are designed to generate income while preserving capital over a medium-term time horizon (3-10 years). The income generated from this bucket can be used to replenish the short-term bucket as needed, allowing the retiree to maintain a stable source of income without depleting their principal. Additionally, fixed income investments can provide a cushion against market volatility, protecting the retiree's wealth during economic downturns. The long-term bucket focuses on growth-oriented investments, such as individual stocks, exchange-traded funds (ETFs), and mutual funds that invest in equities. This bucket is designed to provide long-term growth and capital appreciation, supporting the retiree's spending needs over an extended retirement period (10+ years). Equity investments can offer higher returns than fixed income investments, but they also carry higher risk. Therefore, this bucket is suitable for a longer time horizon, allowing the retiree to ride out market fluctuations and capitalize on the long-term growth potential of equities. To implement a Retirement Bucket Strategy, retirees need to assess their income needs, allocate assets, and monitor their bucket allocations. Retirees should start by estimating their annual expenses and determining the amount of income required to cover those costs. This process helps in allocating assets to each bucket. Once income needs are assessed, retirees can allocate their assets among the three buckets based on their risk tolerance, time horizon, and investment objectives. Regularly reviewing and rebalancing the buckets ensures that the strategy remains aligned with retirees' financial goals and changing market conditions. The Retirement Bucket Strategy can be customized based on individual risk tolerance, income sources, and market conditions. Retirees with different risk tolerances can adjust their bucket allocations to reflect their preferences, opting for more conservative or aggressive investment mixes. Retirees should consider other income sources, such as Social Security, pensions, and annuities, when implementing their bucket strategy. This can help optimize the overall retirement income plan. The Retirement Bucket Strategy should be flexible enough to accommodate changes in market conditions, allowing retirees to adjust their asset allocations and withdrawal strategies accordingly. The Retirement Bucket Strategy offers multiple benefits to retirees, including flexibility, risk mitigation, and psychological advantages. This strategy allows retirees to adjust their asset allocation and withdrawal strategies based on changing needs and market conditions. It provides a clear framework for managing investments throughout retirement. By separating assets based on the time horizon, this strategy reduces the impact of negative returns on retirement income. It ensures that short-term income needs are met while preserving long-term growth potential. Having separate buckets for different investment horizons can provide a sense of control and comfort to retirees. It helps them visualize their financial future and make more informed decisions. Despite its benefits, the Retirement Bucket Strategy also has some challenges and limitations that retirees should be aware of. Estimating the length of retirement can be challenging, as longevity is uncertain. This makes it difficult to determine the ideal allocation for each bucket and the appropriate withdrawal rate. Inflation and market volatility can impact the value of assets in each bucket. Retirees should account for these factors when implementing their bucket strategy to maintain their purchasing power and avoid running out of funds. Emotions can influence retirees' investment decisions, leading to suboptimal choices. It's essential for retirees to remain disciplined and stick to their bucket strategy, even during periods of market turbulence. In conclusion, the Retirement Bucket Strategy offers a flexible and effective way to manage retirement assets, but it's crucial to weigh its pros and cons. Retirees should carefully consider the advantages and challenges of the Retirement Bucket Strategy to determine if it's the right approach for their financial goals and personal circumstances. It's also essential for retirees to explore and compare other retirement strategies, such as annuities, systematic withdrawal plans, or dividend income strategies, to ensure they choose the most suitable option for their needs.What Is a Retirement Bucket Strategy?

Key Components of a Retirement Bucket Strategy

Each bucket serves a unique purpose and focuses on different investment types and time horizons to help ensure a stable and secure retirement.Short-Term Bucket: Liquid Assets

Intermediate-Term Bucket: Fixed Income Investments

Long-Term Bucket: Equity Investments

Periodically, gains from the long-term bucket can be used to replenish the intermediate and short-term buckets, ensuring a sustainable flow of funds throughout retirement.Implementation of Retirement Bucket Strategy

Assessing Retirement Income Needs

Allocating Assets Across Buckets

Rebalancing and Monitoring Bucket Allocations

Adapting the Retirement Bucket Strategy to Personal Circumstances

Adjusting for Different Risk Tolerances

Incorporating Various Sources of Income

Adapting to Changing Market Conditions

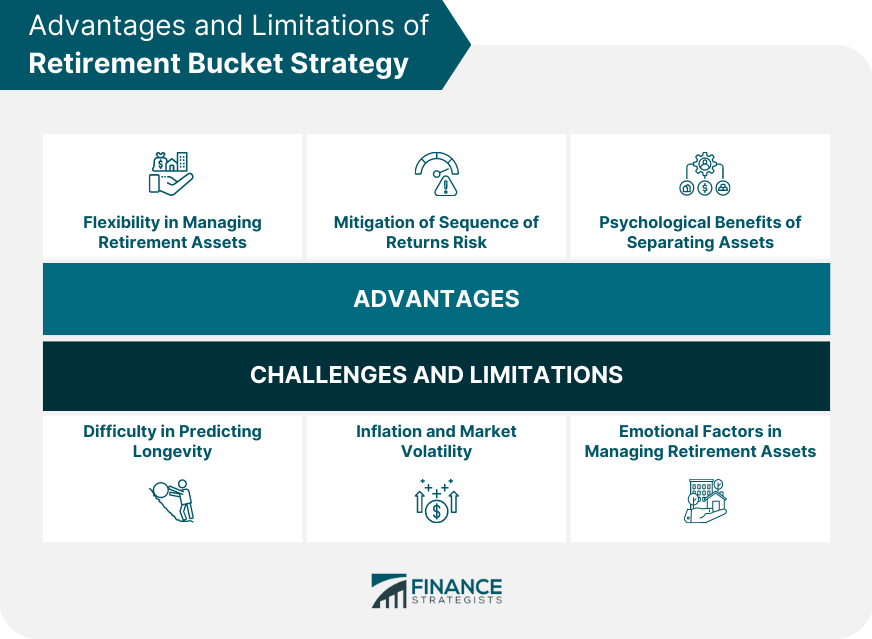

Advantages of Using Retirement Bucket Strategy

Flexibility in Managing Retirement Assets

Mitigation of Sequence of Returns Risk

Psychological Benefits of Separating Assets

Challenges and Limitations of Retirement Bucket Strategy

Difficulty in Predicting Longevity

Inflation and Market Volatility

Emotional Factors in Managing Retirement Assets

Conclusion

Retirement Bucket Strategy FAQs

It is a retirement planning approach where funds are divided into different "buckets" based on time horizon and risk tolerance.

It helps retirees better manage their investments, reduces risk, and provides a clear plan for withdrawing money during retirement.

It typically includes a cash bucket for short-term needs, a fixed-income bucket for medium-term needs, and a growth bucket for long-term needs.

It depends on your individual needs and goals, including factors like retirement age, desired lifestyle, and risk tolerance. Consult a financial advisor for personalized advice.

No, it may not be suitable for individuals with a shorter time horizon or those who are uncomfortable with market volatility. It's important to evaluate your own situation before adopting any investment strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.