Real Estate Syndication is a collaborative investment strategy wherein multiple investors pool their financial resources and expertise to acquire, develop, or manage a property or portfolio of properties. This collective approach enables participants to access more significant and potentially more profitable real estate opportunities than they could individually. Sponsors are responsible for identifying, acquiring, and managing the real estate investments within a syndicate. They bring industry knowledge and expertise to the table, ensuring the success of the venture. Sponsors are responsible for several tasks, including: Identifying and acquiring investment properties Securing financing and equity partners Overseeing property management and operations Coordinating with real estate professionals, such as brokers, attorneys, and accountants There are two main types of sponsors: 1. General Partners (GPs) are responsible for the day-to-day management of the syndicate and typically contribute a portion of the equity. 2. Limited Partners (LPs) are passive investors who contribute capital but do not participate in the day-to-day management of the syndicate. Investors in real estate syndicates can be classified into two categories: Active investors are those who actively participate in the management and decision-making process of the syndicate. They are typically general partners or sponsors. Passive investors contribute capital to the syndicate but do not participate in its management. They rely on the expertise of the sponsors to manage the investment and generate returns. Real estate syndicates work with various professionals to ensure the success of their investments. Some of these professionals include: Property managers Real estate brokers Attorneys Accountants There are three primary types of real estate syndications: In equity syndications, investors pool their capital to acquire ownership of a property. They share in the property's cash flow, appreciation, and profits from the eventual sale of the property. Debt syndications involve investors pooling their capital to provide loans for property owners or developers. The investors earn returns from the interest and principal repayments made by the borrower. Hybrid syndications combine elements of both equity and debt syndications. Investors may provide both debt financing and equity investments in a single property or project. Real estate syndications can take on various legal structures, such as: Limited partnerships consist of one or more general partners who manage the syndicate and limited partners who contribute capital but do not participate in management. Limited partners have limited liability for the partnership's debts and obligations. LLCs are popular legal structures for real estate syndications, offering limited liability protection for investors and flexible management options. They can be structured as single-member or multi-member LLCs. REITs are publicly traded or non-traded investment vehicles that pool investor capital to invest in income-producing real estate properties. REITs offer investors the benefits of real estate ownership without the direct responsibility of property management. Real estate syndications can be structured in various ways, including: Investors directly invest in the syndicate, either as equity partners or debt providers. Crowdfunding platforms enable investors to pool their capital and invest in real estate syndications online. This method provides broader access to investment opportunities and simplifies the investment process for smaller investors. Private placements involve raising capital from accredited investors through private offerings. These offerings are exempt from the registration requirements of the Securities Act of 1933, provided they meet specific criteria. The real estate syndication process involves several steps: Sponsors research and analyze potential investment properties, considering factors such as location, market conditions, property type, and potential returns. Sponsors perform thorough due diligence on the selected properties, evaluating their physical condition, financial performance, and potential risks and rewards. Sponsors assemble a team of real estate professionals, including property managers, brokers, attorneys, and accountants, to support the syndication process. Sponsors secure financing from banks, private lenders, or investors to fund the acquisition and management of the property. Sponsors create the legal structure and draft the necessary documentation, such as operating agreements, private placement memorandums, and subscription agreements. Once the syndication is established, the sponsors acquire the property and oversee its management, including property improvements, leasing, and maintenance. Sponsors identify exit strategies, such as selling the property or refinancing, to generate returns for investors. Profits are distributed according to the agreed-upon terms in the syndication documents. Real estate syndications must adhere to several regulatory and compliance aspects, including: Securities laws govern the offering and sale of investments in real estate syndications. Syndicators must comply with these laws or qualify for exemptions, such as Regulation D private placements. Real estate syndications must comply with SEC regulations, including filing appropriate forms and disclosures. Non-compliance can result in fines, penalties, or legal action. In addition to federal regulations, real estate syndications must also comply with state securities laws, which may vary from state to state. Real estate syndication offers several benefits for investors, including: Investing in real estate syndications allows investors to diversify their portfolios by adding real estate assets, reducing the overall risk of their investments. By pooling resources, syndication investors can access larger, more profitable investment opportunities than they could individually. Syndication investors benefit from the expertise of professional sponsors and real estate managers who oversee the acquisition and management of properties. Passive investors in real estate syndications can earn income from cash flow and property appreciation without actively managing the investment. Real estate syndications offer various tax benefits, including depreciation deductions and pass-through taxation. Investing in real estate syndications comes with certain risks and challenges, such as: Changes in market conditions, such as economic downturns or fluctuations in property values, can negatively impact the performance of real estate syndications. Real estate syndications are relatively illiquid investments, which means that investors may not be able to easily sell their interests or access their capital when needed. The success of syndication depends on the expertise and performance of the sponsor. Poor management or decision-making can result in losses for investors. Real estate syndications are subject to various legal and regulatory requirements, and non-compliance can result in financial penalties or legal disputes. Operational risks, such as property damage, tenant vacancies, or mismanagement, can adversely affect the performance of real estate syndications. To maximize the potential for success in real estate syndications, investors and sponsors should consider the following best practices: Investors should thoroughly research potential sponsors, evaluating their track record, experience, and reputation in the industry. Sponsors should maintain open lines of communication with investors, providing regular updates on property performance, financial results, and any significant events or changes. Investors should diversify their real estate syndication investments to reduce exposure to specific property types, markets, or sponsors. Sponsors should conduct regular financial analyses of their syndication investments, evaluating performance against projections and adjusting strategies as needed. Investors and sponsors should stay informed about industry trends and best practices by participating in educational events, networking with other professionals, and reading industry publications. Real estate syndication is a powerful investment strategy that allows multiple investors to pool their resources and expertise to access more significant and profitable real estate opportunities. Key players in syndications include sponsors, investors, and real estate professionals, while legal structures can range from limited partnerships to LLCs and REITs. There are various types of syndications, such as equity, debt, and hybrid, each with its own benefits and risks. To ensure success, it is crucial for investors and sponsors to follow best practices, including thorough due diligence, effective communication, risk management, and ongoing education. By understanding the intricacies of real estate syndication, investors can unlock its potential and diversify their investment portfolios while generating passive income and enjoying the benefits of professional management.Definition of Real Estate Syndication

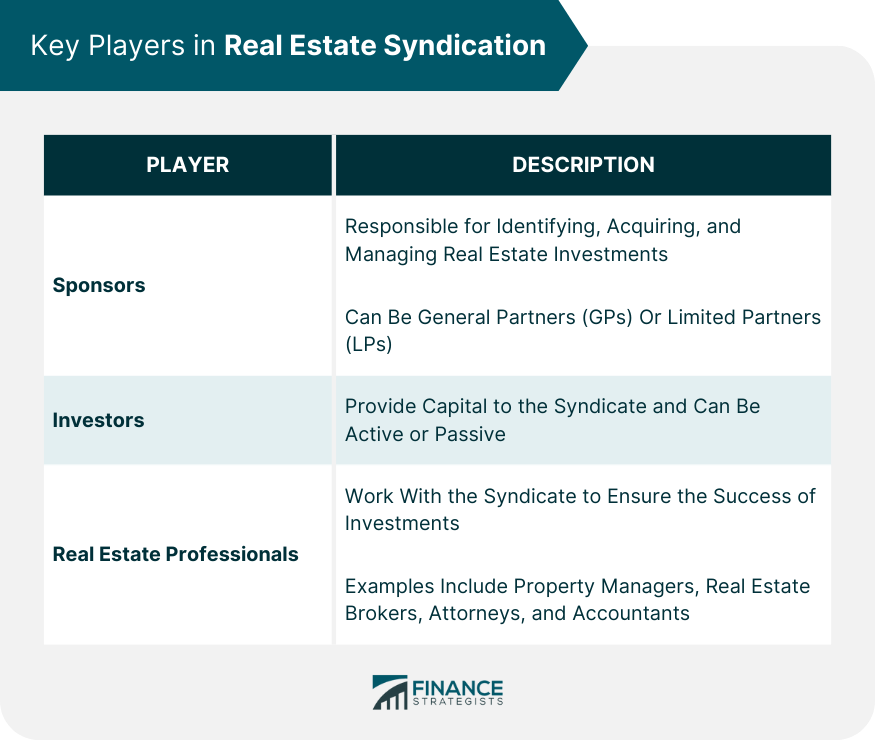

Key Players in Real Estate Syndication

Sponsors

Roles and Responsibilities

Types of Sponsors

Investors

Active Investors

Passive Investors

Real Estate Professionals

Types of Real Estate Syndications

Equity Syndications

Debt Syndications

Hybrid Syndications

Structure of Real Estate Syndication

Legal Structures

Limited Partnerships

Limited Liability Companies (LLCs)

Real Estate Investment Trusts (REITs)

Investment Structures

Direct Investment

Crowdfunding

Private Placements

Real Estate Syndication Process

Identifying Investment Opportunities

Due Diligence and Property Analysis

Assembling the Syndication Team

Securing Financing

Legal Documentation and Formation

Property Acquisition and Management

Exit Strategies and Distribution of Profits

Regulatory and Compliance Aspects

Securities Laws and Exemptions

Securities and Exchange Commission (SEC) Regulations

State Securities Regulations

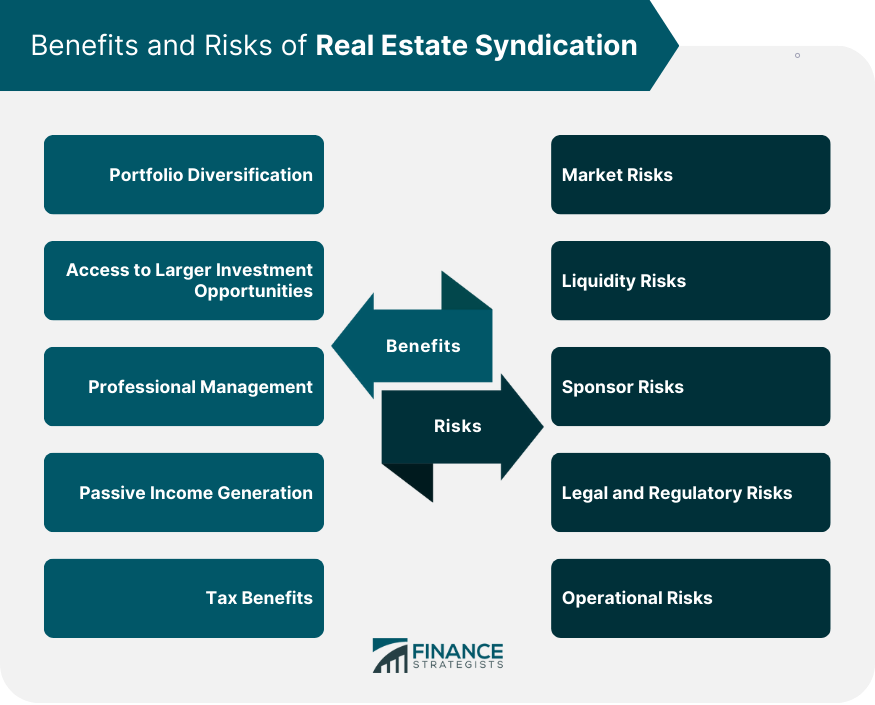

Benefits of Real Estate Syndication

Portfolio Diversification

Access to Larger Investment Opportunities

Professional Management

Passive Income Generation

Tax Benefits

Risks and Challenges of Real Estate Syndication

Market Risks

Liquidity Risks

Sponsor Risks

Legal and Regulatory Risks

Operational Risks

Best Practices for Real Estate Syndication Success

Sponsor Selection and Due Diligence

Communication and Transparency

Risk Management and Diversification

Financial Planning and Analysis

Ongoing Education and Networking

Conclusion

Real Estate Syndication FAQs

Real estate syndication is a method of pooling financial resources and expertise from multiple investors to invest in larger, more lucrative properties than they could individually. The process involves key players such as sponsors, investors, and real estate professionals working together to acquire, manage, and eventually sell the property or generate income from its operations.

There are three primary types of real estate syndications: equity syndications, debt syndications, and hybrid syndications. Equity syndications involve investors pooling their capital to acquire ownership of a property, while debt syndications involve investors providing loans for property owners or developers. Hybrid syndications combine elements of both equity and debt syndications.

Investing in real estate syndications offers several benefits, including portfolio diversification, access to larger investment opportunities, professional management, passive income generation, and tax benefits. These advantages can make real estate syndications an attractive option for investors seeking to expand their investment portfolios.

Some risks associated with real estate syndications include market risks, liquidity risks, sponsor risks, legal and regulatory risks, and operational risks. Investors should carefully consider these risks before participating in syndication and conduct thorough due diligence to minimize potential losses.

To get started with real estate syndication investments, you can research potential sponsors, investment opportunities, and legal structures. Consider networking with other investors, joining real estate investment groups, or participating in industry events to learn more about syndication opportunities. Additionally, you can explore online crowdfunding platforms that offer access to syndicated investments. It's essential to conduct thorough due diligence before investing in any real estate syndication to ensure a successful outcome.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.