The Real Estate Settlement Procedures Act, commonly referred to as RESPA, is a federal law enacted in the United States in 1974. It was designed to bring more transparency to homebuyers and to protect them during the process of purchasing residential property. RESPA applies primarily to federally related mortgage loans, covering most residential first mortgages. It establishes a set of mandatory disclosures and requirements to prevent harmful practices such as kickbacks or referral fees, among others. The main purpose of RESPA is to protect consumers during the homebuying process, a complex and often daunting endeavor. RESPA does this by mandating certain disclosures and prohibiting certain practices. It helps homebuyers understand their rights and the costs associated with real estate transactions, providing a level playing field in the mortgage marketplace. RESPA emerged from a period of reform in the United States during the early 1970s. Congress recognized the need to safeguard consumers during real estate transactions, and RESPA was passed as a solution. The law was later amended in 1990 to cover additional abusive practices and again in 2010 under the Dodd-Frank Wall Street Reform and Consumer Protection Act, which gave enforcement authority to the Consumer Financial Protection Bureau (CFPB). The objectives and goals of RESPA are simple and consumer-centric. The act seeks to ensure transparency and fairness in the real estate settlement process by requiring lenders to provide consumers with timely and adequate disclosures. These disclosures enable consumers to understand the nature and cost of the real estate settlement process. In addition, RESPA aims to shield consumers from abusive practices such as kickbacks and unnecessary charges. Section 6 of RESPA prohibits the giving or accepting of any fee, kickback, or anything of value in exchange for referrals of settlement service business. This provision seeks to eliminate under-the-table deals that can inflate costs for consumers. Business arrangements between service providers are allowed under RESPA, but only if certain conditions are met. Notably, any payment received must be for services actually performed and not merely for the referral. Section 8 of RESPA prohibits certain practices related to settlement services. It forbids anyone from giving or accepting a fee, kickback, or any other thing of value in exchange for referrals of settlement service business involving a federally related mortgage loan. This prohibition extends to the giving or accepting of any part of a charge for services that are not performed. The intent of this section is to ensure that consumers receive services at fair prices, without artificially inflated costs due to unearned fees or kickbacks. Section 9 of RESPA contains disclosure requirements for loan servicing. It mandates that loan servicers provide clear and timely disclosures to borrowers regarding the servicing of their loans. This includes information about the assignment, sale, or transfer of loan servicing to another entity. These disclosures must be given at the time of loan settlement and also if the loan servicing is transferred thereafter. Section 10 of RESPA imposes requirements on the handling of escrow accounts. Escrow accounts are typically used to pay taxes and insurance related to the property. Under RESPA, lenders are required to provide initial and annual escrow statements to borrowers. These statements outline the taxes and insurance premiums paid from the account and detail the escrow payments required from the borrower. Section 12 of RESPA prohibits sellers from requiring homebuyers to purchase title insurance from a particular company. This provision allows buyers to shop for title insurance, fostering competition and potentially lowering prices. While sellers can recommend a title insurance company, they cannot require the buyer to use that company. This prohibition ensures that consumers have freedom of choice and are not coerced into purchasing services from specific providers. Section 13 of RESPA prohibits the mandatory use of affiliated settlement service providers. This means that a lender cannot require a borrower to use an affiliated service provider, such as a specific title insurance company or closing attorney. By prohibiting this practice, RESPA seeks to protect consumers from situations where they could be directed towards high-cost providers due to affiliations rather than the quality or cost of service. The impact of RESPA on consumer rights and interests is substantial. By promoting transparency and prohibiting harmful practices, RESPA empowers consumers in the real estate settlement process. The act ensures that consumers receive timely and adequate information about their loan and settlement costs. It also protects consumers from abusive practices, such as kickbacks or referral fees, that can inflate costs or lead to subpar services. RESPA plays a crucial role in ensuring transparency and fairness in real estate transactions. It requires lenders to provide clear and comprehensive disclosures about the nature and costs of the real estate settlement process. These disclosures allow consumers to better understand the process and make informed decisions. By prohibiting certain practices, RESPA also promotes fairness, ensuring that consumers receive quality services at a fair price. RESPA provides several remedies and enforcement mechanisms to protect consumers. Consumers can file complaints with the Consumer Financial Protection Bureau (CFPB), which enforces RESPA. Consumers may also have the right to sue under RESPA. For instance, if a service provider violates the prohibition against kickbacks or referral fees, a consumer can bring a lawsuit and potentially recover three times the amount of any charge paid. Financial institutions have significant compliance responsibilities under RESPA. Lenders and mortgage servicers must provide a series of disclosures to borrowers throughout the loan process. They also must adhere to the act's prohibitions on certain practices, such as giving or accepting kickbacks in exchange for referrals. Additionally, institutions are responsible for properly handling escrow accounts, providing borrowers with periodic statements, and responding promptly to written borrower inquiries or complaints. RESPA places significant disclosure and transparency requirements on financial institutions. These institutions must provide disclosures at various points during the loan process, including when the borrower applies for a loan, when the loan is settled, and if the loan servicing is transferred. These disclosures must clearly explain the costs associated with the loan and the real estate settlement process. This transparency helps consumers understand their obligations and the costs they will incur. RESPA has important implications for mortgage origination and servicing practices. For example, mortgage servicers must respond promptly to written inquiries or complaints from borrowers. Additionally, when originating a mortgage, lenders must give borrowers the opportunity to shop for certain services, fostering competition and potentially lowering prices. These and other requirements can impact the way institutions conduct their operations and interact with consumers. RESPA has a close relationship with the Truth in Lending Act (TILA), another important consumer protection law. TILA requires lenders to provide consumers with clear and accurate information about the cost of credit. Both RESPA and TILA share the goal of empowering consumers through transparent and accurate disclosures. In 2015, the CFPB integrated the disclosures required by RESPA and TILA into two forms to make the loan process more understandable for consumers. RESPA aligns closely with the Consumer Financial Protection Bureau (CFPB) regulations. The CFPB is responsible for enforcing RESPA, along with several other consumer protection laws. The Bureau's regulations seek to protect consumers from unfair, deceptive, or abusive practices in financial transactions. By requiring transparent disclosures and prohibiting harmful practices, RESPA complements these regulatory efforts. While RESPA is a federal law, it doesn't operate in isolation from state laws. Each state has its own real estate laws and regulations, and these may interact with RESPA in various ways. For instance, state laws may establish additional requirements or consumer protections beyond those provided by RESPA. In such cases, lenders and other service providers must comply with both the state and federal regulations. Since its inception, RESPA has undergone several updates to its regulations and guidance. One of the most significant changes came in 2010, when enforcement of RESPA transferred to the CFPB. In recent years, the CFPB has continued to update RESPA regulations and guidance. These updates aim to address emerging issues and to enhance protections for consumers. The impact of RESPA on the real estate industry is substantial. By requiring disclosures and prohibiting certain practices, RESPA has helped to create a more transparent and fair marketplace. However, compliance with RESPA also imposes costs on the industry. Service providers must invest in compliance systems and training, and they may face penalties for violations. While RESPA has many benefits, it has also faced criticisms and challenges. Some argue that the law is overly complex and burdensome, especially for smaller service providers. Others suggest that RESPA could be more effective in preventing certain abusive practices. These criticisms underscore the ongoing need to balance consumer protection with industry concerns. RESPA is a critical piece of legislation that plays a vital role in the U.S. housing market. Its main function is to safeguard consumers, ensuring they have access to transparent and accurate information during the homebuying process. Through its various provisions, RESPA seeks to shield consumers from potentially unfair and costly practices. RESPA's role extends beyond the domain of real estate transactions. It has a significant bearing on wealth management, primarily because purchasing a home is one of the largest financial decisions a person will make. By providing transparent disclosures and protections against abusive practices, RESPA helps individuals make informed decisions that can significantly impact their financial health and wealth.What Is the Real Estate Settlement Procedures Act (RESPA)?

Background and Purpose of RESPA

Historical Context and Legislative Background

Objectives and Goals of RESPA

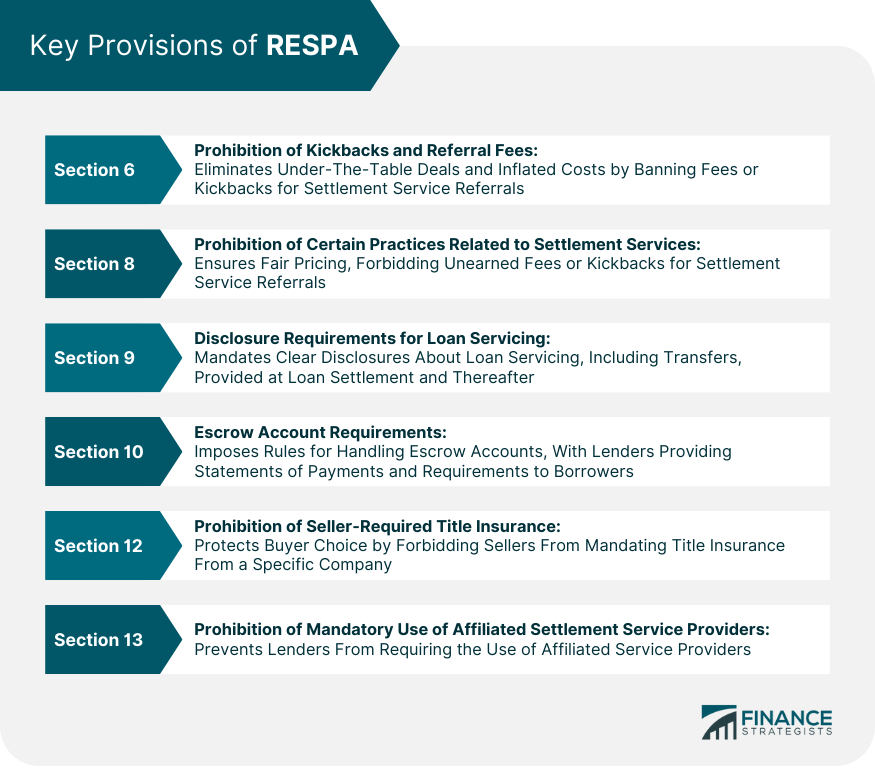

Key Provisions of RESPA

Section 6: Prohibition of Kickbacks and Referral Fees

Section 8: Prohibition of Certain Practices Related to Settlement Services

Section 9: Disclosure Requirements for Loan Servicing

Section 10: Escrow Account Requirements

Section 12: Prohibition of Seller-Required Title Insurance

Section 13: Prohibition of Mandatory Use of Affiliated Settlement Service Providers

RESPA and Consumer Protection

Impact of RESPA on Consumer Rights and Interests

Ensuring Transparency and Fairness in Real Estate Transactions

Consumer Remedies and Enforcement Mechanisms Under RESPA

RESPA and the Role of Financial Institutions

Compliance Responsibilities of Lenders and Mortgage Servicers

Disclosures and Transparency Requirements for Financial Institutions

Implications for Mortgage Origination and Servicing Practices

RESPA's Relationship With Other Laws and Regulations

Connection to the Truth in Lending Act (TILA)

Alignment With the Consumer Financial Protection Bureau (CFPB) Regulations

Interaction With State-Specific Real Estate Laws and Regulations

Recent Developments and Controversies

Updates to RESPA Regulations and Guidance

Impact of RESPA on the Real Estate Industry

Criticisms and Challenges to RESPA's Effectiveness

Final Thoughts

Real Estate Settlement Procedures Act (RESPA) FAQs

RESPA is a U.S. federal law that protects consumers during the homebuying process. It provides for the disclosure of settlement costs and prohibits certain practices that can inflate the cost of closing a real estate transaction.

RESPA is enforced by the Consumer Financial Protection Bureau (CFPB).

RESPA covers most residential real estate transactions that involve a federally related mortgage loan.

RESPA prohibits practices such as the giving or accepting of kickbacks or referral fees in exchange for referrals of settlement service business. It also prohibits service providers from charging for services they did not actually perform.

Consumers have the right to receive disclosures about the cost of their real estate transaction, to be protected from certain harmful practices, and to sue for violations of certain RESPA provisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.