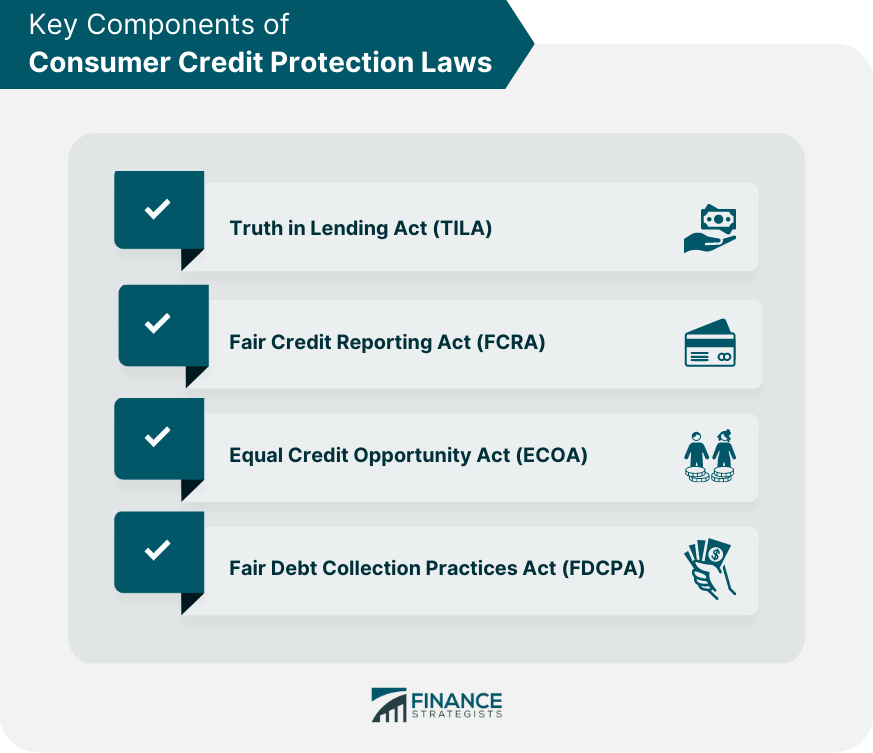

Consumer credit protection law refers to a set of regulations designed to protect consumers from deceptive or abusive lending and credit practices. These laws ensure transparency, fairness, and accuracy in the lending market by promoting the informed use of credit, regulating credit reporting, prohibiting discrimination in lending, and preventing unfair debt collection practices. Key components of consumer credit protection law include the Truth in Lending Act (TILA), the Fair Credit Reporting Act (FCRA), the Equal Credit Opportunity Act (ECOA), and the Fair Debt Collection Practices Act (FDCPA). Consumer credit protection laws have their roots in the early 20th century as a response to the growing need for regulations to protect consumers from unfair and deceptive credit practices. Early laws focused primarily on the regulation of interest rates and the establishment of consumer rights. Over the years, consumer credit protection laws have evolved to address emerging challenges, such as the rise in consumer debt and the increasing sophistication of financial products. Significant milestones include the passage of the Truth in Lending Act (1968), the Fair Credit Reporting Act (1970), the Equal Credit Opportunity Act (1974), and the Fair Debt Collection Practices Act (1977). Global financial crises, such as the Great Depression and the 2008 financial crisis, have highlighted the need for robust consumer credit protection laws. These events have led to increased scrutiny of lending practices and the introduction of new regulations aimed at preventing future crises and protecting consumers. The Truth in Lending Act is a federal law that aims to promote the informed use of consumer credit by requiring transparent and accurate disclosures about the terms and costs of loans and other credit products. TILA mandates that lenders and credit providers disclose key information to consumers, such as the annual percentage rate (APR), finance charges, and other costs associated with borrowing. Regulation Z is the set of rules that implement TILA, which the Consumer Financial Protection Bureau (CFPB) enforces. The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, dissemination, and use of consumer credit information by credit reporting agencies. Under the FCRA, consumers have the right to access their credit reports, dispute inaccurate information, and place security freezes on their reports to prevent identity theft. Credit reporting agencies are required to maintain accurate and complete information, investigate consumer disputes, and correct or delete inaccurate information. The Equal Credit Opportunity Act is a federal law that prohibits lenders from discriminating against applicants based on race, color, religion, national origin, sex, marital status, age, or receipt of public assistance. ECOA ensures that credit decisions are based on an individual's creditworthiness rather than on discriminatory factors. The ECOA is enforced by various federal agencies, including the CFPB and the Federal Trade Commission (FTC). Violations of the ECOA can result in civil penalties and legal actions. The Fair Debt Collection Practices Act is a federal law that protects consumers from abusive, deceptive, and unfair debt collection practices by third-party debt collectors. Under the FDCPA, debt collectors are prohibited from engaging in practices such as harassment, making false statements, and using unfair means to collect debts. The FDCPA provides consumers with the right to dispute debts and request validation, as well as the right to sue debt collectors for violations of the law. Consumers may also be entitled to statutory damages, attorney's fees, and other remedies. The FTC is an independent federal agency that enforces consumer protection laws, including some aspects of consumer credit protection law, such as the ECOA and the FDCPA. The CFPB is a federal agency responsible for protecting consumers in the financial marketplace. It enforces consumer credit protection laws, including TILA, FCRA, and ECOA, and develops and enforces regulations to prevent unfair, deceptive, or abusive practices. State regulatory agencies, such as state attorneys general and consumer protection divisions, also enforce consumer credit protection laws and address violations at the state level. Regulatory agencies have the authority to take enforcement actions against violators of consumer credit protection laws, including issuing cease and desist orders, imposing civil penalties, and pursuing legal actions. Consumers have the right to access their credit reports from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once per year, free of charge. Consumers have the right to dispute inaccurate information on their credit reports, and credit reporting agencies are required to investigate and correct any errors. Consumers should take steps to protect their personal information and monitor their credit reports regularly to prevent identity theft and fraud. Consumers should be aware of the factors that influence their credit scores and take steps to maintain good credit, such as making timely payments and using credit responsibly. Consumer credit protection laws are regulations designed to protect consumers from deceptive or abusive lending and credit practices, ensuring transparency, fairness, and accuracy in the lending market. The key components of consumer credit protection law include the Truth in Lending Act, the Fair Credit Reporting Act, the Equal Credit Opportunity Act, and the Fair Debt Collection Practices Act. These laws are enforced by various federal agencies, such as the Consumer Financial Protection Bureau and the Federal Trade Commission, as well as state regulatory agencies. Consumers have the right to access their credit reports, dispute inaccurate information, and prevent identity theft and fraud. It is essential for consumers to understand their rights and responsibilities and take steps to maintain good credit. To ensure you make the most informed financial decisions and stay up-to-date with consumer credit protection laws, consider hiring a banking expert who can guide you through the complexities of the credit system and help you safeguard your financial future. What Are Consumer Credit Protection Laws?

History of Consumer Credit Protection Law

Early Consumer Credit Laws and Regulations

Evolution and Significant Milestones

Influence of Global Financial Crises on Consumer Credit Protection Law

Key Components of Consumer Credit Protection Law

Truth in Lending Act (TILA)

Fair Credit Reporting Act (FCRA)

Equal Credit Opportunity Act (ECOA)

Fair Debt Collection Practices Act (FDCPA)

Regulatory Agencies and Enforcement

Federal Trade Commission (FTC)

Consumer Financial Protection Bureau (CFPB)

State Regulatory Agencies

Enforcement Actions and Penalties

Consumer Rights and Responsibilities

Access to Credit Information

Disputing Inaccuracies

Preventing Identity Theft and Fraud

Understanding Credit Scores and Their Impact

Conclusion

Consumer Credit Protection Laws FAQs

The primary purpose of consumer credit protection laws is to safeguard consumers from deceptive or abusive lending and credit practices by promoting transparency, fairness, and accurate information in the lending market.

The Truth in Lending Act (TILA) and Regulation Z contributes to consumer credit protection by requiring lenders and credit providers to disclose key information about the terms and costs of loans and credit products, such as annual percentage rates (APR), finance charges, and other costs associated with borrowing.

Under the Fair Credit Reporting Act (FCRA), consumers have the right to access their credit reports, dispute inaccurate information, and place security freezes on their reports to prevent identity theft, contributing to consumer credit protection.

The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) are the primary federal agencies responsible for enforcing consumer credit protection laws in the United States. At the same time, state regulatory agencies also play a role in enforcement at the state level.

Consumers can exercise their rights and responsibilities related to consumer credit protection by accessing their credit reports regularly, disputing inaccuracies, preventing identity theft and fraud, and understanding the factors that influence their credit scores, such as making timely payments and using credit responsibly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.