Leasehold is a type of property tenure where a person or entity (the leaseholder or lessee) is granted the right to occupy and use a property for a specified period of time as outlined in a lease agreement. This period can range from several years to centuries. The property is owned by a landlord (the freeholder or lessor), and when the lease expires, ownership reverts to them. During the lease period, the leaseholder may be obligated to pay ground rent, service charges, and other costs as stipulated in the lease agreement. The lessee often has the right to improve or alter the property, subject to the terms of the lease. It's also worth noting that the lease can potentially be sold or transferred, subject to the conditions set out in the agreement. There are several types of leasehold tenures, each with its unique characteristics and legal implications. Fixed leaseholds, or term of years absolute, constitute the majority of leasehold agreements. In this arrangement, the lease term is predetermined and absolute, often spanning several decades. Periodic leaseholds, as the name suggests, run for recurrent periods. The periods could be weekly, monthly, or annually, with automatic renewal unless the tenant or the landlord provides notice to terminate. A tenancy at will is a flexible leasehold agreement where either party may terminate the lease without notice. Despite their relative infrequency, such tenancies offer maximum flexibility to both the landlord and the tenant. A tenancy at sufferance arises when a tenant continues to occupy a property after their lease has expired without the landlord's permission. While this is not an ideal situation, it can sometimes occur inadvertently. Understanding the contrast between leasehold and freehold property rights is crucial. The key difference between a leasehold and a freehold lies in ownership. Freeholders own the land and the building indefinitely, whereas leaseholders have a time-limited right to live in a property. Freehold offers the benefit of permanent ownership without having to worry about lease expiration. On the other hand, leasehold often comes with obligations like service charges and ground rent, but it can be a more affordable way of homeownership. The leasehold system operates within a complex legal framework. The leasehold agreement defines the rights and obligations of the tenant and the landlord. It specifies terms like the length of the lease, rent payments, maintenance responsibilities, and other crucial details. Leaseholders have a right to occupy and use the property within the terms stipulated in the lease. However, they also have obligations like paying ground rent and maintaining the property. In disputes between landlords and tenants, the Leasehold Valuation Tribunal (LVT) serves as an essential legal resource. They can make determinations on a variety of matters, like service charges or lease extensions. Leaseholds carry specific financial implications, often affecting property value and the cost of living. Leasehold Valuation: The valuation of a leasehold property considers factors like the length of the remaining lease, ground rent, and expected service charges. Ground Rent and Service Charges: A sum paid annually to the landlord, while service charges cover the cost of maintaining the common parts of the property. Leasehold Extensions and Purchasing Freehold: Often have the right to extend their lease or purchase the freehold, but this can involve significant costs. Leaseholds play a significant role in the real estate investment market. Impact on Property Value: The length of the remaining lease can significantly impact a property's value. Shorter leases may deter potential buyers, impacting liquidity and market value. Considerations for Investors: Investors in leasehold properties need to consider additional costs like service charges and ground rent, which can affect investment returns. Leasehold Reform: This has been on the agenda of many governments due to growing concerns over unfair practices. Recent Developments in Leasehold Legislation: There have been significant changes in leasehold legislation in recent years. For instance, the UK plans to abolish ground rents on new leasehold properties. Implications for Leaseholders: These legislative changes aim to make leasehold fairer and more transparent, which could potentially benefit current and future leaseholders. Leasehold as a form of tenure has been subject to much debate, with some predicting substantial changes in the coming years. Trends in Leasehold Properties: A noticeable trend in recent years is the increasing number of leasehold properties, particularly in urban areas where space is at a premium. Predictions and Speculations: Future developments may include increased regulation and potential reform of the leasehold system to provide greater protection for leaseholders. Leasehold is a crucial aspect of property tenure, granting the leaseholder the right to occupy and utilize the property for a pre-determined period, usually in exchange for ground rent and service charges. Various leasehold types exist, each carrying unique characteristics and legal implications. A crucial distinction lies between leasehold and freehold, the latter providing indefinite ownership. The legal framework governing leaseholds centers around lease agreements defining rights and obligations, and in disputes, the Leasehold Valuation Tribunal serves as a key adjudicator. Financially, leasehold valuations depend on several factors, including the remaining lease duration and anticipated service charges. As an essential component in the real estate investment sector, leaseholds impact property value and investment returns. Recent legislation shifts are aimed at improving fairness and transparency in leasehold practices. The future of leaseholds is likely to be shaped by regulatory changes and a growing prevalence of leasehold properties in urban settings.Definition of Leasehold

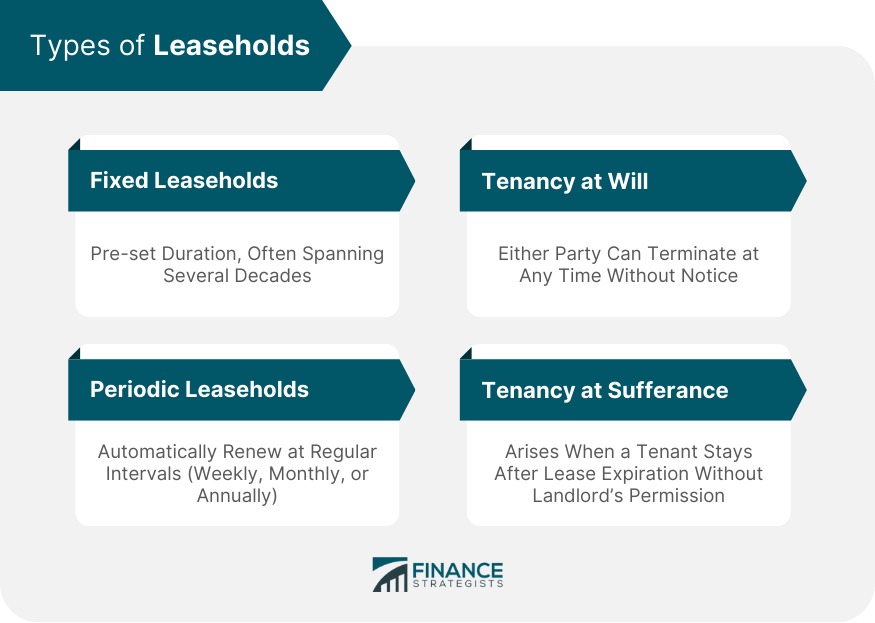

Types of Leaseholds

Fixed Leaseholds

Periodic Leaseholds

Tenancy at Will

Tenancy at Sufferance

Leasehold vs Freehold

Key Differences

Advantages and Disadvantages

Legal Aspects of Leaseholds

Leasehold Agreements

Leasehold Rights and Obligations

Role of the Leasehold Valuation Tribunal (LVT)

Financial Aspects of Leaseholds

Leasehold in Real Estate Investment

The Future of Leasehold

Bottom Line

Leasehold FAQs

Leaseholds come in four types: fixed leaseholds with a pre-set duration, periodic leaseholds which renew at regular intervals, tenancy at will where either party can terminate at any time without notice, and tenancy at sufferance when a tenant stays in a property without the landlord's permission after the lease has ended.

In a leasehold, the tenant has the right to occupy a property for a fixed period of time, while the land itself is owned by the freeholder. In contrast, a freeholder owns both the property and the land on which it stands indefinitely.

Leaseholds often come with financial obligations like ground rent, service charges for maintaining communal areas, and potentially high costs for lease extensions or purchasing the freehold.

One successful example is the regeneration of London's Docklands, where leasehold properties played a central role and saw significant capital growth. However, leasehold investments also come with risks, as demonstrated by controversies over escalating ground rents in the UK.

The future of leaseholds could see increased regulation and reform to provide more protection for leaseholders. Trends indicate a growing number of leasehold properties, particularly in urban areas, despite ongoing debates about their fairness and transparency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.