The Heroes Earned Retirement Opportunities Act (HERO) is a federal law enacted in 2006 to address retirement benefits for U.S. military service members. The act allows active duty military personnel to contribute to a tax-advantaged Individual Retirement Account (IRA) based on their tax-exempt combat pay, helping them save for retirement and securing their financial future. The primary purpose of the HERO Act is to address the unique challenges faced by military service members in planning for retirement. Prior to the HERO Act, military personnel receiving tax-exempt combat pay were not eligible to contribute to an IRA, leaving them at a disadvantage in terms of saving for retirement. The HERO Act aims to level the playing field, ensuring that all service members have the opportunity to build a strong retirement foundation. Military retirement benefits are designed to provide financial security and stability to service members and their families after they leave active duty. These benefits typically include a pension, healthcare coverage, and access to various support programs and services. Military retirement benefits are generally based on factors such as years of service, rank, and the specific terms of a service member's retirement plan. Veterans often face unique challenges in retirement, stemming from the nature of their service and the potential long-term impacts of their military experience. These challenges can include physical and mental health issues, difficulty finding civilian employment, and the need for ongoing support and care for themselves and their families. Additionally, many veterans may have limited opportunities to save for retirement due to the structure of military compensation and the limitations placed on retirement savings vehicles prior to the HERO Act. The HERO Act enables active duty military personnel to contribute to an IRA based on their tax-exempt combat pay. This provision effectively expands the retirement savings options available to service members, allowing them to grow their savings on a tax-advantaged basis. The HERO Act does not create a separate retirement plan but instead modifies the rules for existing IRAs, making them more accessible to military personnel. To be eligible for the retirement benefits provided by the HERO Act, an individual must be an active duty service member receiving tax-exempt combat pay. This includes service members deployed to combat zones, as well as those engaged in hazardous duty or other qualifying activities. There is no minimum length of service requirement, and eligibility is determined on a year-to-year basis, depending on the individual's combat pay status. HERO benefits differ from traditional military retirement benefits in that they specifically address the retirement savings needs of service members receiving tax-exempt combat pay. While traditional military retirement benefits, such as pensions and healthcare coverage, are provided as part of a service member's overall compensation package, HERO benefits offer an additional avenue for retirement savings that was previously unavailable. This increased access to tax-advantaged retirement savings can have a significant impact on a service member's long-term financial security. Retirement planning is a critical aspect of long-term financial security, as it helps individuals ensure they have sufficient resources to maintain their desired lifestyle after they stop working. A well-structured retirement plan can provide a reliable income stream, protect against inflation and market volatility, and help manage risks associated with increasing life expectancies and changing personal circumstances. The HERO Act plays an essential role in retirement planning for veterans by expanding their access to tax-advantaged retirement savings vehicles. By allowing service members receiving tax-exempt combat pay to contribute to an IRA, the HERO Act helps veterans build a stronger financial foundation for their retirement years. This added opportunity for retirement savings can make a significant difference in a veteran's ability to achieve their retirement goals and maintain their desired lifestyle throughout their golden years. The HERO Act was implemented through changes to the tax code, modifying the rules governing IRA contributions to include tax-exempt combat pay as eligible income. Service members can now contribute to either a traditional or Roth IRA based on their tax-exempt combat pay, up to the annual contribution limits set by the IRS. The implementation of the HERO Act has been a significant step in addressing the unique retirement planning challenges faced by military personnel. The HERO Act has the potential to significantly impact the financial well-being of veterans and their families by providing greater access to tax-advantaged retirement savings options. By allowing service members to contribute to an IRA based on their tax-exempt combat pay, the HERO Act helps ensure that veterans have the opportunity to build a strong retirement nest egg. In turn, this can lead to increased financial stability for veterans and their families, helping them navigate the challenges of retirement and maintain their quality of life. The HERO Act provides veterans with increased retirement options that can improve their financial security in retirement. For example, veterans may choose to receive a lump sum payment or an annuity. These options can provide flexibility for veterans to manage their finances based on their unique needs. HERO benefits can provide retired service members with improved financial security. This can help ensure they have sufficient resources to maintain their desired lifestyle after they stop working. By providing additional retirement benefits, HERO helps to bridge the gap between traditional military retirement benefits and civilian retirement benefits. HERO benefits can have a significant impact on the employment and quality of life of veterans. By providing additional retirement benefits, veterans may be more likely to retire earlier or transition to a new career. This can free up job opportunities for younger service members and contribute to a more diverse and inclusive workforce. Additionally, improved financial security can lead to improved mental and physical health, which can contribute to a better quality of life for veterans and their families. Despite its benefits, the HERO Act has faced some criticisms. One concern is that the act does not go far enough in addressing the broader challenges faced by veterans in retirement. While the HERO Act provides an important opportunity for retirement savings, it does not directly address issues such as physical and mental health challenges, employment difficulties, or the need for ongoing support and care. Critics argue that a more comprehensive approach to veterans' retirement planning is necessary to fully address the unique needs of this population. Another criticism is that the HERO Act may not provide sufficient incentives for service members to take advantage of its provisions. Some argue that the act could be more effective if it included additional incentives, such as matching contributions from the government or the military, to encourage greater participation and higher savings rates among eligible service members. There have been some controversies surrounding the HERO Act, primarily related to its potential impact on the broader military retirement system. Some argue that the act may inadvertently undermine the traditional military retirement benefits by encouraging service members to rely more heavily on individual retirement savings rather than the pension system. Critics worry that this shift could ultimately weaken the overall military retirement system, leading to reduced benefits and support for veterans in the future. Others contend that the HERO Act may disproportionately benefit certain service members, such as those in higher ranks or with longer tenures, who are more likely to have access to financial planning resources and support. This could potentially exacerbate existing inequalities within the military community, as lower-ranking service members or those with fewer resources may be less able to take full advantage of the act's provisions. The Heroes Earned Retirement Opportunities Act (HERO) is a federal law that allows active duty military personnel receiving tax-exempt combat pay to contribute to an IRA, providing them with greater access to tax-advantaged retirement savings options. The act aims to address the unique retirement planning challenges faced by service members and help them build a strong financial foundation for their retirement years. The provisions of the HERO Act include expanding access to IRA contributions for service members receiving tax-exempt combat pay, as well as establishing eligibility requirements for these benefits. The act differs from traditional military retirement benefits by specifically targeting the retirement savings needs of service members with tax-exempt combat pay, offering an additional avenue for building retirement savings. The HERO Act plays a crucial role in retirement planning for veterans by providing them with expanded access to tax-advantaged retirement savings options. This additional opportunity for retirement savings can make a significant difference in a veteran's ability to achieve their retirement goals and maintain their desired lifestyle throughout their golden years. By addressing the unique challenges faced by military personnel in retirement planning, the HERO Act helps ensure that veterans have the resources and support they need to build a secure financial future.What Is the Heroes Earned Retirement Opportunities Act (HERO)?

Background Information

Overview of Military Retirement Benefits

Issues Faced by Veterans in Retirement

HERO Provisions

Retirement Benefits Under HERO

Eligibility Requirements for HERO Benefits

How HERO Benefits Differ From Traditional Military Retirement Benefits

Importance in Retirement Planning

Significance of Retirement Planning

Role of HERO in Retirement Planning for Veterans

Implementation and Impact of HERO

Implementation

Potential Impact on Veterans and Their Families

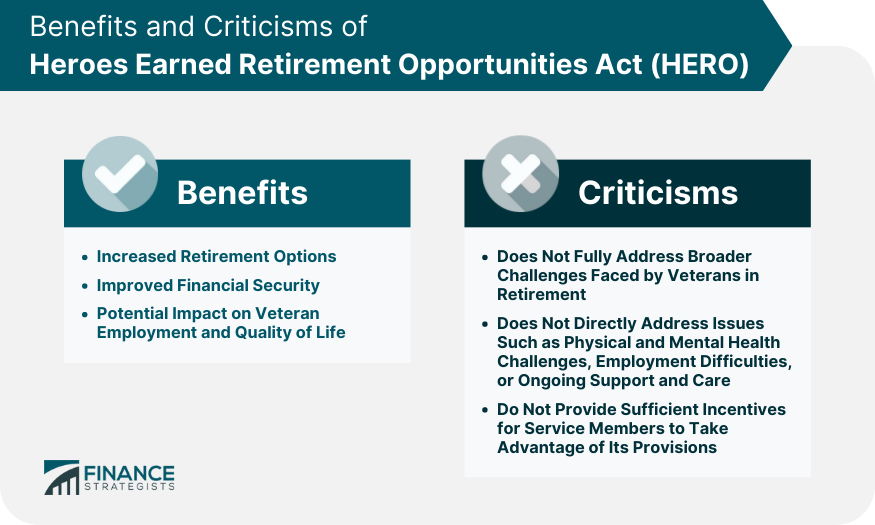

Benefits of HERO

Increased Retirement Options for Veterans

Improved Financial Security for Retired Service Members

Potential Impact on Veteran Employment and Quality of Life

Criticisms of HERO

Controversies Surrounding HERO

Final Thoughts

Heroes Earned Retirement Opportunities Act (HERO) FAQs

The HERO Act is a federal law that provides retirement benefits to military service members who have served for at least 20 years.

To be eligible for HERO benefits, you must have served in the military for at least 20 years and have received an honorable discharge.

HERO benefits offer more flexibility and options for retirement planning, including the ability to receive a lump sum payment or annuity.

HERO has provided additional retirement options for veterans, which can help improve their financial security and stability in retirement.

Critics have raised concerns about the financial sustainability of HERO benefits and whether they adequately address the needs of all veterans, especially those with disabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.