Lease-option agreements, also known as lease-to-own or rent-to-own agreements, are a type of real estate transaction where a tenant rents a property from a landlord with the option to purchase the property at a later date. The tenant pays an option fee and a portion of their monthly rent may be applied towards the eventual purchase price. The primary purpose of lease-option agreements is to provide a flexible path to homeownership for tenants who may not be able to secure a traditional mortgage due to poor credit history, insufficient down payment, or other financial challenges. These agreements also benefit landlords by providing a potential buyer for their property and a steady stream of rental income. A lease-option to purchase agreement is a type of lease-option agreement in which the tenant has the option to buy the property at a predetermined price within a specified time frame. This type of agreement provides tenants with the opportunity to build equity in the property while renting and eventually purchase the property if they choose to do so. A lease-option to buy agreement is similar to a lease-option to purchase agreement, but the tenant's option to buy is not tied to a specific time frame. Instead, the tenant may exercise their option to buy the property at any time during the lease term, provided they meet the terms and conditions outlined in the agreement. A lease-purchase agreement is a type of lease-option agreement in which the tenant is obligated to purchase the property at the end of the lease term. This type of agreement is more binding on the tenant, as they are committed to purchasing the property rather than simply having the option to do so. In this type of lease-option agreement, the purchase price of the property is specified in the contract. This allows the tenant and landlord to have a clear understanding of the potential future transaction and provides the tenant with the certainty of knowing the exact price they will pay if they choose to exercise their option to purchase. In a lease-option agreement with purchase price escalation, the purchase price of the property increases over time, often based on a predetermined formula or percentage. This type of agreement can provide the landlord with additional protection against inflation and market fluctuations while still offering the tenant the opportunity to purchase the property. Lease-option agreements offer flexibility for the tenant, allowing them to rent the property with the option to purchase it at a later date. This provides an opportunity for the tenant to build credit, save for a down payment, and make an informed decision about whether to purchase the property. Tenants who enter into lease-option agreements have the opportunity to improve their credit history by making timely rental payments. This can help tenants qualify for a mortgage when they are ready to exercise their option to purchase the property. In some lease-option agreements, the purchase price of the property is set at the beginning of the lease term. This can provide the tenant with the benefit of locking in the purchase price, potentially allowing them to purchase the property at a lower price than market value if property values rise during the lease term. One risk of lease-option agreements is the uncertainty of the future real estate market. If property values decline during the lease term, the tenant may find themselves paying more for the property than it is worth when they exercise their option to purchase. Tenants in a lease-option agreement risk losing their option fee and any additional rent payments that have been applied toward the purchase price if they choose not to exercise their option to buy or are unable to secure financing. This financial loss can be significant, particularly if the tenant has invested in improvements to the property. Lease-option agreements can lead to legal disputes between the tenant and landlord, particularly if the terms and conditions of the agreement are not clearly defined. Misunderstandings or disagreements about the purchase price, option fee, or property condition can result in costly litigation. A lease-option agreement should include key components such as the rental term, monthly rent amount, option fee, portion of rent applied toward the purchase price, purchase price, and time frame for exercising the option to buy. It should also outline the responsibilities of both parties concerning property maintenance, taxes, and insurance. Both the tenant and landlord should carefully negotiate the terms of the lease-option agreement to ensure a fair and mutually beneficial arrangement. This includes discussing the purchase price, option fee, and rental payments, as well as any specific terms or conditions related to the property. Once both parties have agreed on the terms of the lease-option agreement, a written contract should be prepared and signed by both parties. It is recommended that both the tenant and landlord seek legal counsel to review the agreement before signing to ensure that their rights and interests are protected. The tenant has the right to possess and use the property during the lease term, as well as the option to purchase the property according to the terms of the agreement. They may also have the right to make improvements to the property, subject to the landlord's approval. The tenant is responsible for paying the rent, option fee, and any additional payments agreed upon in the lease-option agreement. They are also responsible for maintaining the property and complying with any applicable laws or regulations. The landlord retains the legal title to the property until the tenant exercises their option to purchase and completes the transaction. They have the right to receive rental payments and the option fee, as well as the right to enforce the terms of the lease-option agreement. The landlord is responsible for disclosing any material defects or issues with the property, as well as ensuring that the property is free of liens and encumbrances that could affect the tenant's ownership rights. They may also be responsible for certain property maintenance tasks, depending on the terms of the agreement. A lease-option agreement differs from a standard lease agreement in that it provides the tenant with the option to purchase the property. In a standard lease agreement, the tenant rents the property without any intention or option to buy it. A lease-option agreement is distinct from a purchase agreement, as it combines elements of both leasing and purchasing. A purchase agreement is a contract for the outright sale of a property, without any rental or option components. While lease-option agreements and rent-to-own agreements are similar, there are some differences. A rent-to-own agreement typically includes a mandatory purchase at the end of the rental period, while a lease-option agreement provides the tenant with the choice to purchase the property or not. Additionally, rent-to-own agreements often involve a higher portion of the monthly rent being applied toward the purchase price, whereas lease-option agreements may have a smaller portion allocated toward the purchase price. Lease-option agreements offer a flexible alternative for tenants who may not be able to secure a traditional mortgage, as well as landlords seeking a potential buyer and rental income. These agreements come in various forms and provide benefits such as flexibility, credit building, and the potential to lock in a purchase price. However, lease-option agreements also carry risks, such as market uncertainty, the possibility of losing money, and potential legal disputes. Both tenants and landlords should seek legal advice when entering into a lease-option agreement to ensure their rights and interests are protected. A well-drafted and reviewed agreement can minimize the risk of disputes and provide a clear understanding of each party's rights and obligations. Lease-option agreements may become an increasingly popular financing option for tenants and landlords. However, it is essential that both parties understand their rights and obligations under a lease-option agreement and seek professional advice to ensure a successful and fair transaction.What Are Lease-Option Agreements?

Types of Lease-Option Agreements

Lease-Option to Purchase Agreement

Lease-Option to Buy Agreement

Lease-Purchase Agreement

Lease-Option Agreement With Purchase Price

Lease-Option Agreement With Purchase Price Escalation

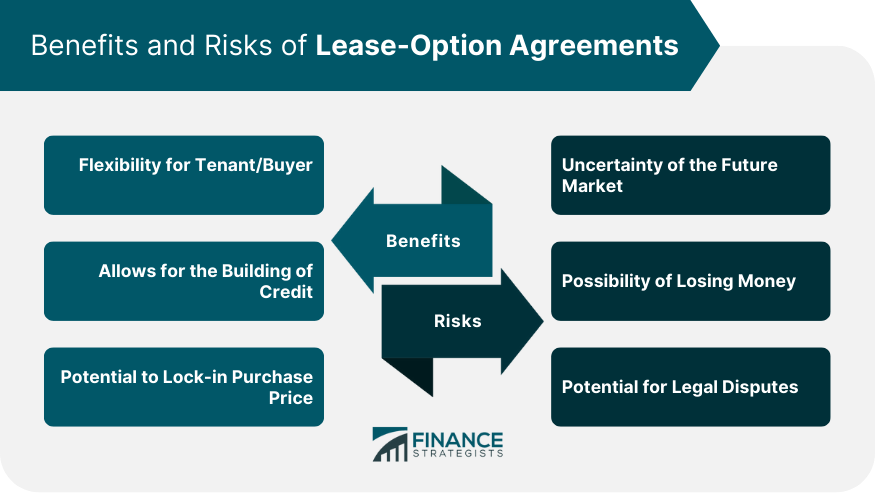

Benefits of Lease-Option Agreements

Flexibility for Tenant/Buyer

Allows for the Building of Credit

Potential to Lock-In Purchase Price

Risks of Lease-Option Agreements

Uncertainty of the Future Market

Possibility of Losing Money

Potential for Legal Disputes

Process of Creating a Lease-Option Agreement

Components of a Lease-Option Agreement

Negotiating Terms of the Agreement

Finalizing the Agreement

Rights and Obligations of the Parties Involved

Rights of the Tenant/Buyer

Obligations of the Tenant/Buyer

Rights of the Landlord/Seller

Obligations of the Landlord/Seller

Differences Between Lease-Option Agreements and Other Real Estate Agreements

Lease-Option Agreement vs. Lease Agreement

Lease-Option Agreement vs. Purchase Agreement

Lease-Option Agreement vs. Rent-to-Own Agreement

Bottom Line

Lease-Option Agreements FAQs

A lease-option agreement is a contract between a landlord/seller and a tenant/buyer that combines a lease agreement with an option to purchase the property.

The benefits of a lease-option agreement include flexibility for the tenant/buyer, the ability to build credit, and the potential to lock in a purchase price.

The risks of a lease-option agreement include uncertainty in the future market, the possibility of losing money, and the potential for legal disputes.

Yes, a lease-option agreement can be renegotiated if both parties agree to the changes.

A lease-option agreement is similar to a rent-to-own agreement, but it differs in that it provides the option to purchase the property, whereas a rent-to-own agreement requires the tenant to purchase the property.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.