Tender Offer Funds are a type of investment fund that allows investors to purchase shares of a portfolio of securities that will be purchased by the fund's management at a fixed price. Essentially, tender offer funds are a way for investors to gain exposure to a specific set of securities and then sell those securities back to the fund at a set price. Tender offer funds are becoming increasingly popular with investors because they offer a unique investment opportunity with potential benefits such as liquidity, diversification, professional management, and transparency. Moreover, investing in tender offer funds can provide a range of benefits such as access to a diversified portfolio of assets, professional management, and the potential for higher returns compared to traditional investment options. Closed-end funds are investment funds that raise capital by issuing a fixed number of shares that trade on a stock exchange. Unlike open-end funds, closed-end funds do not issue or redeem shares on a daily basis. Instead, investors can only buy or sell shares of closed-end funds on the open market. This means that the price of a closed-end fund is determined by supply and demand rather than its net asset value (NAV). Exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges, similar to closed-end funds. However, ETFs are designed to track the performance of an underlying index, such as the S&P 500 or the NASDAQ. ETFs are open-end funds, meaning that they issue and redeem shares on a daily basis. This allows the price of an ETF to be closely aligned with its NAV. Mutual funds are investment funds that pool money from many investors to purchase a portfolio of securities. Mutual funds are open-end funds, meaning that they issue and redeem shares on a daily basis. The price of a mutual fund is based on its net asset value, which is calculated at the end of each trading day based on the value of the securities in the fund's portfolio. One of the main benefits of investing in tender offer funds is liquidity. Since investors can sell their shares back to the fund at a fixed price, they have the ability to exit the investment relatively quickly. This can be particularly important in volatile markets where investors may need to adjust their portfolios quickly. Another benefit of investing in tender offer funds is diversification. Tender offer funds typically invest in a range of securities, which can help to reduce overall portfolio risk. By investing in a diversified portfolio, investors can potentially earn higher returns and reduce their overall risk. Investing in tender offer funds also provides access to professional management. Finally, investing in tender offer funds provides transparency. Since tender offer funds are required to disclose their holdings on a regular basis, investors can see exactly what securities make up the fund's portfolio. This can be helpful for investors who want to understand where their money is being invested. One of the main risks of investing in tender offer funds is market risk. The value of the securities in the fund's portfolio can be affected by a range of market factors, such as changes in interest rates, economic conditions, and geopolitical events. As a result, the value of the fund's shares can fluctuate and investors may experience losses. Another risk of investing in tender offer funds is liquidity risk. While tender offer funds provide liquidity to investors, the underlying securities in the fund's portfolio may not be liquid. This can make it difficult for the fund's management team to sell the securities at a fair price, which can lead to losses for investors. Finally, tender offer funds are also subject to credit risk. If the securities in the fund's portfolio are issued by companies that experience financial difficulties or default on their debt, the value of the fund's shares can decline. This can result in losses for investors. One of the most important factors to consider when investing in tender offer funds is the fund's performance. Investors should review the fund's historical returns and compare them to its benchmark to determine if the fund has performed well over time. Investors should also consider the fees and expenses associated with investing in tender offer funds. These can include management fees, performance fees, and transaction costs. It's important to understand how these fees will impact the fund's overall returns and to compare them to other investment options. Investors should also consider their investment objectives when selecting a tender offer fund. Some funds may be designed for growth, while others may focus on generating income. Understanding your investment objectives can help you select a fund that aligns with your goals. Finally, investors should consider their investment horizon when investing in tender offer funds. If you have a longer investment horizon, you may be able to tolerate more risk and invest in funds that have higher potential returns. However, if you have a shorter investment horizon, you may want to focus on funds that provide more stability and lower risk. In conclusion, tender offer funds provide investors with a unique investment opportunity that can offer a range of benefits such as liquidity, diversification, professional management, and transparency. However, investors should also be aware of the risks associated with investing in tender offer funds, including market risk, liquidity risk, and credit risk. Overall, investing in tender offer funds can be a valuable addition to a diversified investment portfolio. By considering the factors discussed in this article, investors can select funds that align with their investment objectives and risk tolerance. As with any investment, it's important to conduct thorough research and seek professional advice before making any investment decisions.Definition of Tender Offer Funds

Types of Tender Offer Funds

Closed-End Funds

Exchange-Traded Funds (ETFs)

Mutual Funds

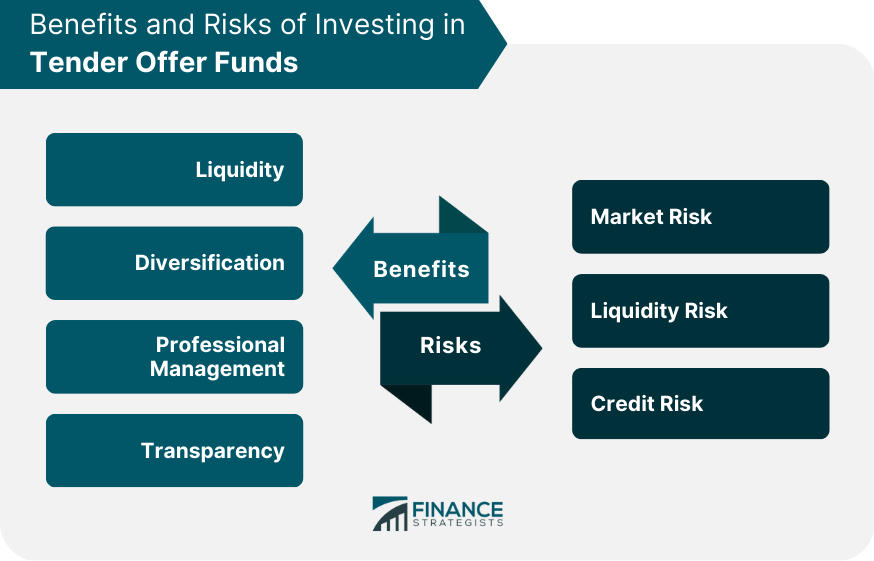

Benefits of Investing in Tender Offer Funds

Liquidity

Diversification

Professional Management

The fund's management team is responsible for selecting the securities that make up the fund's portfolio, which can help to ensure that the portfolio is well-diversified and aligned with the fund's investment objectives.Transparency

Risks of Investing in Tender Offer Funds

Market Risk

Liquidity Risk

Credit Risk

Factors to Consider When Investing in Tender Offer Funds

Fund Performance

Fund Fees and Expenses

Investment Objectives

Investment Horizon

Conclusion

Tender Offer Funds FAQs

Tender offer funds are mutual funds or exchange-traded funds (ETFs) that invest in securities of companies that are targeted for acquisition or takeover.

Tender offer funds typically invest in securities such as common stock, preferred stock, and debt securities of companies that are the subject of a tender offer.

Tender offer funds provide the potential for high returns in a short period, as they invest in companies that are subject to acquisition at a premium price. They also offer diversification benefits and can be used to hedge against market volatility.

Tender offer funds are subject to a number of risks, including the risk that a tender offer may not occur or may occur at a lower price than expected. They are also subject to market and liquidity risks.

Tender offer funds are considered to be high-risk investments and may not be suitable for all investors. They are typically recommended for sophisticated investors who have a higher tolerance for risk and a longer investment horizon.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.