Currency risk premium refers to the additional return that investors demand for taking on the risk of holding assets denominated in a foreign currency. This concept is crucial for understanding the complexities of international finance. The currency risk premium is generally considered a compensation for the potential loss in value of a foreign currency asset due to fluctuations in exchange rates. It is the difference between the expected return on a foreign currency investment and the risk-free return, which is typically measured using a domestic risk-free interest rate. Currency risk premium plays a vital role in the world of international finance, as it helps investors evaluate the risks and rewards associated with investing in foreign currencies. It is particularly important for multinational corporations, investment managers, and other market participants who are exposed to currency risk through their international operations and investments. In the context of exchange rate determination, currency risk premium acts as a key component in understanding the underlying forces that drive exchange rate movements. When a currency's risk premium increases, investors will demand higher returns to compensate for the additional risk, which can result in depreciation of that currency relative to others. Interest rate differentials are a primary determinant of currency risk premium. Higher interest rates in a country can attract foreign investors, as they seek higher returns on their investments. This section will discuss the relationship between interest rate differentials and currency risk premium. As interest rates in one country rise relative to those in another, the demand for the higher-yielding currency may increase, leading to an appreciation of that currency. Consequently, the currency risk premium for the higher-yielding currency may decrease, as the additional return compensates investors for the potential currency risk. Conversely, when interest rate differentials decrease, the currency risk premium may increase, as investors demand more compensation for taking on currency risk. Inflation rate differentials can also have a significant impact on currency risk premium. Higher inflation in a country can lead to a depreciation of its currency, as it erodes the real purchasing power of the currency. A higher inflation rate in a country relative to its trading partners may cause investors to demand a higher currency risk premium to compensate for the potential loss in value due to inflation. As a result, the currency may depreciate further, leading to a higher risk premium. On the other hand, lower inflation rates can lead to a lower currency risk premium, as investors perceive less risk associated with the currency's purchasing power. Uncovered interest rate parity (UIRP) is a widely used theoretical framework for estimating currency risk premium. According to UIRP, the expected return on an investment in a foreign currency should be equal to the risk-free return in the domestic currency, plus the currency risk premium. Under UIRP, the currency risk premium can be estimated as the difference between the expected change in the exchange rate and the interest rate differential between the two countries. If the expected change in the exchange rate is greater than the interest rate differential, then the currency risk premium is positive, implying that investors demand a higher return for holding the foreign currency asset. Conversely, if the expected change in the exchange rate is less than the interest rate differential, the currency risk premium is negative, suggesting that investors may be willing to accept a lower return for holding the foreign currency asset. Forward rate bias is another method for estimating currency risk premium, which involves analyzing the difference between the forward exchange rate and the expected future spot exchange rate. This section will discuss the use of forward rate bias in measuring currency risk premium. If the forward exchange rate is higher than the expected future spot exchange rate, this suggests that the foreign currency is overvalued, and the currency risk premium is negative. Conversely, if the forward exchange rate is lower than the expected future spot exchange rate, the foreign currency is undervalued, and the currency risk premium is positive. This approach is particularly useful for estimating currency risk premium in the short term, as forward rates reflect market expectations of future exchange rates. Econometric models are statistical models used to estimate currency risk premium based on various economic and financial factors. This section will explore the use of econometric models in measuring currency risk premium. Econometric models typically use multiple regression analysis to identify the significant variables that influence currency risk premium, such as interest rate differentials, inflation rate differentials, economic growth, and political stability. These models are useful for understanding the complex relationships between different factors and currency risk premium. However, they are often criticized for their assumptions and limitations, as they may not capture all the relevant variables and can be sensitive to data errors and model specification. Market-based approaches involve analyzing the prices of financial instruments to estimate currency risk premium. This section will discuss the use of market-based approaches in measuring currency risk premium. One such approach is the implied volatility of currency options, which reflects market expectations of future exchange rate volatility. Higher implied volatility suggests that investors perceive higher currency risk, leading to a higher currency risk premium. Another approach is the use of credit default swaps, which reflect the cost of insuring against the default risk of a sovereign or corporate borrower. Higher credit default swap spreads suggest a higher perceived risk associated with the borrower's currency, leading to a higher currency risk premium. Currency risk premium plays an important role in asset pricing models, such as the Capital Asset Pricing Model (CAPM) and the Arbitrage Pricing Theory (APT). This section will discuss the role of currency risk premium in these models. In CAPM, currency risk premium is incorporated into the beta coefficient, which measures the sensitivity of an asset's return to changes in the overall market. A higher beta coefficient suggests a higher exposure to currency risk, leading to a higher expected return. In APT, currency risk premium is one of the multiple factors that influence asset prices, alongside other macroeconomic and financial factors. Currency risk premium can offer diversification benefits to investors who hold a globally diversified portfolio of assets. This section will explore the diversification benefits of currency risk premium. Investing in assets denominated in different currencies can reduce the overall volatility of the portfolio, as currency risk premium is not perfectly correlated with other types of risk, such as equity or interest rate risk. Furthermore, currency risk premium can offer a potential source of return for investors who are willing to take on currency risk. Hedging strategies can be used to manage currency risk in international investments. This section will discuss some of the common hedging strategies used to mitigate currency risk. One such strategy is forward contracts, which allow investors to lock in a future exchange rate and eliminate the uncertainty associated with currency fluctuations. Another strategy is currency swaps, which involve exchanging one currency for another at a predetermined rate, typically for a fixed period of time. Hedging strategies can be costly and can reduce the potential returns of the investment, but they can also offer protection against adverse currency movements. Currency overlay management involves actively managing currency risk within a portfolio to enhance returns and manage risk. This section will discuss the concept of currency overlay management and its benefits. Currency overlay managers use a variety of techniques to actively manage currency risk, such as implementing hedging strategies, selecting currencies with favorable risk-return profiles, and optimizing currency exposure based on market conditions. This approach can provide a more efficient way to manage currency risk, as currency overlay managers have specialized expertise and access to a broader range of investment instruments. Empirical studies have shown that currency risk premium is not static but rather varies over time. This section will discuss the time-varying nature of currency risk premium. The currency risk premium can change in response to various economic and political factors, such as changes in interest rates, inflation, economic growth, and geopolitical events. Some studies have found that currency risk premium is higher during periods of economic uncertainty and political instability, while others have found that it is lower during periods of global economic growth and stability. Empirical studies have also explored the relationship between currency risk premium and economic fundamentals, such as interest rate differentials, inflation rate differentials, and economic growth. This section will discuss the empirical evidence on the relationship between currency risk premium and economic fundamentals. Many studies have found that interest rate differentials and inflation rate differentials are significant determinants of currency risk premium, while the relationship with economic growth is less clear. However, the strength of these relationships may vary across different countries and time periods. Empirical studies have also examined the currency risk premium in both developed and emerging markets. This section will discuss the evidence on the currency risk premium in these markets. Some studies have found that currency risk premium is higher in emerging markets than in developed markets, due to the higher levels of political and economic risk associated with these countries. Other studies have found that the relationship between currency risk premium and economic fundamentals may differ between developed and emerging markets, highlighting the importance of considering the unique characteristics of each market. Estimating currency risk premium is not an exact science, and different methods can yield different results. This section will discuss the challenges of accurately estimating currency risk premium. One of the main challenges is the uncertainty associated with exchange rate movements, which can make it difficult to forecast future exchange rates and estimate currency risk premium. In addition, different methods for estimating currency risk premium may make different assumptions and have different limitations, which can lead to inconsistent results. Behavioral finance perspectives suggest that investors may not always behave rationally when it comes to currency risk, leading to potential biases in their investment decisions. This section will discuss some of the behavioral finance perspectives on currency risk premium. For example, investors may exhibit herding behavior, where they follow the actions of other investors rather than making independent decisions based on their own analysis. Additionally, investors may exhibit anchoring bias, where they place too much weight on past exchange rate movements and fail to consider current economic fundamentals. The concept of currency risk premium has implications for the efficient market hypothesis, which suggests that financial markets incorporate all available information into asset prices. This section will discuss the market efficiency implications of currency risk premium. If financial markets are efficient, then currency risk premium should reflect all available information about economic and financial conditions. However, if currency risk premium is influenced by factors that are not fully reflected in asset prices, then financial markets may not be perfectly efficient. Currency risk premium is a crucial concept for investors and market participants who are exposed to currency risk. This section will highlight the importance of understanding currency risk premium and its implications. By understanding currency risk premium, investors can make informed decisions about international investments and manage currency risk more effectively. It is also important for policymakers to understand the role of currency risk premium in exchange rate determination and international trade. Currency risk premium has implications for both policy makers and market participants. This section will discuss some of these implications. Policy makers can use currency risk premium as a gauge of the perceived risk associated with a country's currency and make policy decisions accordingly. For example, they may adjust interest rates or implement policies to improve economic and political stability to reduce currency risk premium. Market participants can use currency risk premium as a tool for making investment decisions and managing risk. They can also use the information on currency risk premium to develop investment strategies that take advantage of potential diversification benefits and hedging opportunities. What Is Currency Risk Premium?

Factors Influencing Currency Risk Premium

Interest Rate Differentials

Inflation Rate Differentials

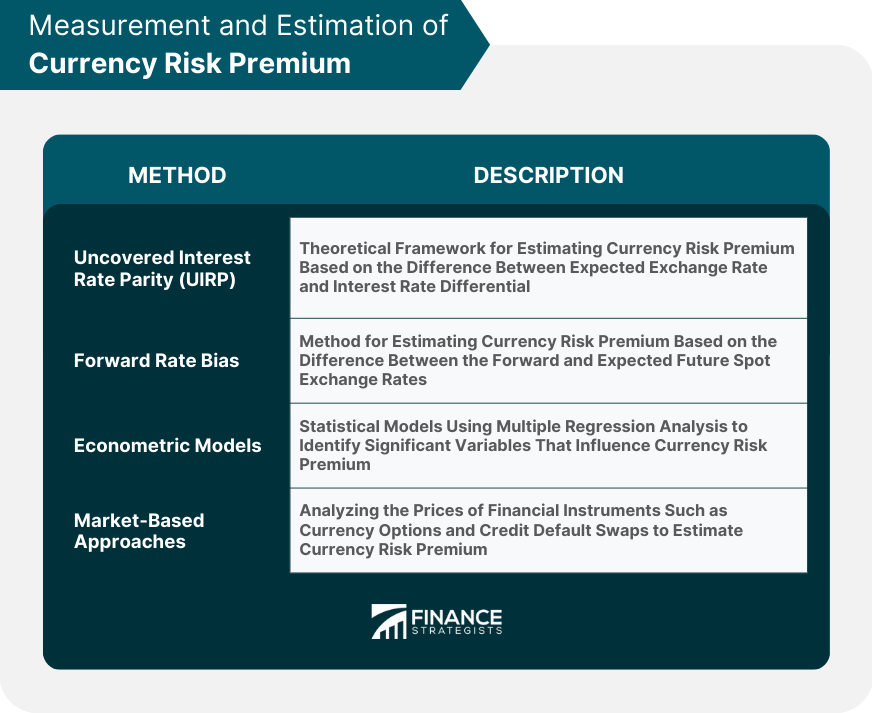

Measurement and Estimation of Currency Risk Premium

Uncovered Interest Rate Parity

Forward Rate Bias

Econometric Models

Market-Based Approaches

Currency Risk Premium and Portfolio Management

Role in Asset Pricing Models

Diversification Benefits

Hedging Strategies

Currency Overlay Management

Empirical Evidence on Currency Risk Premium

Time-Varying Nature of Risk Premium

Relationship With Economic Fundamentals

Evidence From Developed and Emerging Markets

Limitations and Critiques of Currency Risk Premium

Difficulty in Accurate Estimation

Behavioral Finance Perspectives

Market Efficiency Implications

Conclusion

Currency Risk Premium FAQs

A currency risk premium is the extra return that investors require to compensate for the uncertainty associated with foreign currency investments.

Currency risk premium can be estimated using various methods, including the uncovered interest rate parity model, the asset pricing model, and the yield curve approach.

Currency risk premium is important because it helps investors make informed decisions about foreign currency investments and manage their currency risk exposure effectively.

To manage currency risk premium, investors can use various hedging strategies, such as forward contracts, options, and currency ETFs, to reduce their exposure to currency fluctuations.

No, currency risk premium cannot be eliminated entirely because foreign currency investments will always carry some degree of uncertainty and risk. However, it can be managed and minimized to some extent.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.