A Window Guaranteed Investment Contract (GIC) is an insurance product that offers a guaranteed return on investment over a certain period, typically used as part of the fixed-income segment in retirement or 401(k) plans. Unlike traditional GICs, which require a lump-sum deposit, a Window GIC provides flexibility by allowing staggered deposits over a predetermined timeframe, aptly termed the "window". This characteristic is beneficial for entities like pension funds with staggered cash flows. Interest on the deposits is credited from the deposit date until the contract's end, with the insurer guaranteeing the principal and either a fixed or floating return. However, the validity of this guarantee depends on the insurer's creditworthiness. Unlike traditional GICs, Window GICs come with a 'window' period. This period allows investors to make additional deposits to the initial investment anytime within this window. The window period can be as short as a few months or as long as the entire contract duration, depending on the agreement's specifics. Regardless of the number of deposits or their timing, all funds within the Window GIC earn a guaranteed rate of return. This rate is agreed upon at the inception of the contract. It provides a reliable and predictable income stream for the investor, adding stability to their portfolio. The duration of a Window GIC is fixed at the start of the contract. Typically, these contracts have maturity dates that range from one to five years. The fixed term means that the investment is illiquid for this period, similar to traditional GICs. A Window GIC operates under a straightforward mechanism. An investor enters into a contract with an insurance company and contributes an initial deposit. Over the agreed window period, the investor can make additional deposits. These extra deposits and the initial amount earn a guaranteed rate of return until the contract's maturity date. The window period's timeframe can vary based on the contract's terms. It could last the entire contract duration or be limited to a specific timeframe. The length of the contract itself can also differ, but most Window GICs have terms between one to five years. The window feature in a Window GIC offers a significant advantage for investors with regular cash inflows, such as pension funds, retirement plans, or corporate entities. This feature allows them to earn a guaranteed return on these inflows immediately upon deposit, providing an effective tool for cash management. Window GICs provide a high level of stability and security for investors. The principal investment and the returns are both guaranteed by the issuing insurance company, making them a safe investment choice, especially in volatile market conditions. In addition to security, Window GICs offer flexibility through the window feature, allowing investors to deposit funds anytime during the window period. This feature enhances liquidity, as investors can invest funds as they become available. This risk pertains to the potential financial instability or insolvency of the insurance company issuing the Window GIC. If the company encounters financial difficulties, it may not be able to meet the agreed-upon terms of the contract, including paying the interest or returning the principal to the investor, leading to possible investment losses. Window GICs, while offering a safe and predictable return, often have a lower rate of return compared to other investment options such as equities or bonds. This implies a trade-off between safety and potential returns, creating an opportunity cost for the investor, and may also pose an inflation risk if the return rate fails to keep up with the inflation rate. Your financial goals play a crucial role in determining whether a Window GIC is an appropriate investment choice. These goals can range from saving for retirement, to buying a house, or simply preserving capital. If you're looking for a safe and reliable investment to meet long-term financial goals such as retirement, Window GICs can be an attractive option. They offer steady returns over time, which can contribute significantly to a retirement nest egg when compounded. However, if your financial goal requires a high return in a shorter time frame, such as saving for a down payment on a house within a few years, Window GICs might not be the best choice. In this case, you might want to explore other higher-yielding investment options. Another factor to consider before investing in Window GICs is your liquidity needs. GICs are designed to be held to maturity, and early withdrawal can come with penalties. In some cases, if you need to withdraw your investment before the end of the term, you may have to pay a penalty or even lose some of the interest that has been accrued. This makes Window GICs less suitable for those who need ready access to their funds. While GICs can be part of an overall savings strategy, they may not be the best choice for emergency funds that need to be readily accessible. Finally, your risk tolerance is another vital consideration when deciding whether to invest in Window GICs. Risk tolerance is the degree of variability in investment returns that an investor is willing to withstand. If you are risk-averse and prioritize the safety of your capital, Window GICs can be an appealing choice. They offer a guaranteed return, ensuring that your capital is preserved while still earning a steady return. On the other hand, if you're more risk-tolerant and are seeking potentially higher returns, investing in riskier assets might be more appropriate. It's important to remember that while these assets can offer higher returns, they also come with a higher risk of losing some or all of your initial investment. One of the main use cases for Window GICs is in pension funds and retirement plans. These entities often receive regular contributions that must be invested securely and efficiently. Window GICs can provide an excellent solution for these requirements. Apart from pension funds and retirement plans, Window GICs are commonly used by non-profit organizations, educational institutions, and corporations. These entities often have regular cash inflows and require secure, flexible investment options. Investing in a Window GIC involves identifying a suitable insurance company, understanding the contract terms, making the initial deposit, and making additional deposits during the window period. Whether a Window GIC fits your investment portfolio depends on your financial objectives, risk tolerance, and cash flow patterns. If you have regular cash inflows and seek a secure investment with guaranteed returns, a Window GIC can be a suitable choice. Window GICs are regulated by insurance and financial industry regulations. Investors must understand these laws and regulations to ensure compliance and to understand their rights and obligations under the contract. Compliance requirements for Window GICs can include adhering to the contract's terms, understanding the investment's tax implications, and following any regulatory requirements for reporting and disclosures. As the financial landscape evolves, so do the trends in Window GICs. Recent trends include more flexible window periods and the possibility of customizable rates of return based on the investor's requirements. The Window GIC landscape could see significant changes in the future due to technological advancements, changing regulatory environments, and shifts in investor preferences. As such, investors must stay informed about these changes to make the most of their Window GIC investments. A Window Guaranteed Investment Contract (GIC) is a unique financial instrument that provides a blend of security, guaranteed returns, and flexibility. This contract, agreed upon between an investor and an insurance company, involves an initial deposit by the investor with the opportunity to make additional deposits during a pre-determined 'window' period. In exchange, the insurance company guarantees a specific rate of return on these deposits throughout the contract's term. Window GICs are particularly advantageous for investors expecting regular cash inflows and seeking a secure, flexible investment option. They play a crucial role in diversifying investment portfolios and managing cash flows efficiently. However, like any investment, it's important to understand the product, align it with your financial objectives, and assess risk tolerance before investing. Consult with a financial advisor to see how Window GICs can fit into your wealth management strategy.What Is a Window Guaranteed Investment Contract (GIC)?

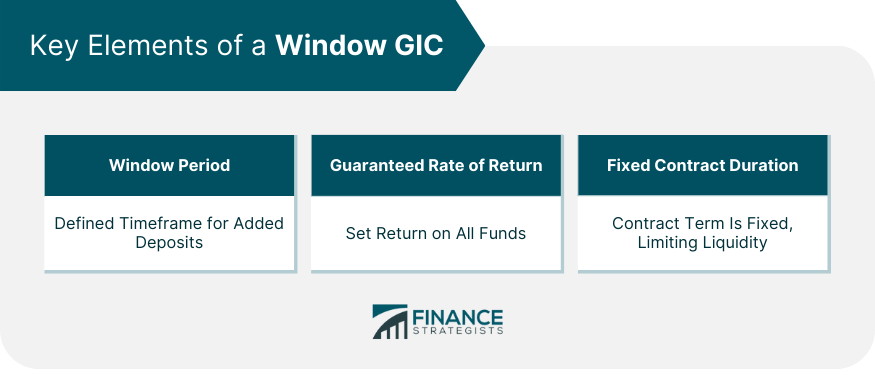

Key Elements of a Window GIC

Window Period

Guaranteed Rate of Return

Fixed Contract Duration

Detailed Explanation of Window GICs

Mechanics

Time Frames

Window Feature in Window GICs

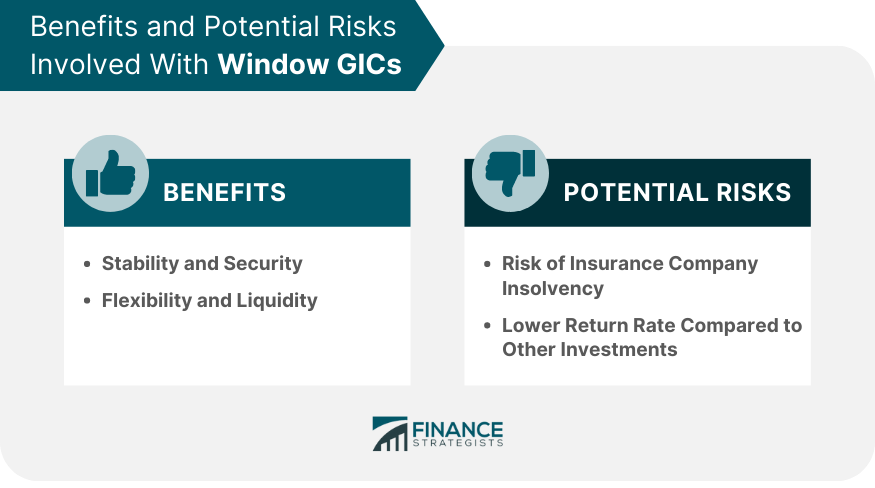

Benefits of Window GICs

Stability and Security

Flexibility and Liquidity

Potential Risks Involved With Window GICs

Risk of Insurance Company Insolvency

Lower Return Rate Compared to Other Investments

Considerations for Investors Before Opting for Window GICs

Understanding Your Financial Goals

Long-Term Goals

Short-Term Goals

Evaluating Liquidity Needs

Penalties for Early Withdrawal

Suitability for Emergency Funds

Assessing Risk Tolerance

For Risk-Averse Investors

For Risk-Tolerant Investors

Use Cases of Window GICs

Situations Where Window GICs Are Used

Industries or Sectors That Commonly Use Window GICs

How to Invest in a Window GIC

Step-By-Step Guide

Determining if a Window GIC Is Right for Your Investment Portfolio

Legal and Regulatory Aspects of Window Guaranteed Investment Contract

Relevant Laws and Regulations Pertaining to Window GICs

Compliance Requirements for Window GICs

Future of Window GICs

Emerging Trends

Potential Changes and Developments

Final Thoughts

Window Guaranteed Investment Contracts (GIC) FAQs

The main difference lies in the flexibility of deposits. A traditional GIC allows for a single lump-sum deposit at the contract's start. In contrast, a Window GIC permits multiple deposits during a specified 'window' period.

Window GICs are generally safe investments as the issuing insurance company backs them. However, like any investment, they are subject to the issuer's financial health. It's always advisable to check the insurer's credit rating before investing.

Window GICs, like traditional GICs, are meant to be held until maturity. Early withdrawals may be subject to penalties or forfeit of interest. However, terms can vary, so it's important to understand your specific contract.

No, you cannot make additional deposits to that Window GIC once the window period has closed. However, you can open a new Window GIC for further investments.

The interest earned on Window GICs is typically subject to income tax. However, if the GIC is held within a registered retirement account, it may benefit from tax-deferred growth. Always consult with a tax professional to understand your specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.