Performance attribution is a financial analysis technique used to evaluate a portfolio's performance relative to its benchmark by decomposing the portfolio's return into various components. This process helps identify the drivers of a portfolio's outperformance or underperformance. It provides insights into the effectiveness of asset allocation decisions and the ability of a portfolio manager to generate alpha. By understanding the sources of a portfolio's returns, investors and portfolio managers can assess the manager's skills, refine investment strategies, and enhance transparency and communication with clients. The Brinson-Fachler model is a widely used performance attribution model that measures the contribution of allocation and selection decisions to a portfolio's excess return. The model's basic formula decomposes a portfolio's return into three components: allocation effect, selection effect, and interaction effect. The Brinson-Fachler model is used to evaluate a portfolio manager's ability to select securities and allocate assets effectively. The model helps identify the sources of a portfolio's outperformance or underperformance relative to a benchmark. The Brinson-Fachler model is easy to understand and apply, but it may need to capture the complexity of multi-currency or multi-factor portfolios adequately. The Brinson-Hood-Beebower (BHB) model is an extension of the Brinson-Fachler model, which focuses on the decomposition of a portfolio's excess return into allocation and selection effects. This model also includes an interaction effect, although it is only sometimes reported. Similar to the Brinson-Fachler model, the BHB model is used to evaluate a portfolio manager's skill in selecting securities and allocating assets. The BHB model is widely accepted and easy to implement, but it shares the same limitations as the Brinson-Fachler model, including its inability to capture the complexity of multi-currency or multi-factor portfolios. The Karnosky-Singer performance attribution model extends the Brinson-Fachler model to incorporate currency effects, making it more suitable for global portfolios. This model is commonly used for global portfolios, as it helps investors understand the impact of currency fluctuations on their investments. The Karnosky-Singer model provides a more comprehensive view of a global portfolio's performance but can be more complex to implement compared to the Brinson-Fachler and BHB models. The Frongello model is a flexible performance attribution model that allows for various levels of granularity in the analysis, including multiple factors and sub-asset classes. The Frongello model can be used to analyze complex portfolios with multiple factors and sub-asset classes, providing a more in-depth understanding of performance drivers. This model offers high flexibility and customization, but it can be more challenging to implement and interpret due to its complexity. Additional performance attribution models include multi-currency and multi-factor models, which aim to capture the complexity of various investment strategies and global portfolios. The security selection effect measures the contribution of a portfolio manager's security selection skills to a portfolio's excess return. The allocation effect measures the impact of a portfolio manager's asset allocation decisions on a portfolio's excess return. The interaction effect captures the combined influence of security selection and allocation decisions on a portfolio's excess return. The currency effect measures the impact of currency fluctuations on the performance of a global portfolio. The timing effect reflects the contribution of a portfolio manager's market timing ability to a portfolio's excess return. This component is often difficult to measure and needs to be included in all performance attribution models. Performance attribution is widely used in portfolio management for various purposes: Evaluating Manager Performance: Performance attribution helps determine whether a portfolio manager's skills have contributed to the outperformance or underperformance of a portfolio relative to its benchmark. Identifying Sources of Alpha: Performance attribution sheds light on the sources of excess return, allowing investors and managers to refine their investment strategies. Risk Management: Performance attribution enables portfolio managers to identify and manage risk factors that may impact a portfolio's performance. Performance attribution plays a crucial role in client communication and reporting: Transparency and Accountability: Performance attribution allows investment managers to demonstrate their value to clients by clearly explaining the drivers of a portfolio's performance. Addressing Client Concerns: By identifying factors contributing to a portfolio's performance, performance attribution helps investment managers effectively address client concerns and expectations. Performance attribution is also essential for regulatory compliance: Performance Presentation Standards: Investment managers are required to adhere to performance presentation standards, such as the Global Investment Performance Standards (GIPS), which mandate the use of performance attribution in reporting. Requirements for Performance Reporting: Performance attribution supports investment managers in meeting regulatory requirements for transparent and accurate performance reporting. Performance attribution has several challenges and limitations: Model Risk and Assumptions: Different performance attribution models are based on varying assumptions, which can lead to different results and interpretations. Data Quality and Availability: Accurate and timely data is critical for performance attribution analysis, but data quality and availability can sometimes be an issue. Benchmark Selection and Appropriateness: The choice of the benchmark can significantly impact performance attribution results, and selecting an inappropriate benchmark can lead to misleading conclusions. Frequency and Timing of Analysis: The frequency and timing of performance attribution analysis can impact the results, potentially masking short-term trends or introducing noise. Interpretation and Communication of Results: Interpreting and communicating performance attribution results can be challenging, particularly when dealing with complex portfolios and sophisticated models. Performance attribution is a critical tool in the finance industry, enabling investment professionals to understand the drivers of a portfolio's performance, evaluate manager skill, and refine investment strategies. While challenges and limitations exist, the field of performance attribution is evolving to address these concerns and better serve the needs of investors and investment professionals. Continued research and improvement in attribution methodologies will further enhance the value of performance attribution in the modern finance landscape.What Is Performance Attribution?

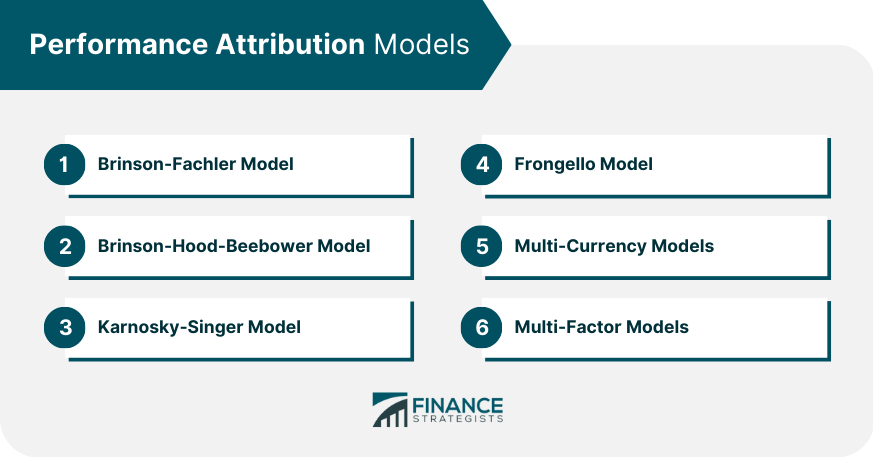

Performance Attribution Models

Brinson-Fachler Model

Brinson-Hood-Beebower Model

Karnosky-Singer Model

Frongello Model

Other Performance Attribution Models

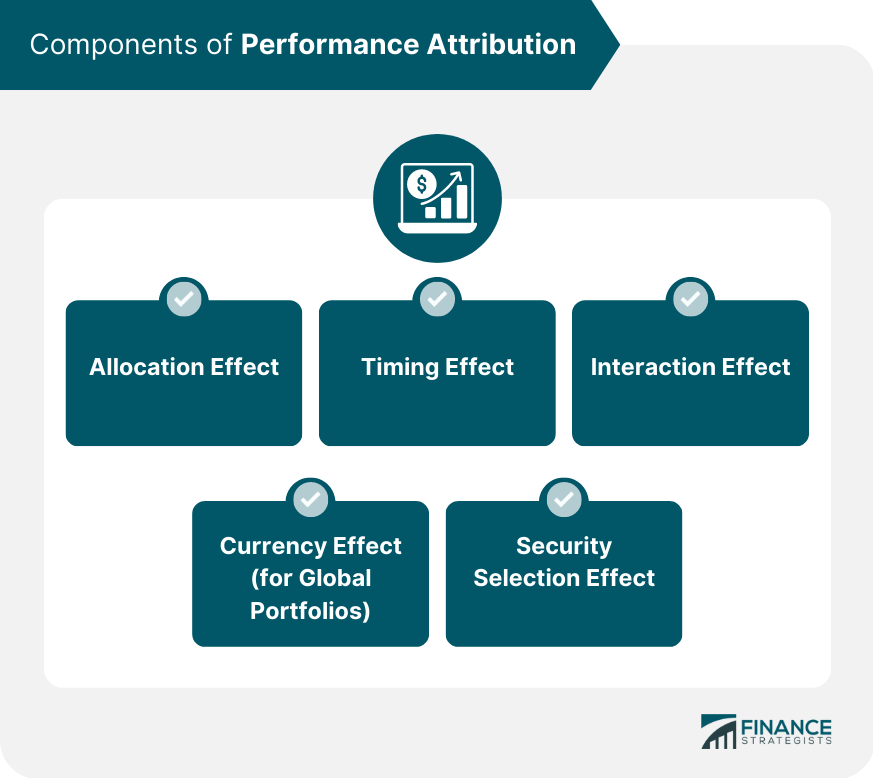

Components of Performance Attribution

Security Selection Effect

Allocation Effect

Interaction Effect

Currency Effect (for Global Portfolios)

Timing Effect

Applications of Performance Attribution

Portfolio Management

Client Communication and Reporting

Regulatory Compliance

Challenges and Limitations of Performance Attribution

Conclusion

Performance Attribution FAQs

Performance attribution is a financial analysis technique used to evaluate a portfolio's performance relative to its benchmark by decomposing the portfolio's return into various components. This helps identify the drivers of a portfolio's outperformance or underperformance and provides insights into the effectiveness of asset allocation decisions and the ability of a portfolio manager to generate alpha.

Performance attribution is essential for investors and portfolio managers because it helps them understand the sources of a portfolio's returns, assess a portfolio manager's skill, and refine investment strategies. It also enhances transparency, accountability, and communication between investment professionals and clients by clearly explaining the factors driving a portfolio's performance.

The key components of performance attribution include the security selection effect, allocation effect, interaction effect, currency effect (for global portfolios), and timing effect. These components help measure the impact of a portfolio manager's security selection skills, asset allocation decisions, currency management, and market timing ability on a portfolio's excess return.

There are several performance attribution models, including the Brinson-Fachler model, the Brinson-Hood-Beebower model, the Karnosky-Singer model, and the Frongello model. Each model has its own set of advantages and limitations, depending on the complexity of the portfolio and the desired level of analysis. For example, the Brinson-Fachler model is widely used and easy to understand but may not capture the complexity of multi-currency or multi-factor portfolios. In contrast, the Karnosky-Singer model is more suitable for global portfolios.

The challenges and limitations of performance attribution include model risk and assumptions, data quality and availability, benchmark selection and appropriateness, frequency and timing of analysis, and interpretation and communication of results. These factors can affect the accuracy and usefulness of performance attribution analysis, making it essential for investment professionals to consider the choice of models, data sources carefully, and benchmarks when conducting performance attribution studies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.