Paper trading, also known as virtual or simulation trading, is a practice method where prospective traders use simulated trading accounts while avoiding any real monetary risk. This trading practice enables individuals to test and fine-tune their trading strategies, understand market dynamics, and get accustomed to the trading platform, all without the anxiety of potential financial loss. Paper trading serves as a valuable educational tool that bridges the gap between learning and practical application in the financial markets. Historically, paper trading got its name from the practice of writing down trades on paper and tracking their hypothetical performance over time. With the advent of technology and the internet, paper trading has evolved significantly. Today, numerous online trading platforms offer virtual trading accounts with real-time market data, allowing a realistic trading experience. This evolution has made paper trading more accessible and effective as a learning tool for aspiring traders. Choosing the right platform for paper trading is crucial. Some popular platforms offering paper trading options include TD Ameritrade's thinkorswim, Interactive Brokers' Trader Workstation, and E*TRADE. These platforms offer realistic market conditions, a wide range of trading tools, and robust data for analysis. When choosing a platform, one should consider factors such as user-friendliness, available tools and resources, and customer support. To get the most out of paper trading, it's vital to simulate real market conditions as closely as possible. This includes trading with a realistic amount of simulated money, taking into account trading fees, and reacting to real-time market news and trends. Keeping track of all trades and analyzing them is a key part of paper trading. Traders should maintain a trading journal detailing their trades, including the reason for entering and exiting a trade, the strategy used, and the trade's outcome. This practice helps traders identify their strengths and weaknesses and improve their strategies over time. While paper trading is an excellent learning tool, it lacks the emotional impact of real trading. The fear of loss and the thrill of gain, which significantly influence a trader's decision-making process in real trading, are absent in paper trading. It's important for traders to be aware of this difference and prepare themselves emotionally when transitioning to real trading. In paper trading, there's no real monetary risk, which can lead to a disregard for risk management strategies. However, in real trading, implementing risk management is crucial. Traders need to set stop-loss orders to limit potential losses and take-profit orders to ensure they don't miss out on gains. In real trading, large trades can impact the market, causing price slippage. However, in paper trading, trades do not affect the market, and orders are always filled at the intended prices. This discrepancy can lead to inflated paper trading results compared to real trading. A trade plan is a comprehensive set of rules and guidelines that define how, when, and why you trade. It includes your trading goals, risk tolerance levels, preferred trading instruments, and specific criteria for entering and exiting trades. Developing a clear and detailed trade plan is a vital step in successful paper trading. Once you have a trade plan, the next step is to implement it consistently in your paper trading. This involves executing trades based on your plan and avoiding impulsive decisions. By sticking to your plan, you can assess its effectiveness and make necessary adjustments. Regular evaluation of your trade plan is essential to improve your trading performance. This involves reviewing your trading journal, analyzing your successful and unsuccessful trades, and identifying areas for improvement. You should consider factors like whether you're meeting your trading goals, how well you're managing risk, and whether you're following your trade plan consistently. One of the most significant advantages of paper trading is its risk-free nature. By using simulated money, traders can learn the ropes of trading without the fear of losing real money. This feature allows traders to understand the mechanics of trading, such as placing orders, setting stop losses, and taking profits, in a stress-free environment. Paper trading also helps traders understand market dynamics. By monitoring market trends and news, traders learn how these factors influence asset prices. For instance, they can observe how a company's stock price responds to its earnings report or how a currency pair reacts to a change in interest rates. Testing trading strategies is another crucial aspect of paper trading. Traders can experiment with various strategies, such as day trading, swing trading, and scalping, to see which works best for them. Additionally, they can use technical analysis tools and indicators available on the trading platform to aid their decision-making process. While the absence of real monetary risk in paper trading is an advantage for learning, it's also a limitation. Without real money at stake, traders may take risky trades that they wouldn't in real trading, leading to unrealistic expectations and untested risk management strategies. In paper trading, all orders are filled at the exact prices traders specify, which is not always the case in real trading due to price slippage and market impact. This discrepancy can lead to overly optimistic paper trading results. Successful paper trading can sometimes lead to overconfidence, causing traders to overlook risks and make impulsive decisions in real trading. It's crucial to remember that paper trading is a learning tool and success in paper trading doesn't guarantee success in real trading. Determining when to transition from paper trading to real trading can be challenging. A good indicator is consistent profitability and a clear understanding of market dynamics and your trading strategy. However, remember that real trading involves additional factors like emotional pressure and market impact, which you need to prepare for. Transitioning to real trading comes with challenges, the most significant being the emotional impact of real monetary gain and loss. Other challenges include dealing with price slippage and the potential impact of your trades on the market. To ensure a smooth transition, start with a small amount of money in real trading and gradually increase it as you gain confidence and experience. Continue to follow your trade plan and risk management strategies, and regularly review and adjust them as needed. Paper trading is a risk-free, simulated trading practice that allows aspiring traders to learn the ropes of trading, understand market dynamics, and test their trading strategies without any real monetary risk. Paper trading is an invaluable educational tool in the trading world, offering a risk-free platform for learning and strategy testing. However, it's important to be aware of its limitations, such as the absence of real monetary risk and unrealistic market fill. To make the most of paper trading, choose the right platform, simulate real market conditions, and track and analyze your trades. For individuals new to trading, seeking professional advice can be very beneficial. A professional can provide personalized guidance based on your financial goals and risk tolerance. They can also help you develop a robust trade plan and advise you on effective risk management strategies. What Is a Paper Trade?

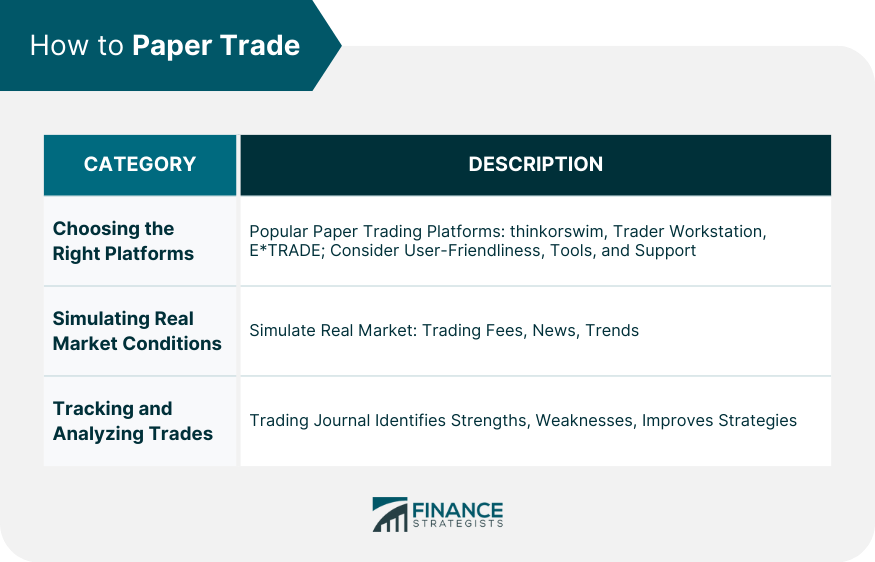

How to Paper Trade

Choosing the Right Platforms

Simulating Real Market Conditions

Tracking and Analyzing Trades

Paper Trade vs Real Trade

Differences in Emotional Impact

Risk Factors

Market Impact

Paper Trade Strategies

Developing a Trade Plan

Implementing the Trade Plan

Evaluating the Trade Plan

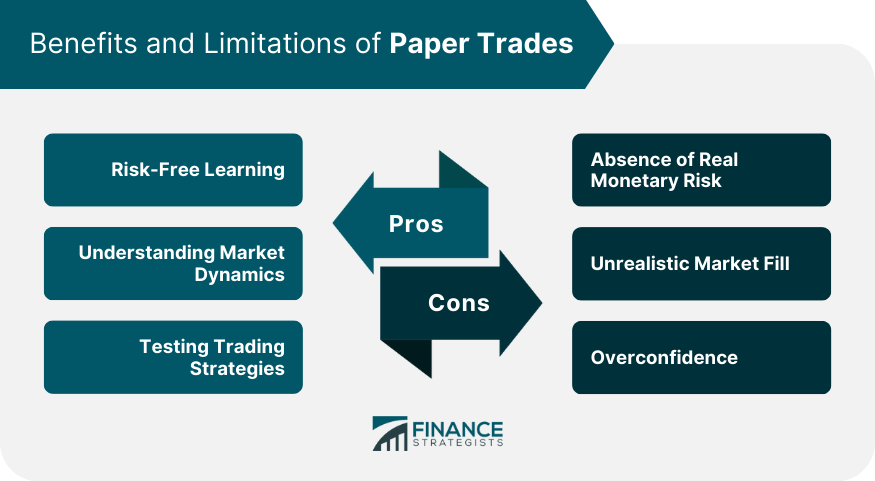

Benefits of Paper Trades

Risk-Free Learning

Understanding Market Dynamics

Testing Trading Strategies

Limitations of Paper Trades

Absence of Real Monetary Risk

Unrealistic Market Fill

Overconfidence

Transitioning From Paper Trade to Real Trade

When to Make the Shift

Challenges in Transitioning

Strategies for a Smooth Transition

Final Thoughts

Paper Trade FAQs

Paper trading serves as a risk-free platform for aspiring traders to learn about the trading process, understand market dynamics, and test trading strategies.

While paper trading platforms today offer real-time market data and a wide range of trading tools, the experience is not entirely identical to real trading. The emotional impact, price slippage, and market impact in real trading are factors that paper trading cannot replicate.

Paper trading is a valuable learning tool that can help you understand trading mechanics and test your strategies. However, success in paper trading does not guarantee success in real trading due to factors like emotional pressure and market impact.

You should consider transitioning when you're consistently profitable in paper trading, have a good understanding of market dynamics, and feel confident in your trading strategy. However, be prepared for the additional emotional pressure and other challenges of real trading.

While it's possible to start with real trading, it's not advisable, especially for beginners. Paper trading allows you to learn and make mistakes without any financial risk, making it an invaluable first step in your trading journey.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.