An Overnight Position in finance describes a scenario where a trader holds a security or financial instrument past the close of a trading day and into the next one. The global markets' interconnected nature significantly impacts these positions, as events occurring in one region during non-trading hours can cause substantial shifts in another region's market, influencing the value of the held positions. The advantages of maintaining an Overnight Position include potential for higher returns, especially in volatile markets and across different time zones. However, there are inherent disadvantages as well. These include exposure to gap risk, where there could be a significant difference between the closing price of one trading day and the opening price of the next, and vulnerability to unpredictable market conditions due to after-hours news or global events. Balancing these factors is crucial when considering an Overnight Position. Trading involves a sequence of actions: opening a position when buying or selling a financial instrument, and then closing that position when the reverse action is undertaken. An overnight position occurs when a trader retains a position at the close of the daily trading session, which extends into the next day. This hold period can range from a single night to several days, weeks, or even months, depending on the trader's strategy. Potential for Higher Returns: In volatile markets, significant price changes can occur outside regular trading hours. If a trader can accurately predict these changes, they can realize substantial profits. Capitalizing on Global Time Zones: Markets like Forex operate 24 hours, allowing traders to capitalize on different time zones. An investor can take advantage of economic events happening during the Asian or European trading sessions, for example. Exposure to Gap Risk: Holding an overnight position exposes the trader to gap risk. This is when the opening price of a security significantly differs from the previous day's closing price due to after-hours news or events. Unpredictability of Market Conditions: Market conditions can change rapidly due to factors like economic indicators, policy changes, or geopolitical events. This unpredictability can negatively impact a trader's overnight position. In the stock market, an overnight position can be risky because of the potential for significant price changes due to after-hours news or corporate announcements. However, it can also be profitable if the trader accurately predicts these changes. The Forex market operates 24 hours a day, five days a week, across different time zones. Therefore, an overnight position is standard practice. However, due to fluctuations in currency values based on geopolitical events and economic indicators, this type of trading can be highly volatile. Futures contracts are agreements to buy or sell a specific asset at a predetermined price at a future date. Therefore, holding an overnight position in futures trading could mean potentially significant profits or losses, depending on market volatility and the trader's ability to predict market trends. Global markets significantly impact overnight positions, which are investment positions held open after the end of a trading day. Market events, such as policy changes, economic data releases, or geopolitical developments in different time zones can lead to price fluctuations, impacting the value of these positions. Overnight Positions risks also include currency exchange rate changes, particularly for positions in foreign markets. Additionally, the inability to respond to these events in real-time due to market closure adds to the risk. Therefore, managing overnight positions requires a thorough understanding of global markets and a well-strategized risk management plan. Interest or swap rates are a critical factor when considering overnight positions, particularly in Forex trading. A swap is an interest fee that is either paid or received by a trader who holds a position overnight due to the difference in interest rates between the two currencies in a pair. Depending on the direction of the trade and the interest rate differential, this could either lead to a net gain or loss, impacting the profitability of the position. One common method is to use stop loss orders, which automatically sell a security when it reaches a specific price. This strategy helps limit potential losses if the market moves in an unfavorable direction. Hedging strategies can also be useful for managing risk. These may involve taking an offsetting position in a related security to protect against adverse price movements. For instance, a trader holding a long position in a stock might purchase a put option on the same stock, providing insurance if the stock's price falls. Diversification is another critical strategy in risk management. Holding a variety of investments can help buffer against significant losses, as poor performance in one investment may be offset by strong performance in another. Regulatory considerations play a crucial role in managing overnight positions. Regulations often stipulate the amount of capital that must be maintained to cover potential losses from these positions, known as the overnight margin requirement. This requirement is designed to protect investors and brokers from the risk associated with price fluctuations while the market is closed. Additionally, regulations may limit the types and quantity of positions that can be held overnight, particularly in volatile or less liquid markets. Compliance with these regulations is essential to avoid penalties and ensure the financial stability of the investing entity. A notable example of a successful overnight position is the bet against the British Pound by George Soros in 1992. Soros held a short position overnight, predicting that the Pound would fall. When the Bank of England withdrew from the European Exchange Rate Mechanism the following day, the Pound plummeted, and Soros reportedly made a profit. On the flip side, the collapse of Long-Term Capital Management (LTCM) in 1998 serves as a cautionary tale. LTCM, a hedge fund, held risky overnight positions in derivatives. When Russia defaulted on its bonds, it triggered a global financial crisis, and LTCM's positions quickly became unsustainable, leading to a significant financial loss and eventually, the fund's collapse. Overnight Position in financial trading refers to the situation where an investor retains a security or financial instrument beyond the close of the trading day and into the next one. This strategy is significantly influenced by global market dynamics, as events in one region can cause substantial price movements in another, thus impacting the value of the held positions. Holding an Overnight Position offers potential advantages, such as the opportunity for higher returns, especially in volatile markets and across different time zones. However, it also carries certain risks, including exposure to gap risk and the unpredictability of market conditions due to after-hours events. Therefore, understanding the concept of an Overnight Position, its potential benefits, risks, and the influence of global markets, is crucial for informed decision-making in financial trading.Definition of Overnight Positions

The Mechanics of Overnight Positions

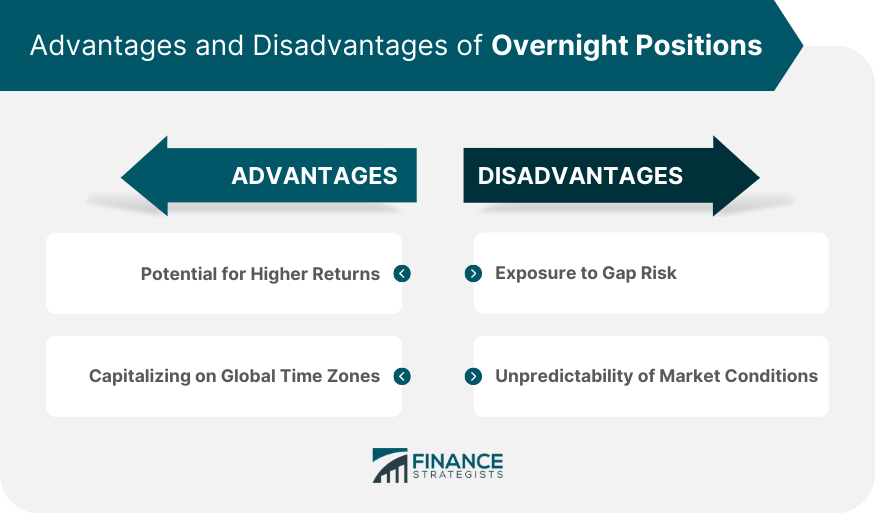

Advantages and Disadvantages of Overnight Positions

Advantages of Overnight Positions

Disadvantages of Overnight Position

Overnight Positions and Different Financial Instruments

In the Stock Market

In Forex Trading

In Futures Trading

The Impact of Global Markets on Overnight Positions

Overnight Positions and Interest (Swap) Rates

Managing Risk With Overnight Positions

Using Stop Loss Orders

Implementing Hedging Strategies

Importance of Diversification

Regulatory Considerations For Overnight Positions

Case Studies on Overnight Positions

Successful Overnight Positions

Lessons From Unsuccessful Overnight Positions

Conclusion

Overnight Position FAQs

An Overnight Position in financial trading refers to a situation where a trader holds a security or financial instrument past the close of the trading day and into the next one. This position could be long (buying) or short (selling).

Holding an Overnight Position comes with several risks. These include gap risk, where a significant difference between the closing price of one trading day and the opening price of the next can occur. Also, unpredictable market conditions due to after-hours news or events can impact the value of the held position.

An Overnight Position can offer potential benefits such as higher returns, especially in volatile markets where significant price changes can occur overnight. Additionally, for markets like Forex that operate 24 hours, traders can capitalize on events happening in different time zones.

In Forex trading, a trader holding an Overnight Position will either pay or receive a swap, an interest fee due to the difference in interest rates between the two currencies in a pair. Depending on the direction of the trade and the interest rate differential, this could either lead to a net gain or loss.

Traders can manage the risk of an Overnight Position by using stop loss orders, which automatically sell a security when it reaches a specified price. Implementing hedging strategies, such as taking an offsetting position in a related security, can also help. Diversification of investments is another important strategy for risk management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.