Good This Week is a term used in the realm of finance, particularly in the sphere of stock trading. It refers to an order type that remains active in the market until the end of the trading week. This type of order can benefit traders seeking to capitalize on short-term market fluctuations throughout the week without actively monitoring the market daily. Understanding and applying the GTW concept in financial analysis can give traders and investors unique insights. It can help investors assess short-term market dynamics and decide when to buy or sell securities. The GTW approach is pivotal in managing market volatility, enhancing investment strategies, and optimizing potential returns. The advent of GTW can be traced back to the evolution of stock market operations and the increasing complexity of trading strategies. As financial markets grew more volatile and fast-paced, traders sought more sophisticated tools to manage their trades, giving birth to order types like GTW. The primary principle behind GTW is that it allows traders to place an order that stays active for a week. This means that the order will keep trying to execute based on the trader's specifications until the end of the week or until it is manually canceled. This principle is particularly beneficial for traders who cannot monitor the markets constantly but have a good sense of weekly market trends. One of the key components of GTW is an understanding of financial market conditions. This includes awareness of macroeconomic indicators, trends in global and domestic markets, and specific sector performance. Economic indicators such as inflation rates, unemployment rates, GDP growth, and consumer sentiment indices are integral to GTW analysis. These indicators provide insights into the economy's overall health, which can influence market trends and stock prices. Investor sentiment, the overall attitude of investors toward a particular market or security, is another crucial component of GTW. Sentiment can drive market fluctuations and often reflects economic indicators and financial news. GTW orders allow an investor to plan their trading strategy for the week and set specific orders that align with this strategy. This can save time and effort as the investor does not need to continually monitor the market and place orders manually. Since these orders remain open for the entire week, GTW provide the opportunity to execute trades at the desired price within this timeframe. This is especially beneficial in volatile markets, where prices can fluctuate widely within short periods. By setting a specific price for a trade, an investor can ensure they do not pay more (in the case of a buy order) or receive less (in the case of a sell order) than their set limit. This can help to protect against sudden market movements and manage potential losses. By setting a limit price, investors can avoid buying a security at a higher price or selling at a lower price than they are comfortable with. In addition, since GTW orders are automatically cancelled if not executed by the end of the week, investors can save on potential costs associated with keeping an order open for longer periods. By allowing the setting of specific trade parameters for the week, they can help to streamline the trading process. This is particularly beneficial for busy investors or those who may not have the time or ability to closely monitor the markets throughout the trading week. If the market never reaches the specified price within the week, the order will not be executed. Consequently, investors might miss out on potential gains if the market moves in a favorable direction after the order is cancelled. The GTW order remains active for only one week, which might not be a sufficient time frame for certain trading strategies. Some market moves occur over a longer time period, and a GTW order might expire before these moves take place. This limitation might require the investor to continually reassess and place new orders each week. GTW orders may not be suitable for highly volatile markets. If the market price suddenly drops well below your GTW sell order, or rises much higher than your GTW buy order, you might miss out on the chance to trade at the most advantageous times. In some cases, short-term market fluctuations can trigger the execution of a GTW order, only for the price to move back towards the previous levels. This could result in buying at a higher price or selling at a lower price than would have been possible with a more flexible trading approach. For large orders or less liquid securities, there is a risk that a GTW order might be partially filled. This means that only part of the order is executed, which could leave the investor with an unintended open position at the end of the week. GTW orders are often most effective in stable markets where prices are expected to remain within a relatively predictable range. If the market is highly volatile, GTW orders may be less effective due to the greater likelihood of rapid price changes. In such situations, it might be prudent to consider other types of orders or trading strategies. Price alerts can notify you when a security's price reaches a certain level, allowing you to review your GTW order and adjust it if necessary. This can help you respond more effectively to changing market conditions. Even though GTW orders remain active for a week, it's still important to review your orders regularly and adjust them based on changes in market conditions or your investment strategy. This can help to ensure that your orders continue to align with your goals and the current market situation. While GTW orders can be a helpful tool, it's important not to rely on them exclusively. Consider using a variety of trading tools and strategies to diversify your approach and mitigate risk. This could include other types of orders, like stop orders or trailing stop orders, as well as different trading strategies suited to various market conditions. Good This Week orders offer traders and investors a valuable tool to navigate the complexities of the stock market. GTW orders provide flexibility and convenience, allowing traders to capitalize on short-term market fluctuations without constant monitoring. They enable better control over trading activity, simplify the trading process, and contribute to risk management by setting specific price limits. However, there are certain drawbacks to consider. GTW orders may result in missed trading opportunities, have a limited time frame, and may not be suitable for highly volatile markets. False executions and potential partial fills are also factors to be aware of. To make the most of GTW orders, it is important to understand market volatility, use price alerts, regularly review and adjust orders, and diversify trading tools and strategies.What Is Good This Week (GTW)?

Understanding the GTW Concept

Historical Background

Basic Principles

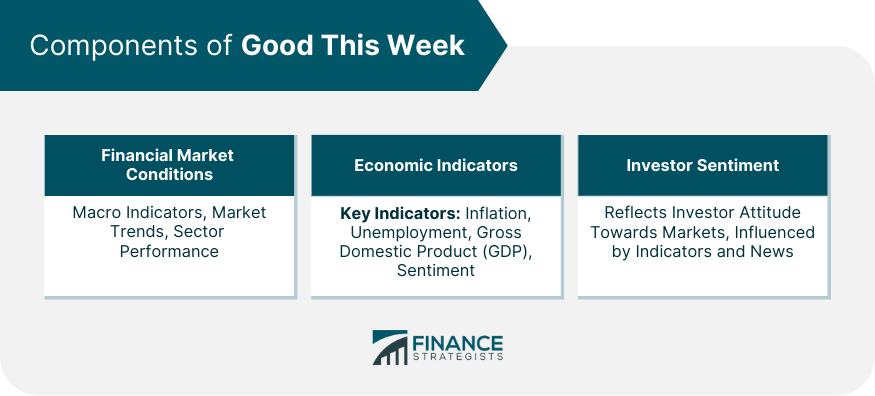

Components of Good This Week

Financial Market Conditions

Economic Indicators

Investor Sentiment

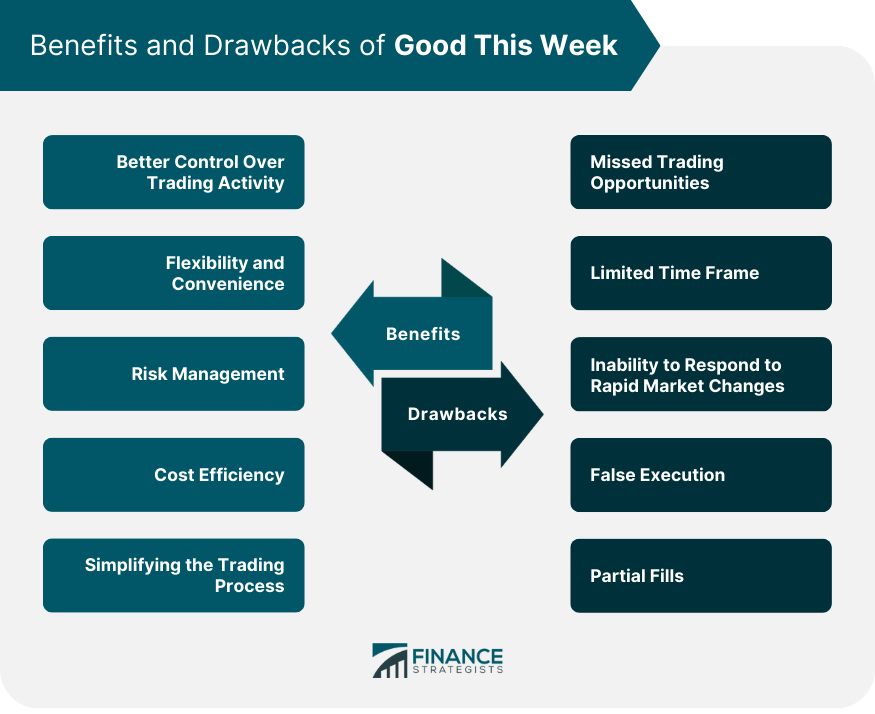

Benefits of Good This Week

Better Control Over Trading Activity

Flexibility and Convenience

Risk Management

Cost Efficiency

Simplifying the Trading Process

Drawbacks of Good This Week

Missed Trading Opportunities

Limited Time Frame

Inability to Respond to Rapid Market Changes

False Execution

Partial Fills

Best Practices With Good This Week

Understand Market Volatility

Use Price Alerts

Regularly Review and Adjust Orders

Diversify Your Tools

Conclusion

Good This Week (GTW) FAQs

A GTW order is a type of order in stock trading that remains active in the market until the end of the trading week. It allows traders to capitalize on short-term market fluctuations without the need for constant monitoring.

GTW orders provide flexibility and convenience to traders. They allow traders to plan their trading strategy for the week and set specific orders that align with their strategy. This saves time and effort as traders do not need to continually monitor the market and manually place orders.

If a GTW order is not executed by the end of the week, it is automatically canceled. This means that the order will not be executed if the specified price is not reached within the week.

Yes, there are some drawbacks to consider. GTW orders may result in missed trading opportunities if the market does not reach the specified price within the week. Additionally, the limited time frame of a GTW order may not be sufficient for certain trading strategies.

To effectively use GTW orders, traders should understand market volatility, set price alerts to stay informed of price movements, regularly review and adjust their orders based on market conditions, and consider diversifying their trading tools and strategies to mitigate risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.