The Financial Information Exchange (FIX) protocols are a series of message specifications developed for the real-time electronic exchange of securities transactions. The protocols form the backbone of communication in the financial industry, standardizing the process of sending and receiving messages related to trade execution, order routing, market data dissemination, and more. FIX protocols offer several advantages including speed and efficiency in transactions due to their standardized format, reduced trading costs through automation, easy integration and interoperability across different systems, and global consistency due to their wide adoption in the financial industry. Despite its advantages, implementing FIX protocols can be technically challenging and require continuous monitoring. Security issues pose another challenge as FIX is susceptible to cyber-attacks. Furthermore, the verbose nature of FIX protocols makes them less suitable for transmitting large amounts of market data, and as a text-based protocol, they can consume more bandwidth than binary protocols. The Financial Information Exchange (FIX) protocol is a messaging standard developed specifically for the real-time electronic exchange of securities transactions. It is a series of message specifications for exchanging electronic information related to securities transactions and markets. Since its inception, FIX has evolved over several versions. Each version brought improvements and additional functionality to cater to the growing demands of the financial industry. The most commonly used version today is FIX 4.2, although later versions like FIX 4.4 and FIX 5.0 are also in use. The FIX protocol is built on a series of key-value pairs, with each pair representing a unique identifier and its corresponding value. For example, a tag might represent a client's order ID, and the corresponding value would be the actual order ID. The Financial Information Exchange protocols consist of two primary components: administrative and application messages. Administrative messages are responsible for managing session-level behaviors such as logon, logout, and heartbeat to maintain the connection and ensure its integrity. Application messages, on the other hand, are used for business-related communication, including orders, executions, and trade reports. These components work together to facilitate seamless and efficient communication in the financial industry. FIX protocols are often used to route orders for execution. The protocols enable orders to be sent from order management systems at buy-side firms to sell-side firms which then execute the trades. FIX is also essential for pre-trade and post-trade communication. It allows for the real-time exchange of order statuses, fills, and trade confirmations, providing full visibility throughout the trade lifecycle. FIX protocols also play a significant role in disseminating market data. Exchanges, for example, can use FIX to distribute information about prices and volumes to traders and other market participants. In today's fast-paced trading environment, FIX is a cornerstone for algorithmic trading and order management systems. These systems rely heavily on FIX for the rapid and efficient transmission of order and execution information. FIX provides a standard format for messages that enables quick and efficient transmission of information. This results in faster execution of trades and reduced latency. By automating communication processes, FIX reduces the need for manual intervention and the associated costs. It also decreases the risk of errors that could potentially lead to trade breaks and financial losses. FIX is widely adopted across the financial industry, enabling easy integration and interoperability between different systems, platforms, and networks. FIX provides a standardized method of communication that ensures consistency across different geographical locations and financial markets. Implementing and maintaining a FIX environment can be technically challenging. It requires a thorough understanding of the protocol, as well as continuous monitoring and troubleshooting. Like any electronic communication system, FIX is susceptible to cyber-attacks. As such, robust security measures need to be in place to ensure data integrity and confidentiality. Despite its widespread use, FIX does have its limitations. For instance, it is less suitable for transmitting large amounts of market data due to its verbose format. Also, as a text-based protocol, it can consume more bandwidth compared to binary protocols. FIX has become the de facto standard for equity trading. For instance, a global investment bank might use FIX to send orders to a broker in a foreign market, who in turn routes these orders to the relevant exchange for execution. It allows for streamlined, real-time communication and significantly reduces the time to execute trades. In the foreign exchange market, FIX is used by banks, brokers, and liquidity providers for transmitting FX spot, forward, and option trade information. It enables these participants to communicate in real-time, executing trades efficiently and accurately. For derivatives trading, including futures and options, FIX allows traders to submit orders, receive trade confirmations, and monitor their positions. It provides a reliable and consistent method for transmitting complex derivatives orders and trades. In the bond market, FIX is used for trading both corporate and government bonds. It enables the electronic communication of bids, offers, and trades, providing greater transparency and efficiency in this traditionally over-the-counter market. As the financial industry continues to evolve, so too does the FIX protocol. New versions are being developed to address the ever-changing needs of market participants. For example, FIX is expanding to support new asset classes and trading strategies. Technological advancements in the financial sector, such as the rise of algorithmic trading and high-frequency trading, have led to increased adoption and reliance on FIX. As technology continues to drive change in the industry, the importance of FIX is likely to grow even further. The future of electronic trading is intrinsically linked with the future of FIX. As markets become more interconnected and electronic trading becomes more prevalent, the role of FIX as a standard messaging protocol is expected to become even more critical. Regulatory changes can also impact the future of FIX. For example, regulations requiring increased transparency and reporting could lead to new requirements for FIX messaging. As such, it's important for those using FIX to stay abreast of regulatory developments. Understanding the Financial Information Exchange (FIX) protocols is vital for anyone operating within the global financial ecosystem. These protocols have revolutionized the way securities transactions are communicated, providing speed, efficiency, and standardization. They've significantly reduced the cost of trading and allowed for seamless integration and interoperability across different systems, platforms, and networks. However, there are challenges and limitations to FIX. It can be technically complex to implement and maintain, and there are inherent security risks due to potential cyber-attacks. Additionally, its verbose text-based format may not be suitable for transmitting large amounts of market data. Despite these challenges, the benefits of FIX far outweigh the drawbacks, making it a cornerstone in the financial industry. As we continue to evolve in the digital era, the relevance and impact of FIX protocols are expected to grow even further.Definition of Financial Information Exchange (FIX)

FIX Protocols

Understanding FIX Protocols

Development and Versions of FIX Protocols

Structure of FIX Protocol Messages

Key Components of FIX Protocols

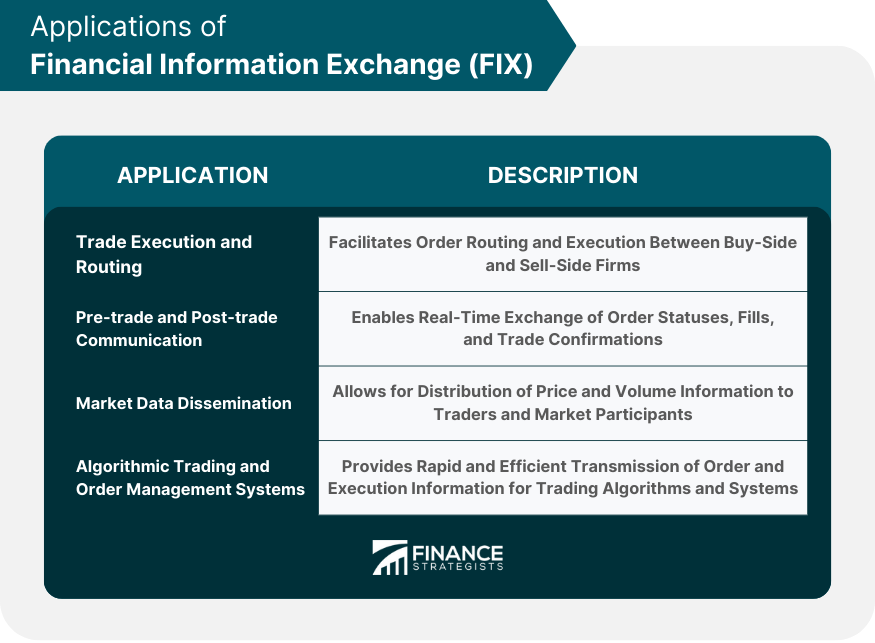

Applications of Financial Information Exchange (FIX)

Trade Execution and Routing

Pre-trade and Post-trade Communication

Market Data Dissemination

Algorithmic Trading and Order Management Systems

Advantages of Financial Information Exchange (FIX)

Efficiency and Speed in Transactions

Reduction in Cost of Trading

Integration and Interoperability Benefits

Global Standardization and Consistency

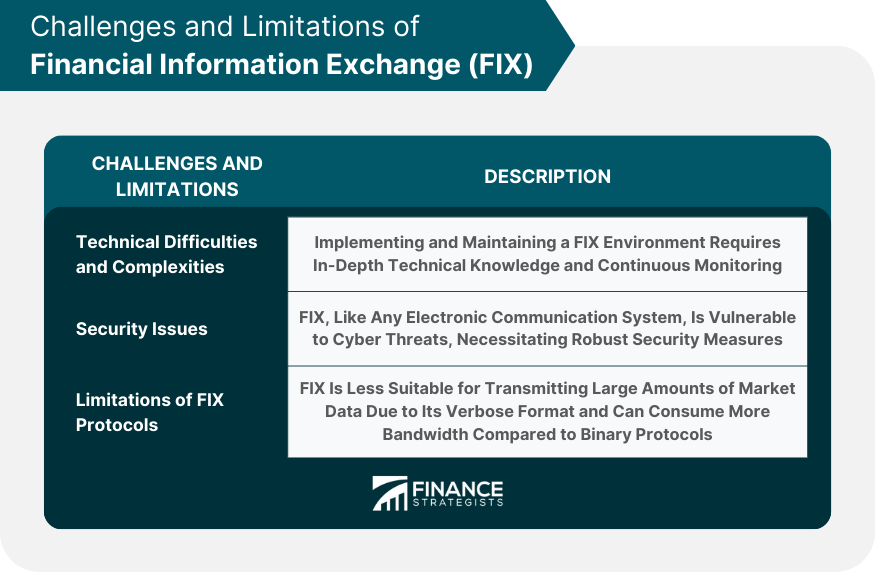

Challenges and Limitations of Financial Information Exchange (FIX)

Technical Difficulties and Complexities

Security Issues

Limitations of FIX Protocols

Case Studies: Financial Information Exchange (FIX) in Practice

FIX in Equity Trading

FIX in Foreign Exchange Trading

FIX in Derivatives Trading

FIX in the Bond Market

The Future of Financial Information Exchange (FIX)

Emerging Trends and Improvements in FIX Protocols

FIX and the Impact of Financial Technology Advancements

FIX and the Future of Electronic Trading

Regulatory Considerations in the Future of FIX

Conclusion

Financial Information Exchange (FIX) FAQs

The Financial Information Exchange (FIX) protocol is a series of messaging specifications developed for the real-time electronic exchange of securities transactions. It is widely used by financial institutions globally to communicate trade-related information.

The key components of FIX protocols are administrative and application messages. Administrative messages handle session management, while application messages handle business-related communication like order execution and trade reporting.

FIX is extensively used for trade execution and routing, pre-trade and post-trade communication, market data dissemination, and in algorithmic trading and order management systems.

FIX offers several advantages including speed and efficiency in transactions, reduced trading costs, easy system integration and interoperability, and consistent global communication standards.

Implementing and maintaining a FIX environment can be technically challenging and requires continuous monitoring. Security is another concern as FIX is susceptible to cyber-attacks. FIX's verbose nature and the fact that it's a text-based protocol can lead to higher bandwidth consumption compared to binary protocols.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.