Carried interest, also known as "carry," refers to a share of profits earned by investment fund managers or general partners in private equity, venture capital, or certain hedge funds. It represents a portion of the investment gains achieved beyond a specific threshold, known as the hurdle rate or preferred return, which is typically set to ensure that limited partners receive a minimum return on their investments. The purpose of carried interest is to align the interests of fund managers with those of the investors. It incentivizes fund managers to generate high returns by providing them with a share of the profits realized from successful investments, thereby motivating them to make sound investment decisions and actively manage the fund's portfolio. The concept of carried interest in the financial sector can be traced back to medieval Europe, but it became prevalent in the modern private equity industry in the mid-20th century. It was seen as a means to align the interests of fund managers and their investors. Since then, it has been a fundamental part of the compensation structure in private equity, hedge funds, and venture capital. Carried interest is typically a percentage of the fund's profits that the fund managers receive in addition to their management fee, which is usually a fixed percentage of the fund's total assets. While the management fee is guaranteed, carried interest is contingent on the fund generating profits. The standard "2 and 20" compensation structure in private equity and hedge funds refers to a 2% management fee and a 20% carried interest. The calculation of carried interest often involves a hurdle rate or preferred return. This means that the fund's investors receive their initial capital plus a predetermined return before the managers start earning carried interest. For instance, if a fund has an 8% hurdle rate, the fund managers only start receiving carried interest once the fund has returned the initial investment plus an 8% return to its investors. Let's assume a private equity fund has $100 million in assets under management, a 2% management fee and a 20% carried interest with an 8% hurdle rate. If the fund returns $150 million after the sale of its investments, the first $108 million (the return of initial investment plus the hurdle rate) goes to the investors. The remaining $42 million is split between the investors and the fund managers according to the carried interest rate. So, the managers would receive $8.4 million (20% of $42 million) as carried interest. Private equity firms pool capital from institutional and individual investors to invest in businesses and assets, while hedge funds invest in a broader range of assets, often using complex strategies and leverage to generate returns. Both types of funds are usually structured as limited partnerships, with the investors as the limited partners and the fund managers as the general partners. In private equity and hedge funds, carried interest is a fundamental part of the compensation for the fund managers. It provides significant upside potential and aligns the managers' interests with those of the investors. Carried interest can influence investment decisions as fund managers have a direct stake in the fund's profits. It incentivizes them to take on higher-risk, higher-reward investments in the hope of maximizing returns. However, it can also lead to excessive risk-taking, as fund managers may be encouraged to pursue high-risk investments to achieve higher returns and consequently, a larger carry. Real estate investment involves purchasing property with the expectation of earning returns through rental income, appreciation, or both. These investments can range from residential properties to commercial real estate like office buildings, shopping centers, and industrial properties. In a real estate investment partnership, the developer or sponsor typically serves as the general partner and is responsible for managing the project. The investors are the limited partners. The general partner usually receives a percentage of the profits as carried interest, providing an incentive to maximize the project's profitability. Consider a real estate developer that forms a partnership with investors to build a residential complex. The developer contributes 10% of the required capital, and the investors provide the rest. Once the project is completed and the units are sold, the proceeds are used to pay back the investors' capital contributions plus a preferred return. Any remaining profits are divided between the developer and the investors based on the agreed-upon carried interest rate. If the developer has a 20% carried interest, they would receive 20% of these remaining profits. In the United States, the treatment of carried interest has been subject to changes and proposed changes in tax laws. For instance, the Tax Cuts and Jobs Act of 2017 imposed a three-year holding period for qualifying for long-term capital gains treatment on carried interest. Internationally, the treatment of carried interest varies. Some jurisdictions, like the United Kingdom, treat carried interest as capital gains, while others, like Canada, tax it as ordinary income. Various proposals have been made to change the tax treatment of carried interest. If these changes are enacted, they could significantly increase the tax burden on fund managers and potentially influence the structure of compensation in the investment industry. Carried interest aligns the interests of fund managers and investors, incentivizing managers to maximize returns. However, it can also encourage excessive risk-taking. Furthermore, the tax treatment of carried interest is seen by some as unfair and contributing to income inequality. The ethical debates surrounding carried interest primarily focus on its tax treatment. While some view the current policy as a justified reward for risk, others see it as an unjust benefit for the wealthy. Carried interest plays a significant role in discussions about income inequality, given the large sums of money involved and the preferential tax treatment it often receives. Critics argue that the policy exacerbates income inequality, as it allows some of the wealthiest individuals to pay a lower percentage of their income in taxes than many middle-class individuals. Carried interest, often termed "carry," is a profit share given to investment managers, serving as a performance incentive that encourages the maximization of fund performance. It is a fundamental part of the compensation structure in areas like private equity, hedge funds, and venture capital. The calculation of carried interest usually involves a hurdle rate or preferred return, ensuring that investors receive their initial capital plus a specified return before managers start receiving carried interest. In investment sectors like private equity and hedge funds, carried interest plays a significant role in aligning the interests of fund managers and investors. It underscores the principle of shared risk and reward, making it an essential concept for anyone involved in or considering an investment in these types of funds. Understanding carried interest is crucial for successful navigation in the complex landscape of investment funds.Definition of Carried Interest

Historical Context and Development of Carried Interest

Understanding the Concept of Carried Interest

Detailed Explanation of Carried Interest

How Carried Interest is Calculated

Examples of Carried Interest in Practice

Role of Carried Interest in Private Equity and Hedge Funds

Explanation of Private Equity and Hedge Funds

Carried Interest as a Compensation Mechanism in These Sectors

Impact of Carried Interest on Investment Decisions

Carried Interest and Real Estate Investments

Explanation of Real Estate Investments

How Carried Interest Works in Real Estate

Case Studies of Carried Interest in Real Estate Investment

Carried Interest Regulation and Legislation

Domestic Regulations Pertaining to Carried Interest

International Regulations on Carried Interest

Proposed Legislation Changes and Their Potential Impact

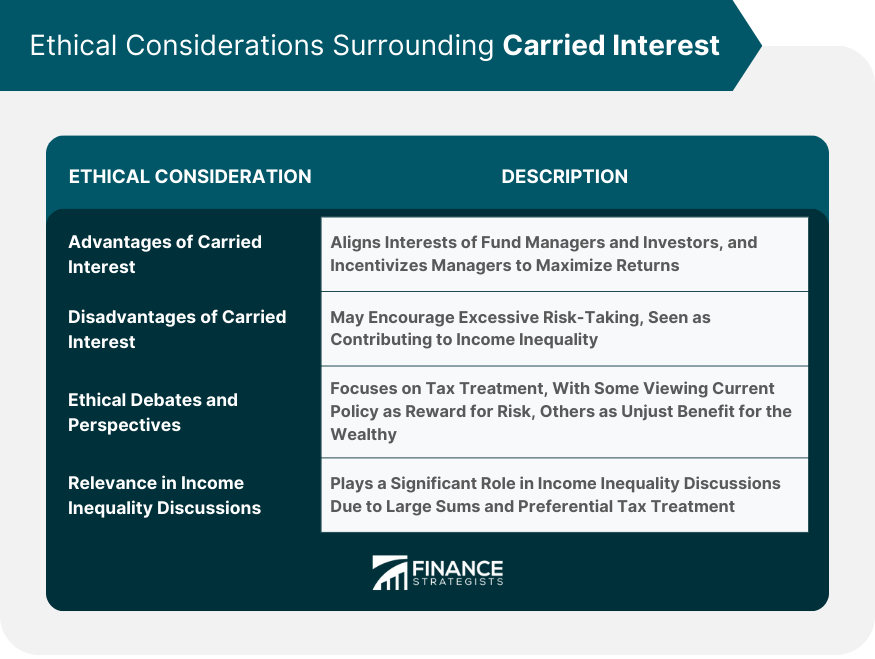

Ethical Considerations Surrounding Carried Interest

Advantages and Disadvantages of Carried Interest

Ethical Debates and Perspectives

Relevance of Carried Interest in Income Inequality Discussions

Bottom Line

Carried Interest FAQs

Carried interest, often referred to as "carry," is a share of the profits from an investment that is paid to the investment manager. It acts as a performance incentive, motivating the manager to maximize the returns on the fund's investments. Carried interest is a critical part of the compensation structure in investment sectors like private equity, hedge funds, and venture capital.

Carried interest is typically a percentage of a fund's profits that the fund managers receive over and above their management fee. The calculation often involves a hurdle rate or preferred return, which means that the fund's investors receive their initial capital plus a predetermined return before the managers start earning carried interest.

In real estate investment partnerships, the developer or sponsor (the general partner) typically receives a percentage of the profits as carried interest. This provides an incentive for them to maximize the project's profitability. Once the investors' capital contributions and a preferred return are paid back, any remaining profits are divided based on the agreed-upon carried interest rate.

In many jurisdictions, carried interest is taxed at the long-term capital gains rate, which is usually lower than the ordinary income tax rate. This is because the income is considered a return on investment rather than compensation for services. However, the tax treatment of carried interest has been a subject of debate and may vary between jurisdictions.

The future of carried interest depends on changes in legislation, the evolution of the investment industry, and societal attitudes toward income inequality. Potential changes in the tax treatment of carried interest or modifications to its structure in investment funds could be on the horizon. Technological developments, like the rise of cryptocurrency and blockchain, could also influence the future of carried interest.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.