Portfolio attribution analysis is a quantitative method used by investment managers to evaluate the performance of a portfolio by comparing it against a benchmark. It helps identify the sources of excess return, or "alpha," by breaking down the active return into various attribution effects. This analysis assists investment managers in understanding the drivers of portfolio performance, evaluating their investment strategies, and communicating results to clients. Effective portfolio attribution analysis enables investment managers to: Evaluate their investment decisions by isolating the impact of security selection, asset allocation, and other factors. Identify areas for improvement in their investment process. Enhance risk management by understanding the sources of portfolio risk. Communicate their investment strategies' effectiveness to clients and stakeholders. To conduct a portfolio attribution analysis, it is essential to understand its key components: Portfolio returns represent the total return generated by the portfolio over a specific evaluation period, including capital gains, dividends, and interest. Benchmark returns are the returns of a selected benchmark, which serves as a performance comparison for the portfolio. This benchmark is typically a market index that represents the investment universe of the portfolio. Active returns, also known as excess returns or relative returns, are the difference between the portfolio returns and the benchmark returns. They indicate the additional value generated by the investment manager's decisions. Portfolio weights and benchmark weights represent the proportion of each asset or sector in the portfolio and the benchmark, respectively. These weights are used to assess the impact of asset allocation decisions on portfolio performance. Security-level returns are the individual returns of each security in the portfolio and the benchmark. They are used to evaluate the impact of security selection decisions on portfolio performance. There are various attribution models used by investment managers to conduct portfolio attribution analysis: The Brinson-Fachler model, also known as the three-factor model, breaks down active return into three components: allocation effect, selection effect, and interaction effect. The allocation effect measures the impact of asset allocation decisions on the active return. It reflects the difference between the portfolio weights and benchmark weights, multiplied by the benchmark returns. The selection effect measures the impact of security selection decisions on the active return. It reflects the difference between the portfolio returns and benchmark returns for each security, multiplied by the portfolio weights. The interaction effect measures the combined impact of allocation and selection decisions on the active return. It is calculated as the product of the differences in portfolio and benchmark weights and the differences in portfolio and benchmark returns. The Brinson-Hood-Beebower model, or the two-factor model, is a simplified version of the Brinson-Fachler model. It breaks down active return into two components: allocation effect and selection effect, ignoring the interaction effect. The Karnosky-Singer model is a global attribution model that separates the active return into two components: global attribution and currency attribution. Global attribution measures the impact of security selection and asset allocation decisions on the active return, excluding the currency effect. Currency attribution measures the impact of currency exposure decisions on the active return, including both the direct currency effect and the indirect effect through security selection. Risk-adjusted attribution models incorporate risk factors into the analysis to provide a more comprehensive assessment of portfolio performance. Some popular risk-adjusted attribution models are: The Treynor-Black model measures the portfolio's performance by comparing the risk-adjusted active return to the benchmark's risk-adjusted return. This model takes into account the portfolio's systematic risk, or beta, and its unsystematic risk, or alpha. The information ratio measures the portfolio's active return per unit of active risk, or tracking error, compared to the benchmark. A higher information ratio indicates better risk-adjusted performance. To conduct a portfolio attribution analysis, investment managers should follow these steps: Determine the portfolio and the benchmark that will be used for comparison. The chosen benchmark should be representative of the investment universe and strategy of the portfolio. Choose an appropriate evaluation period for the analysis. This period should be long enough to capture the investment manager's decisions and provide a meaningful assessment of performance. Gather the required data, including portfolio and benchmark returns, weights, and security-level returns for the evaluation period. Select an attribution model that best fits the investment strategy and objectives of the portfolio. Using the chosen attribution model, calculate the allocation, selection, and other attribution effects that contribute to the portfolio's active return. Analyze the calculated attribution effects to understand the drivers of portfolio performance and identify areas for improvement or adjustment in the investment strategy. Portfolio attribution analysis can be used for various purposes in the investment management process: Investment managers can use portfolio attribution analysis to evaluate their portfolio's performance by comparing it against a benchmark, identifying the sources of excess return, and understanding the impact of their investment decisions. By analyzing the drivers of portfolio performance, investment managers can assess the effectiveness of their investment strategy and make adjustments to improve future performance. Understanding the sources of portfolio risk through attribution analysis can help investment managers enhance their risk management processes, ensuring that risks are taken in line with their investment objectives. Portfolio attribution analysis provides investment managers with a transparent and structured framework for communicating their investment strategies' effectiveness and performance to clients and stakeholders. Despite its usefulness, portfolio attribution analysis has some limitations and challenges: Attribution models may not capture all aspects of a portfolio's performance or may make simplifying assumptions that can affect the accuracy of the analysis. Attribution analysis relies on accurate and timely data. Data availability and quality can be a challenge, particularly for complex or illiquid assets. The chosen evaluation period can influence the results of the attribution analysis. Shorter periods may be subject to noise and random fluctuations, while longer periods may not capture recent changes in investment strategy or market conditions. The selection and construction of an appropriate benchmark can be challenging, as it should be representative of the investment universe and strategy of the portfolio. Portfolio attribution analysis plays a crucial role in investment management by helping investment managers evaluate their portfolio's performance, assess their investment strategies, and communicate their results to clients. Understanding the key components of portfolio attribution analysis, selecting appropriate attribution models, and being aware of its limitations and challenges can help investment managers make better-informed decisions and improve their investment process. As the investment landscape evolves, innovations in portfolio attribution analysis will continue to emerge, providing new insights and opportunities for investment managers to enhance their performance.Definition and Purpose of Portfolio Attribution Analysis

Importance in Investment Management

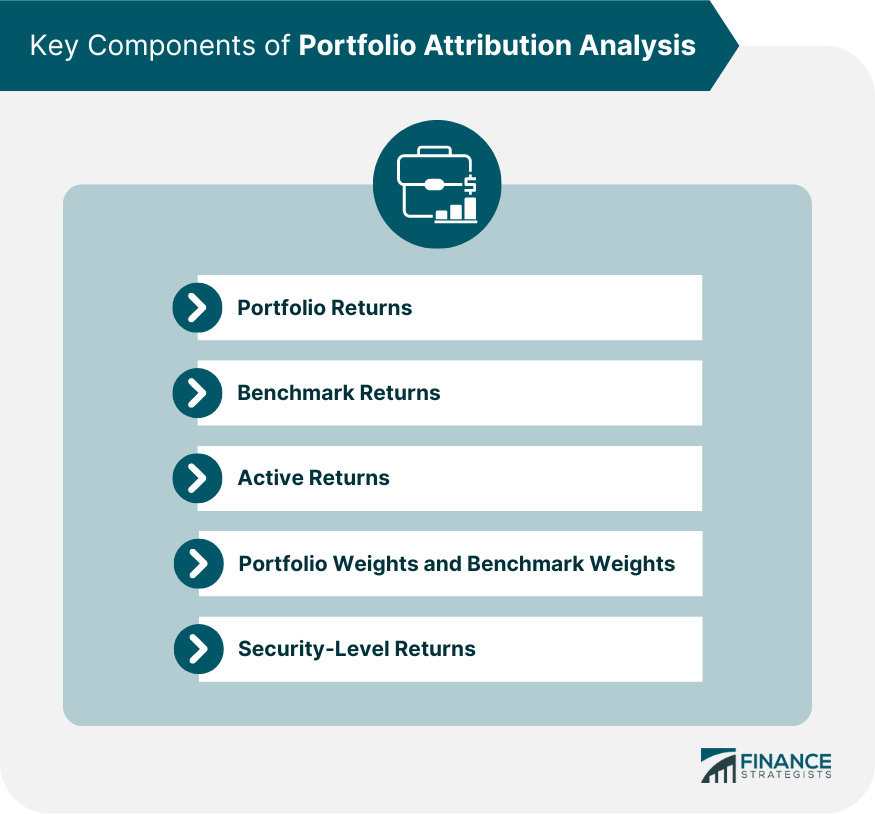

Key Components of Portfolio Attribution Analysis

Portfolio Returns

Benchmark Returns

Active Returns

Portfolio Weights and Benchmark Weights

Security-Level Returns

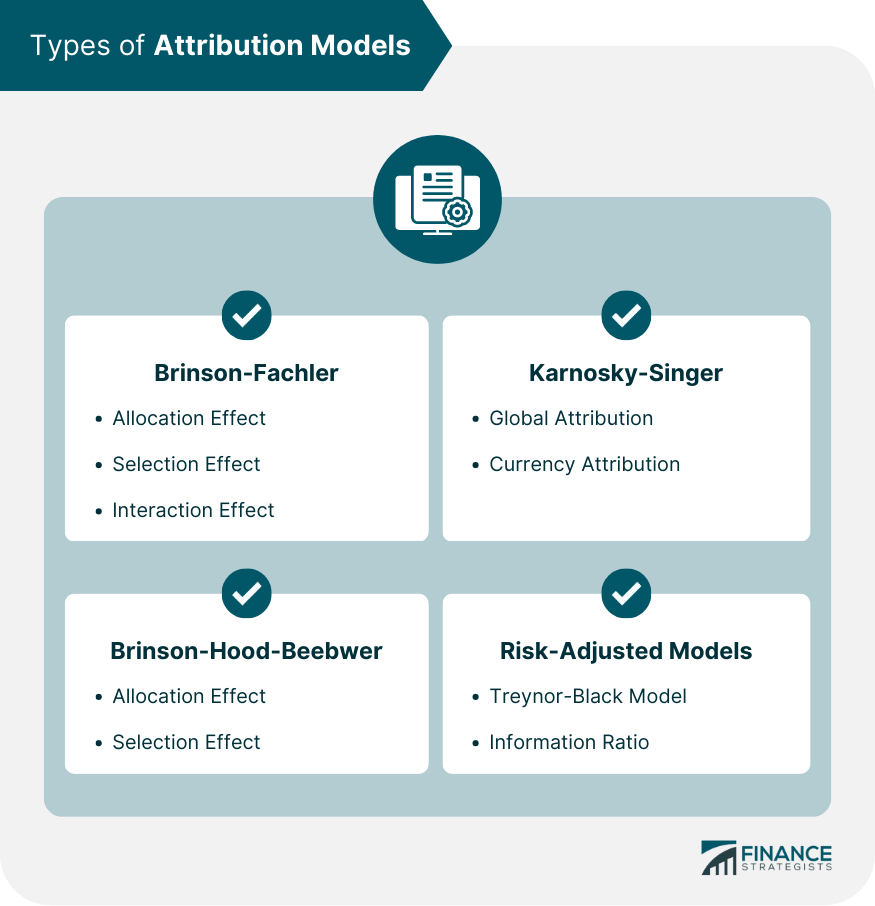

Types of Attribution Models

Brinson-Fachler Model

Allocation Effect

Selection Effect

Interaction Effect

Brinson-Hood-Beebower Model

Karnosky-Singer Model

Global Attribution

Currency Attribution

Risk-Adjusted Attribution Models

Treynor-Black Model

Information Ratio

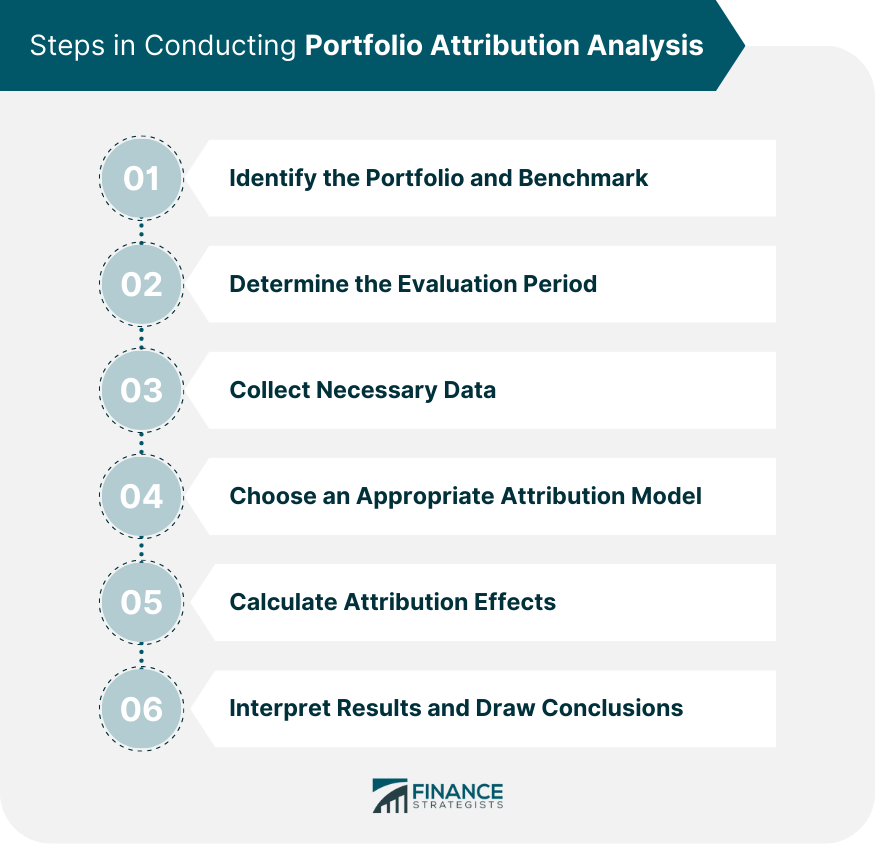

Steps in Conducting Portfolio Attribution Analysis

Identify the Portfolio and Benchmark

Determine the Evaluation Period

Collect Necessary Data

Choose an Appropriate Attribution Model

Calculate Attribution Effects

Interpret Results and Draw Conclusions

Applications and Uses of Portfolio Attribution Analysis

Performance Evaluation

Investment Strategy Assessment

Risk Management

Client Communication and Reporting

Limitations and Challenges of Portfolio Attribution Analysis

Model Limitations

Data Availability and Quality

Time Horizon Considerations

Benchmark Selection and Construction

Conclusion

Portfolio Attribution Analysis FAQs

Portfolio attribution analysis is a quantitative method used to evaluate a portfolio's performance by comparing it against a benchmark. It helps investment managers understand the drivers of portfolio performance, evaluate their investment strategies, manage risk, and communicate results to clients. This analysis is crucial for making informed decisions and improving the investment process.

The key components of portfolio attribution analysis include portfolio returns, benchmark returns, active returns, portfolio weights and benchmark weights, and security-level returns. These components are used to assess the impact of asset allocation, security selection, and other factors on the portfolio's performance.

The main types of attribution models used in portfolio attribution analysis include the Brinson-Fachler model, which breaks down active return into allocation, selection, and interaction effects; the Brinson-Hood-Beebower model, which simplifies the analysis to allocation and selection effects; the Karnosky-Singer model, which separates global and currency attribution effects; and risk-adjusted attribution models, such as the Treynor-Black model and information ratio, which incorporate risk factors into the analysis.

Portfolio attribution analysis can be used for performance evaluation, investment strategy assessment, risk management, and client communication and reporting. By understanding the drivers of portfolio performance, investment managers can make better-informed decisions, adjust their strategies, manage risks more effectively, and transparently communicate their results to clients.

Limitations and challenges of portfolio attribution analysis include model limitations, data availability and quality, time horizon considerations, and benchmark selection and construction. Investment managers can address these challenges by selecting appropriate attribution models, ensuring accurate and timely data, choosing suitable evaluation periods, and carefully constructing representative benchmarks. As the investment landscape evolves, innovations in portfolio attribution analysis will continue to emerge, providing new insights and opportunities for investment managers to enhance their performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.