A Net Worth Statement is a financial statement that provides an overview of an individual's or entity's financial position by detailing the total value of their assets, liabilities, and net worth at a specific point in time. The statement is created by subtracting the total liabilities from the total assets, resulting in the individual's or entity's net worth. This document is useful for assessing an individual's or entity's financial health, tracking financial progress, setting financial goals, and making informed decisions about spending, saving, and investing. A net worth statement is critical for personal financial planning. It allows individuals to understand their current financial situation, identify areas that need improvement, and set realistic financial goals. Lenders often request a net worth statement when considering loan applications. This statement helps them assess an applicant's ability to repay the loan and make informed decisions regarding the terms and conditions of the loan. A net worth statement is essential for retirement planning, as it helps individuals determine how much they need to save and invest to achieve their desired retirement lifestyle. Net worth statements are crucial for managing investments, as they provide a clear picture of an individual's financial position. This information can be used to make informed investment decisions and develop an appropriate investment strategy. By regularly updating and reviewing a net worth statement, individuals can track their financial progress over time and determine if they are on track to meet their financial goals. To create a net worth statement, start by gathering financial information related to assets and liabilities. Assets are items of value owned by an individual or entity, while liabilities are debts or obligations owed to others. Liquid assets are those that can be quickly converted into cash, such as checking and savings accounts, stocks, and bonds. Fixed assets are items of value that cannot be quickly converted into cash, such as real estate, vehicles, and personal property. Current liabilities are short-term debts or obligations that are expected to be settled within one year, such as credit card balances and utility bills. Long-term liabilities are debts or obligations that have a repayment period of more than one year, such as mortgages and student loans. Assign values to assets and liabilities using fair market value, book value, or appraisals as appropriate. The fair market value is the price at which an asset would change hands between a willing buyer and seller, both having knowledge of the relevant facts and neither being under any compulsion to buy or sell. The book value of an asset is its original cost minus accumulated depreciation. Appraisals are formal assessments of the value of an asset by an expert, typically used for real estate or valuable personal property. Subtract total liabilities from total assets to calculate net worth. The debt-to-equity ratio is calculated by dividing total liabilities by total assets. This ratio measures the proportion of debt used to finance an individual's assets. The liquidity ratio is calculated by dividing liquid assets by current liabilities. This ratio measures an individual's ability to cover short-term obligations with readily available funds. The solvency ratio is calculated by dividing net worth by total assets. This ratio measures an individual's ability to meet long-term obligations. Examine the net worth statement to identify trends and patterns in assets, liabilities, and net worth over time. This analysis can help pinpoint areas of concern or opportunities for growth. Use the net worth statement to set realistic financial goals, such as reducing debt, increasing savings, or growing investments. These goals should align with an individual's overall financial plan and long-term objectives. Based on the analysis of the net worth statement, develop strategies to achieve financial goals. This may include budget adjustments, debt repayment plans, or changes in investment strategies. Regular updates to a net worth statement are essential for accurately tracking financial progress and making informed financial decisions. Changes in assets, liabilities, and net worth should be monitored closely to ensure that financial goals are being met. The frequency of updates will depend on individual circumstances and preferences. Some individuals may choose to update their net worth statement quarterly, while others may prefer semi-annual or annual updates. Significant life events, such as marriage, divorce, the birth of a child, or the purchase of a home, may require adjustments to a net worth statement. These events can have a considerable impact on an individual's financial situation and should be taken into account when updating the statement. Avoid overvaluing assets, as this can lead to an inflated net worth and a false sense of financial security. Be realistic when assigning values to assets and use objective measures, such as fair market value or appraisals, whenever possible. Failing to include all liabilities in a net worth statement can result in an inaccurate representation of an individual's financial position. Be sure to include all debts and obligations, both short-term and long-term, to ensure a comprehensive view of one's financial health. Not updating a net worth statement regularly can lead to outdated information and ineffective financial decision-making. Make a commitment to update the statement at least once a year or more frequently, depending on personal preferences and circumstances. While it is possible to create and analyze a net worth statement independently, some individuals may benefit from seeking the advice of a financial professional, such as a financial planner or accountant. These professionals can provide guidance on valuing assets and liabilities, setting financial goals, and developing strategies for improvement. A Net Worth Statement is a valuable tool for assessing an individual's or entity's financial health and progress. It provides a clear picture of one's financial position by detailing assets, liabilities, and net worth at a specific point in time. To create an accurate net worth statement, gather financial information, categorize assets and liabilities, assign values, and calculate net worth. Analyzing a net worth statement involves examining financial ratios, identifying trends and patterns, setting financial goals, and developing strategies for improvement. Regular updates to a net worth statement are essential for tracking progress and making informed financial decisions. It is important to avoid common mistakes such as overvaluing assets, omitting liabilities, failing to update regularly, and not seeking professional assistance. By creating and regularly updating a net worth statement, individuals and entities can make informed financial decisions and achieve their financial goals.Definition of Net Worth Statement

Purpose of a Net Worth Statement

Personal Financial Planning

Loan Applications

Retirement Planning

Investment Management

Tracking Financial Progress

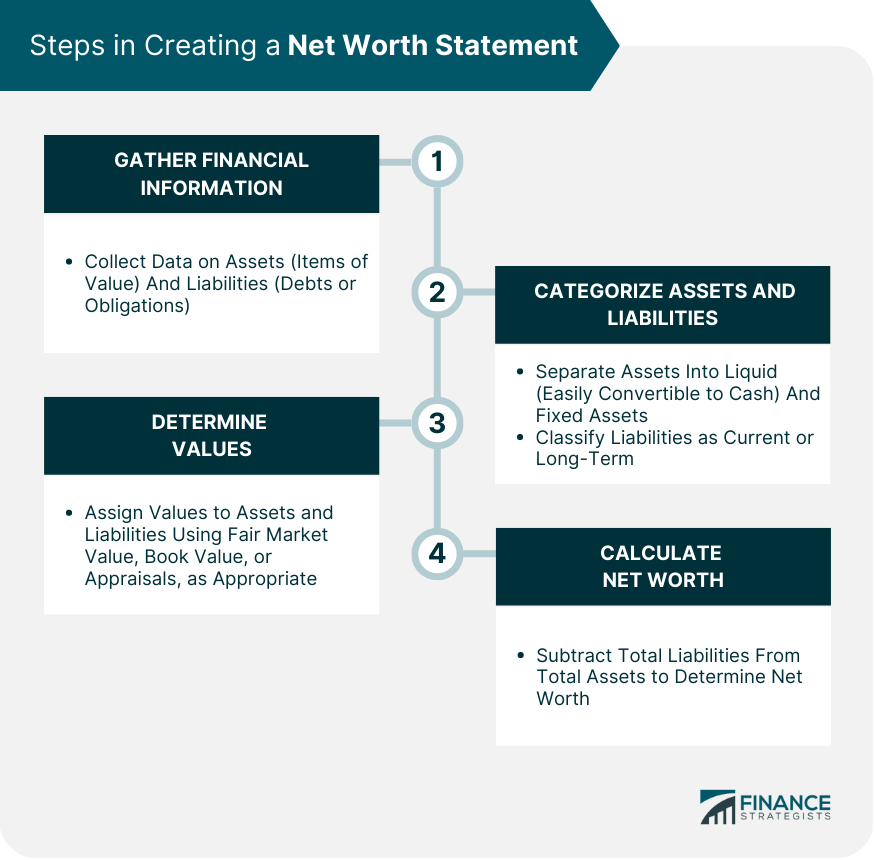

Creating a Net Worth Statement

Gather Financial Information

Categorize Assets and Liabilities

Liquid Assets

Fixed Assets

Current Liabilities

Long-Term Liabilities

Determine the Values of Assets and Liabilities

Fair Market Value

Book Value

Appraisals

Calculate Net Worth

Analyzing a Net Worth Statement

Financial Ratios

Debt-To-Equity Ratio

Liquidity Ratio

Solvency Ratio

Identify Trends and Patterns

Set Financial Goals

Develop Strategies for Improvement

Regularly Updating a Net Worth Statement

Importance of Regular Updates

Frequency of Updates

Adjustments for Life Events

Common Mistakes to Avoid in Net Worth Statements

Overvaluing Assets

Omitting Liabilities

Failing to Regularly Update

Not Seeking Professional Assistance

The Bottom Line

Net Worth Statement FAQs

A Net Worth Statement is a financial document that outlines an individual's total assets and liabilities, with the difference between the two representing their net worth. It is important because it provides a snapshot of one's financial health, helping individuals understand their current financial situation, set financial goals, and make informed decisions about loans, investments, and retirement planning.

To create a Net Worth Statement, gather financial information about your assets and liabilities, categorize them into liquid and fixed assets, as well as current and long-term liabilities, determine the values of these assets and liabilities using fair market value, book value, or appraisals, and calculate your net worth by subtracting total liabilities from total assets.

The frequency of updates to your Net Worth Statement depends on your individual circumstances and preferences. Some people may choose to update it quarterly, while others may prefer semi-annual or annual updates. It is essential to update your statement at least once a year or more frequently if you experience significant life events or changes in your financial situation.

Common mistakes to avoid when creating a Net Worth Statement include overvaluing assets, omitting liabilities, failing to regularly update the statement, and not seeking professional assistance when necessary. By being thorough and realistic in valuing assets and liabilities and committing to regular updates, you can ensure that your net worth statement accurately reflects your financial health.

You can use your Net Worth Statement to analyze your financial health, set realistic financial goals, and develop strategies to achieve those goals. By examining financial ratios such as debt-to-equity, liquidity, and solvency, you can identify trends and patterns, pinpoint areas of concern or opportunities for growth, and make informed decisions about budget adjustments, debt repayment plans, or changes in investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.