The Financial Crimes Enforcement Network is a bureau within the US Department of the Treasury responsible for collecting, analyzing, and disseminating financial intelligence to combat money laundering, terrorism financing, and other financial crimes. Established in 1990, FinCEN plays a critical role in safeguarding the financial system by enforcing regulatory compliance, promoting transparency, and collaborating with law enforcement agencies and international partners. FinCEN was established in April 1990 by the Secretary of the Treasury as a response to growing concerns about money laundering and financial crimes. Initially, the bureau focused on collecting, analyzing, and sharing financial intelligence related to money laundering. However, its role expanded after the September 11, 2001 terrorist attacks, when the USA PATRIOT Act was enacted, and FinCEN's mandate was broadened to include countering the financing of terrorism (CFT). FinCEN's primary objectives are to: 1. Strengthen the integrity and stability of the financial system by enforcing compliance with financial regulations and policies. 2. Detect, prevent, and deter money laundering, terrorism financing, and other financial crimes. 3. Promote collaboration and cooperation among financial institutions, law enforcement agencies, regulators, and international partners. The Director of FinCEN, appointed by the Secretary of the Treasury, serves as the bureau's chief executive officer and reports directly to the Treasury Under Secretary for Terrorism and Financial Intelligence. The Director is responsible for overseeing FinCEN's operations, policies, and strategic direction. FinCEN is organized into six main divisions, each responsible for specific functions related to the bureau's mission: 1. Intelligence Division: Collects, analyzes, and disseminates financial intelligence to support enforcement and regulatory actions. 2. Enforcement Division: Investigates and pursues violations of financial regulations, including money laundering, terrorism financing, and other financial crimes. 3. Regulatory Division: Develops and enforces regulations under the Bank Secrecy Act (BSA) and other relevant laws and provides guidance to financial institutions on regulatory compliance. 4. Policy Division: Develops strategic policy initiatives to address emerging financial crime threats and trends and collaborates with other agencies and international partners to promote global AML/CFT efforts. 5. Information Technology Division: Supports FinCEN's mission by developing and maintaining advanced data analytics, technology infrastructure, and information-sharing capabilities. 6. Administration Division: Manages human resources, budget, procurement, and other administrative functions to support FinCEN's operations. FinCEN coordinates and implements the United States' AML efforts, which involve detecting, preventing, and deterring money laundering activities. This includes enforcing compliance with the Bank Secrecy Act (BSA), analyzing financial intelligence, and collaborating with law enforcement agencies and international partners to disrupt money laundering networks. Following the September 11, 2001 terrorist attacks, FinCEN's mandate was expanded to include CFT. The bureau works closely with law enforcement agencies, intelligence agencies, and international partners to detect, disrupt, and dismantle terrorist financing networks. This includes analyzing financial intelligence, enforcing compliance with CFT regulations, and providing training and guidance to financial institutions. As the administrator of the BSA, FinCEN is responsible for enforcing compliance with the act's requirements among financial institutions. This includes collecting and analyzing financial intelligence, developing and enforcing regulations, and providing guidance to financial institutions on their BSA obligations. FinCEN collaborates with the Internal Revenue Service (IRS) to enforce compliance with FATCA, a law aimed at preventing tax evasion by U.S. taxpayers holding financial assets in foreign accounts. The bureau assists in identifying non-compliant financial institutions and shares relevant information with the IRS to support enforcement actions. FinCEN works closely with other FIUs worldwide to share financial intelligence, collaborate on joint investigations, and promote global AML/CFT efforts. The bureau is a member of the Egmont Group, an international organization of FIUs, which facilitates cooperation and information exchange among its members. Financial institutions are required to file CTRs with FinCEN for cash transactions exceeding $10,000. These reports provide valuable financial intelligence for detecting, preventing, and deterring money laundering, terrorism financing, and other financial crimes. SARs are filed by financial institutions when they detect suspicious activities that may be indicative of money laundering, terrorism financing, or other financial crimes. FinCEN analyzes SARs and shares relevant information with law enforcement agencies and other FIUs to support investigations and enforcement actions. KYC and CDD rules require financial institutions to collect and verify customer information, monitor transactions, and report suspicious activities. These rules are critical for ensuring that financial institutions do not unwittingly facilitate financial crimes and for providing valuable intelligence to FinCEN and other law enforcement agencies. FinCEN collaborates with OFAC to enforce compliance with economic and trade sanctions targeting individuals, entities, and countries involved in illicit activities. The bureau provides financial intelligence to OFAC and assists in identifying non-compliant financial institutions and individuals. FinCEN collects and analyzes financial intelligence, including CTRs, SARs, and other relevant data, to identify trends, patterns, and networks associated with financial crimes. The bureau shares actionable intelligence with law enforcement agencies, regulators, and international partners to support enforcement actions and disrupt criminal networks. FinCEN works closely with federal, state, and local law enforcement agencies to investigate and prosecute financial crimes, including money laundering, terrorism financing, and other illicit activities. The bureau provides financial intelligence, analytical support, and technical assistance to law enforcement agencies to enhance their investigative capabilities. FinCEN has the authority to take enforcement actions against financial institutions and individuals who violate AML/CFT regulations and other financial crime laws. This includes imposing civil monetary penalties, issuing cease and desist orders, and recommending criminal prosecutions to the Department of Justice. FinCEN provides financial institutions with training, guidance, and resources to help them comply with regulatory requirements and detect, prevent, and deter financial crimes. This includes publishing advisory documents, hosting webinars, and conducting outreach events. The emergence of new financial technologies, such as digital payments, mobile banking, and online lending platforms, presents both opportunities and challenges for FinCEN. While these innovations can improve financial inclusion and efficiency, they can also create new vulnerabilities for money laundering, terrorism financing, and other financial crimes. FinCEN must adapt its regulatory and enforcement strategies to keep pace with these rapidly evolving technologies. Cryptocurrencies and decentralized finance (DeFi) platforms have transformed the financial landscape, offering users increased privacy, security, and control over their assets. However, these features also create potential risks for money laundering, terrorism financing, and other illicit activities. FinCEN must develop effective regulatory frameworks and enforcement strategies to address the unique challenges posed by these emerging technologies. As financial crime networks increasingly operate across borders, FinCEN must collaborate with international partners to share intelligence, coordinate enforcement actions, and harmonize regulatory standards. The bureau faces the challenge of navigating diverse legal systems, data privacy regulations, and cultural norms while maintaining effective communication and cooperation among its global partners. FinCEN must strike a delicate balance between protecting individual privacy and ensuring regulatory compliance in its efforts to combat financial crimes. The bureau must continually evaluate its data collection, analysis, and sharing practices to ensure they respect the privacy rights of individuals while still providing critical intelligence for detecting, preventing, and deterring financial crimes. The Financial Crimes Enforcement Network is a bureau within the US Department of the Treasury responsible for collecting, analyzing, and disseminating financial intelligence to combat money laundering, terrorism financing, and other financial crimes. Its primary objectives are to strengthen the integrity and stability of the financial system, detect and prevent financial crimes, and promote collaboration and cooperation among financial institutions, law enforcement agencies, regulators, and international partners. FinCEN is organized into six main divisions, including the Intelligence Division, Enforcement Division, Regulatory Division, Policy Division, Information Technology Division, and Administration Division. The bureau's responsibilities include enforcing compliance with the Bank Secrecy Act, countering the financing of terrorism, and collaborating with other financial intelligence units. FinCEN faces challenges in adapting to new financial technologies, addressing the risks associated with cryptocurrencies and decentralized finance, collaborating with international partners, and balancing privacy concerns with regulatory oversight. Seek out banking services that prioritize regulatory compliance and work in partnership with FinCEN to combat financial crimes.What Is the Financial Crimes Enforcement Network (FinCEN)?

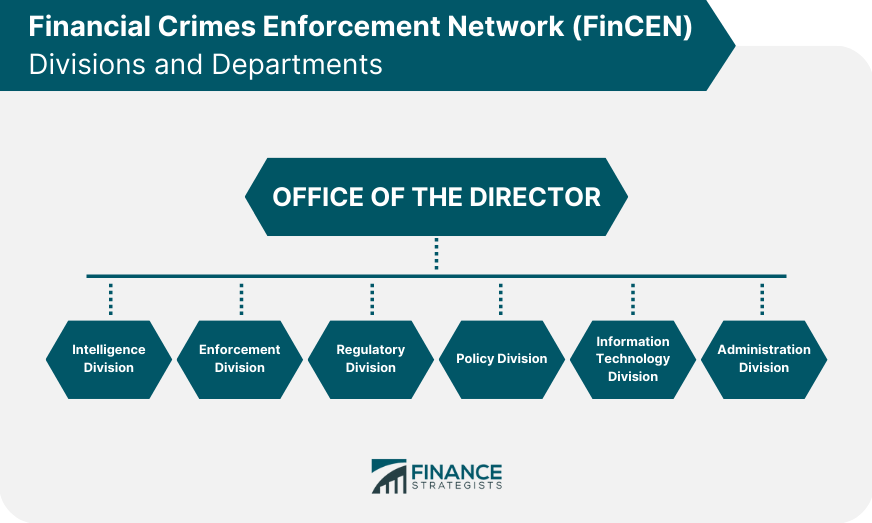

FinCEN Organization Structure

Director of FinCEN

Divisions and Departments

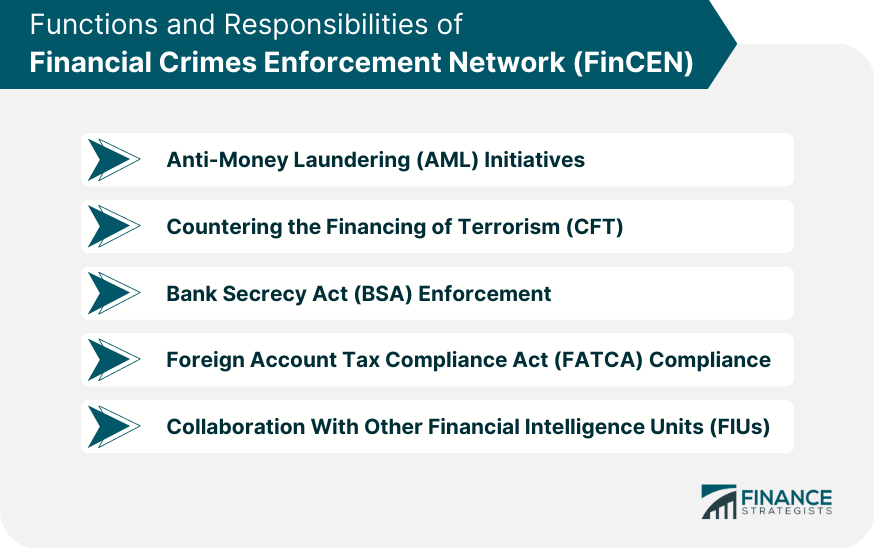

Functions and Responsibilities of FinCEN

Anti-Money Laundering (AML) Initiatives

Countering the Financing of Terrorism

Bank Secrecy Act (BSA) Enforcement

Foreign Account Tax Compliance Act (FATCA) Compliance

Collaboration With Other Financial Intelligence Units (FIUs)

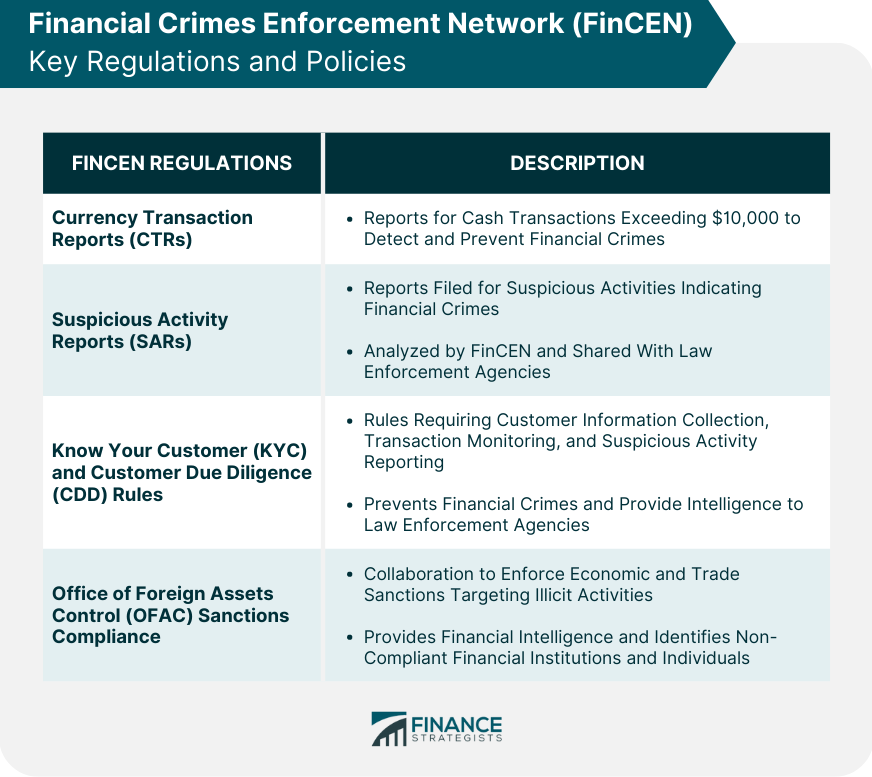

FinCEN Key Regulations and Policies

Currency Transaction Reports (CTRs)

Suspicious Activity Reports (SARs)

Know Your Customer (KYC) and Customer Due Diligence (CDD) Rules

Office of Foreign Assets Control (OFAC) Sanctions Compliance

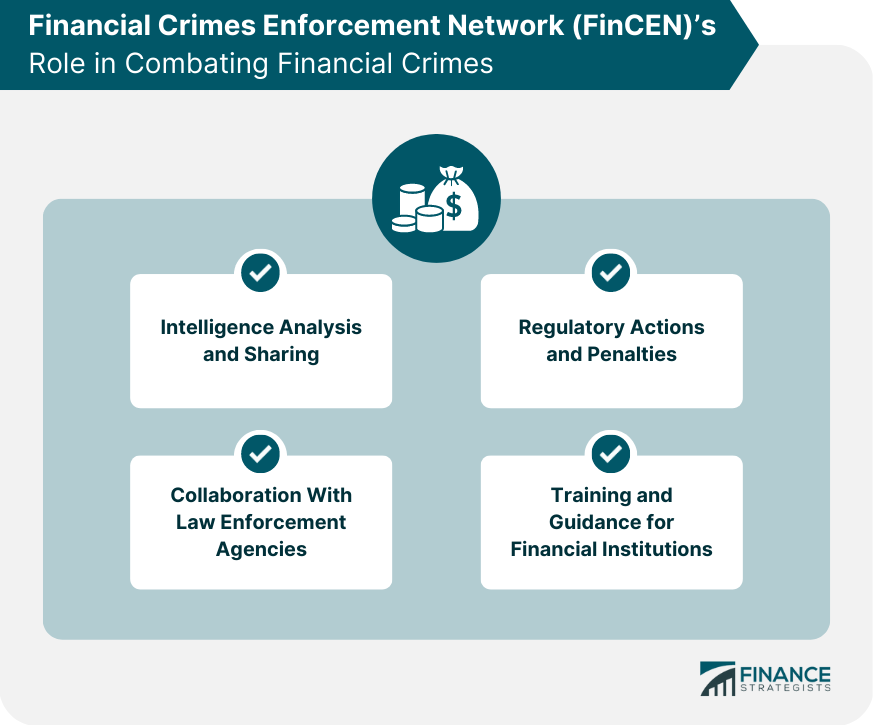

FinCEN's Role in Combating Financial Crimes

Intelligence Analysis and Sharing

Collaboration With Law Enforcement Agencies

Regulatory Actions and Penalties

Training and Guidance for Financial Institutions

Challenges Faced by FinCEN

Rapid Advancements in Financial Technology

Cryptocurrencies and Decentralized Finance

Cross-Border Transactions and International Cooperation

Balancing Privacy Concerns with Regulatory Oversight

Final Thoughts

Financial Crimes Enforcement Network (FinCEN) FAQs

FinCEN is a bureau within the United States Department of the Treasury responsible for collecting, analyzing, and disseminating financial intelligence to combat money laundering, terrorism financing, and other financial crimes.

FinCEN's primary objectives are to strengthen the integrity and stability of the financial system by enforcing compliance with financial regulations and policies, detect, prevent, and deter money laundering, terrorism financing, and other financial crimes, and promote collaboration and cooperation among financial institutions, law enforcement agencies, regulators, and international partners.

FinCEN's key regulations and policies include Currency Transaction Reports (CTRs), Suspicious Activity Reports (SARs), Know Your Customer (KYC) and Customer Due Diligence (CDD) rules, and Office of Foreign Assets Control (OFAC) Sanctions Compliance.

FinCEN faces challenges such as rapid advancements in financial technology, cryptocurrencies, decentralized finance, cross-border transactions and international cooperation, and balancing privacy concerns with regulatory oversight.

FinCEN's role in combating financial crimes includes intelligence analysis and sharing, collaboration with law enforcement agencies, regulatory actions and penalties, and training and guidance for financial institutions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.