U.S. Savings Bonds are debt securities issued by the U.S. Department of the Treasury. They serve as a method for the U.S. government to raise capital, while providing a secure investment option for the public. Two key types of savings bonds are the Series EE and Series I. Series EE bonds provide a fixed interest rate for the life of the bond, whereas Series I bonds offer an interest rate adjusted for inflation, offering some protection against purchasing power loss. The process of U.S. Savings Bond Adjustment involves changes to the bond's redemption value due to accruing interest or shifts in market conditions. The U.S. Treasury, responsible for these adjustments, takes into account variables such as the current interest rates, the original purchase price, accrued interest, and in the case of Series I bonds, the inflation rate. These adjustments can impact the overall value and return of the bond. U.S. Savings Bonds were first introduced in 1935, providing a secure way for the public to invest while supporting federal government funding needs. Over the years, these bonds evolved, offering various series with distinct features to cater to different investor needs. The primary purpose of U.S. Savings Bonds remains the same - to offer a low-risk investment option for individuals while assisting the government in funding its operations. Today, they serve not only as a financial instrument for individual investment but also as a gift, a tool for education savings, and a vehicle for tax incentives.. U.S. Savings Bonds have long been a popular choice for investors seeking a low-risk investment option. The U.S. Department of the Treasury currently issues two main types of savings bonds: Series EE and Series I bonds. Both types offer unique features and benefits tailored to different investor needs and financial situations. Series EE bonds, also known as Patriot Bonds, are low-risk savings products that pay interest based on current market rates. When you purchase a Series EE bond, you pay half of the face value of the bond. For example, a $50 bond costs $25. The interest on Series EE bonds is added to the bond monthly and is paid when you cash the bond. The U.S. Treasury guarantees that these bonds will double in value in 20 years. Series EE bonds are a reliable choice for investors looking for a guaranteed long-term return with minimal risk. The interest earned on these bonds is exempt from state and local taxes, and federal taxes can be deferred until the bond is redeemed or stops earning interest. Series I bonds are a type of U.S. savings bond designed to provide protection against inflation. Unlike Series EE bonds, which have a fixed rate of interest, Series I bonds have a composite yield that includes a fixed rate of return and a semiannual inflation rate. The fixed rate for Series I bonds is determined by the Treasury and remains the same throughout the life of the bond. The inflation rate, however, is adjusted twice a year (in May and November) based on changes in the Consumer Price Index for All Urban Consumers (CPI-U). As with Series EE bonds, the interest on Series I bonds is exempt from state and local taxes, and federal taxes can be deferred until the bond is redeemed or stops earning interest. Several factors can influence savings bond adjustments, including changes in the general level of interest rates, inflation rates, and the time remaining until the bond matures. The general level of interest rates plays a crucial role in determining savings bond adjustments. When interest rates rise, newly issued bonds offer higher coupon rates, making them more attractive to investors. As a result, existing savings bonds with lower coupon rates become less desirable, leading to a decrease in their market value. Conversely, when interest rates decline, existing bonds with higher coupon rates become more valuable, and their market prices increase. Inflation rates also impact savings bond adjustments. Savings bonds typically have a fixed interest rate, meaning their returns may not keep pace with inflation. If the inflation rate rises, the purchasing power of the bond's future interest payments decreases. As a result, investors may be willing to pay less for the bond, leading to a decrease in its market value. Conversely, if the inflation rate decreases, the bond's purchasing power increases, potentially increasing its market value. The time remaining until a savings bond matures affects its adjustments. As a bond approaches its maturity date, its market value tends to converge towards its face value. This is because the bondholder will receive the full face value at maturity, regardless of fluctuations in interest rates or inflation. Therefore, the market value of a bond with a short time to maturity is generally less sensitive to interest rate and inflation changes compared to a bond with a longer time to maturity. Market interest rates greatly influence the value of savings bonds. For example, if market interest rates increase, newly issued bonds will offer higher rates, reducing the relative value of existing bonds. For Series I bonds, inflation plays a crucial role in adjustments. When inflation increases, the semiannual inflation rate applied to these bonds also increases, raising the overall return. Redeeming bonds before their maturity date often leads to adjustments in the bond's value, typically resulting in a lower return than if the bond was held to maturity. The tax implications of bond ownership can trigger adjustments, particularly when interest earned on the bonds is reported and taxed. The U.S. Treasury is responsible for adjusting the values of U.S. Savings Bonds, taking into account interest accruals and changes in market conditions. Bond values are typically adjusted monthly. However, it's essential to remember that Series EE and I bonds cannot be redeemed within the first 12 months of ownership. The adjustment calculation considers the original purchase price, current interest rates, the accrued interest, and the inflation rate (for Series I bonds). Adjustments can increase or decrease the value of a savings bond, affecting the bondholder's return on investment. Understanding bond adjustments is essential for making informed investment decisions. For instance, if a bond's value has been adjusted downward due to rising interest rates, an investor might decide to hold onto the bond until rates stabilize. Interest earned on U.S. Savings Bonds is subject to federal income tax, which can lower the net return on the bond. It's also important to note that the IRS typically taxes the increase in a bond's value when it's cashed, disposed of, or reaches final maturity. Savings bonds are exempt from state and local taxes. This means that any increase in the bond's value due to adjustments isn't subject to these taxes, providing a beneficial aspect of savings bond investment. Taxpayers must report the increase in a savings bond's value in the year it was cashed, disposed of, or reached final maturity. Some investors may choose to report the interest earned annually to avoid a substantial tax liability in the year the bond matures. The U.S. Treasury offers a Savings Bond Calculator on their TreasuryDirect website. This tool allows bondholders to find the current value of their bonds and see how adjustments have affected the bond's worth. TreasuryDirect is an invaluable resource for all matters related to U.S. Savings Bonds. It provides updated interest rates, a detailed FAQ section, and the latest news on bond adjustments. U.S. Savings Bonds serve as a crucial financial instrument, providing a secure and reliable way for individuals to invest and for the government to finance its operations. These bonds come in two primary types, Series EE and Series I, each with its unique interest calculation method and benefits. The adjustment of U.S. Savings Bonds, a process managed by the U.S. Treasury, plays a critical role in determining the bond's current value based on factors such as market interest rates and inflation. Understanding this process allows investors to comprehend the potential shifts in the value of their investments over time. Therefore, a deep understanding of U.S. Savings Bonds, their types, and the process of their value adjustments is paramount for making informed financial decisionsDefinition of US Savings Bond Adjustments

Brief History and Purpose of US Savings Bond Adjustments

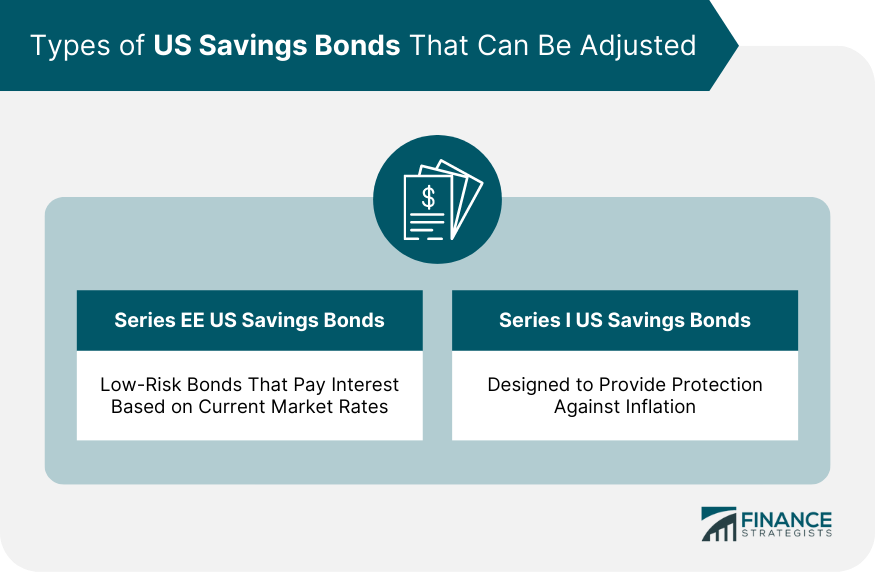

Types of US Savings Bonds That Can Be Adjusted

Series EE US Savings Bonds

Series I US Savings Bonds

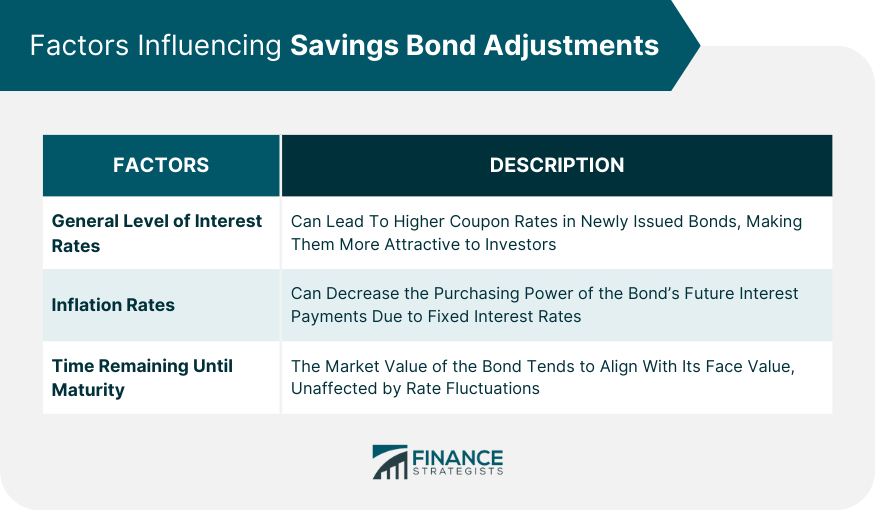

Factors Influencing Savings Bond Adjustments

General Level of Interest Rates

Inflation Rates

Time Remaining Until Maturity

Reasons for US Savings Bond Adjustments

Changes in Market Interest Rates

Inflation and Deflation Considerations

Redeeming Bonds Before Maturity

Tax Implications

Process of US Savings Bond Adjustments

US Treasury's Role in Adjustment

Timing of Savings Bond Adjustments

Calculation of Savings Bond Adjustments

Impact of US Savings Bond Adjustments on Investors

How Adjustments Affect Bond Value

Influence on Investor Decisions

Tax Implications of US Savings Bond Adjustments

Federal Taxes on Savings Bond Adjustments

State and Local Taxes on Savings Bond Adjustments

Reporting Bond Adjustments on Tax Returns

Tools and Resources for US Savings Bond Adjustments

The Savings Bond Calculator

The TreasuryDirect Website and Its Features

Conclusion

US Savings Bond Adjustment FAQs

A U.S. Savings Bond Adjustment refers to the changes in the redemption value of U.S. Savings Bonds due to accruing interest or shifts in market conditions.

The U.S. Department of the Treasury is responsible for adjusting the values of U.S. Savings Bonds, factoring in interest accruals and changes in market conditions.

Adjustments to the values of U.S. Savings Bonds typically occur monthly. However, Series EE and I bonds cannot be redeemed within the first 12 months of ownership.

The adjustment is calculated by considering factors such as the original purchase price of the bond, current market interest rates, the accrued interest, and, in the case of Series I bonds, the inflation rate.

The U.S. Savings Bond Adjustment can either increase or decrease the value of your bonds. This fluctuation directly impacts the return you will receive upon redemption or maturity of the bond.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.