At the most basic level, the dirty price of a bond is the price inclusive of any interest that has accrued since the bond's last coupon payment. This accumulated interest is what distinguishes a dirty price from its cleaner counterpart. It helps investors and traders alike determine the true cost of buying a bond. When a buyer purchases a bond in between coupon payment dates, they effectively owe the seller the accrued interest from the last coupon payment date up to the date of the transaction. This accrued interest is what we refer to as the 'dirty' part of the price. Understanding the dynamic relationship between dirty price, clean price, and accrued interest is key to comprehending bond pricing. This tripartite relationship has significant implications for investors and traders in the bond market. The concept of accrued interest is foundational to the dirty price. Accrued interest is the interest that accumulates each day on the bond between coupon payments. This accumulation depends on the day count convention, which is determined by the bond's specific terms. The convention might be actual/actual, 30/360, or another, each of which affects the calculation of accrued interest. Clean price plays a crucial role in bond pricing. It's the stated price of a bond without any consideration of the accrued interest. The clean price of a bond remains constant between coupon payments, providing a consistent measure for comparing bonds without the effect of varying accrued interest. The dirty price of a bond comes into play when a transaction occurs. The buyer pays the dirty price, which is the clean price plus the accrued interest. In other words, the dirty price is the total amount the buyer pays to the seller, compensating for the interest earned on the bond since the last coupon payment. While the clean price remains steady until the next coupon payment date, the dirty price grows slightly every day due to the accruing interest. This daily increase reflects the ongoing earning potential of the bond, which the buyer must compensate the seller for when purchasing the bond between coupon payments. It is crucial to understand that while the clean price remains fixed between coupon payment dates, the dirty price does not. It continuously increases to account for the interest accruing daily. This increase means the longer the period between the last coupon payment and the transaction date, the higher the dirty price will be compared to the clean price. This evolving nature of the dirty price is a vital consideration for any investor or trader when planning bond transactions. The formula for calculating dirty price is relatively straightforward: To illustrate, let's consider a bond with a clean price of $1020 and accrued interest of $16.67. Using the formula above, the dirty price ($1020 + $16.67) is equal to $1036.67. The dirty price of a bond refers to the total cost of purchasing the bond, including both the price the seller quotes for the bond and any interest that has accrued since the bond's last payment date. The dirty price is, therefore, the price that the buyer actually pays for the bond. The clean price of a bond is the quoted price of the bond without considering any accrued interest. It is basically the price that excludes any interest that has accumulated since the last payment period. Since the dirty price includes accrued interest, it constantly changes from one day to the next due to the accruing interest. As each day passes, the bond earns a day's worth of interest, which increases the dirty price. On the other hand, the clean price does not include any accrued interest. Hence, it does not change on a daily basis due to interest accrual. In most markets, bonds are traded at a dirty price. This means that the buyer pays the seller the dirty price of the bond, which includes any interest that has accumulated since the last coupon payment. Despite bonds being traded at a dirty price, they are generally quoted at a clean price. This means that when you see bond prices in the financial news or online, they are usually the clean prices. The dirty price can provide a more accurate picture of the investment's value since it includes the accrued interest that the buyer would receive if they held the bond until the next coupon payment. The clean price is often used to compare bonds with different coupon payment schedules or to assess the price movements of the bond itself without the influence of the accumulating interest. The practice of quoting bond prices varies between geographies. In Europe, bond prices are typically quoted as dirty prices. This convention implies that all bond quotes already include the accrued interest. Therefore, investors have a clear idea of the total cost they will incur when purchasing the bond. In contrast, bond markets in the United States typically quote clean prices. As a result, investors must separately account for the accrued interest when calculating the total cost of buying the bond. The reason for this geographical distinction is largely historical and has been maintained due to market convention. However, both methods provide the necessary information for investors to make informed decisions. The key is understanding which price—dirty or clean—is being quoted and adjust your calculations accordingly. One of the primary advantages of using the dirty price is the transparency it offers in bond transactions. Dirty prices include not only the bond's market price but also the accrued interest. Consequently, investors and traders have a clear view of the total cost that will be incurred in the transaction, eliminating surprises during the settlement. With the dirty price offering a comprehensive view of the total transaction cost, investors can enhance their budgeting and cost-planning strategies. Since the dirty price reflects the actual cash amount that will change hands, investors can more accurately forecast their cash outflows and investment returns. Despite its advantages, the dirty price presents some challenges. One significant issue is the difficulty in comparing bonds with different coupon payment dates or day count conventions. Since these factors influence the accrued interest component of the dirty price, bonds can appear more or less costly, obscuring a straightforward price comparison. The dirty price's variability can also be a potential drawback. As it includes accrued interest, the dirty price changes every day, even if the bond's market price (clean price) remains unchanged. This constant change can make tracking and analysis more complex for investors. For example, if an investor is tracking the performance of a bond over time, the fluctuating dirty price can make it difficult to ascertain whether changes in price are due to market movements or merely accruing interest. The dirty price directly impacts bond trading and pricing. It determines the total cash flow in bond transactions and thus influences investment decisions. When bond prices rise, the dirty price increases faster than the clean price due to the additional accrued interest. Conversely, when bond prices fall, the dirty price decreases more slowly. Investment decisions, especially in bond markets, heavily depend on price evaluations. Understanding the concept of dirty price allows investors to account for accrued interest, providing a more accurate picture of potential profits and returns. Remember, while the clean price is useful for comparing bonds, the dirty price is what you actually pay when purchasing a bond. Therefore, investors should factor in both prices when making investment decisions, ensuring a holistic understanding of their potential investment. The dirty price represents the total cost of a bond transaction, including both the market price of the bond and the interest accrued since the last coupon payment. Its calculation, while relatively straightforward, requires an understanding of accrued interest and its relationship with clean prices. Contrasting dirty and clean prices helps clarify the bond market's pricing mechanisms. The dirty price, inclusive of accrued interest, gives a complete picture of a bond's cost, aiding in budget planning. However, it can complicate comparisons between different bonds due to variations in coupon payment dates and day count conventions. Recognizing the benefits and potential drawbacks of using dirty prices can help investors make informed decisions. As with all financial decisions, it is recommended to seek professional advice, such as wealth management services, to guide your investment choices.What Is Dirty Price?

Relationship Between Dirty Price, Clean Price, and Accrued Interest

Understanding Accrued Interest

Role of Clean Price in Bond Pricing

Transition From Clean Price to Dirty Price

Daily Evolution of Dirty Price

Calculation of Dirty Price

Differences Between Dirty Price and Clean Price

Definition

Interest Accrual

Trading and Quotation

Investment Evaluation

Geographical Differences in Quoting Bond Prices

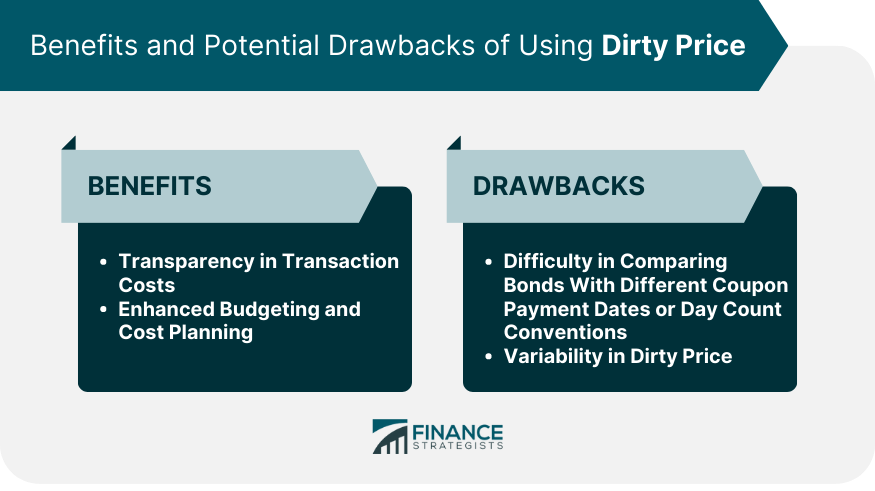

Benefits of Using Dirty Price

Transparency in Transaction Costs

Enhanced Budgeting and Cost Planning

Potential Drawbacks of Using Dirty Price

Difficulty in Comparing Bonds

Variability in Dirty Price

Implications of Dirty Price for Investors and Traders

Impact on Bond Trading and Pricing

Role of Dirty Price in Investment Decisions

Final Thoughts

Dirty Price FAQs

A dirty price is the total price of a bond, inclusive of accrued interest since the last coupon payment.

The dirty price is calculated by adding the clean price of the bond to the accrued interest.

The difference lies in the inclusion of accrued interest. A dirty price includes accrued interest, while a clean price does not.

The dirty price provides transparency in transaction costs and enhances budgeting and cost planning by revealing the actual cash outflow.

The dirty price can complicate comparisons between different bonds due to variations in coupon payment dates and day count conventions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.