Blockchain investments refer to the act of allocating capital into projects, ventures, or assets that are built on or related to blockchain technology. Blockchain, initially introduced as the underlying technology for cryptocurrencies like Bitcoin, has evolved into a versatile and transformative technology with applications beyond digital currencies. As a decentralized and transparent ledger system, blockchain provides enhanced security, immutability, and efficiency in various industries. In the context of investments, blockchain offers unique opportunities for individuals, institutions, and businesses to participate in the growth and development of this innovative technology. The most direct way to invest in blockchain is through cryptocurrencies. Cryptocurrencies like Bitcoin and Ethereum are digital assets that utilize blockchain technology for decentralized control, as opposed to centralized banking systems. They present an opportunity for high returns due to their volatile nature but also come with a fair amount of risk. Investors can also invest in companies that are pioneering the development and use of blockchain technology. These can range from established tech companies like IBM, which has a division dedicated to blockchain technologies, to startups developing new blockchain-based solutions. A less direct but more diversified option is investing in blockchain exchange-traded funds (ETFs) or blockchain funds. These financial products pool together different blockchain-related assets, including both cryptocurrencies and stocks of blockchain companies. They offer investors exposure to the blockchain sector without requiring them to manage individual assets. It's vital to research and understand the basics of blockchain and the specific assets or companies you plan to invest in. Understanding the fundamentals will give you a better grasp of the market dynamics and potential risks and rewards. Decide whether you are going to be a long-term investor or a short-term trader. Long-term investors, often referred to as "HODLers" in the crypto world, tend to buy and hold assets, while short-term traders attempt to profit from price fluctuations. You'll need to choose a platform or exchange to facilitate your investments. Factors to consider include security, fees, available assets or stocks, user experience, and customer support. Once you've decided on your investment, you can proceed to purchase. For crypto, this usually involves buying and transferring the assets to a secure digital wallet. For stocks or ETFs, the assets will be held in a brokerage account. Blockchain investments can be highly volatile. Regular monitoring allows you to react to market changes and manage your portfolio accordingly. Blockchain investing has the potential for high returns, particularly in the crypto market where price swings can be significant. It allows for diversification of your investment portfolio as blockchain assets and stocks often have different risk and return profiles from traditional assets. Blockchain is anticipated to disrupt various sectors, much like how the internet did. By investing now, you're positioning yourself to profit from this disruption. This is a unique feature that differentiates them from traditional investments and adds another dimension of value for some investors. Regulatory and legal risks are also present as blockchain technology and cryptocurrencies are still relatively new, and regulatory frameworks around the world are evolving. There is a significant lack of investor protection in the crypto market compared to traditional markets, making it a riskier investment. Additionally, the technical complexity of blockchain and cryptocurrencies may pose a challenge for those without a technical background. Before investing, it's essential to consider your risk tolerance and investment goals. Blockchain investments can be risky and should align with your overall investment strategy. Including factors that drive price movements is also key. Keep in mind that the crypto market operates 24/7, unlike traditional stock markets, leading to around-the-clock price changes. The legal and regulatory stance on blockchain and cryptocurrencies varies across countries and can significantly impact your investments. This means securing your digital wallets for cryptocurrencies and ensuring you're using secure and reputable platforms or exchanges for your investments. Often known as "HODLing" (Hold On for Dear Life) in the crypto world, this involves buying and holding your investments, regardless of market volatility, with the expectation that the value will increase in the long term. This strategy, albeit a more hands-on and risky one, involves buying and selling assets within the same day to profit from price fluctuations. Diversifying within your blockchain investments can also help manage risk. This could involve investing in a mix of cryptocurrencies, blockchain stocks, and blockchain funds or ETFs. When choosing a platform for your investments, you should compare fees and commissions, which can eat into your returns if they're too high. The security of the platform is paramount, given the risk of hacks in the digital space. The accessibility and user experience of the platform is also important, especially if you're new to blockchain investments. Customer support and educational resources can also make a significant difference in your investing journey. Good customer service can provide peace of mind, while educational resources can help you understand the market and make informed investment decisions. Investing in blockchain is a strategic process that requires careful consideration. Comprehending the technology and the different investment forms it offers – from cryptocurrencies to blockchain stocks and ETFs – forms the foundational step. Determining an investment strategy that suits your financial goals and risk appetite is essential, followed by the selection of a trustworthy platform for your investments. Once your investment is made, it is crucial to stay vigilant by continuously monitoring market movements. Given the high volatility and inherent risks of blockchain investments, informed decision-making and alignment with your broader financial objectives become all the more significant. The road to blockchain investment may seem complex, but with thorough research and understanding, it could lead to substantial potential gains.What Are Blockchain Investments?

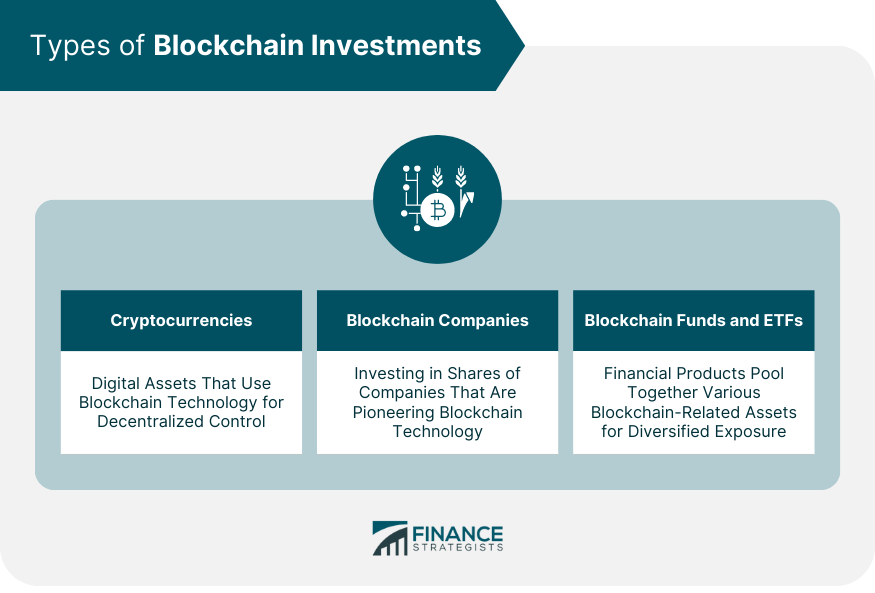

Types of Blockchain Investments

Cryptocurrencies

Blockchain Companies

Blockchain Funds and ETFs

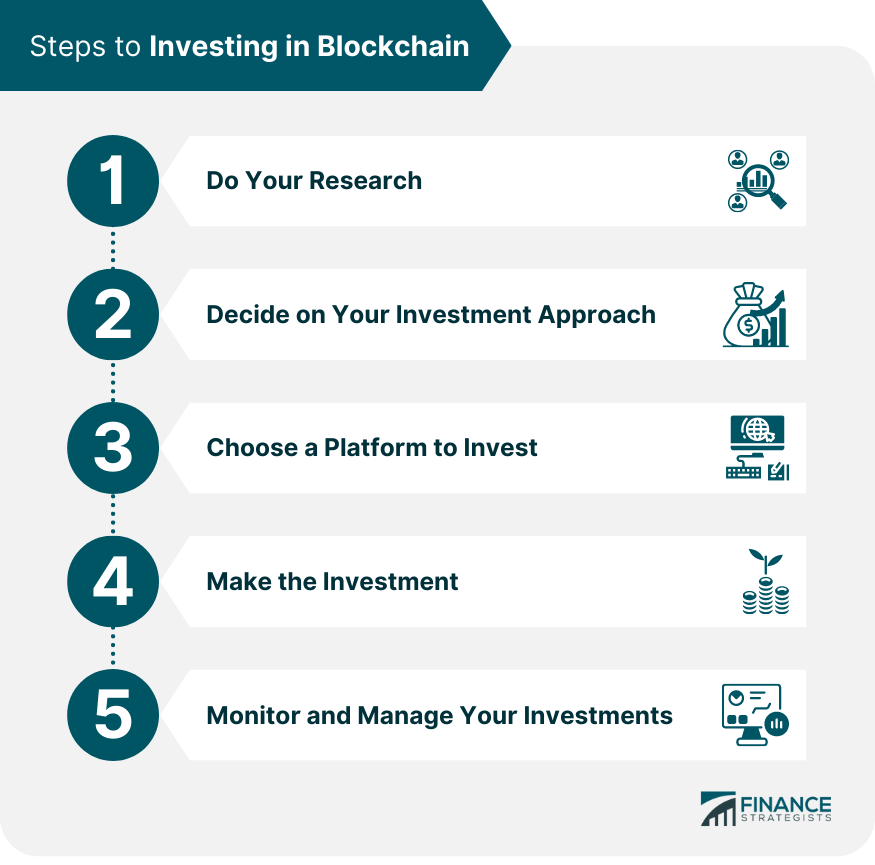

Steps to Investing in Blockchain

Do Your Research

Decide on Your Investment Approach

Choose a Platform to Invest

Make the Investment

Monitor and Manage Your Investments

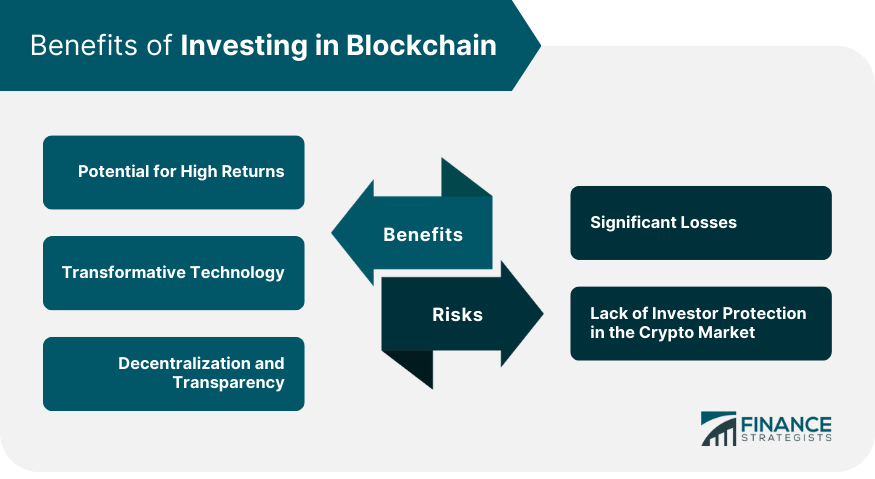

Benefits of Investing in Blockchain

Potential for High Returns

Transformative Technology

Decentralization and Transparency

Challenges of Investing in Blockchain

Significant Losses

Lack of Investor Protection in the Crypto Market

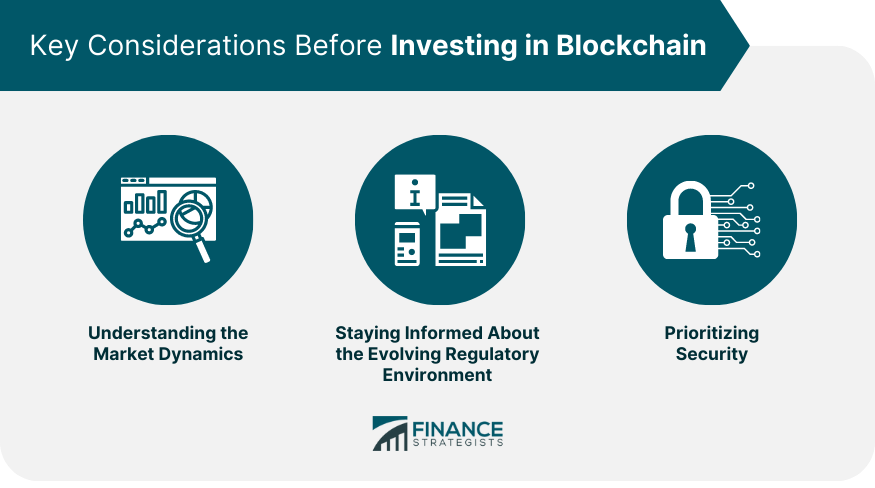

Key Considerations Before Investing in Blockchain

Understanding the Market Dynamics

Staying Informed About the Evolving Regulatory Environment

Prioritizing Security

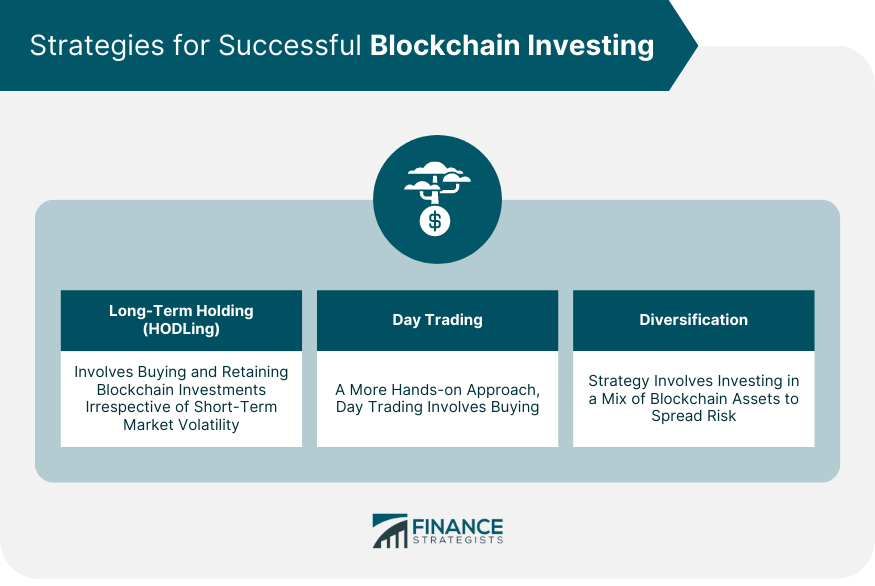

Strategies for Successful Blockchain Investing

Long-Term Holding

Day Trading

Diversification

Evaluating Blockchain Investment Platforms

Conclusion

How to Invest in Blockchain FAQs

Some popular options for investing in blockchain include buying cryptocurrencies, investing in stocks of blockchain companies, and purchasing shares of blockchain funds or ETFs. These different options offer various levels of direct exposure to blockchain technology and its potential growth.

Investing in blockchain could yield high returns given the potential growth of this transformative technology. It also offers opportunities for portfolio diversification and provides exposure to an innovative sector. Furthermore, investing in blockchain supports principles like decentralization and transparency that are at the core of this technology.

Investing in blockchain can present several challenges, including high volatility, regulatory and legal uncertainties, and a lack of investor protection compared to traditional investments. The technical complexity of blockchain and cryptocurrencies can also be challenging for those without a strong understanding of the technology.

Ensuring the security of your blockchain investments largely involves choosing secure platforms or exchanges for your investments and employing safe digital practices. This might include using hardware wallets for cryptocurrency storage, enabling two-factor authentication on your accounts, and being wary of phishing attempts.

Successful strategies for investing in blockchain can include long-term holding (or "HODLing"), which involves retaining assets regardless of short-term market volatility and diversifying your blockchain investments across different assets. Regular monitoring and rebalancing of your portfolio, and staying informed about market and regulatory changes, are also crucial.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.