Blockchain and machine learning are two revolutionary technologies that have been reshaping the landscape of many industries, including finance. Blockchain is a decentralized, transparent, and immutable digital ledger system. Machine learning, on the other hand, is a subset of artificial intelligence (AI) that enables computers to learn and adapt from experience, improving their performance over time without being explicitly programmed. When these two technologies are combined, they unlock new possibilities in data analysis, prediction, and decision-making. Blockchain can provide a secure and reliable source of data, which is essential for machine learning algorithms. Machine learning, in return, can analyze blockchain data to identify patterns, generate insights, and even automate decisions based on these insights. The convergence of blockchain and machine learning has the potential to create high-value applications, especially in the financial sector. It opens up opportunities for more secure, efficient, and transparent financial systems. It also allows for the automation of complex processes, the detection of fraudulent activities, and the prediction of market trends with greater accuracy. Blockchain's transparency and immutability ensure that the data it contains is reliable and has not been tampered with. This data integrity is crucial for machine learning models, which rely heavily on data quality. Accurate data leads to more accurate predictions and insights from these models. Moreover, blockchain allows multiple parties to access and contribute to the same data set, which can significantly enrich the data available for machine learning analysis. Machine learning algorithms can analyze blockchain transactions and identify patterns that humans might overlook. For example, in the context of financial markets, machine learning models can analyze blockchain-based transaction data to predict future market trends. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, are a notable feature of blockchain. Machine learning can be used to inform the execution of these smart contracts. For instance, a machine learning model could predict when a contract condition is likely to be met and trigger the contract execution accordingly. Blockchain's distributed nature makes it resilient against cyber-attacks. Every transaction is encrypted and added to the blockchain, making it nearly impossible for hackers to alter the data. When combined with machine learning, which can predict and identify suspicious activities, the security of the financial system can be significantly enhanced. Machine learning models can generate valuable insights from blockchain data, facilitating more informed decision-making. These insights could be used to assess credit risk, determine investment strategies, or identify potential market opportunities. The combination of blockchain and machine learning can automate complex processes, such as trading, compliance checks, and fraud detection. This not only reduces human errors but also frees up resources, allowing financial institutions to focus more on strategic planning and innovation. Both blockchain and machine learning are complex technologies that require substantial computational resources. Developing and maintaining systems that integrate both technologies can be challenging and costly. Although blockchain data is encrypted, privacy concerns may arise, especially when personal data is involved. Regulations on data privacy, such as the General Data Protection Regulation (GDPR) in the European Union, can also pose challenges. The regulatory environment for blockchain and machine learning is still evolving. Financial institutions need to navigate these uncertainties and ensure their practices comply with existing and upcoming regulations. Blockchain and machine learning can revolutionize various financial services, such as lending, insurance, and asset management. By increasing efficiency, enhancing security, and providing a more personalized customer experience, these technologies can transform the way these services are provided and consumed. Blockchain and machine learning can significantly improve fraud detection. Blockchain's transparency makes it difficult for fraudulent transactions to go unnoticed, while machine learning can identify unusual patterns that may indicate fraudulent activities. Machine learning models can analyze blockchain data to predict potential risks, enabling financial institutions to proactively manage these risks. For example, machine learning algorithms can predict credit default risks based on blockchain transaction data. The convergence of blockchain and machine learning will continue to advance with the ongoing developments in these technologies. With more sophisticated algorithms and more scalable blockchain solutions, the applications of these technologies in the financial sector will expand. Looking ahead, we can expect to see more use cases of blockchain and machine learning across different industries. For instance, in supply chain management, these technologies could be used to track and predict the flow of goods. In healthcare, they could be used to secure patient data and predict patient outcomes. The fusion of blockchain and machine learning offers transformative potential in the financial sector. This potent combination ensures enhanced data integrity, facilitating accurate predictions and effective decision-making. By bolstering data security and automating complex processes, these technologies significantly improve efficiency and reliability. However, challenges remain, including technical complexity, privacy concerns, and evolving regulations, all of which require diligent attention and innovative solutions. Despite these obstacles, the future promises further advancements in technology, with wider industry applications, improved fraud detection, and more efficient risk management. Embracing the symbiosis of blockchain and machine learning is key to unlocking next-level innovation in the financial industry and beyond.What Is Blockchain and Machine Learning?

Purpose and Importance

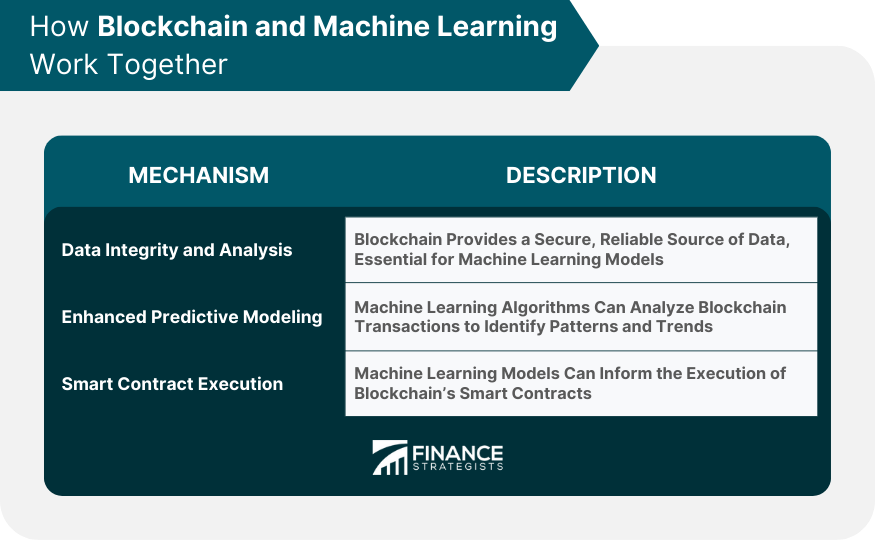

How Blockchain and Machine Learning Work Together

Data Integrity and Analysis

Enhanced Predictive Modeling

Smart Contract Execution

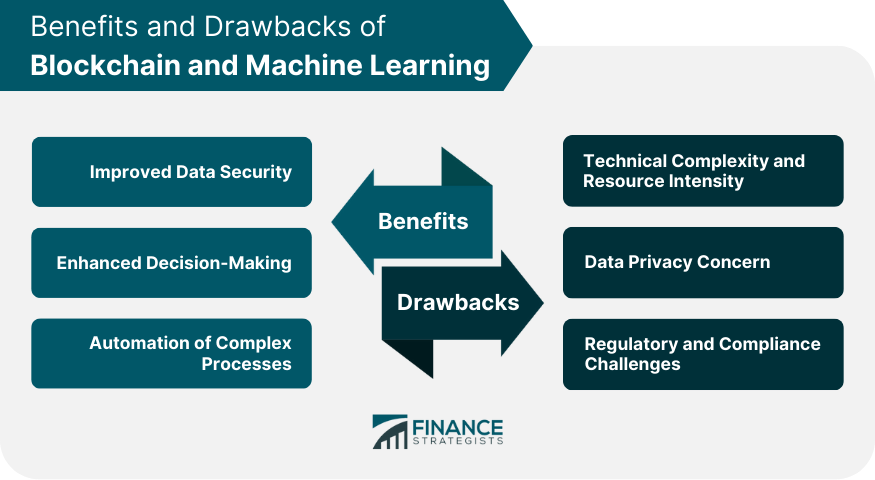

Benefits of Blockchain and Machine Learning

Improved Data Security

Enhanced Decision-Making

Automation of Complex Processes

Drawbacks of Blockchain and Machine Learning

Technical Complexity and Resource Intensity

Data Privacy Concerns

Regulatory and Compliance Challenges

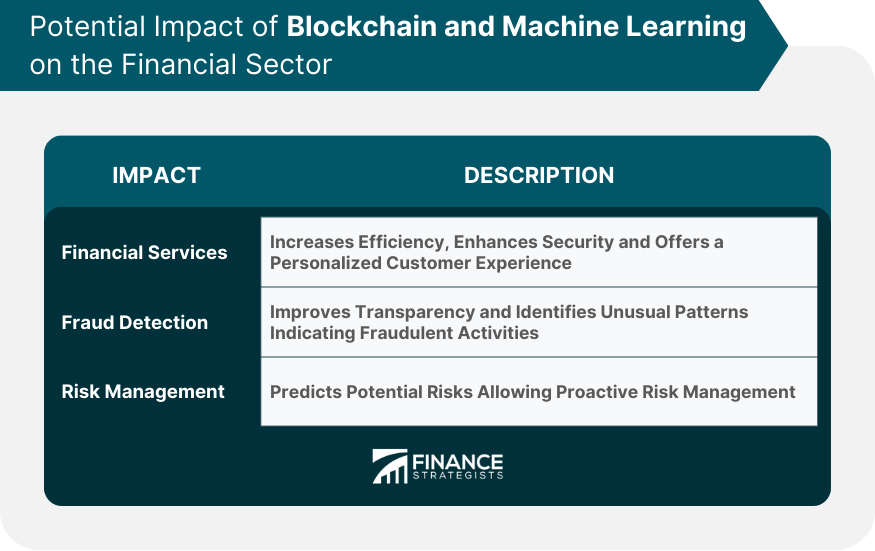

Potential Impact of Blockchain and Machine Learning on the Financial Sector

Revolutionizing Financial Services

Enhancing Fraud Detection

Advancing Risk Management

Future Perspectives on Blockchain and Machine Learning

Advancements in Technology

Potential Industry Use Cases

Conclusion

Blockchain and Machine Learning FAQs

Blockchain provides a secure and reliable source of data, which is essential for machine learning algorithms. Machine learning, in return, can analyze blockchain data to identify patterns, generate insights, and even automate decisions based on these insights.

Blockchain improves the data quality for machine learning. Its transparency and immutability ensure that the data fed into machine learning models is reliable and has not been tampered with. Accurate data leads to more accurate predictions and insights.

Blockchain's encrypted and decentralized nature makes it resilient against cyber-attacks. When combined with machine learning, which can predict and identify suspicious activities, the security of systems can be significantly enhanced.

Some of the challenges include technical complexity and resource intensity, data privacy concerns, and regulatory and compliance challenges. Both technologies are complex and require substantial computational resources, which can be challenging and costly.

They can revolutionize various financial services by increasing efficiency, enhancing security, and providing a more personalized customer experience. They also enhance fraud detection and risk management capabilities of financial institutions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.