Permissioned Blockchain is a specialized type of blockchain technology where network access and action execution are confined to certain entities or specific members. Unlike public blockchains open to everyone, participation in a permissioned blockchain is dictated by predefined rules concerning participants' capabilities and access levels. Participants are typically vetted and approved by a central entity or a consensus mechanism where multiple entities agree on their inclusion. This blockchain model ensures transactions are visible only to the parties involved and those with necessary permissions, enhancing data privacy and security. Due to the limited number of nodes involved in the consensus process, it often enables faster transaction times and improved scalability compared to public blockchains. In wealth management, the controlled, efficient environment of permissioned blockchain facilitates large-volume transactions, secure client asset management, and swift compliance. This leads to streamlined operations, potential cost savings, enhanced client service, and potential new industry standards. At the core of a permissioned blockchain, the network's blueprint and the roles of participants are defined by the central controlling entity or entities. Roles within the network can be varied; validators verify and approve transactions while participants initiate transactions. This controlled framework fosters an environment of enhanced security and accountability. Transactional validation within a permissioned blockchain relies on consensus mechanisms. While public blockchains utilize proof-of-work systems, known for their energy-intensive processes, permissioned blockchains favor more efficient systems like Proof of Stake (PoS) or Practical Byzantine Fault Tolerance (PBFT). These mechanisms enable expedited transaction times and increased scalability. Permissioned blockchain offers wealth management firms an accurate, real-time snapshot of a client's portfolio. Each transaction is recorded and verified, ensuring a clear and unambiguous audit trail. This trail allows advisors to provide comprehensive guidance and aids informed decision-making. Compliance and reporting become simpler processes within the scope of a permissioned blockchain. A singular source of truth enables wealth management firms to produce accurate and efficient regulatory reports. Additionally, automation of compliance tasks reduces the potential for human errors and mitigates operational risks. Enhanced security is a notable advantage of implementing a permissioned blockchain. Each transaction is encrypted and linked to the previous one, making it virtually impossible to tamper with past records. Given that only authorized entities can validate transactions, the risk of malicious activities is significantly mitigated. The immutable and auditable transaction history that a permissioned blockchain provides fosters an environment of transparency. This clarity ensures clients that their data is unaltered and accurate, which in turn cultivates greater confidence in their wealth management firms. The automation of many manual tasks, such as data reconciliation, by a permissioned blockchain results in decreased operational inefficiencies. This improvement can lead to cost savings and allows firms to focus their resources on value-adding activities, like enhancing client services or innovating new products. Despite its many benefits, the implementation of blockchain technology presents its own set of challenges. Firms must ensure that their chosen blockchain platform is compatible with existing systems, a process that may require substantial technical expertise and resources. As blockchain technology is a relatively new field, regulatory frameworks are still in development. Wealth management firms must traverse this uncertain landscape and ensure their blockchain initiatives are fully compliant with all relevant laws and regulations. A permissioned blockchain relies on the participation of all relevant entities for effective operation. If any parties are unable or unwilling to join the network, it can curtail the effectiveness and potential benefits of the blockchain. The application of permissioned blockchain can drastically enhance the client experience within wealth management. Faster transaction times, increased trust, and improved communication between clients and wealth managers are a few of the benefits offered by the technology. The efficiency of asset transfers can be greatly improved with the application of blockchain. Real-time transfers without intermediaries streamline the process and reduce associated costs, making wealth management services more accessible to a broader audience. A permissioned blockchain provides a singular, accurate, and immutable data source. This capability transforms data management practices within wealth management firms, resulting in improved decision-making, more effective risk management, and increased operational efficiency. Permissioned blockchain, with its controlled network environment and enhanced security and accountability, offers transformative opportunities in wealth management. Its mechanics, centered on consensus mechanisms like Proof of Stake (PoS) or Practical Byzantine Fault Tolerance (PBFT), streamline transaction validation and improve scalability. The advantages, such as increased security measures, promotion of transparency, and operational efficiency, are critical. However, there are also challenges like technical and integration hurdles, regulatory uncertainties, and network participation dependencies to consider. The application of permissioned blockchain in wealth management can redefine asset transfer mechanisms, enhance client experience, and transform data management practices. Despite the challenges, the compelling advantages make it an innovative solution for future wealth management practices. If you are seeking to future-proof your wealth management strategy, explore the possibility of incorporating permissioned blockchain into your operations. It may unlock new efficiencies and benefits that could redefine your service standards and client relationships. What Is Permissioned Blockchain?

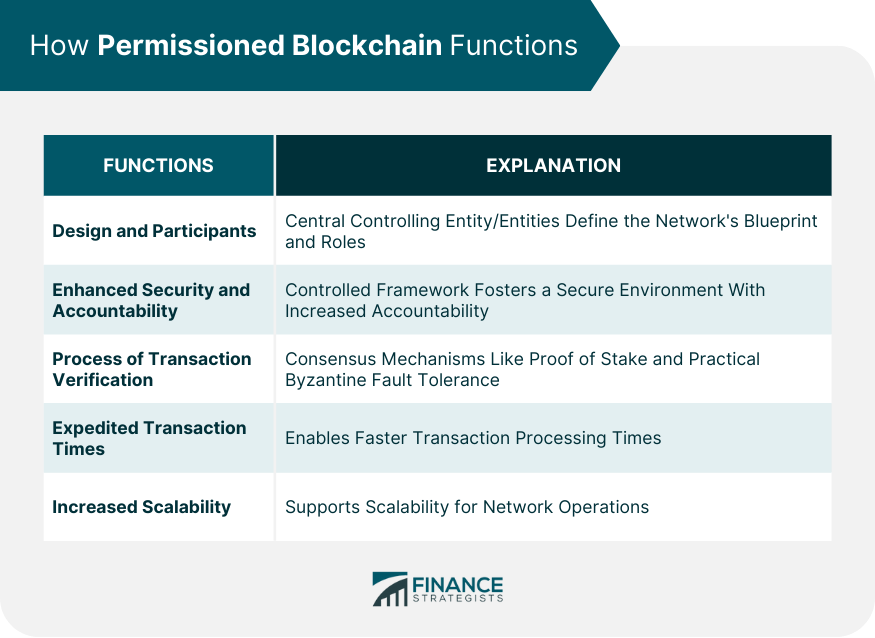

How Permissioned Blockchain Functions

Design and Participants

Process of Transaction Verification

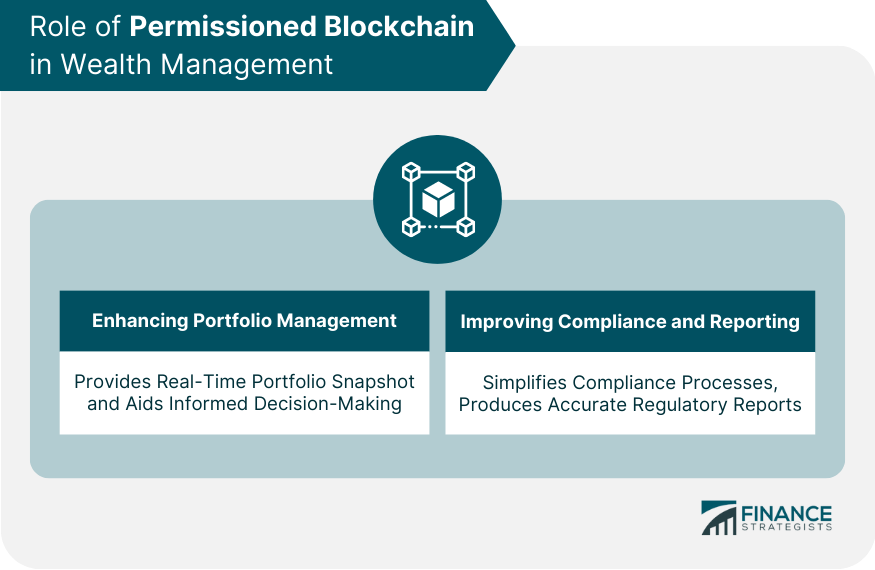

Role of Permissioned Blockchain in Wealth Management

Enhancing Portfolio Management

Improving Compliance and Reporting

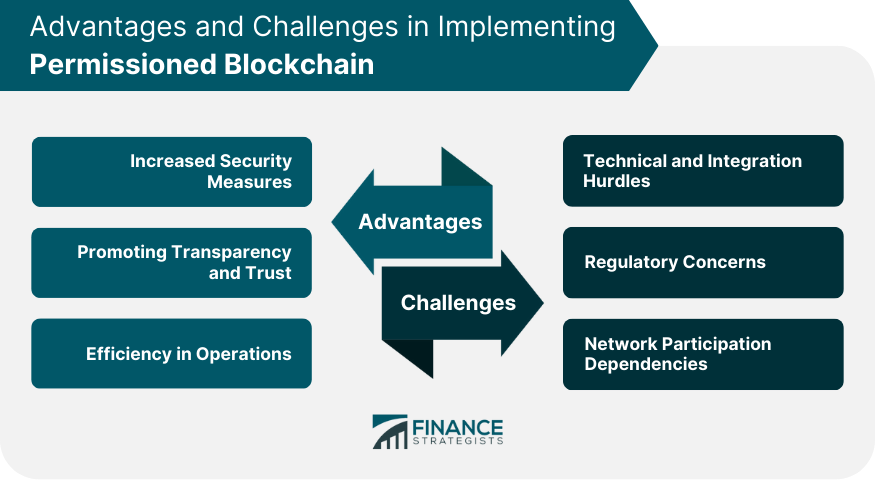

Advantages of Implementing Permissioned Blockchain in Wealth Management

Increased Security Measures

Promoting Transparency and Trust

Efficiency in Operations

Challenges in Implementing Permissioned Blockchain in Wealth Management

Technical and Integration Hurdles

Regulatory Concerns

Network Participation Dependencies

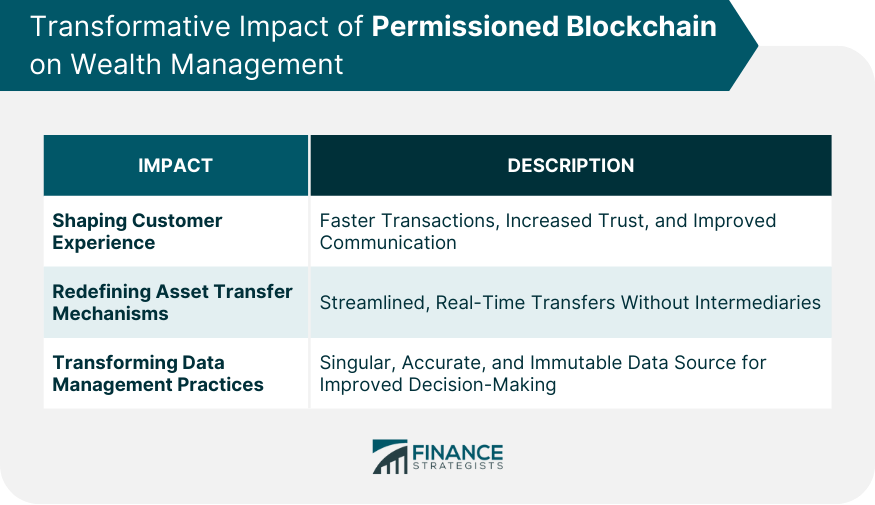

Transformative Impact of Permissioned Blockchain on Wealth Management

Shaping Customer Experience

Redefining Asset Transfer Mechanisms

Transforming Data Management Practices

Conclusion

Permissioned Blockchain FAQs

Permissioned blockchain is a controlled network where selected entities manage accessibility and actions, offering enhanced security and scalability.

It enables streamlined operations, enhanced privacy, accurate portfolio management, improved compliance, and potential cost reductions.

Increased security measures, transparency, and efficiency through encrypted transactions, immutable records, and automation of manual tasks.

Technical and integration hurdles, regulatory concerns, and the dependency on the participation of relevant entities.

It shapes customer experience with faster transactions and improved communication, redefines asset transfer mechanisms, and transforms data management practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.