Making money with blockchain refers to the various methods of generating income through activities centered around blockchain technology, including cryptocurrency investments, blockchain consulting, mining, and more. These innovative financial opportunities offer potential high returns, and serve the greater purpose of paving the way for a decentralized financial ecosystem, providing more financial control to individuals, and driving digital transformation across multiple industries. Engaging with these income-generating strategies can have a profound impact on the readers by offering them new and diversified sources of income, enhancing their understanding of emerging technologies, and encouraging them to participate in the changing financial landscape. These ways to make money with blockchain are part of the wider context of the digital revolution in finance and commerce, empowering individuals and reshaping the global economy. One of the most common ways to make money with blockchain is through cryptocurrency investments. Purchasing digital currencies like Bitcoin, Ethereum, or other altcoins at a lower price and selling them when their value increases can result in substantial profits. As businesses explore blockchain applications, there's an increasing demand for experts who understand this technology. Blockchain consultants help businesses understand how they can benefit from blockchain, guiding them through its adoption and implementation. With the rise of decentralized applications (dApps) and smart contracts, there's a growing need for blockchain developers. These specialists create blockchain platforms and applications, and their high-demand skills can command significant compensation. Mining involves using computational power to solve complex mathematical problems that maintain and secure the blockchain network. Miners are rewarded with new coins for their effort, making it a potential income source. ICOs and IEOs are fundraising methods used by blockchain projects. Investors purchase tokens in the hope that their value will increase as the project becomes successful. Yield farming is a process where crypto holders participate in DeFi protocols to earn interest or fees. This innovative blockchain application is a novel way to earn passive income. Tokenization allows for physical assets to be represented as digital tokens on the blockchain. Profits can be made from buying, selling, or trading these asset-backed tokens. Cryptocurrency trading involves buying, selling, and exchanging cryptocurrencies on crypto exchanges. Profits are made by capitalizing on price fluctuations. Involves participating in a proof-of-stake (PoS) blockchain network by holding and "staking" a cryptocurrency in a wallet to support network operations like block validation, security, and governance. Blockchain-related ventures, particularly cryptocurrency investments, can provide high returns compared to traditional investments. Incorporating blockchain assets in your portfolio can enhance diversification, potentially reducing risk and improving returns over time. Can be accessed and utilized worldwide, enabling individuals from various regions to participate in income-generating activities. Blockchain provides a decentralized and autonomous system, empowering individuals to control their financial transactions without intermediaries. Offer a form of financial inclusion, enabling those without access to traditional banking to participate in the global economy. The price of cryptocurrencies can be extremely volatile, resulting in high-risk investments. Regulatory landscapes for blockchain and cryptocurrency are still being defined and can vary by jurisdiction, creating uncertainty for investors and businesses. The blockchain industry is not as heavily regulated as traditional finance, which means less consumer protection. The technical complexity of blockchain may deter individuals and institutions from adopting and investing in related technologies. Some blockchain activities, like crypto mining, are energy-intensive and raise environmental sustainability concerns. A deep understanding of blockchain technology, including how it works and its potential applications, is critical for anyone looking to make money in this field. Markets Understanding market trends, price indicators, and the overall cryptocurrency ecosystem is crucial for effective trading or investing. Trends The ability to analyze cryptocurrency trends can inform investment decisions and strategies, helping to maximize profits and mitigate risks. Staying updated with the evolving legal and regulatory landscape for blockchain and cryptocurrencies can help avoid legal complications and risks. Given the volatility of cryptocurrency markets, strong risk management skills are essential to protect against potential losses. Generating income through blockchain can have profound economic implications. It has led to the creation of new industries, job opportunities, and has the potential to redistribute wealth in society. Blockchain's potential to generate income challenges traditional financial systems. It could lead to more decentralized, efficient, and inclusive financial services. The pursuit of making money with blockchain drives innovation. It encourages the development of new applications and solutions and stimulates technological advancement. While there are environmental concerns with some blockchain activities, the technology also offers potential solutions to environmental challenges, including transparent and efficient energy trading systems. The transformative potential of blockchain technology extends beyond its known applications to diverse ways of generating income. This includes activities like cryptocurrency investments, blockchain consulting, mining, participating in ICOs and IEOs, DeFi yield farming, asset tokenization, cryptocurrency trading, and staking cryptocurrencies. These methods, while they offer significant financial benefits and contribute to a decentralized financial ecosystem, come with their own risks, notably, high volatility and regulatory uncertainties. Essential skills such as a deep understanding of blockchain technology, familiarity with cryptocurrency markets, ability to analyze trends, legal awareness, and risk management are paramount for success. The impact of making money with blockchain is multifaceted, encompassing economic, traditional finance, innovation, and environmental aspects. Embracing these income-generating methods contributes to the digital revolution, propelling us toward an inclusive, decentralized, and innovative global economy.Making Money With Blockchain: Overview

How Making Money With Blockchain Works

Cryptocurrency Investments

Blockchain Consulting

Blockchain Development

Crypto Mining

Initial Coin Offerings (ICOs) & Initial Exchange Offerings (IEOs)

DeFi Yield Farming Decentralized Finance (DeFi)

Tokenization of Assets

Cryptocurrency Trading

Staking Cryptocurrencies Staking

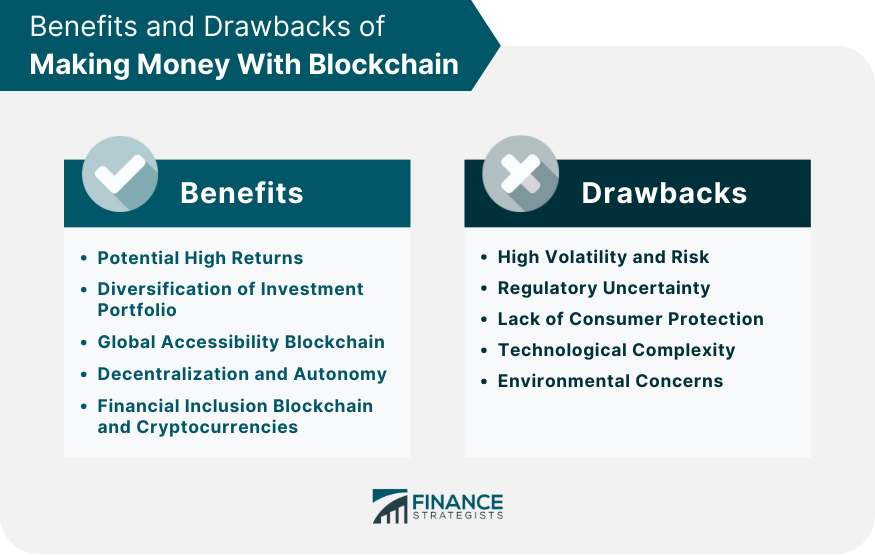

Benefits of Making Money With Blockchain

Potential High Returns

Diversification of Investment Portfolio

Global Accessibility Blockchain

Decentralization and Autonomy

Financial Inclusion Blockchain and Cryptocurrencies

Drawbacks of Making Money With Blockchain

High Volatility and Risk

Regulatory Uncertainty

Lack of Consumer Protection

Technological Complexity

Environmental Concerns

Essential Tools and Skills for Making Money With Blockchain

Understanding of Blockchain Technology

Knowledge of Cryptocurrency

Skill in Analyzing Cryptocurrency

Awareness of Legal and Regulatory Issues

Ability to Manage Risk

Impact of Making Money With Blockchain

Economic Impact

Influence on Traditional Finance

Role in Fostering Innovation

Impact on Environmental Sustainability

Conclusion

Ways to Make Money With Blockchain FAQs

Cryptocurrency mining involves using computational power to solve complex mathematical problems that maintain and secure the blockchain network. Miners are rewarded with new coins for their effort, providing a potential income source.

Tokenization allows physical assets to be represented as digital tokens on the blockchain. You can make money by buying, selling, or trading these asset-backed tokens, benefiting from their potential value appreciation.

DeFi yield farming involves participating in decentralized finance (DeFi) protocols with your crypto holdings to earn interest or fees. By providing liquidity or participating in specific activities, you can earn passive income in the form of additional cryptocurrencies.

Cryptocurrency trading involves buying, selling, and exchanging cryptocurrencies on crypto exchanges. By capitalizing on price fluctuations and making strategic trades, you can generate profits from the market movements.

Staking involves participating in a proof-of-stake (PoS) blockchain network by holding and "staking" a cryptocurrency in a wallet to support network operations. By doing so, you can earn rewards in the form of additional cryptocurrency tokens for your contribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.