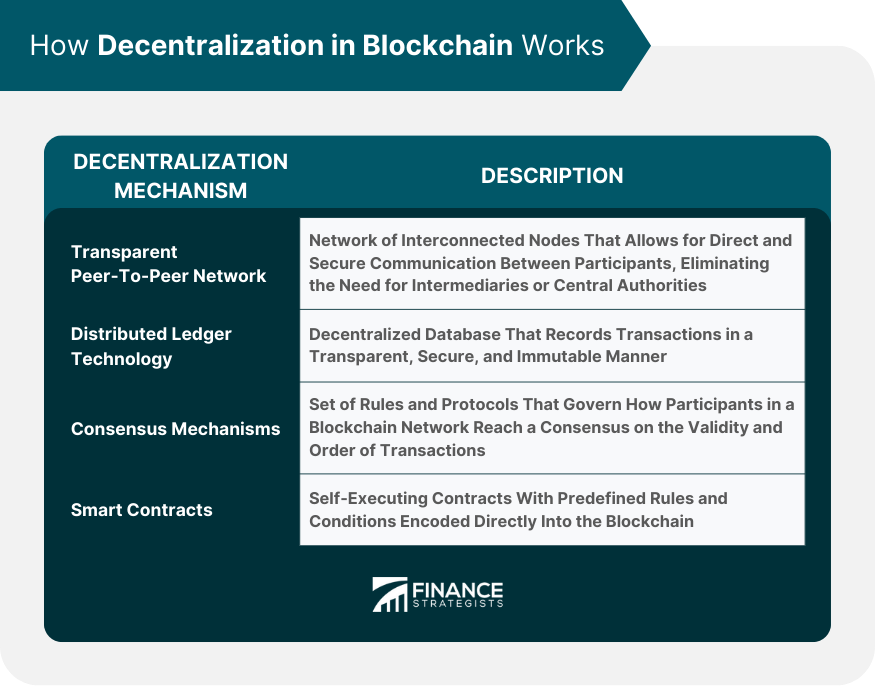

Decentralization in blockchain refers to the distribution of authority, control, and decision-making power among multiple participants within a blockchain network. Unlike traditional financial systems that rely on central authorities or intermediaries, decentralization allows for direct transactions and interactions between individuals or entities. This approach enhances transparency, security, and immutability in wealth management by eliminating the need for intermediaries and enabling more efficient and inclusive financial services. It revolutionizes the way wealth is managed, offering increased efficiency, reduced costs, and enhanced accessibility for individuals and businesses. Decentralization in blockchain operates through transparent peer-to-peer networks, distributed ledger technology, consensus mechanisms, and smart contracts. A transparent peer-to-peer network lies at the heart of decentralization in blockchain technology. It serves as the foundation for direct and secure communication between participants, eliminating the need for intermediaries or central authorities. In a transparent peer-to-peer network, participants connect directly with each other, forming a network of interconnected nodes. This direct connectivity allows for efficient and real-time communication, enabling the verification and validation of transactions without relying on a centralized entity. One of the key advantages of a transparent peer-to-peer network is the visibility of transactions. When a transaction occurs within the network, it is recorded in a shared ledger, often referred to as the blockchain. This transparency promotes trust and accountability, as participants can independently verify the validity of transactions and track the flow of assets. Distributed ledger serves as the underlying infrastructure for recording and storing transactions in a transparent, secure, and distributed manner. In a blockchain network, the ledger, also known as the blockchain, is not stored in a central location but is distributed across multiple network nodes. Each participating node maintains a complete copy of the ledger, creating a decentralized network of synchronized copies. The distributed nature of the ledger ensures transparency among participants. This promotes trust and allows for independent verification of transactions, reducing the reliance on centralized authorities for validation and record-keeping. Additionally, distributed ledger technology provides immutability to the blockchain. Once a transaction is recorded in a block and added to the chain, it becomes extremely difficult to alter or tamper with. Any modification or tampering attempt to a transaction would require the consensus of a majority of network nodes, making the blockchain highly resistant to unauthorized changes. Consensus mechanisms provide a set of rules and protocols that govern how agreement is reached and how transactions are validated within the network. One widely known consensus mechanism is Proof of Work (PoW), which is used by cryptocurrencies like Bitcoin. In PoW, participants, known as miners, compete to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain. The miner who successfully solves the puzzle is rewarded with cryptocurrency. In a Proof of Stake (PoS), participants, called validators, are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and "stake" in the network. Validators are selected based on their stake, and their chances of being chosen to validate a block increase with the amount of cryptocurrency they hold. Delegated Proof of Stake (DPoS) is a consensus mechanism in blockchain networks where participants delegate voting power to trusted delegates for transaction validation. It improves scalability and energy efficiency, making it suitable for high-performance applications. Practical Byzantine Fault Tolerance (PBFT) ensures consensus in distributed networks with known and trusted participants, offering fast transaction confirmation and high fault tolerance. These are self-executing contracts with predefined rules and conditions encoded directly into the blockchain. These contracts automate and facilitate the execution of agreements, enabling secure and transparent transactions without the need for intermediaries or trusted third parties. By leveraging the capabilities of blockchain technology, smart contracts enable decentralized and autonomous execution of contractual obligations. The terms and conditions of the contract are written in code, which is stored and executed on the blockchain. This eliminates the need for traditional legal agreements and intermediaries, such as lawyers or escrow services, to oversee and enforce the terms of the contract. Smart contracts have diverse applications across various industries. They can be used for executing financial transactions, managing supply chain processes, facilitating real estate transactions, implementing digital identity solutions, and much more. Decentralization in blockchain brings forth numerous advantages that can reshape the future of finance. Decentralization in blockchain technology brings about enhanced security and immutability through the use of a distributed ledger. This distributed ledger, maintained across multiple network participants, plays a crucial role in ensuring the integrity and security of transaction records. The decentralized nature of blockchain makes it highly resistant to tampering and malicious attacks. In traditional centralized systems, a single point of failure or vulnerability can expose the entire system to risks. However, in a decentralized blockchain network, each transaction is verified and recorded by multiple participants, known as nodes, across the network. This distributed verification process adds an extra layer of security, as the consensus of multiple participants is required for a transaction to be considered valid and added to the ledger. In traditional financial systems, intermediaries such as banks, clearinghouses, and payment processors play a crucial role in facilitating transactions and ensuring trust between parties. However, these intermediaries often impose fees, delays, and complexities in the transaction process. With decentralization, blockchain eliminates the need for intermediaries by enabling direct peer-to-peer interactions. Transactions can be conducted directly between participants on the blockchain network without the involvement of third-party intermediaries. By removing intermediaries, blockchain technology eliminates the fees typically charged by banks or payment processors for their services. This reduction in transaction costs is particularly beneficial for businesses and individuals who frequently engage in financial activities and transactions. Given that every transaction is recorded on a distributed ledger, visible to all network participants, manipulations or fraudulent activities become significantly challenging to execute. But transparency in blockchain isn't just about visibility - it's a key trust-building mechanism. In traditional finance systems, trust is built on intermediaries' credibility. With blockchain's decentralized design, trust is inherently built into the system. Each transaction can be independently verified, and the immutable nature of the ledger assures participants that once a transaction is validated and added, it cannot be altered or removed. This trust, based on transparency and verifiability, can drive a higher level of confidence in financial transactions, fostering a more robust, reliable financial system. Blockchain's decentralization holds a transformative potential to mend the fractures in financial inclusivity, extending beyond the conventional boundaries of traditional banking systems. The structure of blockchain eradicates the requirement of a central authority, thereby eliminating potential barriers for the unbanked or underbanked populations. This technology opens up a world of financial services, from money transfers to loans, to those who were previously excluded, bringing forth a new era of economic empowerment. In regions where traditional banking infrastructure may be inadequate or even non-existent, blockchain can provide a decentralized, secure, and transparent platform for financial transactions. While decentralization offers significant advantages, it also poses challenges that need to be addressed for widespread adoption. With a swelling volume of transactions, the network's speed and efficiency could be hampered, leading to slower transaction times and an overall degradation in performance. Innovations like layer-two protocols and sharding are actively being investigated as viable remedies to counter the scalability challenges. Layer-two protocols are secondary frameworks built on top of an existing blockchain, designed to handle a larger volume of transactions off-chain before settling the final state on the main chain. This technique could potentially alleviate network congestion and expedite transaction speeds. Similarly, sharding is a technique that splits a blockchain's network into smaller, more manageable parts, known as shards. Each shard processes its own transactions and smart contracts, effectively distributing the workload and allowing for more transactions to be processed in parallel. This approach could significantly enhance the network's scalability and speed. The energy demands associated with blockchain, particularly within Proof of Work (PoW) systems, cast a long shadow of environmental concern. The vast power required for the mining process in PoW not only necessitates significant energy resources but also contributes to carbon emissions, painting an alarming environmental portrait. The urgency of this issue has ignited the innovation aimed at cultivating more energy-efficient consensus mechanisms. One alternative is the Proof of Stake (PoS) protocol. In stark contrast to the PoW system, PoS selects validators based on their stake in the network, bypassing the energy-intensive mining process. This evolution could lead to a more sustainable blockchain landscape, balancing the extraordinary benefits of the technology with the imperatives of environmental stewardiness. The decentralization characteristic of blockchain introduces an intricate web of regulatory and legal hurdles. Contemporary frameworks often stumble in their efforts to align with the rapid evolution of this groundbreaking technology. Traditional legal and regulatory models are typically ill-equipped to accommodate the nuances and specificities of a decentralized environment, leading to uncertainties and gray areas. However, governments and regulatory bodies worldwide are cognizant of these challenges. They are actively endeavoring to formulate suitable regulations that strike a delicate balance between fostering technological innovation and ensuring robust consumer protection. These regulatory pursuits aim to sculpt a conducive environment for decentralized systems. By providing legal clarity and security, they could potentially encourage further innovation in the space, bolster investor confidence, and facilitate the wider adoption of blockchain technology. Decentralization, a foundational principle of blockchain technology, revolutionizes traditional systems by distributing control and authority among numerous network participants, thereby eliminating the need for centralized governance. This approach makes blockchain networks more secure, transparent, and resistant to manipulation. The functioning of decentralized blockchain is facilitated by peer-to-peer networks, distributed ledger technology, consensus mechanisms, and smart contracts. In essence, decentralization offers enhanced security, reduced reliance on intermediaries, increased transparency, and potential for greater financial inclusivity. However, challenges like scalability issues, high energy consumption, and regulatory uncertainty must be addressed to ensure widespread adoption of this revolutionary technology. Despite these obstacles, the ongoing work on scalable solutions, energy-efficient mechanisms, and the development of supportive regulatory frameworks instill confidence in blockchain's potential to shape the future of various industries.What Is Decentralization in Blockchain?

How Decentralization in Blockchain Works

Transparent Peer-to-Peer Network

Distributed Ledger Technology

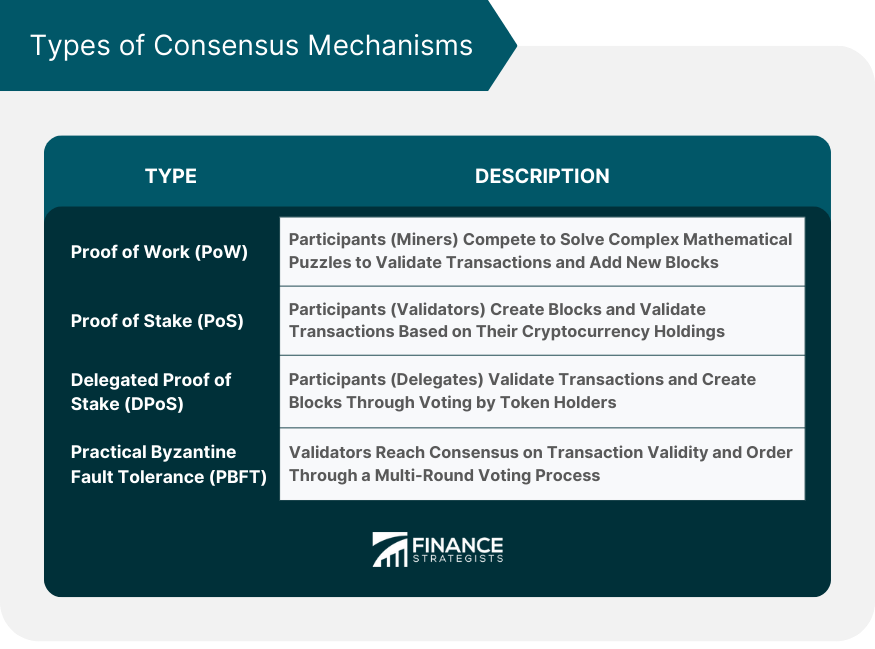

Consensus Mechanisms

Proof of Work (PoW)

Proof of Stake (PoS)

Delegated Proof of Stake (DPoS)

Smart Contracts

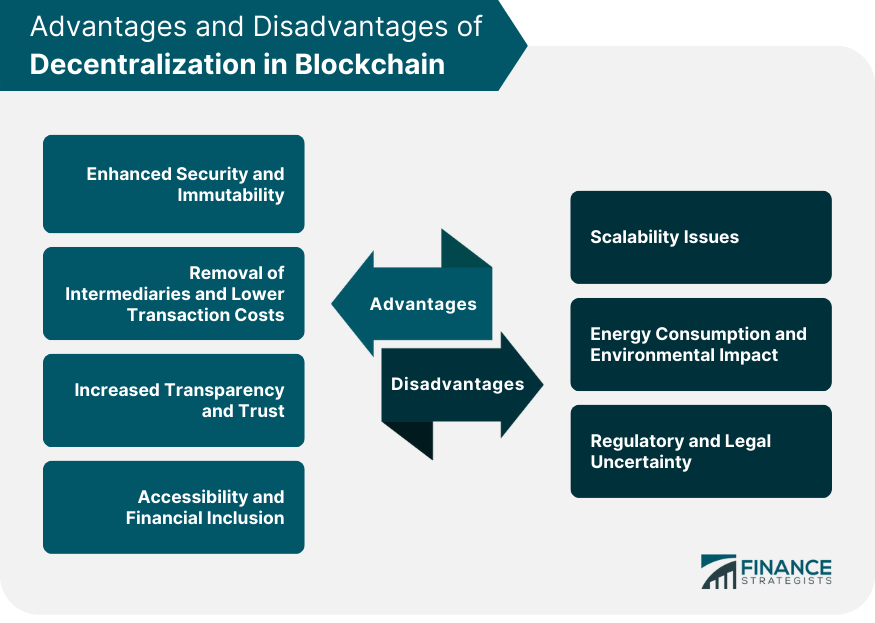

Advantages of Decentralization in Blockchain

Enhanced Security and Immutability

Removal of Intermediaries and Lower Transaction Costs

Increased Transparency and Trust

Accessibility and Financial Inclusion

Disadvantages of Decentralization in Blockchain

Scalability Issues

Energy Consumption and Environmental Impact

Regulatory and Legal Uncertainty

Conclusion

Decentralization in Blockchain FAQs

Decentralization in blockchain refers to the distribution of authority and control among multiple participants, eliminating the need for a central governing entity. It ensures that no single entity has complete control over the network, making it more transparent, secure, and resistant to manipulation.

Decentralization in blockchain operates through transparent peer-to-peer networks, distributed ledger technology, consensus mechanisms, and smart contracts. These components facilitate direct communication, shared record-keeping, consensus-based decision-making, and autonomous execution of agreements, enhancing the network's security and transparency.

Decentralization in blockchain brings enhanced security, removal of intermediaries, increased transparency, and the potential for greater financial inclusion. It improves the integrity of transaction records, reduces transaction costs, fosters trust, and enables broader access to financial services, especially for the unbanked population.

Decentralization in blockchain faces challenges such as scalability issues, energy consumption, and regulatory uncertainty. As networks expand, scalability becomes a concern, and energy-intensive consensus mechanisms may raise environmental concerns. Additionally, the evolving regulatory landscape poses uncertainties for decentralized systems.

Consensus mechanisms, such as Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS), are essential for decentralized decision-making and validation in blockchain networks. They enable participants to agree on the state of the ledger and validate transactions without relying on a central authority, establishing trust, security, and autonomy in the network.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.