Blockchain in money transfers refers to the application of blockchain technology in the field of money transfers. At its core, blockchain technology is a type of decentralized ledger or database known as a blockchain. This blockchain records, tracks, and validates transactions without requiring intermediaries like banks or traditional financial institutions. The role of blockchain in money transfers cannot be overstated. Its decentralized structure means that transactions are transparent, and everyone participating in the network holds a copy of the entire transaction history. This negates the need for trust in a central authority, providing a secure platform where the risk of fraud and manipulation is greatly reduced. Blockchain in money transfers operates on key principles: cryptography, decentralization, and consensus. To illustrate, when a sender initiates a money transfer, the details are broadcasted to a network of computers, also called nodes. Using cryptographic algorithms, these nodes validate the transaction. Once approved, the transaction is grouped with other transactions to form a block. This block is then added to the pre-existing blockchain. The process begins when a sender initiates a transaction. This action generates a unique transaction ID with details such as the sender's and recipient's wallet addresses and the amount to be transferred. The nodes within the network verify the transaction details, along with the sender's balance. Following verification, the transaction is validated and added to the blockchain. Blockchain technology prioritizes security. Every transaction is sealed with a digital signature, only achievable using the sender's private key. This means that the alteration of the transaction by anyone else is nearly impossible. The distributed nature of transaction records across the network of nodes makes the system highly resilient against attacks and manipulation. Blockchain technology's debut in money transfers is linked to the emergence of Bitcoin in 2009. Bitcoin brought forward the idea of a decentralized, peer-to-peer digital currency, enabling secure and cost-effective international money transfers. The concept was later adapted by other cryptocurrencies, each providing unique features and capabilities. Over time, advancements in blockchain technology have led to the development of more sophisticated platforms for money transfers. Today, there are platforms offering smart contracts, which automatically carry out transactions based on pre-set conditions. Decentralized finance (DeFi) applications are also gaining traction, enabling a seamless blend of blockchain technology with conventional financial systems. Blockchain technology considerably enhances the speed and efficiency of money transfers. Unlike traditional banking systems that may take several days to process international transactions, blockchain-based transactions can be completed in minutes, regardless of the geographical locations of the involved parties. Blockchain technology uses cryptographic principles to secure transactions, reducing the likelihood of fraud. Its transparent structure makes it difficult for fraudulent activities to take place, further bolstering the security of money transfers. The immutable nature of the blockchain ledger provides a detailed history of transactions, ensuring full transparency and traceability. This attribute is particularly useful in cases where transaction proofs are required, such as in dispute resolution or auditing processes. Blockchain transactions do not require intermediaries, resulting in significantly lower costs. This reduction in transaction costs makes blockchain a compelling option for international remittances, where transaction fees are often high. The biggest challenge for blockchain in money transfers is regulatory uncertainty. As a new technology, the legal framework surrounding blockchain transactions differs vastly across jurisdictions. This leads to a sense of uncertainty and potential risks for users. Public blockchain networks like Bitcoin can experience scalability issues, impacting transaction speeds and costs. While solutions to these problems are in development, widespread adoption is yet to occur. The general public's understanding of blockchain technology remains limited. This lack of comprehension can cause hesitancy in adopting and using blockchain for money transfers, despite its numerous benefits. Blockchain technology, particularly through cryptocurrencies, has opened up new avenues for diversifying portfolios in wealth management. Investors can include crypto assets in their portfolios to mitigate risks associated with traditional assets and potentially gain higher returns. The transparency and traceability provided by blockchain technology plays a crucial role in risk management. Wealth managers can track the origins and destinations of funds, helping to mitigate risks associated with fraud and money laundering. Blockchain technology is revolutionizing the realm of money transfers with its decentralized structure, enhancing security, traceability, and efficiency. Leveraging cryptographic algorithms, blockchain facilitates transactions across a network of nodes, delivering real-time validation and robust security measures. It not only accelerates transaction speeds compared to traditional banking systems but also reduces costs by eliminating intermediaries. Moreover, it's making strides in wealth management, assisting in portfolio diversification and risk management. However, the technology faces challenges, such as regulatory uncertainty, technical scalability issues, and limited public understanding. Despite these hurdles, the potential of blockchain in transforming money transfers and financial services remains vast. As you navigate this financial revolution, seeking expert wealth management services can help individuals and businesses harness the full potential of blockchain. These professionals can provide guidance in understanding, adopting, and effectively utilizing blockchain technology in an ever-evolving financial landscapeWhat Is Blockchain in Money Transfers?

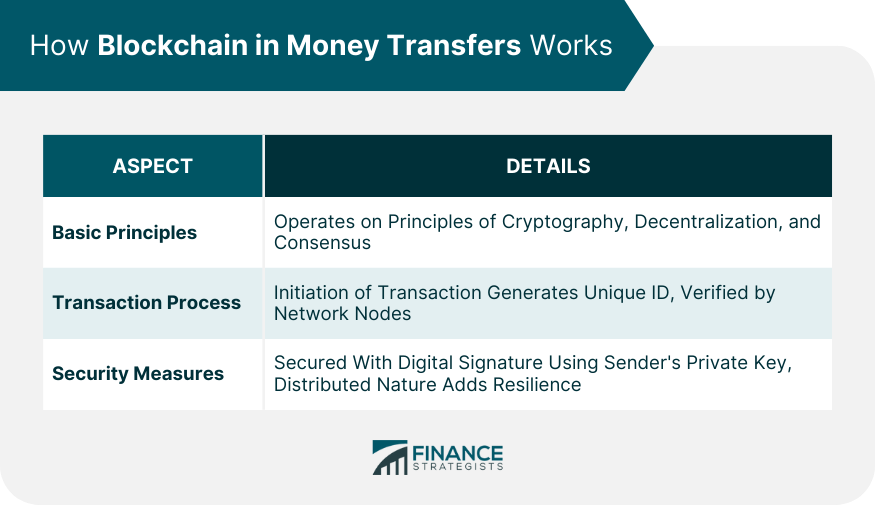

How Blockchain in Money Transfers Works

Basic Principles of Blockchain in Transferring Money

Transaction Process in Blockchain Money Transfers

Security Measures in Blockchain Money Transfers

Evolution of Blockchain in Money Transfers

Origins and Early Development

Recent Advances and Current Trends

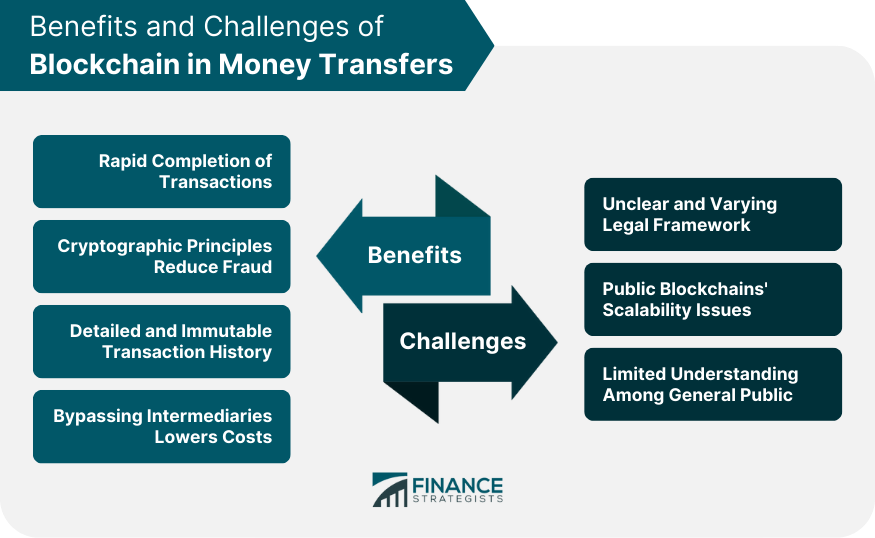

Benefits of Blockchain in Money Transfers

Speed and Efficiency

Security and Fraud Reduction

Transparency and Traceability

Lower Costs

Challenges of Blockchain in Money Transfers

Regulatory and Legal Concerns

Technical Challenges and Scalability Issues

Public Acceptance and Understanding

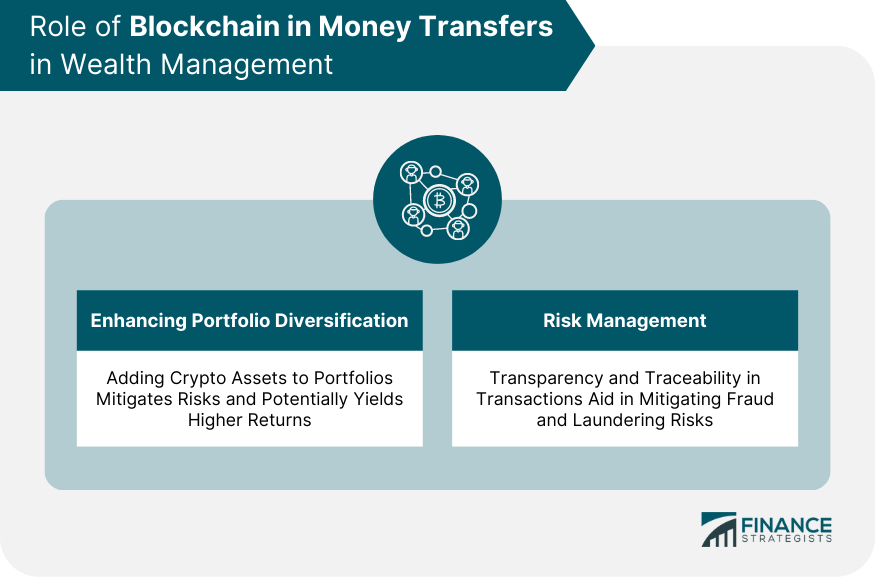

Blockchain in Money Transfers’ Role in Wealth Management

Enhancing Portfolio Diversification

Risk Management

The Bottom Line

Blockchain in Money Transfers FAQs

Using blockchain in money transfer offers rapid transactions, reduced fraud, transparency, and lower costs.

Challenges in using money transfers include legal uncertainty, scalability issues, and limited public understanding.

Blockchain utilizes cryptography and a distributed network to secure transactions and prevent fraud.

Yes, blockchain enables the inclusion of crypto assets, mitigating risks and potentially increasing returns.

Public acceptance drives adoption, fostering trust and understanding of the technology's benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.