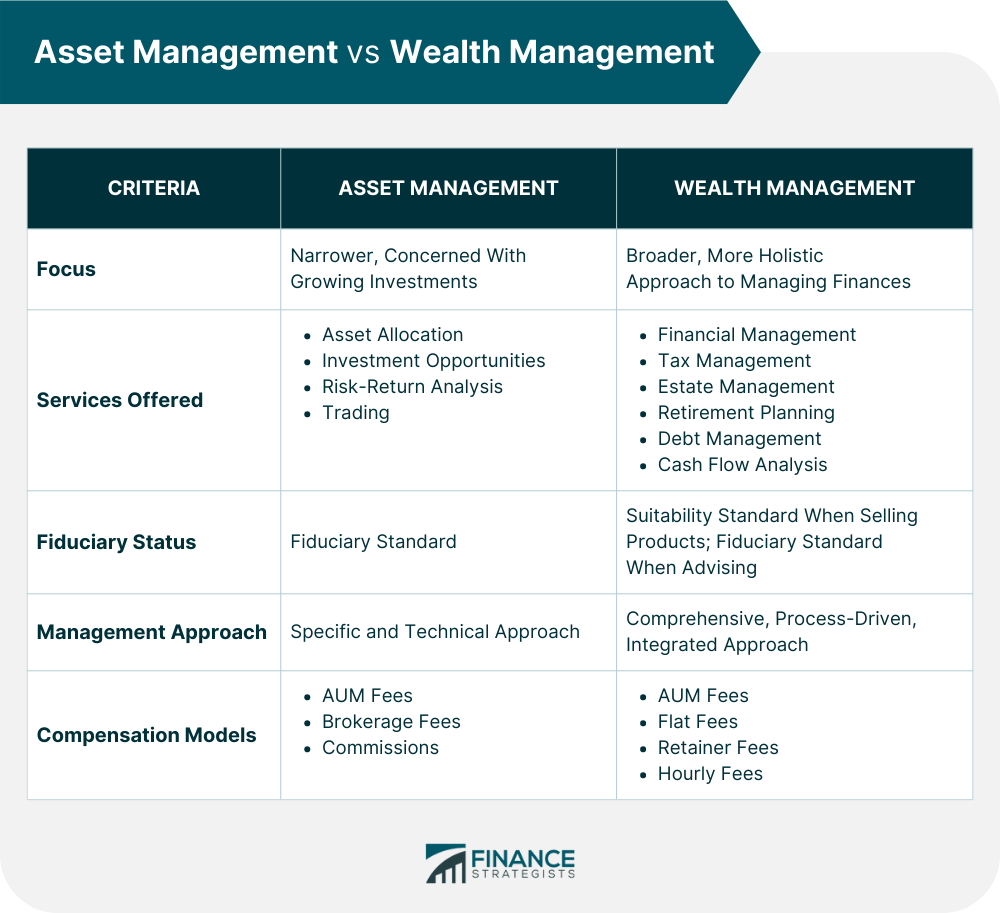

Asset management and wealth management services are popular options for individuals to help them manage and grow their financial resources. Asset management is focused on increasing a client’s investments, while wealth management is concerned with more holistic financial planning for a client’s long-term goals. Asset management is essentially a subset of wealth management. Deciding between Asset Management and Wealth Management? Click here. Asset management is the process of managing a portfolio of investments such as stocks, bonds, and other financial instruments. It primarily focuses on ensuring that assets generate a return on investment while minimizing loss exposure. It uses diversification, rebalancing, and risk management strategies to help clients achieve their desired returns. Asset managers monitor markets to identify new opportunities and manage portfolios accordingly. They advise which investments are best for a particular individual or company based on the client’s goals and risk tolerance. They may offer different products such as mutual funds, exchange-traded funds (ETFs), real estate investments, derivatives, and commodities. Additionally, asset managers may provide advisory services such as risk management, portfolio construction and review, performance monitoring, and tax optimization. Asset managers charge fees for their services based on commissions or on a percentage of assets under management (AUM). These fees are typically progressive, meaning they decrease as the size of the account increases. Wealth management is a specialized form of financial advice designed to help individuals, families, and business owners create, preserve, and transfer wealth. This involves creating a plan that encompasses the client’s lifestyle and goals. It leverages an array of services such as asset management, tax planning, education planning, estate planning, insurance, retirement planning, and even philanthropic advice to develop an integrated approach to managing a client’s wealth. Wealth management is centered on helping clients reach their goals by developing customized strategies based on their individual financial situations and needs. It guides the best way to deploy assets for maximum quality of life and long-term financial security. A wealth manager can help you create an effective plan for any stage of life, from managing day-to-day finances to developing advanced estate plans. Working with them ensures that your finances are organized for long-term success, and that plans are reviewed regularly to accommodate changes in life circumstances such as career transitions, retirement, or major life events like marriage or having children. Wealth managers may charge hourly or per-year fees, a flat fee, or AUM fees. Essentially, asset management is a subset of wealth management. They differ in focus, services offered, fiduciary status, management approach, and compensation models. Asset management has a singular focus — growing a client’s investment portfolio. It ensures that assets generate a return on investment while minimizing the possibility of incurring losses by considering the client’s goals and risk tolerance. On the other hand, wealth management has a broader, more holistic focus when managing an individual’s finances. It works to provide advice on all aspects of a client’s financial plan, ensuring long-term wealth protection. While investment growth is essential in wealth management, it also concentrates on other aspects of a client’s financial situation, aiming to improve quality of life and financial security. Due to their difference in focus, asset management provides a more limited set of services than wealth management. Asset managers generally provide investment advice like asset allocation, new opportunities, risk-return analysis, and other portfolio management services. They may also handle day-to-day investment management, from opening accounts to placing trades. Wealth managers offer broader services, such as financial, tax, estate, and retirement planning. They can also guide education planning, insurance, legacy planning, and philanthropic contribution. Other wealth management services may include succession planning, debt management, trust management, cash flow analysis, and other wealth preservation and growth areas. A fiduciary is a person or entity entrusted to manage and protect the assets of another. As such, they must place their client’s interests ahead of their own when providing advice or managing investments. Wealth managers are held to a fiduciary standard. This means they must strictly adhere to the fiduciary duty and not place their own interests ahead of their clients. Their advice should always be for the benefit of their clients. An asset manager is only a fiduciary when fulfilling a role as an advisor. When selling investment products, they are only held to a suitability standard, meaning they must ensure their products are suitable for the client but not necessarily the best option. Asset and wealth managers also approach management differently, another consequence of their divergent focus mentioned above. Asset managers are more specific and technical in managing a client’s investments. They use their expertise to determine the right investment strategy and mix of assets for their clients. Wealth managers, on the other hand, are more comprehensive and process-driven. They strive to create an integrated approach with financial experts, lawyers, accountants, and others to create, preserve, grow, and transfer their client’s wealth. It is important to understand where you will invest your money and how much you will pay for services, be it asset or wealth management. Both earn through AUM fees though they differ in the percentage charged, ranging from 0.25% to 1% of the portfolio per year. Asset managers may also charge brokerage fees for trades and account openings. They may also earn a commission from different investment products they sell. On the other hand, wealth managers can charge flat, retainer, or hourly fees, depending on the specific service provided. They typically charge less as the amount of managed wealth increases. The decision to avail of asset or wealth management services depends on your needs and goals. You should also consider the types of investments you are looking to get or the level of service you need. Also, consider how much you are willing and able to pay for their services. Asset management is suitable for individuals who want to delegate the task of managing their investments. In contrast, wealth management is better suited for those who want more comprehensive advice and guidance on financial planning. For instance, asset management could be an ideal choice if you want to diversify your portfolio and generate returns without actively managing it. On the other hand, if you need help with retirement planning, estate planning, or tax optimization, then a wealth manager might be more appropriate. Some firms offer both asset and wealth management services so that clients can benefit from their expertise in both areas. Wealth management is also more suited for people with higher net worth since the services tend to be more expensive. Some wealth managers also require a minimum investment amount to avail of their services. In contrast, asset management tends to cost less, making it accessible to people from all equal income brackets looking to grow their wealth. To determine which type of service best suits your needs and goals, the best course of action is to consult a qualified financial advisor. No matter what you decide, remember to choose wisely, as it can be costly in terms of money and time. Here are some tips for finding the right asset or wealth manager: References can provide invaluable insight into how well a prospective manager has handled money in the past. Make sure to reach out to current and former clients for their experiences with the asset or wealth manager. You may also ask for referrals from family, friends, or colleagues. Combined with online databases, their firsthand experience will greatly increase confidence in your potential asset or wealth manager. Do background research on potential managers online —look at websites, read reviews, and check if they have qualifications like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Investment Management Analyst (CIMA). You may use the Securities and Exchange Commission (SEC) Action Lookup - Individual (SALI) tool to see if a potential asset or wealth manager has ever been disciplined by the SEC and the Investment Adviser Public Disclosure (IAPD) website to check credentials and background. Also, ensure that you understand how they manage money, their investment philosophy, fees charged, services offered, and other relevant information. Ask detailed questions about the asset or wealth manager’s background and experience. Verify information from your own online research. Interview at least two potential choices before making a decision. Ask questions like: What is your experience managing portfolios? How will you manage my money? What fees will I be charged? How often do you review investment performance? How do you plan to manage other aspects of my wealth? Asset management and wealth management are both viable services that offer different sets of benefits. Asset management primarily focuses on increasing investments and avoiding risk, while wealth management is a broader, more holistic approach to financial planning. When deciding between the two, it is important to consider your financial goals, needs, and the amount of money you are willing to invest. Also, consider their differences in focus, services offered, fiduciary status, compensation models, and management approach. Knowledge about these services can help you make an informed decision and ensure that your finances are managed effectively. Always do your due diligence when hiring an asset or wealth manager, as this can save you from costly mistakes.Asset Management vs Wealth Management: An Overview

This article will guide you in understanding the differences between asset management and wealth management. It will also provide advice on deciding which service is right for you and how to find the right manager for your needs.What Is Asset Management?

What Is Wealth Management?

Key Differences Between Asset Management and Wealth Management

Focus

Services Offered

Fiduciary Status

Management Approach

Compensation Models

Asset Management vs Wealth Management: Which Is Right for You?

How to Find an Asset or Wealth Manager

Get References

Check Background and Qualifications

Interview

Final Thoughts

Asset Management vs Wealth Management FAQs

Asset management is the process of making wise investments in order to generate returns, while wealth management focuses on developing personalized strategies for individuals to reach their financial goals by optimizing all aspects of their financial lives.

Yes, asset management may involve some aspects of financial planning such as tax optimization, portfolio diversification, and risk management.

No, wealth management is available to individuals regardless of their net worth. It can help people achieve their financial goals by providing strategic advice tailored to their unique needs and circumstances.

Yes, asset management includes advisory services such as investment advice and portfolio rebalancing in order to help clients make informed decisions about their investments.

When choosing a professional to manage your assets or wealth, consider factors such as their investment style, fees, experience, and track record. Additionally, it is important to ensure that you have a clear understanding of the services they are providing and the terms of the agreement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.