The International Swaps and Derivatives Association (ISDA) is a global organization that plays a pivotal role in managing risk in the derivatives marketplace. Its core function is to advance effective risk management for all participants in the derivative industry and to develop standardized documentation for OTC (over-the-counter) derivatives. Essentially, ISDA helps to foster a more secure and efficient operating environment for these financial transactions. ISDA was established in 1985 as a response to the growing need for a standardized global framework for trading derivatives. Prior to its inception, derivative transactions were plagued by legal uncertainties and operational inefficiencies. ISDA's creation represented a pivotal moment in financial history, marking a concerted effort to streamline and secure the burgeoning derivatives market. ISDA operates under the leadership of an Executive Committee consisting of officers elected from ISDA member institutions. This committee oversees a broad range of working groups and steering committees, each focused on different aspects of the derivatives market. ISDA’s responsibilities are multifaceted, including the production of standard documentation for derivatives transactions, promoting sound risk management practices, and engaging with regulatory bodies to shape policies that impact the derivatives industry. ISDA also plays a critical role in education and advocacy, offering a range of training programs, conferences, and public commentaries on key industry issues. ISDA is central to the global derivatives market, facilitating transactions that impact a broad range of industries and economies. By creating standardized documentation, ISDA reduces uncertainty and complexity in derivatives trading, promoting liquidity and fostering a more stable financial system. Through its ongoing work in risk management and regulatory advocacy, ISDA contributes significantly to the overall stability of the financial system. Its standard contracts and dispute resolution mechanisms help to minimize the risk of costly and destabilizing legal disputes. Furthermore, ISDA's advocacy efforts are crucial in shaping balanced, risk-sensitive regulation for the derivatives industry. At the heart of ISDA's standardized documentation is the Master Agreement. This contract forms the basis for the majority of derivatives transactions globally and includes provisions covering payment obligations, default, termination, and other key aspects of a derivatives contract. The Credit Support Annex (CSA) is another critical part of ISDA's documentation. The CSA contains the terms and conditions for the provision of collateral to mitigate credit risk in a derivatives transaction. ISDA has also developed a series of definitions documents that provide a common language for describing key terms in derivatives contracts. These definitions play a crucial role in ensuring clarity and mutual understanding between contracting parties. ISDA plays a proactive role in shaping financial regulation. It works closely with policymakers around the world to develop balanced, effective regulation for the derivatives industry, leveraging its deep expertise and global perspective to advocate for the industry's interests. Financial crises, such as the 2008 Global Financial Crisis, have had profound impacts on ISDA and derivatives regulation. In the aftermath of these crises, ISDA has often been called upon to adapt its standard documentation and practices to meet evolving regulatory requirements and market conditions. ISDA is known for its efforts to standardize derivatives contracts. It has developed and maintains the ISDA Master Agreement, which provides a standardized framework for over-the-counter derivatives transactions. This helps promote efficiency, transparency, and legal certainty in the derivatives market. ISDA has developed a range of documentation and protocols that help market participants address legal, operational, and regulatory challenges. For example, the ISDA Master Agreement and related documents provide a comprehensive framework for documenting OTC derivatives transactions. Additionally, ISDA has introduced protocols like the ISDA Master Agreement Resolution Stay Protocol and the ISDA 2016 Variation Margin Protocol to facilitate compliance with regulatory requirements. ISDA has been actively involved in initiatives related to collateral and margin requirements for derivatives. It has developed the ISDA SIMM™ (Standard Initial Margin Model), which provides a standardized methodology for calculating initial margin for non-cleared derivatives. ISDA has focused on promoting central clearing for derivatives and enhancing risk management practices. It has developed standard documentation for central counterparties (CCPs) and clearing members, such as the ISDA Clearing Membership Agreement. ISDA has also been involved in discussions and initiatives on implementing risk management standards, such as the Fundamental Review of the Trading Book (FRTB). ISDA has recognized the potential of technology and digital solutions in transforming the derivatives market. It has explored various initiatives in this space, including distributed ledger technology (DLT) and smart contracts. ISDA has collaborated with industry partners to explore the use of DLT for certain aspects of derivatives processing, such as trade confirmations and post-trade events. While the International Swaps and Derivatives Association has played a crucial role in the global derivatives market, it has faced a number of criticisms over the years: Critics have questioned the transparency of ISDA's decision-making processes, particularly those of the Determinations Committees which decide whether a credit event (like a default) has occurred that triggers payment on credit default swaps. Concerns have been raised about potential conflicts of interest. The Determinations Committees, for example, are composed of representatives from major banks who might have vested interests in the outcomes of the decisions. ISDA has faced criticism for its role in the 2008 financial crisis. The widespread use of ISDA's standardized contracts enabled the proliferation of complex derivatives, which many argue contributed to the severity of the crisis. Moreover, some critics contend that ISDA's definitions and rules were not adequately prepared to handle the fallout from a systemic crisis of that magnitude. ISDA's role in influencing derivatives regulation has also been criticized. Some critics argue that the association's close involvement in shaping regulation gives too much power to the banks and financial institutions that constitute its membership, potentially at the expense of public interest. The International Swaps and Derivatives Association underscores the framework for the global derivatives market. Established in 1985, it is an organization dedicated to fostering effective risk management practices and standardizing documentation across the market. Its continuous adaptation to the ever-evolving financial landscape, despite facing occasional criticisms and controversies, demonstrates the pivotal role ISDA plays in shaping the course of the world's financial ecosystem. ISDA’s immense impact on the international financial arena can hardly be overstated. It has played a seminal role in fostering stability within the vast expanse of the derivatives market. The organization’s dedicated efforts in mitigating risks of systemic crises have made it an integral part of the financial industry. As the future unfolds, ISDA's pivotal role in encouraging innovation, enhancing transparency, and promoting sound risk management will remain instrumental in driving the evolution of the global financial system. In light of the intricate complexities of the financial market and the derivatives industry, individuals and businesses should not hesitate to seek professional guidance. By engaging with knowledgeable professionals, they can better navigate the landscape shaped by ISDA, make informed decisions, and effectively manage their risk exposures. Understanding and leveraging ISDA’s principles and the tools it has developed are crucial steps toward achieving success in the world of finance.What Is the International Swaps and Derivatives Association (ISDA)?

ISDA Structure and Key Responsibilities

Organizational Structure

Overview of Key Responsibilities

ISDA's Role in the Global Financial System

Importance in Derivatives Market

ISDA's Contribution to Financial Stability

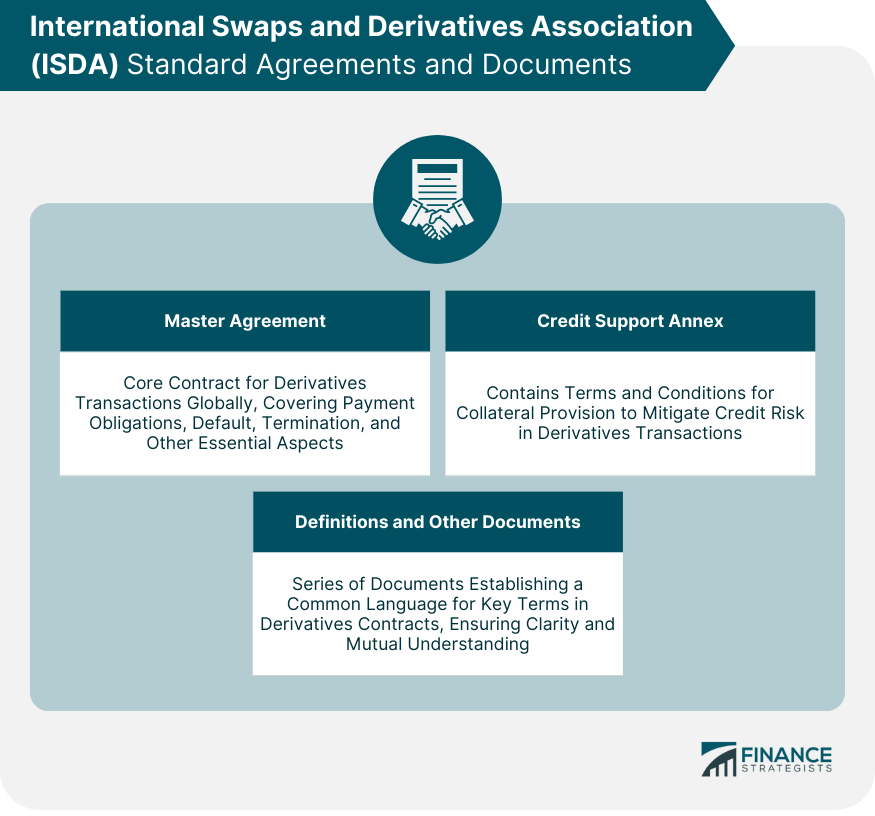

ISDA Standard Agreements and Documents

The Master Agreement

Credit Support Annex

Definitions and Other Documentation

ISDA and Derivatives Regulation

ISDA's Role in Financial Regulation

Impact of Financial Crises on ISDA and Derivatives Regulation

Major Initiatives and Innovations by ISDA

Standardization of Derivatives Contracts

Documentation and Protocols

Collateral and Margin Initiatives

Clearing and Risk Management

Technology and Digital Initiatives

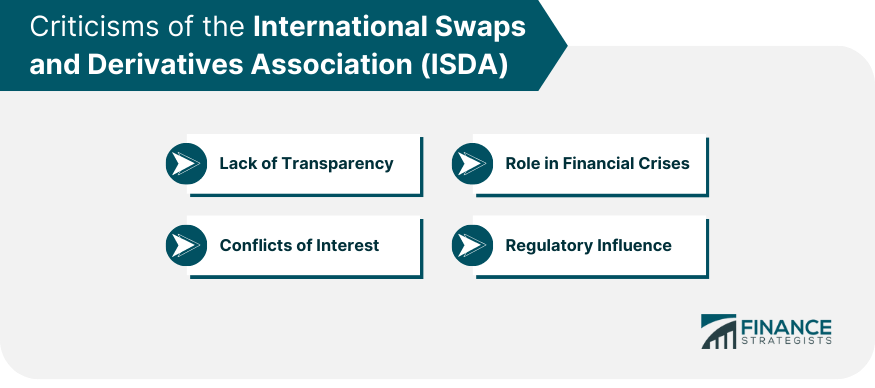

Criticisms of ISDA

Lack of Transparency

Conflicts of Interest

Role in Financial Crises

Regulatory Influence

Final Thoughts

International Swaps and Derivatives Association (ISDA) FAQs

The International Swaps and Derivatives Association is a trade association that represents participants in the global over-the-counter (OTC) derivatives markets. It serves as a platform for market participants to collaborate, discuss industry issues, develop standards, and create market practices.

The primary purpose of ISDA is to enhance the efficiency, transparency, and integrity of the global derivatives markets. It achieves this by facilitating the development and implementation of best practices, standard documentation (such as the ISDA Master Agreement), and protocols for market participants. ISDA also plays a vital role in advocating for the interests of its members and providing a forum for industry-wide discussions and collaboration.

ISDA plays an active role in engaging with regulatory authorities worldwide to advocate for effective and balanced derivatives regulation. It provides industry perspectives, expertise, and recommendations to help shape regulatory policies and frameworks. ISDA also collaborates with regulators to develop industry guidelines and standards that promote transparency, risk management, and the stability of the derivatives markets.

The ISDA Master Agreement is a standardized legal document that governs the terms and conditions of over-the-counter derivative transactions between parties. It provides a framework for parties to enter into multiple transactions under a single agreement, which helps to streamline and simplify the negotiation and execution process.

ISDA promotes sound risk management practices by developing industry standards and best practices. It provides tools and frameworks for measuring, managing, and mitigating risks associated with derivatives, such as credit risk, operational risk, and market risk. ISDA also promotes the adoption of risk management techniques, including collateralization and portfolio compression.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.