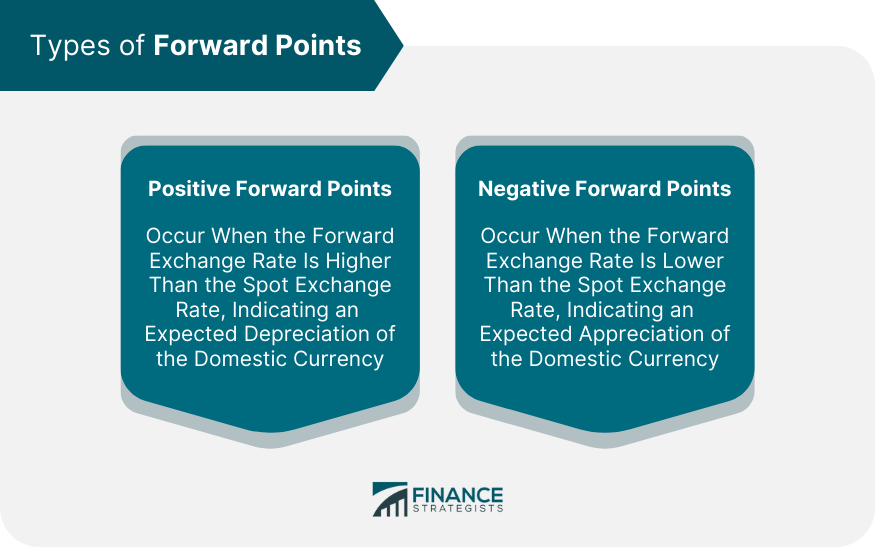

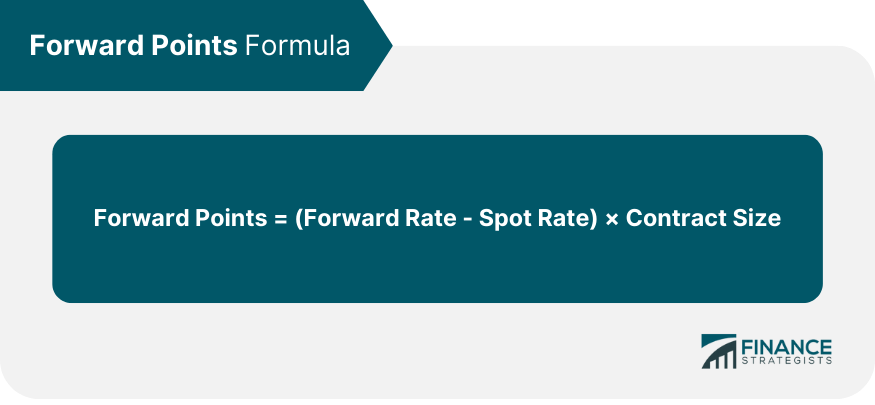

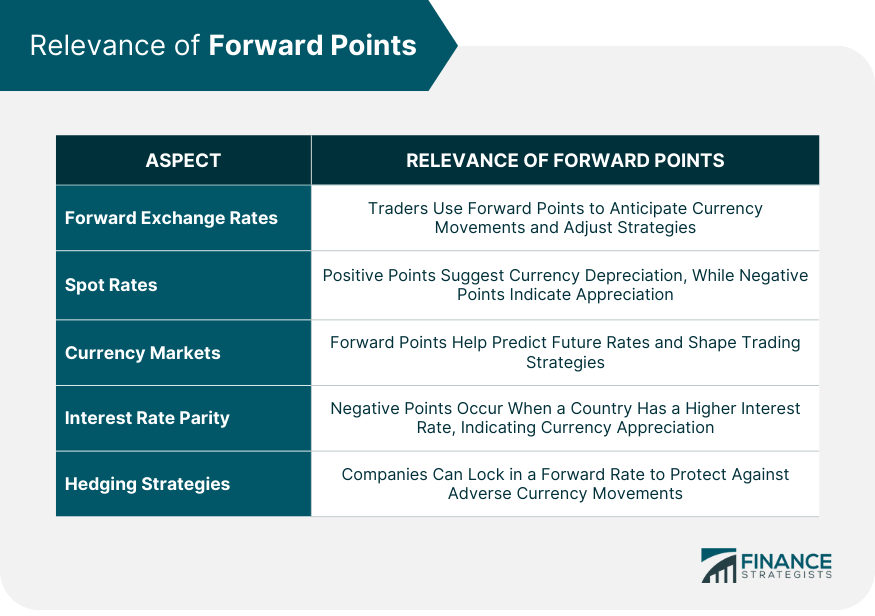

Forward points are adjustments made to the spot exchange rate to derive the forward exchange rate. They are essentially the difference between the forward exchange rate and the spot exchange rate, quoted in terms of points (also called pips). Forward points reflect the interest rate differential between two currencies and serve as an indicator of the market's expectation of future currency exchange rates. They are a critical component in foreign exchange markets, particularly in forward contracts and currency swaps, where they help manage foreign exchange risk. In foreign exchange, forward points are critical tools traders use to manage risk and make informed decisions. Positive forward points occur when the forward exchange rate exceeds the spot exchange rate. This scenario typically arises when the interest rate of the domestic currency is lower than that of the foreign currency. In this case, traders expect the domestic currency to depreciate in the future, leading to positive forward points. For example, if the spot rate between the USD and EUR is 1.2, and the forward rate for a 90-day contract is 1.2050, the forward points would be +50. This suggests the market expects the USD to depreciate against the EUR in the next 90 days. Negative forward points occur when the forward exchange rate is lower than the spot exchange rate. This happens when the domestic currency's interest rate is higher than the foreign currency's. In this situation, the market expects the domestic currency to appreciate in the future, leading to negative forward points. For instance, if the spot rate between the USD and EUR is 1.2, and the forward rate for a 90-day contract is 1.1950, the forward points would be -50. This indicates that the market expects the USD to appreciate against the EUR in the next 90 days. Understanding the mechanics of forward points is key to navigating the complex world of foreign exchange markets effectively. The forward points formula calculates the adjustment to the spot exchange rate to derive the forward exchange rate. It is typically expressed as: In this formula, the forward rate refers to the agreed-upon exchange rate for a future date, the spot rate is the current exchange rate, and the contract size represents the quantity of currency being exchanged. The forward points indicate the deviation from the spot rate and are used to determine the exchange rate for a specific forward contract. The primary factor affecting forward points is the interest rate differential between the two currencies involved. Other factors include market expectations of future interest rate changes, inflation expectations, and geopolitical events. Forward points plays a crucial role in determining forward exchange rates. The forward exchange rate is essentially the spot exchange rate adjusted by the forward points. This relationship helps traders anticipate future currency movements and adjust their strategies accordingly. Consider a scenario where the spot exchange rate between the U.S. Dollar and the Euro is 1.2, and the 90-day forward points are -0.0040. The forward exchange rate would be calculated as 1.2 - 0.0040, which equals 1.1960. This suggests that the market expects the U.S. Dollar to strengthen relative to the Euro over the next 90 days. The relationship between forward points and spot rates provides valuable insights into the dynamics of foreign exchange markets. While spot rates represent the current exchange rate between two currencies, forward rates, determined by adding or subtracting the forward points from the spot rate, represent the expected future exchange rate. Thus, forward points act as the bridge between the present and the future currency exchange rate. If forward points are positive, the forward exchange rate is higher than the spot rate, indicating that the market expects the domestic currency to depreciate. Conversely, if forward points are negative, the market expects the domestic currency to appreciate. Forward points are vital in predicting future exchange rates and shaping trading strategies. Forward points, by reflecting the interest rate differential between two currencies, give traders an idea of where the market expects future exchange rates. Traders can use this information to make informed decisions about buying and selling currencies. Traders can use forward points to hedge against foreign exchange risk, especially in situations where they expect significant future currency fluctuations. By locking in a forward rate now, they can protect themselves from potential losses due to adverse currency movements in the future. Interest rate parity is a fundamental principle in international finance that plays a crucial role in understanding forward points. Interest rate parity states that the interest rate differential between two countries equals the differential between the forward and spot exchange rates of their currencies. This principle ensures there is no arbitrage opportunity in the currency market. The interest rate differential between the two countries is reflected in the value of forward points. If one country's interest rate is higher than the other's, its currency will typically have negative forward points and vice versa. This happens because investors are expected to flock to the country with the higher interest rate, leading to an appreciation of its currency in the future. Forward points are often used in hedging strategies to manage foreign exchange risk. By locking in a forward rate, companies can hedge against potential adverse currency movements. This can be particularly useful for multinational corporations with significant revenue or cost exposures in foreign currencies. Consider a U.S. company that expects to receive payment in Euros 90 days from now. Given the uncertainty of future EUR/USD exchange rates, the company can enter a forward contract to sell Euros and buy U.S. Dollars at a predetermined rate 90 days from now, eliminating its foreign exchange risk. While forward points are a valuable tool in financial markets, they also come with certain risks. Market risk refers to the potential changes in the value of a financial instrument due to market-wide shocks. In the context of forward points, changes in interest rates, inflation expectations, or geopolitical events can all lead to changes in the value of forward points, impacting the profitability of forward contracts. Credit risk is the risk that one party in a financial contract will default on its obligations. If a party in a forward contract default, the other party may lose the benefit of the agreed-upon forward rate, leading to potential financial loss. Liquidity risk refers to the risk that a party may not be able to exit a financial position without significantly impacting the market price. In the context of forward points, if a currency pair is not widely traded, it may be difficult to enter or exit positions at the desired price. Forward points are adjustments made to the spot exchange rate to derive the forward exchange rate. They reflect interest rate differentials and manage foreign exchange risk. Positive forward points indicate expected currency depreciation, while negative points suggest expected appreciation. Forward points are calculated by subtracting the spot rate from the forward rate and multiplying by the contract size. They help determine forward exchange rates and provide insights into market expectations. Traders use forward points for hedging and making informed trading decisions. However, forward points also come with risks, including market, credit, and liquidity risks. Understanding forward points is crucial for navigating currency markets effectively.Definition of Forward Points

Types of Forward Points

Positive Forward Points

Negative Forward Points

Mechanics of Forward Points

Calculation Method

Factors Affecting the Value

Forward Points in Forward Exchange Rates

Forward Points and Spot Rates

Forward Points in Currency Markets

Forward Points and Interest Rate Parity

Forward Points in Hedging Strategies

Risks Associated With Forward Points

Market Risk

Credit Risk

Liquidity Risk

Conclusion

Forward Points FAQs

Forward Points are adjustments used to calculate the forward exchange rate from the spot exchange rate. They are particularly crucial in the foreign exchange market, where they are used in foreign exchange contracts and swaps to hedge against foreign exchange risk.

Forward points equals Forward Rate less Spot Rate multiplied by Contract Size. They adjust the spot rate to derive the forward rate in currency exchange. Contract size determines the quantity exchanged. Forward points indicate deviation from the spot rate.

Forward Points reflect the interest rate differential between two countries, which aligns with the principle of Interest Rate Parity. This principle states that the interest rate differential between two countries equals the differential between the forward and spot exchange rates of their currencies.

The risks associated with Forward Points include market risk, credit risk, and liquidity risk. Market risk involves potential changes in the value of forward points due to market-wide shocks. Credit risk is the risk of a party in a forward contract defaulting on its obligations. Liquidity risk refers to the risk that a party may not be able to exit a financial position without significantly impacting the market price.

Forward Points are often used in hedging strategies to manage foreign exchange risk. By locking in a forward rate, the spot rate adjusted by the forward points, companies can hedge against potential adverse currency movements. This can be particularly useful for multinational corporations with significant revenue or cost exposures in foreign currencies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.