Corporate taxes are taxes imposed on the net profit of corporations or business entities by the government. These taxes are a primary source of revenue for governments around the world. Essentially, when a corporation generates a profit from its operations, whether it's from selling goods, providing services, or other income streams, a portion of that profit is owed to the government in the form of taxes. Companies are required to file tax returns, much like individuals, detailing their revenues, expenses, and the resulting profit or loss. Deductions, credits, and other fiscal mechanisms might be available to reduce the total tax liability, but the primary aim is for businesses to contribute fairly to the state's revenue based on their financial success. Starting off with corporate tax filing requires a detailed understanding of the corporation's taxable income. Here’s a step-by-step breakdown: Begin by listing all sources of revenue: Product or service sales Income from leasing or renting out assets Once you have a clear figure on total revenue, it's time to subtract the permissible business expenses: Employee salaries and wages Daily operational costs (e.g., utilities, rent) Business-specific expenses (e.g., marketing, research and development) Incorporate deductions based on the reduced value of assets over time: Depreciation: This pertains to tangible assets like machinery, vehicles, and buildings. Amortization: Relevant for intangible assets like patents, trademarks, or copyrights. Businesses sometimes face financial setbacks. In such cases, there are provisions to ease tax burdens: Carry-Forward Losses: If a business incurs a loss in a particular year, it might offset this against profits in future years. Carry-Back Losses: Conversely, if a company has profits now but had losses in past years, it can offset its current profits with those past losses, effectively reducing the present taxable income. Choosing the right tax form is a foundational step in ensuring an accurate corporate tax filing. In simpler terms: For Standard Corporations in the U.S.: The majority of corporations turn to Form 1120. This is the go-to form used for the U.S. Corporation Income Tax Return. For Special Types of Corporations: In S Corporations, the company's earnings and losses directly impact the individual tax returns of the shareholders. For these entities, Form 1120S is the appropriate choice. For International Businesses: Each country has its set of tax forms and regulations. Thus, if a company has operations outside the U.S., it's crucial to get familiar with the tax forms required in those specific regions. A smooth and error-free tax filing begins with having the right paperwork in order. Here's what corporations need to gather and why: These displays the money a company earned (revenues) and spent (expenses) over a given period. It’s a clear picture of profit and loss. This document is like a snapshot of a company's wealth. It lists: Assets: Everything the company owns, from buildings to office chairs. Liabilities: All the money the company owes to others. Equity: Essentially, it's what's left when you subtract liabilities from assets; this is what belongs to the owners or shareholders. Every penny that comes in or goes out needs a paper trail. This includes: Receipts from sales or services Bills for purchases or services received Other records of transactions, whether it's a small office purchase or a big-ticket machinery buy Think of these as your tax history. They offer invaluable insights into past filings, which can guide current efforts. They're especially useful if you're trying to spot trends, make predictions, or simply cross-check figures. After collating all necessary documents, the next step is to compute the actual tax liability. Every country has its tax rate brackets, and the applicable tax rate often depends on the corporation's income range. Within these brackets, various credits and deductions can significantly influence the tax amount. It's essential to be thorough in this step because incorrect calculations can lead to underpayment or overpayment. Both scenarios are undesirable: underpayment can result in penalties, while overpayment means the company loses out on capital that could be invested elsewhere. Figuring out how to file your taxes can be as crucial as determining what you owe. Here's a breakdown of the various ways corporations can submit their tax returns: E-filing: Think of this as the modern, digital route to tax submission. It's quick, efficient, and cuts down on paperwork. Plus, there's an added convenience of filing anytime, anywhere. Traditional Paper Filing: This is the old-school, pen-and-paper method. While it might seem outdated, some corporations, particularly those sticking to hand-written accounting books, still opt for this method. Tax Software: These software options come packed with tools that guide corporations step by step. They auto-calculate, offer guidance on deductions, and help fill out forms correctly. Hire a Tax Professional: They are up-to-date with the latest tax laws, deductions, and credits, ensuring the corporation gets the best possible outcome. Once the tax liability is established, corporations need to ensure timely payment. Multiple payment options, including electronic funds transfers, checks, or credit card payments, offer flexibility. Some governments also offer the ability to schedule installment payments for corporations that cannot pay their full tax bill at once. However, it's essential to note that delayed payments might incur interest or penalties. The tax-filing process doesn’t end once the taxes are paid. Maintaining comprehensive records post-filing is crucial. Not only does it make the process more manageable in subsequent years, but robust record-keeping is also essential if questions or issues arise later on. Stored tax documents should be easily accessible but kept securely to protect sensitive financial data. Navigating the world of corporate taxes can be complex, but being aware of common pitfalls can save corporations time, money, and potential legal headaches. Missing Deadlines: Corporations should mark tax deadlines clearly. Submitting tax returns late can result in hefty fines and penalties. Overlooking Deductions: Deductions can significantly lower a corporation's taxable income. It is essential to be aware of all allowable expenses and deductions to ensure you're not paying more tax than necessary. Not Keeping Accurate Records: Keeping clear and comprehensive financial records ensures that the tax filing process is accurate and verifiable. Using the Wrong Tax Form: Using the wrong tax form can lead to complications. Each corporate structure has its specific form, so it's essential to ensure you're using the one that matches your corporation's profile. Estimating Numbers: Estimating income, expenses, or deductions can lead to inaccuracies, which might result in either overpaying or underpaying taxes. Handling tax disputes proactively and with the right expertise can mitigate potential risks and lead to quicker, more favorable resolutions. Hire a Tax Attorney: When disputes arise, having a knowledgeable tax attorney can provide invaluable guidance. They understand the intricacies of tax law and can represent your corporation's interests effectively. Keep Comprehensive Documentation: Always ensure that all financial transactions, communications with tax agencies, and previous tax filings are well-documented. Open Communication With Tax Authorities: Actively engage with the concerned tax agencies. Open dialogue can help clarify misunderstandings and may lead to a resolution without formal legal proceedings. Consider Alternative Dispute Resolution (ADR): ADR methods, such as mediation or arbitration, offer a less adversarial approach to resolving disputes compared to traditional litigation. Stay Updated on Tax Laws and Regulations: Regularly updating your knowledge can preempt potential issues, ensuring that your filings remain compliant with the latest regulations. Corporate taxes represent a vital revenue stream for governments worldwide. These taxes are levied on a corporation's net profits, necessitating meticulous calculation and filing procedures. Starting with an understanding of taxable income, revenue streams and deductible expenses must be accurately assessed. Gathering essential documentation ensures accuracy in the tax filing process. Precise calculation of tax liability, filing options with professional assistance, and timely tax payment are mandatory to avoid penalties or interest charges. Post-filing, maintaining meticulous records safeguards against disputes and audits. Awareness of common pitfalls, like missed deadlines and erroneous estimations, helps corporations navigate tax complexities successfully. In case of disputes, expert guidance, comprehensive documentation, open communication, and alternative dispute resolution methods can lead to efficient and favorable resolutions. Staying updated with tax laws ensures ongoing compliance and informed decision-making.What Are Corporate Taxes?

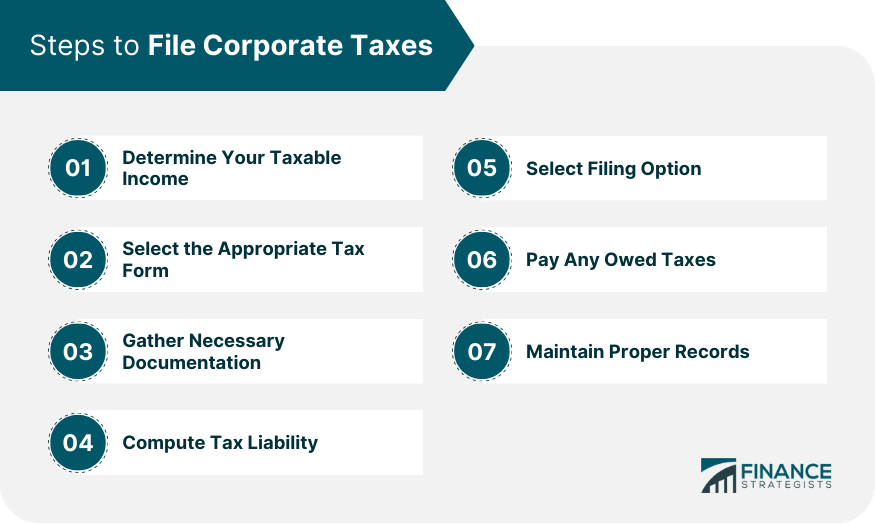

Steps to File Corporate Taxes

Step 1: Determine Your Taxable Income

Revenue Streams

Deductible Expenses

Accounting for Asset Value Reduction

Loss Deductions

Step 2: Select the Appropriate Tax Form

Step 3: Gather Necessary Documentation

Income Statements

Balance Sheets

Transaction Records

Past Tax Returns

Step 4: Compute Tax Liability

Step 5: Select Filing Option

Step 6: Pay Any Owed Taxes

Step 7: Maintain Proper Records

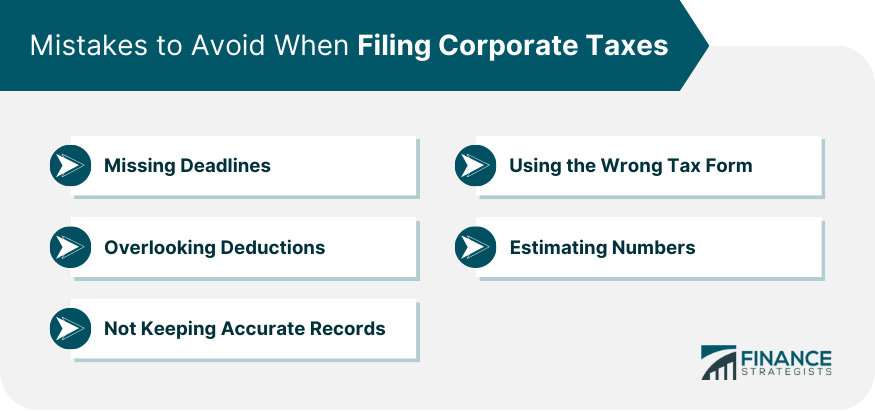

Mistakes to Avoid When Filing Corporate Taxes

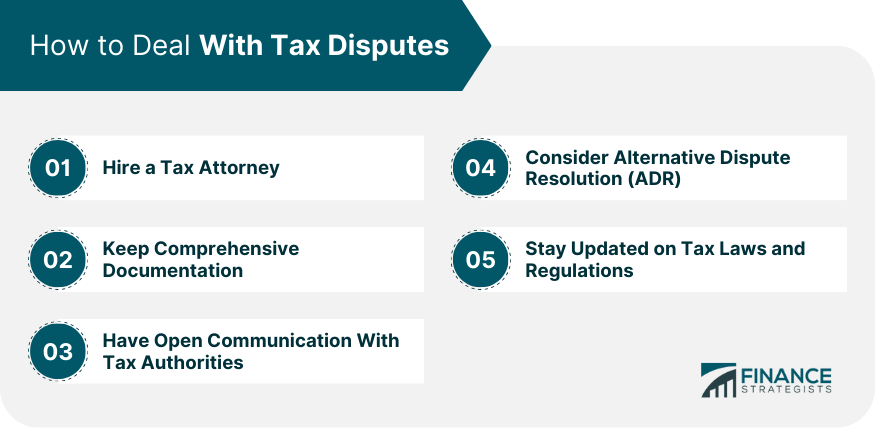

How to Deal With Tax Disputes

Conclusion

How to File Corporate Taxes FAQs

Accurate corporate tax filing involves calculating taxable income, deducting eligible expenses, and selecting the correct tax form based on your business structure.

Filing corporate taxes includes assessing revenue streams, deducting expenses, accounting for asset value reduction, calculating tax liability, selecting the right tax form, and choosing a filing option.

Yes, e-filing is a modern and efficient option for submitting corporate taxes. It reduces paperwork, offers convenience, and allows filing from anywhere.

Common pitfalls to avoid include missing deadlines, overlooking deductions, using the wrong tax form, not keeping accurate records, and estimating numbers instead of using precise figures.

Handling tax disputes involves hiring a tax attorney, maintaining comprehensive documentation, engaging with tax authorities openly, considering alternative dispute resolution methods, and staying updated on tax laws and regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.