501(c)(3) charities are designated as public charities, operating exclusively for educational, charitable, religious, scientific, or literary purposes. They can also be used to promote amateur sports competitions and/or to reduce homelessness, poverty, abuse, and neglect. To qualify as a 501(c)(3), an organization must meet certain criteria established in the Internal Revenue Code. Public charities must either receive a substantial part of their support from the public, including governmental agencies and contributions from private individuals, or they must have the primary goal of providing aid to those who cannot pay for it on their own with minimal fundraising activity. The majority of donations made to these types of organizations are tax-deductible if they meet certain requirements outlined by the Internal Revenue Service (IRS). This means that taxpayers can deduct their donation amounts when filing taxes for that year. In addition to being tax-exempt under section 501(c)(3) of the Internal Revenue Code, all 501(c)(3) charities must also be exempt from federal income taxes under sections 501(a), 509(a), and 170(b)(1). This exemption applies whether or not the charity is organized in the United States or another foreign country. The IRS requires a broad range of reporting and filing requirements based on its size and scope in order to maintain this status. When making a contribution to a qualified 501(c)(3) charity, donors should always make sure that they received an acknowledgment letter acknowledging their gift in accordance with IRS guidelines. Once granted exemption status by the IRS, organizations are allowed to apply for grants, which may require additional reporting requirements depending on the type of grant. Becoming a 501(c)(3) charity offers numerous benefits to the organization and donors alike. For the organization, becoming a qualified 501(c)(3) charity exempts it from paying federal income taxes, allowing it to focus on its charitable purpose and mission. Additionally, it can receive tax-deductible donations from public or private individuals, which may help expand the reach of its charitable projects. Furthermore, it will also be eligible to apply for grants from governmental agencies and nonprofits that may require fewer filing requirements than other types of organizations. On the donor side, making donations to qualified 501(c)(3) charities qualifies for tax deductions when filing taxes for that year. Individuals can choose different options when donating, such as cash contributions, stocks, works of art, or real estate, which are all recorded as charitable deductions on their tax returns, depending on certain criteria set by the IRS. If an organization wishes to gain recognition as a 501(c)(3) charitable entity, it must meet certain eligibility requirements established by the IRS. The main criteria that must be met include operating as a non-profit organization, having an approved charitable purpose, and having no involvement in political campaigns and/or lobbying activities. To qualify as a 501(c)(3), the organization must be a non-profit organization with no shareholders, any profits made must exclusively go towards the charity's mission, and it cannot be organized for profit-making purposes. The charity must have an approved charitable purpose, including educational, scientific, religious, and literary goals. Other accepted purposes are promoting amateur sports competitions, public safety testing, preventing cruelty against children and animals, and providing aid and relief to those in poverty or homelessness with minimal fundraising activity. Organizations granted 501(c)(3) status must not engage in political campaign activities or lobbying efforts, as doing so could result in the revocation of their tax-exempt status and fines for the use of funds. Becoming a qualified non-profit organization requires a detailed application process with the Internal Revenue Service. In order to start the application process with the IRS, organizations must first acquire an employer identification number, which is free of charge. Organizations can apply for an EIN online, then wait up to four weeks for the IRS to send out a written confirmation letter via mail. Alternatively, they can also request their EIN over the phone through the Automated Phone Service, or visit one of the designated offices in person. Once they have obtained their EIN, they must submit Form 1023, which is used to determine whether or not they qualify as a public charity under Section 501(c)(3) of the Internal Revenue Code. This document includes questions concerning organizational structure, mission statement, sources of revenue, and past, present and future plans. Additionally, organizations may also have to submit additional forms such as Form 8718 or Form 872-C, depending on state requirements. Filing fees may also vary by organization size. Lastly, applicants should provide detailed information regarding current operations, including: Articles of incorporation Copies of any contracts List of associate member organizations Minutes from recent board meetings Evidence that contributions are publicly solicited Other documents deemed necessary by IRS agents Becoming a 501(c)(3) charity involves meeting certain eligibility requirements and going through a rigorous application process with the Internal Revenue Service. Organizations must be operated as non-profits, have an approved charitable purpose, and not engage in political campaigns or lobbying activities in order to be granted 501(c)(3) status. Becoming a qualified 510(c)(3) charity involves more than just filling out paperwork, but also adhering to strict guidelines set by the Internal Revenue Service concerning operation expenditure and permissible activities related to promoting its cause. To begin the application process, applicants must obtain an employer identification number (EIN), fill out form 1023, and provide detailed information about their organization such as financial statements, articles of incorporation and evidence of public solicitation for contributions before IRS agents can make their decision. Organizations that fulfill all requirements can move forward knowing they are recognized as a legitimate public charity with numerous benefits available to them and their supporters alike.501(c)(3) Charity

Benefits of Becoming a 501(c)(3) Charity

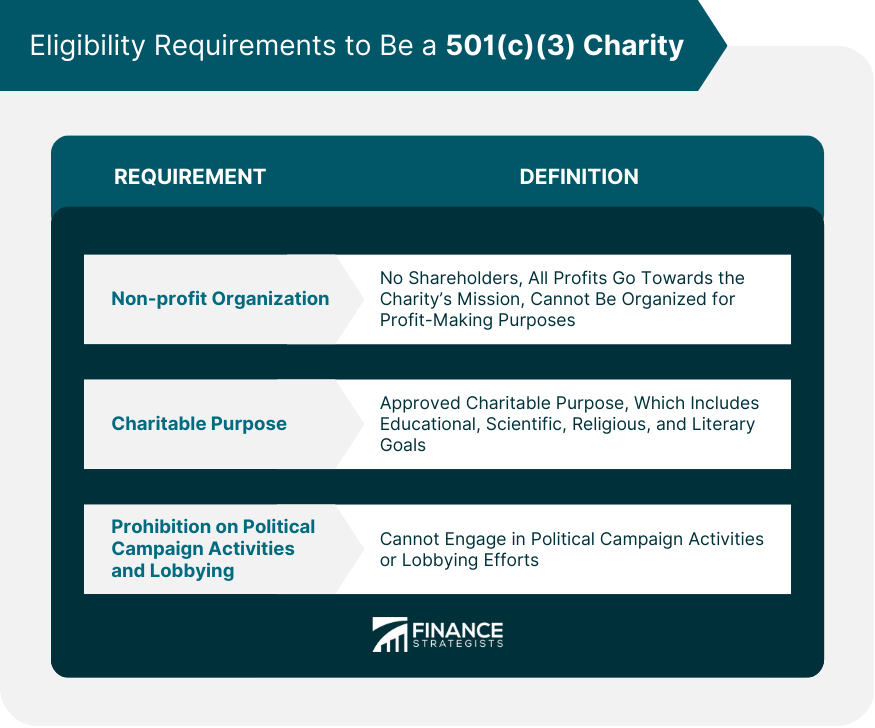

Eligibility Requirements to Be a 501(c)(3) Charity

Non-profit Organization

Charitable Purpose

Prohibition on Political Campaign Activities and Lobbying

Application Process of 501(c)(3) Charity

Conclusion

501(c)(3) Charity FAQs

A 501(c)(3) charity is a type of non-profit organization that has been granted tax-exempt status by the Internal Revenue Service (IRS). This allows them to receive donations from individuals and businesses that are tax deductible for the donor.

If your donation was made to an IRS-approved 501(c)(3) charitable organization, then it is likely tax deductible. Be sure to check with your accountant or financial advisor for more information.

The IRS keeps an updated list of all registered 501(c)(3) charities on their website. You can search for specific organizations or browse through the entire list here: https://www.irs.gov/charities-non-profits/exempt-organizations-select-check

Each registered 501(c)(3) charity must make their annual filing publicly available online through the IRS website, so you can search for the organization's name to see their most recent documents and learn more about their mission and activities. Additionally, many charities have websites where they provide additional information about themselves and their work.

There are no limits on the amount you can donate to a qualified charitable organization. However, in order for your donation to be considered tax deductible, it must meet certain criteria outlined by the IRS, such as requiring that you did not receive anything in exchange for your contribution and that you received an official receipt from the charity for your donation (which includes specific information).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.