Participant-Directed Accounts (PDA) are retirement accounts allowing individuals to make their own investment decisions. They are also sometimes called self-directed retirement accounts or individual-directed retirement accounts. With a PDA, the account holder controls the types of investments made within the account. This means they can invest in various assets, such as stocks, bonds, mutual funds, and alternative investments like real estate or precious metals. PDAs are often used by people who want more control over their retirement savings and who have a good understanding of investing. However, they also require higher financial literacy and research skills than traditional retirement accounts. A 401(k) plan is a type of retirement savings account that allows employees to contribute a portion of their pre-tax income to a PDA, which is then invested in a range of investment options. Employers may also contribute to the plan through matching or profit-sharing. Like 401(k) plans, 403(b) plans are retirement accounts designed for employees of non-profit organizations, public schools, and certain religious institutions. These plans also enable employees to make pre-tax contributions and offer various investment options. A 457 plan is a deferred compensation retirement plan for state and local government employees and certain non-governmental organizations. Contributions to these plans are also made with pre-tax dollars, and investment options are typically similar to those in 401(k) and 403(b) plans. IRAs (Individual Retirement Accounts) are personal retirement savings accounts that allow individuals to make contributions with pre-tax income (Traditional IRA) or after-tax income (Roth IRA). Investment options in IRAs are generally broader than those in employer-sponsored plans. Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals with high-deductible health plans save for healthcare expenses. These accounts can also be invested in a range of investment options, and qualified distributions are tax-free. There are additional PDA options, such as Simplified Employee Pension (SEP) IRAs, Savings Incentive Match Plan for Employees (SIMPLE) IRAs, and Thrift Savings Plans (TSPs) for federal employees. PDAs often allow for pre-tax contributions, which lower the participant's taxable income and reduce their current tax liability. Investment earnings in PDAs grow tax-deferred, meaning that taxes on gains are due when withdrawals are made in retirement. Certain types of PDAs, like Roth IRAs and HSAs, offer tax-free distributions for qualified expenses, providing additional tax savings. PDAs offer various investment options, allowing participants to choose investments that align with their risk tolerance and financial goals. Participants can decide how much to contribute to their PDA, giving them control over their retirement savings strategy. PDAs may allow for loans or hardship withdrawals in certain situations, providing a financial safety net for participants. Many employers offer matching contributions, incentivizing employees to contribute to their retirement savings. Employer contributions may be subject to vesting schedules, ensuring that employees are committed to the organization for a certain period. Some employers may offer profit-sharing contributions, enhancing employees' retirement savings. Investments in PDAs are subject to market fluctuations, which can lead to losses in the account value. Participants may need more knowledge and experience to make informed investment decisions, increasing the risk of poor performance. Participants who make unsuitable investment choices may face losses in their PDA, potentially jeopardizing their retirement savings. PDAs have annual contribution limits, which may restrict the amount individuals can save for retirement. Withdrawing funds from a PDA before reaching the designated retirement age may result in penalties and taxes, reducing the overall savings. Certain types of PDAs, like Traditional IRAs and 401(k) plans, mandate that participants start taking Required Minimum Distributions (RMDs) at a specific age, which may not align with their individual retirement plans. Determining one's risk tolerance and investment objectives when managing a PDA is essential to ensure that investment choices align with long-term financial goals. Asset allocation involves spreading investments across different asset classes, such as stocks, bonds, and cash, to manage risk and optimize returns. Investing in various investment types, like mutual funds, exchange-traded funds (ETFs), and individual securities, can further diversify a portfolio. Regularly rebalancing a PDA can help maintain the desired asset allocation and manage risk effectively. Financial planners can provide guidance on retirement savings strategies and help individuals make informed investment decisions. Investment advisors can offer expert advice on selecting and managing investments within a PDA. Employers may provide educational resources, workshops, or access to professional advice to help employees manage their PDAs effectively. Periodically reviewing the performance of investments within a PDA can help identify areas for improvement and ensure alignment with financial goals. Adjusting investments in response to changes in life circumstances, such as a new job, marriage, or having children, can help maintain a suitable retirement savings strategy. The Internal Revenue Service (IRS) sets annual contribution limits for PDAs, which participants must adhere to. Understanding the tax implications of PDA contributions and withdrawals is crucial to avoid unexpected tax liabilities. Participants must meet specific reporting requirements for their PDAs, as mandated by the IRS. Employer-sponsored PDAs must comply with the Employee Retirement Income Security Act (ERISA), which sets standards for plan administration and fiduciary responsibilities. Employers and plan administrators have fiduciary responsibilities to act in the best interest of plan participants, including selecting appropriate investment options and monitoring plan performance. Employers must provide adequate education and communication to employees about their PDA options and benefits, as required by the Department of Labor (DOL). Participant-Directed Accounts (PDAs) empower individuals to manage their retirement savings by choosing their own investments. Available in various forms, including 401(k) plans, 403(b) plans, IRAs, HSAs, and more, PDAs offer tax benefits, control over investment options, and employer-sponsored incentives. However, they also come with investment risks, contribution limits, and regulatory considerations. To optimize PDAs, individuals should assess risk tolerance, diversify investments, rebalance portfolios, and seek professional advice. Regular monitoring, adjusting investments, and understanding relevant regulations are essential. By making informed decisions, individuals can work toward achieving their retirement goals.What Are Participant-Directed Accounts?

Types of Retirement Plans That Offer Participant-Directed Options

401(k) Plans

403(b) Plans

457 Plans

Individual Retirement Accounts (IRAs)

Health Savings Accounts (HSAs)

Other PDA Options

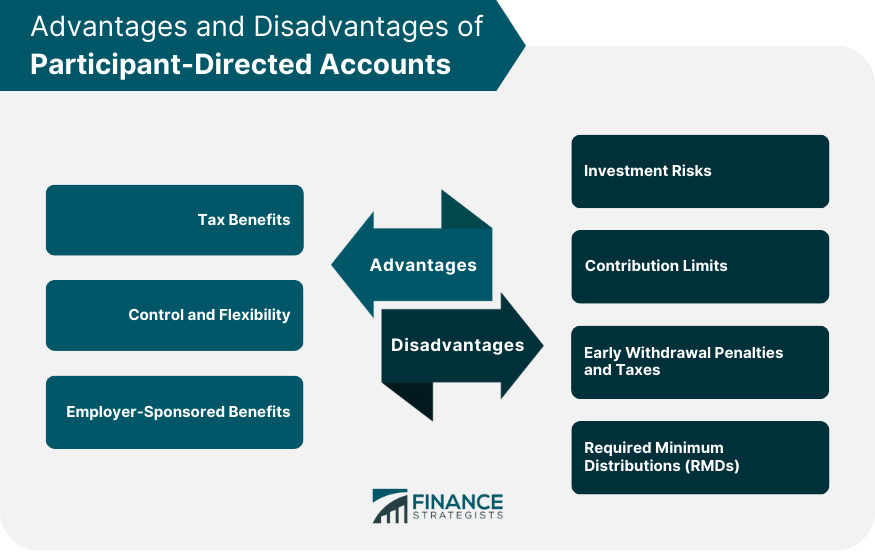

Advantages of Participant-Directed Accounts

Tax Benefits

Pre-Tax Contributions

Tax-Deferred Growth

Tax-Free Distributions for Qualified Expenses

Control and Flexibility

Investment Options

Control Over Contribution Amounts

Access to Funds in Case of Emergencies

Employer-Sponsored Benefits

Matching Contributions

Vesting Schedules

Profit-Sharing Options

Disadvantages of Participant-Directed Accounts

Investment Risks

Market Volatility

Limited Investment Knowledge

Losses Due to Poor Investment Choices

Contribution Limits

Early Withdrawal Penalties and Taxes

Required Minimum Distributions (RMDs)

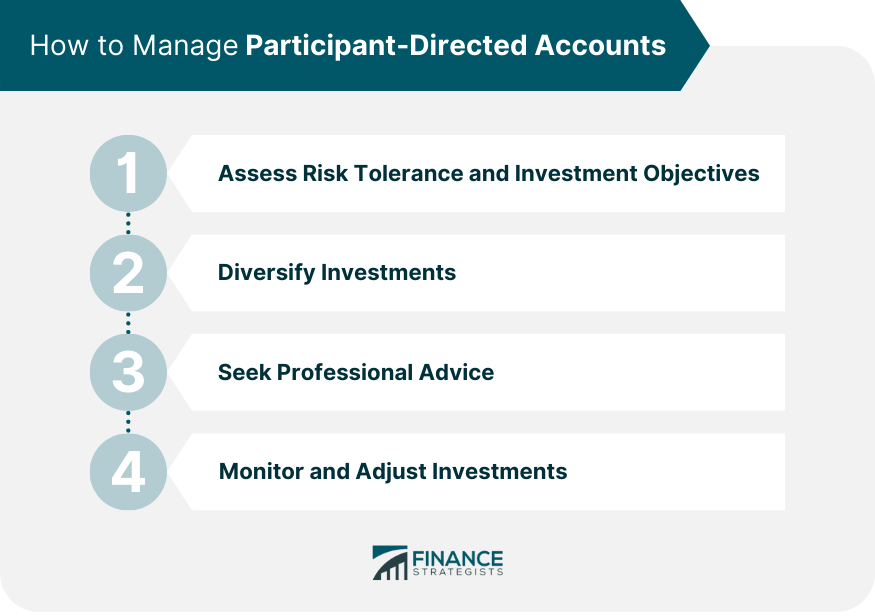

How to Manage Participant-Directed Accounts

Assess Risk Tolerance and Investment Objectives

Diversify Investments

Asset Allocation

Investment Types

Rebalancing Strategies

Seek Professional Advice

Financial Planners

Investment Advisors

Employer-Provided Resources

Monitor and Adjust Investments

Performance Evaluation

Changes in Life Circumstances

Regulatory Framework and Compliance for Participant Directed Accounts

Internal Revenue Service (IRS) Regulations

Contribution Limits

Tax Implications

Reporting Requirements

Department of Labor (DOL) Regulations

ERISA Compliance

Fiduciary Responsibilities

Employee Education and Communication

Conclusion

Participant-Directed Accounts FAQs

A participant-directed account (PDA) is a retirement account allowing individuals to make their own investment decisions.

With a PDA, you can invest in various assets, including stocks, bonds, mutual funds, and alternative investments like real estate or precious metals.

PDAs are often used by people who want more control over their retirement savings and who have a good understanding of investing. However, they also require higher financial literacy and research skills than traditional retirement accounts.

No, not all retirement plans allow for participant-directed accounts. PDAs are typically available through self-directed Individual Retirement Accounts (IRAs) or Solo 401(k) plans. They may also be available through certain employer-sponsored plans, such as a self-directed 401(k) or self-directed SEP-IRA.

The main benefit of a PDA is that it gives you more control over your retirement savings and allows you to invest in a wider range of assets than traditional retirement accounts. However, it's important to note that PDAs require higher financial literacy and research skills, and there is a greater risk of making poor investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.