Starting retirement planning in your 20s brings substantial benefits. It's more than just saving money; it's about cultivating financial discipline and understanding. Early planning means leveraging the time for investments to compound, leading to substantial gains from consistent contributions. In your 20s, you're likely at the start of your career with fewer family responsibilities, making it a prime time for establishing adaptable retirement plans. Early planning allows for learning from investment mistakes with less long-term impact and fosters a mindset focused on long-term financial health. Moreover, it enables a higher risk tolerance, potentially leading to more aggressive, higher-yielding investment strategies. A crucial aspect of retirement planning is accurately estimating future costs. This task involves considering various factors like expected lifestyle, potential healthcare needs, and inflation rates. While online calculators provide a starting point, a more comprehensive approach involves analyzing current expenses, projecting them into the future, and then adjusting for inflation. It's also wise to consider unexpected expenses, which inevitably arise, ensuring your retirement plan is robust and flexible. Establishing realistic retirement goals is a balancing act between current financial capacity and future aspirations. It involves a deep understanding of your income potential and expected lifestyle changes. Goals should be flexible enough to accommodate life's unpredictability, like career changes or family expansions. This flexibility ensures that your retirement plan remains relevant and achievable even as your life evolves. Constructing a budget that integrates retirement savings is a critical first step in financial planning. This budget should account for all expenses, ensuring that retirement savings are treated as a non-negotiable item, similar to rent or utility bills. Consistency in saving, even in small amounts, is key. A budget that respects your current lifestyle while prioritizing future needs establishes a balanced approach to financial well-being. Understanding compound interest is fundamental in retirement planning. It's not just about the money you save but also about the earnings on those savings over time. The longer your money is invested, the more potential it has to grow exponentially, thanks to the compounding effect. This principle makes starting in your 20s incredibly powerful, as it gives your investments more time to compound and grow. For young investors, diversifying investments is a smart strategy to spread risk. This diversification means not putting all your financial eggs in one basket. Instead, it involves spreading your investments across different asset classes, like stocks, bonds, and real estate. This strategy helps mitigate losses if one investment performs poorly, as others may perform well, balancing the overall risk in your portfolio. Familiarizing yourself with various investment types is crucial. Stocks, while volatile, offer high growth potential. Bonds, being more stable, provide a cushion against market swings. Mutual Funds and ETFs offer a mix of different assets, providing a balanced investment approach. Understanding these options allows you to create a portfolio that aligns with your risk tolerance and financial goals. Employer-sponsored plans like 401(k)s and 403(b)s are essential tools in retirement planning. They often include employer match contributions, which can significantly accelerate your savings. It's important to contribute enough to qualify for the full employer match, as this is essentially additional income towards your retirement fund. Additionally, understanding the specifics of these plans, including investment options and tax implications, is vital for maximizing their benefits. IRAs and Roth IRAs offer different but equally valuable benefits. Traditional IRAs provide tax relief now, as contributions are tax-deductible, but taxes are paid upon withdrawal. Roth IRAs, conversely, are funded with post-tax income, but withdrawals during retirement are tax-free. The choice between these accounts should be based on your current tax bracket and expected future income. Navigating student loans while saving for retirement can be challenging. However, it's important to tackle both simultaneously. Completely focusing on loan repayment can delay retirement savings, potentially costing more in lost investment growth. A balanced approach involves maintaining consistent loan payments while also contributing to a retirement fund. Balancing debt repayment with saving for retirement requires a strategic and disciplined approach. Prioritize paying off high-interest debts first, as they cost more over time. Once these are managed, redirecting funds toward retirement savings can accelerate your financial growth. Additionally, consider using extra income, like bonuses or tax refunds, to further balance between debt repayment and savings contributions. Employer match programs are a critical component of many retirement plans. They match a portion of your contributions, effectively doubling your investment up to a certain point. Understanding how much your employer matches and how those matches are calculated is crucial to ensure you're maximizing this benefit. Not taking full advantage of an employer match program is akin to leaving free money on the table. Understanding vesting schedules is essential in retirement planning. Vesting determines when you own the contributions your employer makes to your retirement plan. Some plans offer immediate vesting, while others may require a few years of service before the funds are entirely yours. Knowing your plan's vesting schedule can influence your career decisions, as leaving a job before you're fully vested could mean losing out on significant retirement funds. Incorporating insurance and emergency funds into your retirement plan is crucial. Emergency funds provide a financial safety net for unexpected expenses, reducing the need to withdraw from retirement savings prematurely. Insurance, including health and life policies, protects against unforeseen financial burdens that can derail retirement plans. Regularly contributing to an emergency fund and maintaining adequate insurance coverage is a prudent approach to holistic financial planning. Health Savings Accounts (HSAs) offer a triple tax advantage - tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For young, healthy individuals, HSAs can be an effective tool for accumulating funds for healthcare expenses in retirement. These accounts are especially beneficial as they complement other retirement savings, providing a dedicated fund for future medical costs. Seeking professional financial advice can be a game-changer in retirement planning. A financial advisor can offer tailored advice, helping navigate the complexities of financial planning. Their expertise can be invaluable in optimizing your investment strategy, aligning your retirement goals with your current financial situation, and adjusting your plan as your life evolves. While there's a cost to professional advice, the long-term benefits, in terms of financial security and peace of mind, are often well worth the investment. Procrastination is a common and costly mistake in retirement planning. The longer you wait to start saving, the more you miss out on the benefits of compound interest. Starting even a few years later can mean needing to save significantly more to catch up, making it harder to achieve your retirement goals. Neglecting the impact of inflation and cost of living increases can lead to an underestimation of how much you'll need in retirement. It's important to factor in inflation in your retirement calculations to ensure your savings will be sufficient to maintain your desired lifestyle in the future. Lifestyle choices, such as excessive spending or not prioritizing savings, can have a profound impact on your ability to save for retirement. Being mindful of your spending and making informed choices can help you balance enjoying the present while securing your financial future. Failing to reinvest dividends and interest can significantly hinder the growth of your retirement savings. By reinvesting these earnings, you take full advantage of the compounding effect, allowing your investments to grow faster and larger over time. Planning for retirement in your 20s is a strategic decision with long-term benefits. Starting early leverages the power of compound interest, allowing for smaller contributions to grow significantly over time. Key strategies include budgeting for retirement savings, understanding and utilizing various investment options like stocks, bonds, and retirement accounts, and balancing debt repayment with savings. Maximizing employer benefits, such as match programs and understanding vesting schedules, enhances your retirement plan. Additionally, incorporating emergency funds and insurance and seeking professional advice can fortify your financial security. Avoid common pitfalls like delaying savings, ignoring inflation, and lifestyle inflation to ensure a comfortable retirement. Remember, the decisions you make in your 20s can profoundly impact your financial well-being in later years.Overview and Importance of Early Retirement Planning

Understanding Retirement Needs and Goals

Estimate Future Retirement Costs

Set Realistic and Achievable Goals

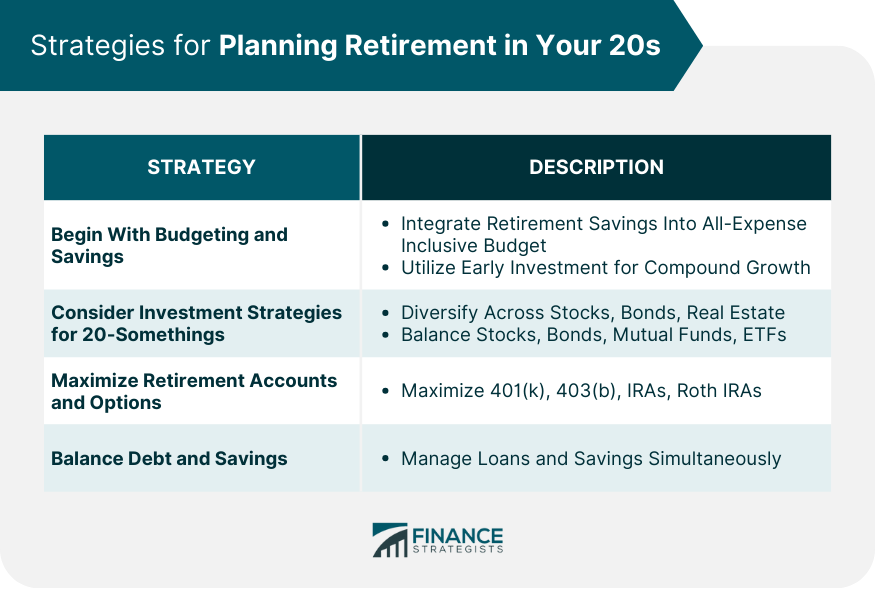

Strategies for Planning Retirement in Your 20s

Begin With Budgeting and Savings

Create a Budget That Includes Retirement Savings

Power of Compound Interest

Consider Investment Strategies for 20-Somethings

Diversification and Risk Management

Types of Investments: Stocks, Bonds, Mutual Funds, and ETFs

Maximize Retirement Accounts and Options

Employer-Sponsored Plans: 401(k) and 403(b)

Individual Retirement Accounts (IRAs) and Roth IRAs

Balance Debt Management With Retirement Savings

Student Loans and Retirement

Strategies for Paying Off Debt While Saving

Maximize Employer Benefits and Contributions

Understand Employer Match Programs

Take Advantage of Vesting Schedules

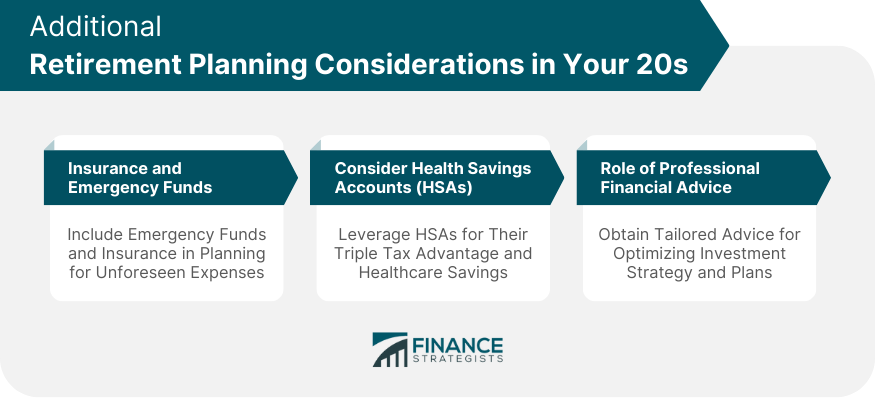

Additional Retirement Planning Considerations in Your 20s

Insurance and Emergency Funds

Consider Health Savings Accounts (HSAs) for Long-Term Benefits

Role of Professional Financial Advice

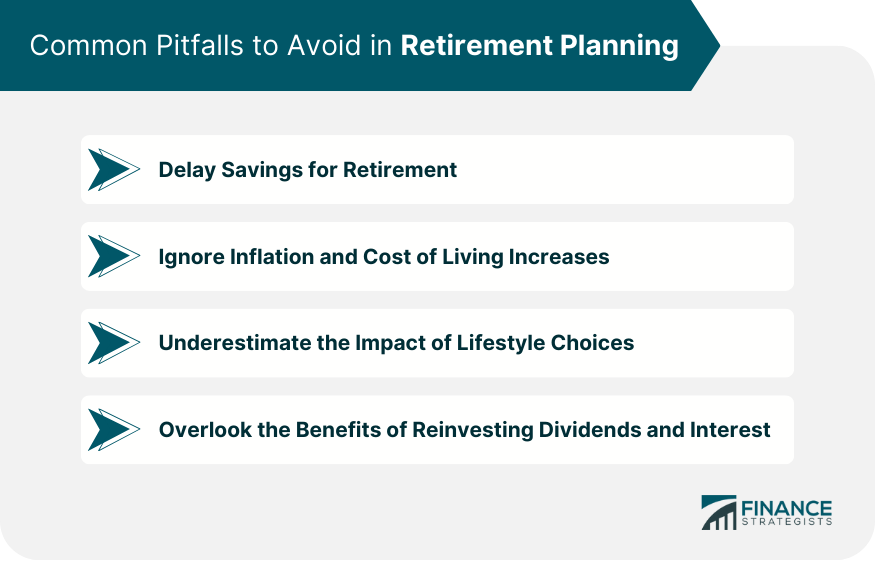

Common Pitfalls to Avoid in Retirement Planning

Delay Savings for Retirement

Ignore Inflation and Cost of Living Increases

Underestimate the Impact of Lifestyle Choices on Retirement Savings

Overlook the Benefits of Reinvesting Dividends and Interest

Final Thoughts

Planning for Retirement in Your 20s FAQs

Beginning retirement planning in your 20s allows you to take advantage of compound interest, develop good financial habits early, and reduce the amount you need to save later.

Balance student loan payments and retirement savings by prioritizing high-interest debts while still contributing to a retirement plan, even if it's a modest amount.

Effective strategies include diversifying your investment portfolio across stocks, bonds, and mutual funds and considering retirement accounts like 401(k)s IRAs and Roth IRAs.

Understanding employer match programs is crucial as they can significantly boost your retirement savings, essentially providing free money toward your retirement goals.

Avoid delaying savings, underestimating the impact of inflation and lifestyle choices on your savings, and neglecting the benefits of reinvesting dividends and interest.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.