The Self-Correction Program is a practical approach to retirement planning that involves ongoing evaluation, adjustment, and flexibility to ensure that financial goals are met. It is a valuable tool for individuals and financial advisors, particularly in the current unpredictable economic environment, as it allows for proactive and responsive retirement planning. Determining when you want to retire is the first step in the SCP process. Factors to consider include your age, career aspirations, and personal preferences. It's essential to be realistic and flexible, as your desired retirement age may change over time. Envisioning your ideal retirement lifestyle will help you establish a clear financial target. Consider factors such as travel, hobbies, and housing needs. Be prepared to adjust your expectations as your financial situation and personal preferences evolve. Identify all potential income sources in retirement, such as Social Security, pensions, and investment income. Estimate your income requirements based on your desired lifestyle and create a plan to bridge any gaps between projected income and expenses. Calculating your net worth, which is the difference between your assets and liabilities, provides a snapshot of your current financial health. This information helps you determine how much progress you've made toward your retirement goals and identify areas for improvement. A thorough cash flow analysis can reveal whether your current savings and investment strategies are sufficient to meet your retirement goals. This process involves tracking your income and expenses to identify areas for potential savings and investment opportunities. Debt management is a crucial aspect of the SCP. Minimizing high-interest debt and maintaining a manageable debt level will free up more funds for savings and investments, ultimately improving your financial readiness for retirement. Inflation erodes the purchasing power of your savings and investments. It's vital to incorporate inflation into your retirement planning by selecting investments with the potential to outpace inflation and adjusting your income requirements accordingly. Market volatility can have a significant impact on your investment portfolio's performance. The SCP emphasizes the importance of diversifying your investments and maintaining an appropriate asset allocation to mitigate the risks associated with market fluctuations. Healthcare costs and long-term care expenses can pose significant challenges to your retirement planning. Consider purchasing long-term care insurance and setting aside funds for unforeseen medical expenses to help protect your retirement savings. Unexpected life events, such as job loss, divorce, or the death of a spouse, can derail your retirement plans. The SCP encourages individuals to maintain an emergency fund and periodically review their financial plans to adapt to unforeseen circumstances. Diversification involves spreading your investments across various asset classes and sectors to reduce risk. This strategy can help protect your portfolio from significant losses due to poor performance in a specific investment or market segment. Asset allocation is the process of determining the appropriate mix of investments based on your risk tolerance, time horizon, and financial goals. A well-balanced portfolio can help you achieve your retirement objectives while managing risk. Understanding your risk tolerance is essential in creating an investment strategy that aligns with your retirement goals. Factors to consider include your age, financial goals, and investment experience. Reassess your risk tolerance periodically to ensure your investments remain aligned with your objectives. Maximizing contributions to retirement accounts, such as 401(k)s and IRAs, can significantly impact your retirement savings. Take advantage of employer matching programs and catch-up contributions for individuals aged 50 or older. Employer-sponsored retirement plans, such as 401(k)s and pensions, can be valuable sources of retirement income. Participate in these plans and review your contribution levels regularly to ensure you're maximizing potential benefits. Consider tax-efficient savings options, such as Roth IRAs and municipal bonds, to minimize your tax burden and increase your retirement savings. Consult a financial advisor to determine the best tax strategies for your specific situation. Life insurance can provide financial security for your loved ones in the event of your death. Evaluate your life insurance needs based on your family's financial requirements and adjust coverage levels as necessary. Long-term care insurance can help cover the cost of services such as in-home care, assisted living, or nursing home care. This coverage can protect your retirement savings from the financial burden of long-term care expenses. Develop a comprehensive estate plan that includes a will, power of attorney, and healthcare directive to ensure your wishes are carried out, and your assets are distributed according to your preferences. The SCP provides individuals with a comprehensive framework for retirement planning, which allows them to monitor and adjust their financial strategies as needed. By following the SCP, individuals can achieve enhanced financial security and peace of mind, knowing that their retirement plan is on track to meet their financial goals. Financial advisors who implement the SCP in their practice can expect improved client satisfaction and retention. By providing a systematic approach to retirement planning, financial advisors can demonstrate their commitment to helping clients achieve their retirement goals, fostering long-lasting relationships built on trust and expertise. One of the key benefits of the SCP is its structured and systematic approach to retirement planning. This methodology ensures that all aspects of an individual's retirement plan are thoroughly considered, from setting clear goals and assessing their current financial situation to identifying potential risks and obstacles. By following the SCP, individuals can create a well-rounded and adaptable retirement plan that addresses their unique financial needs. The SCP emphasizes the importance of flexibility and adaptability in retirement planning. By regularly monitoring and adjusting their retirement plans, individuals can respond more effectively to changes in personal circumstances and market conditions. This adaptability helps individuals maintain a secure financial footing and remain on track to achieve their retirement goals, even when faced with unexpected challenges or opportunities. One potential drawback of the SCP is that it can be a time-consuming and complex process for individuals who may lack the financial knowledge or experience to navigate the intricacies of retirement planning. This complexity may result in individuals feeling overwhelmed, leading to procrastination or disengagement from the process. For financial advisors, implementing the SCP may require additional resources, such as time and effort, to ensure that clients' retirement plans are consistently monitored and adjusted as needed. This increased workload may lead to higher operational costs or the need to hire additional staff to support clients effectively. While the SCP encourages adaptability and flexibility, there is a risk that individuals or financial advisors may place too much emphasis on short-term fluctuations in the market or personal circumstances. This focus on short-term changes could result in unnecessary adjustments to the retirement plan, leading to increased transaction costs and reduced long-term returns. The SCP's continuous monitoring and adjustment process can sometimes lead to individuals or financial advisors making emotional decisions rather than rational ones. Emotions like fear or greed may drive them to make changes to their retirement plan that may not be in their best long-term interest. Finally, the SCP may not be suitable for all investors, particularly those who prefer a more passive or "set-it-and-forget-it" approach to retirement planning. Individuals who are less interested in actively managing their retirement plans may find the SCP's emphasis on continuous monitoring and adjustment too demanding or time-consuming. Schedule regular check-ups with your financial advisor to review your retirement plan and make necessary adjustments. Frequent assessments allow you to identify potential issues and correct them before they become significant problems. As your life circumstances change, so too should your retirement plan. Update your plan to reflect major life events, such as marriage, divorce, job changes, or the birth of a child. Regularly review your investment portfolio to ensure your asset allocation remains in line with your risk tolerance and financial goals. Rebalance your portfolio periodically by adjusting your investments to maintain the desired level of risk. This may involve selling overperforming assets and purchasing underperforming ones to maintain a balanced portfolio. Leverage financial planning tools, such as budgeting apps and online calculators, to monitor your progress and make informed decisions about your retirement planning. Compare your portfolio's performance to appropriate benchmarks, such as market indexes or target-date funds, to assess your progress and make necessary adjustments. Recognize and celebrate milestones achieved in your retirement planning journey. Use setbacks as learning opportunities to refine your strategies and improve future outcomes. The Self-Correction Program is a systematic approach to retirement planning that emphasizes continuous assessment, evaluation, and adjustment. It consists of several key elements, including establishing retirement goals, assessing one's current financial situation, and identifying potential risks and obstacles. By effectively implementing the SCP through investment strategies, saving strategies, and insurance and estate planning, individuals can create a robust and adaptable retirement plan that aligns with their financial goals. Monitoring and adjusting the SCP ensures that your plan remains on track, even in the face of changing personal circumstances or market conditions. Regular reviews, rebalancing your investment portfolio, and tracking progress and milestones are crucial for staying focused on your long-term retirement goals. Consider seeking the assistance of a qualified financial advisor or retirement planning service to guide you through the SCP process. Their expertise and guidance can be invaluable in helping you navigate the complexities of retirement planning, ultimately enhancing your financial security and peace of mind as you approach your golden years.What Is a Self-Correction Program (SCP)?

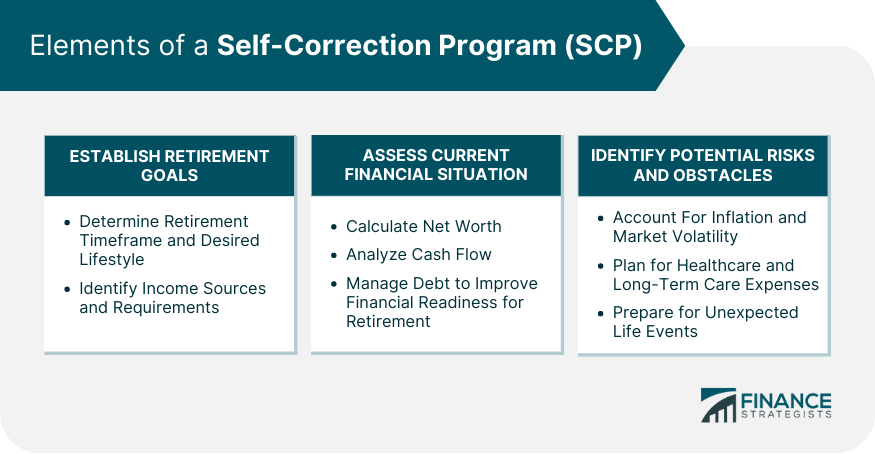

Elements of SCP

Establishing Retirement Goals

Timeframe for Retirement

Desired Lifestyle in Retirement

Income Sources and Requirements

Assessing Current Financial Situation

Net Worth Calculation

Cash Flow Analysis

Debt Management

Identifying Potential Risks and Obstacles

Inflation

Market Volatility

Health Issues and Long-Term Care

Unexpected Life Events

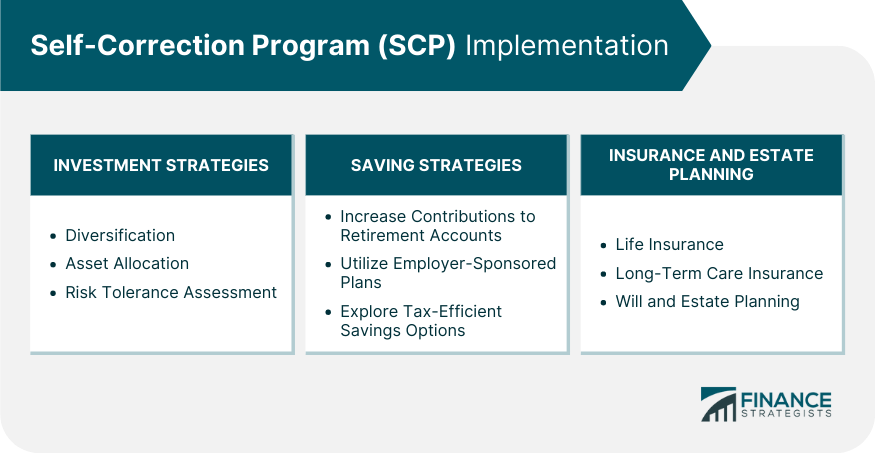

SCP Implementation

Investment Strategies

Diversification

Asset Allocation

Risk Tolerance Assessment

Saving Strategies

Increasing Contributions to Retirement Accounts

Utilizing Employer-Sponsored Plans

Exploring Tax-Efficient Savings Options

Insurance and Estate Planning

Life Insurance

Long-Term Care Insurance

Will and Estate Planning

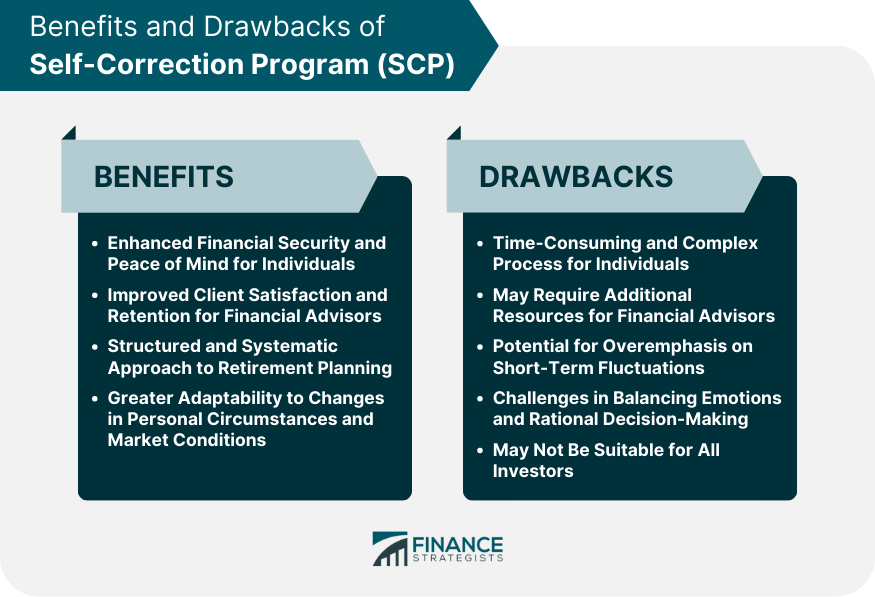

Benefits of the SCP for Individuals and Financial Advisors

Enhanced Financial Security and Peace of Mind for Individuals

Improved Client Satisfaction and Retention for Financial Advisors

Structured and Systematic Approach to Retirement Planning

Greater Adaptability to Changes in Personal Circumstances and Market Conditions

Drawbacks of the SCP for Individuals and Financial Advisors

Time-Consuming and Complex Process for Individuals

May Require Additional Resources for Financial Advisors

Potential for Overemphasis on Short-term Fluctuations

Challenges in Balancing Emotions and Rational Decision-Making

May Not Be Suitable for All Investors

Monitoring and Adjusting the SCP

Regular Review and Assessment of Retirement Goals

Annual or Semi-Annual Check-Ups

Adjusting for Life Changes

Rebalancing Investment Portfolio

Assessing Current Allocation

Making Adjustments to Maintain Desired Risk Level

Tracking Progress and Milestones

Utilizing Financial Planning Tools

Reviewing Performance Against Benchmarks

Celebrating Successes and Learning from Setbacks

Final Thoughts

Self-Correction Program (SCP) FAQs

The Self-Correction Program (SCP) is a systematic approach to retirement planning that emphasizes continuous assessment, evaluation, and adjustment to ensure your financial plan remains on track to achieve your retirement goals. It promotes adaptability, flexibility, and regular monitoring, making it a valuable tool for both individuals and financial advisors.

The SCP helps individuals achieve their retirement goals by providing a structured framework to establish retirement goals, assess their current financial situation, and identify potential risks and obstacles. It encourages proactive engagement in the retirement planning process, allowing for adjustments and modifications as needed in response to changes in personal circumstances and market conditions.

The key elements of the SCP for retirement planning include establishing retirement goals (timeframe, desired lifestyle, income sources, and requirements), assessing the current financial situation (net worth calculation, cash flow analysis, debt management), and identifying potential risks and obstacles (inflation, market volatility, health issues, and unexpected life events).

To implement the SCP in your retirement planning process, focus on creating investment strategies (diversification, asset allocation, risk tolerance assessment), saving strategies (increasing contributions to retirement accounts, utilizing employer-sponsored plans, exploring tax-efficient savings options), and insurance and estate planning (life insurance, long-term care insurance, will and estate planning). Regularly monitor and adjust your plan to ensure it remains aligned with your goals and personal circumstances.

You should review and adjust your SCP at least annually or semi-annually. However, it's essential to update your plan whenever you experience significant life changes, such as marriage, divorce, job changes, or the birth of a child. Frequent assessments allow you to identify potential issues and make adjustments before they become significant problems.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.