Plan sponsor education refers to the process of acquiring knowledge and skills necessary for plan sponsors to effectively manage and administer retirement plans. It covers essential topics such as understanding fiduciary duties, navigating legal and regulatory frameworks, mastering plan design and administration, selecting and monitoring investment options, and effectively communicating with plan participants. This education enables plan sponsors to fulfill their responsibilities, comply with applicable regulations, and help employees achieve their retirement goals. Plan sponsor education is vital for those responsible for managing retirement plans, as it helps them understand their roles and fulfill their fiduciary duties. Well-informed plan sponsors can better serve their employees and reduce the risk of potential legal and financial consequences. Plan sponsors have various responsibilities, including designing, administering, and monitoring their retirement plans. They must also ensure compliance with applicable laws and regulations while providing adequate education and communication to plan participants. Fiduciary duties are the legal obligations plan sponsors must follow when managing a retirement plan. These duties include loyalty, prudence, diversification of investments, and adherence to plan documents, all of which ensure the best interests of plan participants. The duty of loyalty requires plan sponsors to act in the best interest of plan participants and beneficiaries. This means avoiding conflicts of interest and ensuring that the plan is managed for the exclusive benefit of participants. The duty of prudence obligates plan sponsors to act with care, skill, and diligence when managing the plan. This includes selecting appropriate investments and service providers, as well as monitoring their performance. The duty to diversify investments involves selecting a mix of investments to minimize the risk of large losses. Diversification helps protect the plan's assets and ensures participants have access to a range of investment options. Plan sponsors must adhere to the terms of their plan documents, which outline the rules and procedures for plan administration. Following these documents ensures consistency and compliance with legal requirements. Plan sponsors must navigate a complex legal and regulatory framework when managing retirement plans. Key components of this framework include the Employee Retirement Income Security Act, Department of Labor regulations, and Internal Revenue Service (IRS) rules. Employee Retirement Income Security Act (ERISA) is a federal law that sets standards for retirement plans, including fiduciary responsibilities, reporting and disclosure requirements, and minimum standards for participation and vesting. Compliance with ERISA is crucial for plan sponsors to protect plan participants and avoid penalties. The Department of Labor (DOL) enforces ERISA and issues regulations that provide guidance on compliance. Plan sponsors must stay current with DOL regulations to ensure they are meeting their fiduciary duties and maintaining a compliant retirement plan. The Internal Revenue Service (IRS) is responsible for enforcing tax-related provisions of retirement plans. Plan sponsors must adhere to IRS rules to maintain the plan's tax-qualified status, which provides tax benefits to both employers and employees. Non-compliance with fiduciary duties and regulations can result in legal liability, financial penalties, and adverse impacts on employees and plan participants. Understanding these consequences underscores the importance of plan sponsor education. Plan sponsors may face legal liability if they fail to fulfill their fiduciary duties, which can lead to lawsuits and financial losses. Ensuring compliance with regulations and acting in participants' best interests can help mitigate this risk. Non-compliance with regulations can result in financial penalties, including fines and potential disgorgement of profits. Plan sponsors must stay current with regulatory changes to avoid these costly penalties. Failure to comply with regulations and fiduciary duties can negatively impact employees and plan participants. Non-compliance may lead to reduced benefits, limited investment options, and a lack of confidence in the plan sponsor's ability to manage the retirement plan effectively. There are various types of retirement plans, including defined benefit plans, defined contribution plans, and hybrid plans. Understanding the differences between these plans helps plan sponsors select the best option for their organization. Defined benefit plans promise a specific retirement benefit based on a participant's salary, years of service, and a predetermined formula. These plans place the investment risk on the employer, as the employer is responsible for funding the promised benefits. Defined contribution plans, such as 401(k), 403(b), and 457 plans, allow participants to contribute a portion of their salary to the plan. Employers may also contribute through matching or profit-sharing arrangements. Investment risk is placed on participants, as benefits depend on the performance of the investments selected. Hybrid plans combine features of both defined benefit and defined contribution plans, offering a balance between the two. These plans provide some level of guaranteed benefits, while also allowing participants to contribute and manage their investments. When designing a retirement plan, plan sponsors must consider employee eligibility and participation, contribution structures, investment options, and plan fees and expenses. These factors can significantly impact the plan's effectiveness and participant outcomes. Plan sponsors must determine which employees are eligible to participate in the retirement plan and establish rules for entry, such as age and service requirements. Encouraging employee participation is essential for the plan's success and the financial well-being of participants. Plan sponsors must design a contribution structure that outlines employer and employee contributions. This may include matching contributions, profit-sharing arrangements, or automatic enrollment features that help boost participation and savings rates. Offering a diverse range of investment options enables plan participants to build a well-balanced portfolio. Plan sponsors should carefully select and monitor investment options to ensure they align with the plan's objectives and participants' risk tolerance. Plan sponsors must consider the fees and expenses associated with managing the retirement plan, as they can significantly impact investment returns. Providing transparent information about fees helps participants make informed decisions about their investments. Effective plan administration and recordkeeping are crucial for maintaining a compliant retirement plan. Plan sponsors must focus on selecting and monitoring service providers, ensuring timely and accurate reporting, maintaining plan documents and records, and conducting periodic plan reviews. Plan sponsors must carefully select and monitor service providers, such as investment managers, recordkeepers, and third-party administrators. Evaluating providers' performance, fees, and adherence to plan objectives helps ensure the plan operates effectively and complies with regulations. Plan sponsors must ensure that required reports and disclosures are submitted on time and accurately reflect the plan's operations. Timely and accurate reporting helps maintain the plan's compliance and provides valuable information to participants. Plan sponsors must maintain plan documents and records in accordance with applicable regulations. These records serve as the foundation for plan administration and are essential for demonstrating compliance during audits or legal disputes. Regular plan reviews enable plan sponsors to evaluate the plan's performance, identify areas for improvement, and ensure compliance with regulations. These reviews help maintain the plan's effectiveness and promote the financial well-being of participants. Investment selection and monitoring are crucial aspects of retirement plan sponsor education. Plan sponsors are responsible for selecting investment options that are appropriate for the plan and its participants. This involves evaluating investment options based on a variety of factors, such as risk, return, and fees. Plan sponsors should also monitor the performance of investment options and make necessary adjustments to ensure that they continue to meet the needs of plan participants. They should also regularly review fees and expenses associated with the plan to ensure that they are reasonable and necessary. By providing education and resources to participants on investment selection and monitoring, plan sponsors can help promote financial wellness and ensure that participants have the knowledge and tools they need to make decisions about their retirement savings strategies. Additionally, plan sponsors should regularly communicate with participants about investment options and provide updates on performance and changes to the plan. This can help build trust and confidence in the plan and encourage participants to stay engaged and active in managing their retirement savings. Participant education and communication are critical components of effective retirement plan sponsor education. By providing education and resources to participants, plan sponsors can help promote financial wellness and increase the likelihood of employees achieving their retirement goals. To develop an effective communication strategy, plan sponsors should utilize various communication channels, such as email, webinars, and in-person meetings, to ensure that participants receive timely, relevant, and engaging information about their retirement plans. They should also tailor the content to the unique needs and preferences of plan participants, such as providing content in different languages or offering resources that address specific life stages and financial situations. By promoting financial wellness and retirement readiness, plan sponsors can emphasize the importance of making informed decisions about their retirement savings strategies. Finally, to evaluate the success of participant education efforts, plan sponsors should consider participant engagement metrics, participant feedback, and surveys, and plan health indicators. By tracking these measures, plan sponsors can identify areas for improvement and ensure that their education efforts are effective in helping participants achieve their retirement goals. Plan sponsor education is crucial for effectively managing and administering retirement plans. It covers topics such as understanding fiduciary duties, navigating legal and regulatory frameworks, plan design and administration, investment selection and monitoring, and participant education and communication. Plan sponsors have fiduciary duties that include loyalty, prudence, diversification of investments, and adherence to plan documents. They must also comply with complex legal and regulatory frameworks, such as ERISA, DOL regulations, and IRS rules. Non-compliance can result in legal liability, financial penalties, and adverse impacts on employees and plan participants. Effective plan design and administration consider employee eligibility, contribution structures, investment options, plan fees, and expenses. Plan sponsors must also select and monitor service providers, ensure timely and accurate reporting, maintain plan documents and records, and conduct periodic plan reviews. Investment selection and monitoring involve selecting appropriate investment options and regularly monitoring their performance. Participant education and communication help promote financial wellness and retirement readiness.What Is a Plan Sponsor Education?

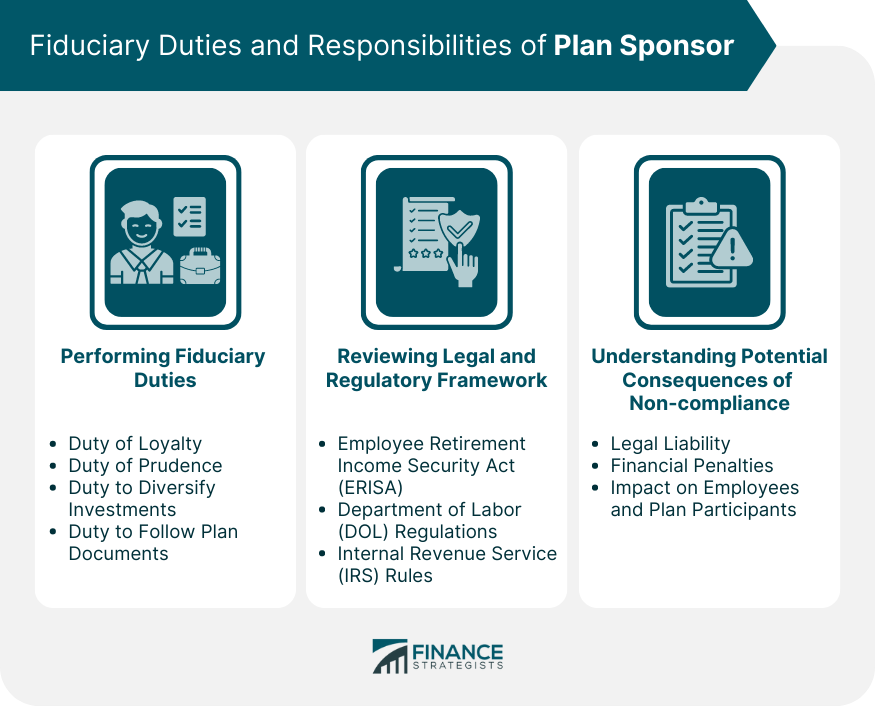

Fiduciary Duties and Responsibilities of Plan Sponsor

Performing Fiduciary Duties

Duty of Loyalty

Duty of Prudence

Duty to Diversify Investments

Duty to Follow Plan Documents

Reviewing Legal and Regulatory Framework

Employee Retirement Income Security Act (ERISA)

Department of Labor (DOL) Regulations

Internal Revenue Service (IRS) Rules

Understanding Potential Consequences of Non-compliance

Legal Liability

Financial Penalties

Impact on Employees and Plan Participants

Plan Design and Administration of Plan Sponsor Education

Types of Retirement Plans

Defined Benefit Plans

Defined Contribution Plans

Hybrid Plans

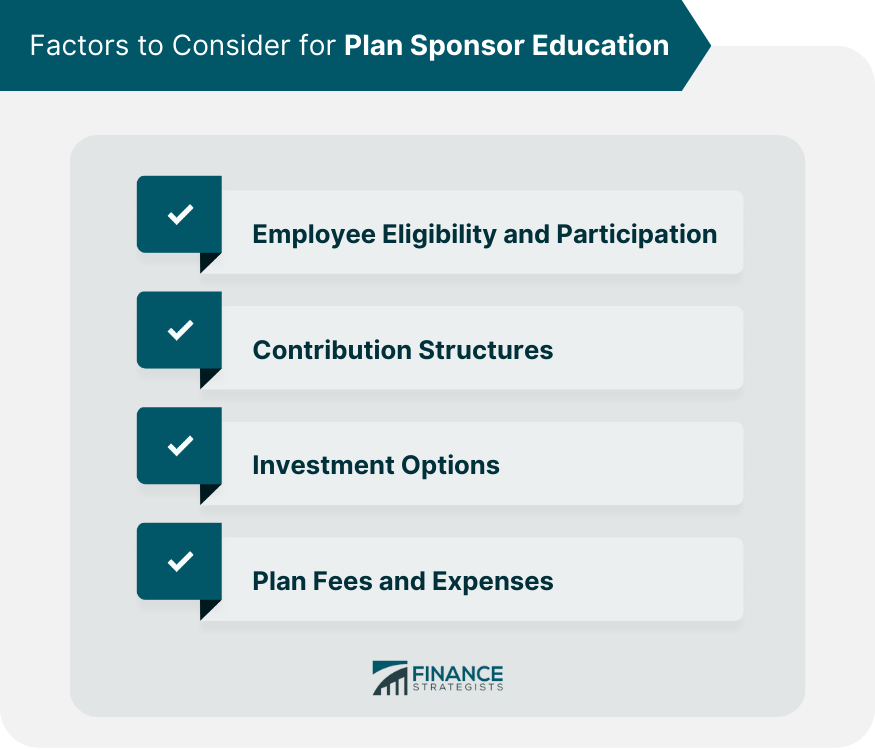

Plan Design Considerations

Employee Eligibility and Participation

Contribution Structures

Investment Options

Plan Fees and Expenses

Plan Administration and Recordkeeping

Selecting and Monitoring Service Providers

Ensuring Timely and Accurate Reporting

Maintaining Plan Documents and Records

Conducting Periodic Plan Reviews

Investment Selection and Monitoring of Plan Sponsor Education

Select Investment Options

Monitor the Performance of Investment Options

Provide Education to Participants

Regular Communication With Participants

Participant Education and Communication

Utilize Various Communication Channels

Tailor Content to Participants

Evaluate Success of Education Efforts

Final Thoughts

Plan Sponsor Education FAQs

Plan sponsor education is essential for ensuring that plan sponsors effectively manage retirement plans, fulfill their fiduciary duties, and comply with applicable regulations. By staying informed and proactive, plan sponsors can better serve their employees and minimize the risk of legal and financial consequences.

Through plan sponsor education, plan sponsors gain the knowledge and skills needed to design, administer, and monitor retirement plans effectively. As a result, employees can benefit from well-structured plans, diversified investment options, and valuable educational resources that help them make informed decisions about their retirement savings.

Key components of plan sponsor education include understanding fiduciary duties and responsibilities, learning about various types of retirement plans, mastering plan design and administration, selecting and monitoring investment options, and effectively communicating with plan participants.

Common challenges that plan sponsors may face include navigating complex regulatory frameworks, staying informed about industry trends and best practices, managing investment options, and effectively communicating with plan participants. Education can help plan sponsors develop the skills and knowledge needed to overcome these challenges by providing access to resources, training, and expert guidance.

Plan sponsors can measure the success of their education efforts by tracking participant engagement metrics, gathering participant feedback and survey responses, and monitoring plan health indicators, such as participation rates, contribution levels, and investment diversification.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.