A Grandparent-Owned 529 Plan is a tax-advantaged savings plan designed to encourage saving for future education costs. These plans, sponsored by states, state agencies, or educational institutions, are named after Section 529 of the Internal Revenue Code. There are two main types of 529 Plans: prepaid tuition plans and education savings plans. 1. Prepaid Tuition Plans: These plans allow account holders to purchase units or credits at participating colleges and universities for future tuition costs at current prices. They do not cover expenses for room and board or other non-tuition expenses. 2. Education Savings Plans: These plans are investment accounts that allow earnings to grow tax-free and withdrawals to be made for qualified education expenses, such as tuition, room and board, and textbooks. Each state offers at least one 529 plan, with some states offering multiple options. While most 529 plans are available to residents of any state, there may be additional tax benefits or incentives for residents who invest in their home state's plan. 529 plans provide significant tax advantages to account holders. Earnings grow tax-free, and withdrawals for qualified education expenses are also tax-free at the federal level. Some states offer tax deductions or credits for contributions. Others exempt qualified withdrawals from state income tax. Qualified education expenses for 529 plans include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Room and board expenses are also eligible if the beneficiary is enrolled at least half-time. In addition, up to $10,000 per year per beneficiary can be used for K-12 tuition expenses. Grandparents should first decide whether a prepaid tuition plan or education savings plan best suits their needs and the needs of their grandchildren. Factors to consider include the age of the grandchild, the anticipated cost of education, and whether the grandchild is likely to attend an in-state or out-of-state institution. When setting up a 529 plan, grandparents must designate a beneficiary, typically their grandchild. The beneficiary can be changed at any time, allowing for flexibility in case the original beneficiary does not pursue higher education. Grandparents can make an initial contribution to the 529 plan and continue making contributions over time. It is essential to be aware of contribution limits, which vary by state and plan. Each 529 plan has its contribution limits, typically based on the total cost of attendance at an eligible institution. Once the balance of the plan reaches this limit, no further contributions can be made. However, earnings may continue to accumulate tax-free. It is important to review the specific limits of the chosen plan to ensure compliance. Education savings plans offer a range of investment options, including age-based portfolios, static portfolios, and individual investment options. When selecting a suitable investment strategy, grandparents should consider their risk tolerance and investment goals. One of the advantages of a 529 plan is the ability to change beneficiaries without tax consequences, as long as the new beneficiary is a family member of the original beneficiary. This allows grandparents to locate unused funds for another grandchild or even back to themselves if they decide to pursue further education. Grandparent-owned 529 plans can have an impact on a student's eligibility for federal financial aid. Assets in a grandparent-owned 529 plan are not reportable on the FAFSA. However, once funds are withdrawn and used for the student's expenses, they are considered untaxed income to the student. This can reduce the student's eligibility for need-based financial aid in the following academic year. There are several strategies grandparents can employ to minimize the negative impact of a 529 plan on financial aid eligibility: Grandparents can wait until the student's final years of college to withdraw, as the FAFSA is based on income information from two years prior. This means that withdrawals made during the student's junior or senior year will not affect their financial aid eligibility. Grandparents can transfer ownership of the 529 plan to the student's parent, which will change the plan's impact on financial aid. Parent-owned 529 plans are assessed at a lower rate on the FAFSA, resulting in a smaller reduction in aid eligibility. Another option is to wait until the student has received their financial aid award before making withdrawals from the grandparent-owned 529 plan. This can help ensure that the 529 plan does not negatively affect the student's aid package. Withdrawals from a 529 plan are tax-free if used for qualified education expenses, such as tuition, fees, books, and supplies required for enrollment or attendance at an eligible educational institution. Room and board expenses are also eligible if the beneficiary is enrolled at least half-time. If withdrawals are made for non-qualified expenses, the earnings portion of the withdrawal will be subject to federal income tax and a 10% penalty. Additionally, state taxes may apply, and any state tax benefits previously claimed may be subject to recapture. Funds in a 529 plan can be rolled over to another 529 plan for the same beneficiary or a new beneficiary who is a family member of the original beneficiary. Rollovers can be made once every 12 months without incurring taxes or penalties. Contributions to a 529 plan are considered completed gifts and are removed from the grandparent's taxable estate. This can benefit estate planning, as it reduces the grandparent's taxable estate while retaining control over the funds. Gifts to a 529 plan are subject to the federal gift tax exclusion, which allows individuals to make annual gifts of up to $18,000 per beneficiary without incurring gift tax. Grandparents can also elect to contribute up to five years' worth of the annual exclusion amount ($90,000) in a single year without triggering the gift tax as long as no additional gifts are made to the same beneficiary during the five-year period. Grandparent-owned 529 plans are generally not subject to the generation-skipping transfer (GST) tax, as long as the grandchild is the direct beneficiary of the plan. However, the GST tax may apply if the grandchild is a "skip person" and the grandparent designates another skip person as the successor beneficiary. One potential drawback of 529 plans is the limited range of investment options compared to other investment vehicles, such as brokerage accounts or individual retirement accounts (IRAs). While most 529 plans offer a variety of investment options, including age-based portfolios and individual investment options, some investors may find these choices limiting. While many states offer tax deductions or credits for contributions to their own 529 plans, not all states extend these benefits to residents who invest in out-of-state plans. This may be a drawback for grandparents who want to invest in an out-of-state plan but would lose state tax benefits by doing so. A grandparent-owned 529 plan can sometimes create tension or misunderstandings within a family, particularly if the grandparent's intentions or expectations regarding the use of the funds are not clearly communicated. It is essential for grandparents to discuss their plans with their adult children and grandchildren to ensure everyone is on the same page regarding the purpose and use of the 529 plan. Grandparent-Owned 529 Plans are tax-advantaged savings plans aimed at encouraging saving for future education costs. These plans, sponsored by states or educational institutions, are named after Section 529 of the Internal Revenue Code. There are two main types of 529 plans: prepaid tuition plans and education savings plans. Prepaid tuition plans cover future tuition costs at current prices, while education savings plans are investment accounts that allow tax-free earnings growth and withdrawals for qualified education expenses. Grandparents can set up a 529 plan for their grandchild, choose the plan type, designate a beneficiary, and make initial and ongoing contributions. Withdrawals from a 529 plan are tax-free if used for qualified education expenses. However, non-qualified withdrawals incur penalties and state taxes may apply. A potential drawback of 529 plans is the limited range of investment options compared to other investment vehicles. Additionally, a grandparent-owned 529 plan may create tension or misunderstandings within a family. Consider consulting with a professional financial advisor to ensure you make the best decisions for your unique financial situation and goals.What Is a Grandparent-Owned 529 Plan?

Understanding 529 Plans

Types of 529 Plans

State-Sponsored Plans

Tax Advantages

Eligible Expenses

Understanding Grandparent-Owned 529 Plans

Setting Up the Plan

Choosing the Plan Type

Designating a Beneficiary

Initial and Ongoing Contributions

Contribution Limits

Investment Options

Changing Beneficiaries

Financial Aid Considerations of Grandparent-Owned 529 Plans

Impact on the Free Application for Federal Student Aid (FAFSA)

Strategies to Minimize Negative Effects

Timing of Distributions

Transferring Ownership

Waiting Until After Financial Aid Award

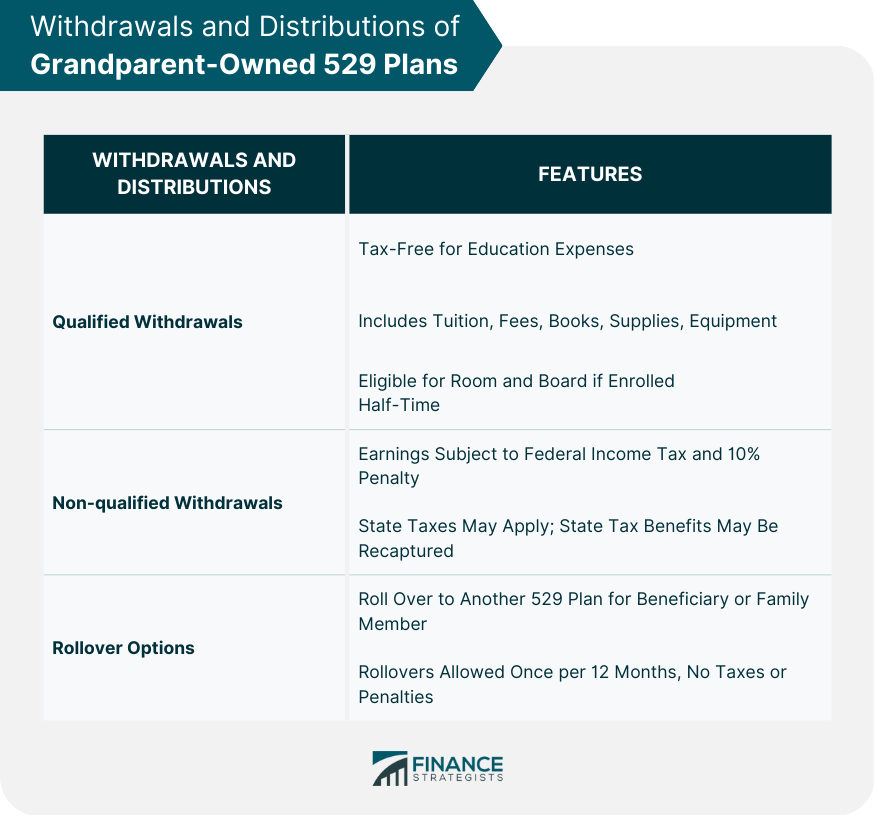

Withdrawals and Distributions of Grandparent-Owned 529 Plans

Qualified Withdrawals

Non-qualified Withdrawals

Rollover Options

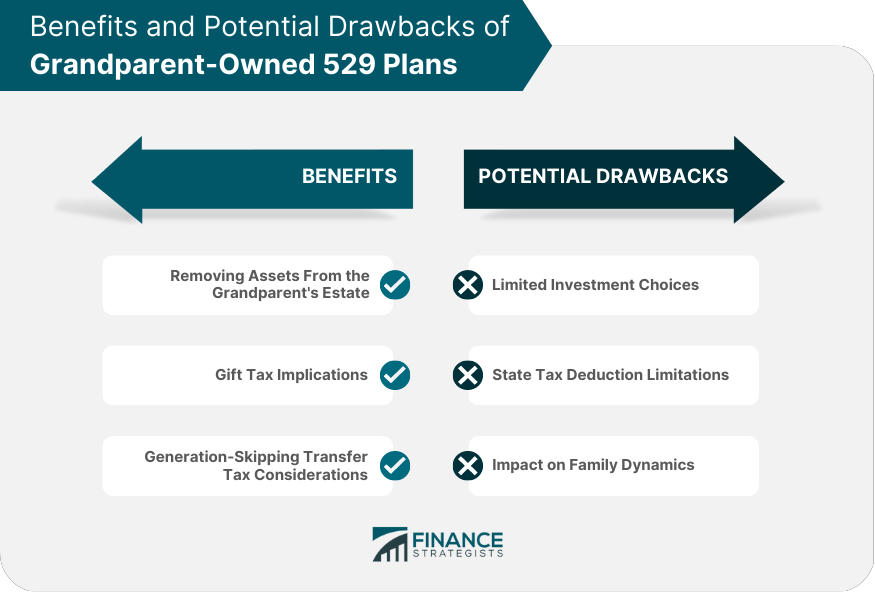

Benefits of Grandparent-Owned 529 Plans

Removing Assets from the Grandparent's Estate

Gift Tax Implications

Generation-Skipping Transfer Tax Considerations

Potential Drawbacks of Grandparent-Owned 529 Plans

Limited Investment Choices

State Tax Deduction Limitations

Impact on Family Dynamics

Final Thoughts

Grandparent-Owned 529 Plans FAQs

A Grandparent-Owned 529 Plan is a tax-advantaged savings plan designed to encourage saving for future education costs. These plans allow grandparents to invest in their grandchild's education while also removing assets from their taxable estate.

Grandparent-owned 529 plans offer tax advantages, flexibility, and estate planning benefits. They can help grandparents invest in their grandchild's education and reduce their taxable estate.

Qualified education expenses for 529 plans include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Room and board expenses are also eligible if the beneficiary is enrolled at least half-time.

Yes, grandparent-owned 529 plans can have an impact on a student's eligibility for federal financial aid. Assets in a grandparent-owned 529 plan are not reportable on the FAFSA. However, once funds are withdrawn and used for the student's expenses, they are considered untaxed income to the student. This can reduce the student's eligibility for need-based financial aid in the following academic year.

Strategies to minimize the negative impact of a grandparent-owned 529 plan on financial aid eligibility include timing of distributions, transferring ownership, and waiting until after financial aid award. Consult with a financial advisor to determine the best strategy for your specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.