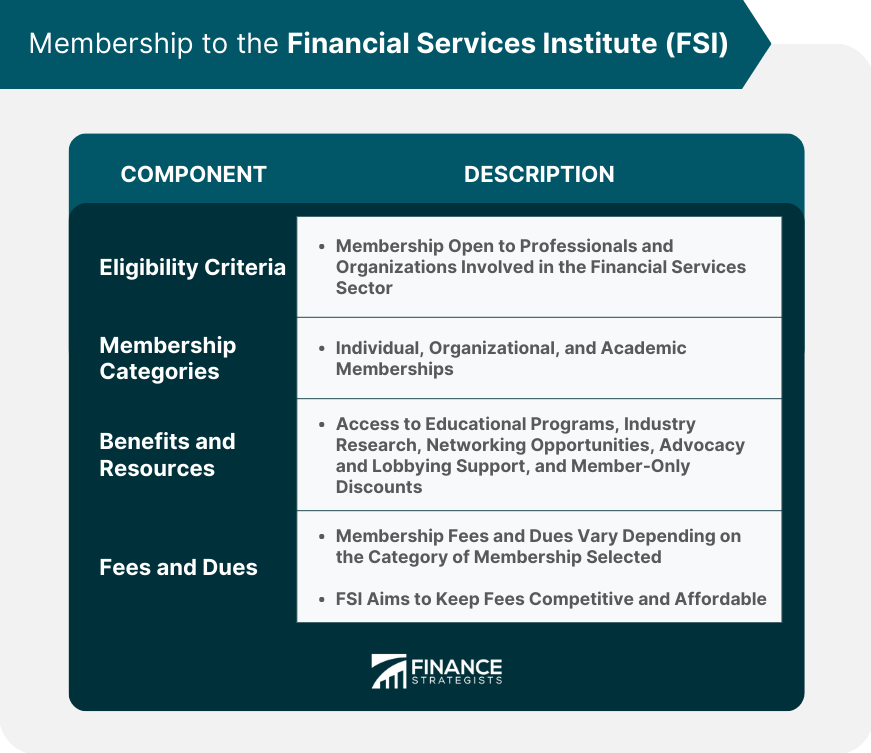

Financial Services Institute (FSI) is a trade association representing independent financial advisors and their affiliated firms in the United States. FSI provides advocacy, professional development, networking, and research resources to its members. By offering education, advocacy, networking, and research opportunities, FSI supports its members in navigating the complex landscape of the financial world. This article delves into the history, organizational structure, core services, and impact of the Financial Services Institute. The Financial Services Institute was founded in the early 2000s as a response to the growing need for a dedicated professional organization that would provide support and resources to professionals in the financial services sector. The founders recognized the importance of creating a platform that would foster collaboration, knowledge sharing, and innovation within the industry. Over the years, FSI has grown in both membership and influence, reaching milestones that have shaped the financial services landscape. Some of these key achievements include the establishment of annual conferences, the development of extensive training and educational programs, and the expansion of its advocacy and lobbying efforts on behalf of its members. FSI has been instrumental in shaping the financial services industry by promoting best practices, fostering collaboration among professionals, and influencing policy changes. Through its various initiatives, FSI has helped create an environment conducive to the growth and prosperity of financial services firms. The FSI Board of Directors is responsible for setting the strategic direction and overseeing the overall management of the organization. Comprising industry leaders, the board ensures that FSI remains focused on its mission to support and develop the financial services sector. FSI's management team is responsible for executing the strategic vision set forth by the board and overseeing the day-to-day operations of the organization. This includes managing FSI's various departments and initiatives, as well as ensuring the organization remains financially sustainable. FSI is organized into several departments and divisions, each responsible for a specific aspect of the organization's mission. These include Professional Development and Training, Advocacy and Lobbying, Networking and Member Engagement, and Research and Publications. FSI also relies on advisory committees and panels to provide expert advice and guidance on various topics related to the financial services industry. These committees are typically composed of industry professionals, academics, and other stakeholders with specialized knowledge and experience. FSI is committed to providing its members with access to high-quality professional development and training opportunities. These include continuing education programs, workshops and seminars, certification courses, and online learning resources. One of FSI's key functions is to represent its members' interests in regulatory matters and policy development. This includes advocating for favorable policies and regulations, as well as engaging in government relations efforts to ensure that the financial services industry's voice is heard. FSI offers numerous opportunities for its members to network and engage with their peers, fostering collaboration and knowledge sharing. These opportunities include conferences, events, member forums, and collaborative initiatives. FSI produces a variety of research materials and publications designed to keep members informed about the latest trends and developments in the financial services industry. These resources include industry reports, whitepapers, policy briefs, and periodicals. Membership in FSI is open to professionals and organizations involved in the financial services sector, including financial advisors, broker-dealers, banks, insurance companies, and other financial institutions. FSI offers several membership categories tailored to the needs and interests of its diverse membership base. These categories include individual, organizational, and academic memberships, allowing professionals and organizations to choose the level of engagement and benefits that best suit their needs. FSI members enjoy a wide range of benefits and resources designed to support their professional growth and development. These benefits include access to educational programs, industry research, networking opportunities, advocacy and lobbying support, and member-only discounts on events and services. Membership fees and dues vary depending on the category of membership selected. FSI strives to keep its fees competitive and affordable to ensure that a diverse range of professionals and organizations can participate in and benefit from its programs and initiatives. FSI actively collaborates with various financial institutions to develop joint initiatives, share knowledge, and promote best practices within the industry. These partnerships often result in increased resources and opportunities for FSI members and the financial services sector as a whole. FSI also partners with academic institutions to enhance its educational offerings, conduct research, and foster innovation in the financial services industry. These partnerships enable FSI to stay at the forefront of industry developments and provide its members with cutting-edge insights and resources. FSI maintains affiliations with other industry associations, both nationally and internationally, to expand its reach and influence in the financial services sector. These affiliations help FSI remain informed about global trends and developments, as well as facilitate collaboration among industry stakeholders. FSI is dedicated to promoting the growth and development of the financial services industry on a global scale. Through its international partnerships and outreach initiatives, FSI works to share its knowledge and resources with professionals and organizations around the world. FSI has made significant contributions to the financial services industry by providing valuable education, advocacy, and networking opportunities. Through its various programs and initiatives, FSI has helped shape the industry, driving innovation and promoting best practices. The financial services industry is constantly evolving and faces a variety of challenges and opportunities. One of the biggest challenges is adapting to changing regulations, which can have a significant impact on the way financial services professionals operate. FSI can help its members stay up-to-date on the latest regulatory developments and provide resources to help them comply with new rules and regulations. Increased competition is another challenge facing the financial services industry. FSI provides its members with access to a variety of networking opportunities and resources to help them stay competitive and differentiate themselves in the marketplace. The rapid pace of technological change is also a challenge for the financial services industry. FSI can help its members stay ahead of the curve by providing educational resources on emerging technologies and how they can be leveraged to improve business operations and better serve clients. Despite these challenges, there are also numerous opportunities in the financial services industry, including growing demand for financial planning and advice, the expansion of global markets, and the potential for innovation and growth. FSI can help its members capitalize on these opportunities by providing resources and support to help them stay competitive and grow their businesses. FSI will continue to focus on its mission of supporting and developing the financial services sector, with an emphasis on expanding its educational offerings, strengthening its advocacy efforts, and fostering greater collaboration among industry stakeholders. By doing so, FSI aims to ensure the long-term success and growth of its members and the financial services industry as a whole. The Financial Services Institute plays a critical role in the development and growth of the financial services sector. Through its comprehensive suite of services and offerings, FSI provides professionals and organizations with the tools, resources, and support needed to succeed in today's dynamic and competitive financial landscape. By joining or supporting FSI, individuals and organizations can contribute to the ongoing success and advancement of the financial services industry.What Is the Financial Services Institute (FSI)?

The Financial Services Institute is a leading organization dedicated to the growth and development of the financial services industry. History and Background of FSI

Origins of FSI

Timeline of Key Milestones and Achievements

Influence on the Financial Services Sector

Organizational Structure of FSI

Board of Directors

Management Team

Departments and Divisions

Advisory Committees and Panels

Core Services and Offerings of the FSI

Professional Development and Training

Advocacy and Lobbying

Networking and Member Engagement

Research and Publications

Membership

Eligibility Criteria

Membership Categories

Benefits and Resources

Fees and Dues

Strategic Partnerships and Alliances

Collaborations With Financial Institutions

Academic Partnerships

Industry Association Affiliations

Global Outreach Initiatives

FSI's Impact and Future Outlook

Contributions to the Financial Services Industry

Challenges and Opportunities

Future Goals and Objectives

Conclusion

Financial Services Institute (FSI) FAQs

Financial Services Institute (FSI) is a trade association representing independent financial advisors and their affiliated firms in the United States.

Membership in the Financial Services Institute (FSI) is open to independent financial advisors and their affiliated firms, as well as individuals and companies that provide services to the independent financial advisor industry.

The Financial Services Institute (FSI) offers its members a range of benefits, including advocacy on behalf of the independent financial advisor industry, educational resources, networking opportunities, and access to industry research and analysis.

The Financial Services Institute (FSI) advocates for the independent financial advisor industry by lobbying lawmakers and regulators on issues that affect the industry, such as tax policy, securities regulation, and retirement policy.

The Financial Services Institute (FSI) offers its members access to a range of educational resources, including webinars, workshops, and conferences on topics such as compliance, practice management, and technology.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.