Financial planning for widows and widowers is a process of evaluating their current financial situation and developing a plan to ensure their future financial security. This process takes into account the individual's current financial status, goals, and risk tolerance to create a comprehensive plan for the future. A spouse's death can significantly impact an individual's financial situation, and proper planning is essential to ensure that their future is secure. Without a plan, individuals may face financial difficulties and be forced to make difficult decisions about their future. The objectives of financial planning for widows and widowers include: Gathering financial information and assessing the current financial situation Reviewing estate planning documents and identifying any immediate financial needs Setting financial goals and assessing risk tolerance Evaluating investment portfolios and insurance coverage Planning for retirement and considering long-term care options Dealing with debt and expenses and seeking professional advice when necessary Building a support system and staying on track with the financial plan I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. During my mother's transition to managing finances as a widow, the most challenging aspects were understanding the full scope of our financial situation and adjusting to the new reality without my father's income. We faced decisions about investments, pension benefits, and re-budgeting with a single income. Navigating these financial changes while grieving was particularly difficult. This profoundly shaped my approach, emphasizing empathy and clear, supportive guidance for those in similar situations. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation The first step in financial planning is to gather all relevant financial information. This includes: Investment account statements Retirement account statements Insurance policies Estate planning documents Tax returns Once you have gathered all the financial information, the next step is to assess your current financial situation. This involves: Identifying any debts Evaluating your assets and liabilities It is essential to review all estate planning documents, including wills, trusts, and power of attorney documents, to ensure that they are up-to-date and accurately reflect your wishes. The death of a spouse can create immediate financial needs, such as funeral expenses, that must be addressed. Identifying these needs and finding ways to meet them is an important part of the financial planning process. The next step in financial planning is to set financial goals. This involves: Evaluating your current financial situation and determining your future needs Identifying short-term and long-term goals Establishing a timeline for achieving these goals It is important to assess your risk tolerance to determine the level of risk you are comfortable with in your investments. This will help guide your investment decisions and ensure that your portfolio aligns with your goals and risk tolerance. Next, evaluate your investment portfolio and make any necessary adjustments. This includes: Reviewing your current investments and determine if they align with your goals and risk tolerance Considering the diversification of your portfolio Seeking professional advice if necessary Reviewing your insurance coverage to ensure that it is adequate and meets your needs is important. This includes: Reviewing life insurance policies and determining if they are still necessary Assessing the need for disability, long-term care, or other types of insurance Updating beneficiaries on all insurance policies Long-term care is an important aspect of financial planning, and it is essential to consider the options available. This includes: Evaluating the need for long-term care insurance Considering alternative options, such as Medicaid or veterans benefits Seeking professional advice to determine the best options for your situation Retirement planning is an important aspect of financial planning, and it is essential to consider your retirement goals and develop a plan to achieve them. This includes: Evaluating your current retirement savings and determining if they are on track to meet your goals Considering alternative retirement savings options, such as annuities or reverse mortgages Seeking professional advice to determine the best options for your situation The death of a spouse can leave behind debt, and it is important to prioritize debt repayment. This includes: Evaluating the amount and type of debt Prioritizing the repayment of high-interest debt Seeking professional advice if necessary It is important to manage monthly expenses and create a budget to ensure you can meet your financial obligations. This includes: Reviewing your income and expenses to determine your monthly budget Identifying areas where expenses can be reduced Seeking professional advice if necessary It is important to understand your tax obligations, including any changes that may result from the death of your spouse. This includes: Reviewing your tax situation and determining any changes that may result from the death of your spouse Seeking professional tax advice if necessary Seeking professional advice is an important aspect of financial planning, and it is essential to seek help when needed. This includes: Seeking advice from a financial planner Seeking advice from a tax professional Seeking advice from an insurance professional Building a team of advisors is an important aspect of financial planning, and it is essential to seek help when needed. This includes: Finding a financial planner Seeking advice from a tax professional Seeking advice from an insurance professional Finding a financial planner is an important aspect of financial planning, and it is essential to seek help when needed. This includes: Evaluating the qualifications and experience of potential financial planners Considering the cost and services offered by different planners Seeking recommendations from friends and family members Joining a support group can provide emotional support and a sense of community during a difficult time. This includes: Finding a support group for widows and widowers Seeking recommendations from friends and family members Building a network of trusted friends and family members is an important aspect of financial planning, and it is essential to seek help when needed. This includes: Building a network of trusted friends and family members who can provide support and assistance Seeking recommendations from friends and family members It is important to review your financial plan regularly to ensure that it remains on track and continues to meet your needs. This includes: Reviewing your financial plan on a regular basis Making adjustments as needed to ensure that it remains aligned with your goals and risk tolerance As your financial situation changes, it is important to make adjustments to your financial plan to ensure that it remains on track and continues to meet your needs. This includes: Reviewing your financial plan regularly Making changes as needed to ensure that it remains aligned with your goals and risk tolerance It is important to stay educated on financial matters to ensure that you are able to make informed decisions about your financial future. This includes: Reading books, articles, and other resources on financial planning Attending seminars, workshops, and other educational events Seeking professional advice when necessary Seeking professional advice is an important aspect of financial planning, and it is essential to seek help when needed. This includes: Seeking advice from a financial planner Seeking advice from a tax professional Seeking advice from an insurance professional Financial planning is essential to managing the aftermath of a spouse's death and ensuring a secure future. The process of financial planning for widows and widowers includes gathering financial information, assessing the current financial situation, setting financial goals, and dealing with debt and expenses. Building a support system, staying on track with your financial plan, and seeking professional advice when necessary are also important aspects of the financial planning process. The death of a spouse can be a traumatic event that has far-reaching effects on a person's life, including their financial situation. Proper financial planning is essential to ensure that individuals are able to navigate this challenging time and secure their financial future. Taking action and seeking help when needed is critical to the financial planning process. It is important to seek the advice of professionals and build a support system to ensure that you are able to navigate this difficult time and secure your financial future. Financial planning for widows and widowers is critical to managing the aftermath of a spouse's death and ensuring a secure future.Basics of Financial Planning for Widows and Widowers

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Understanding the Financial Status of Widows and Widowers

Gathering Financial Information

Assessing Your Current Financial Situation

Reviewing Estate Planning Documents

Identifying Any Immediate Financial Needs

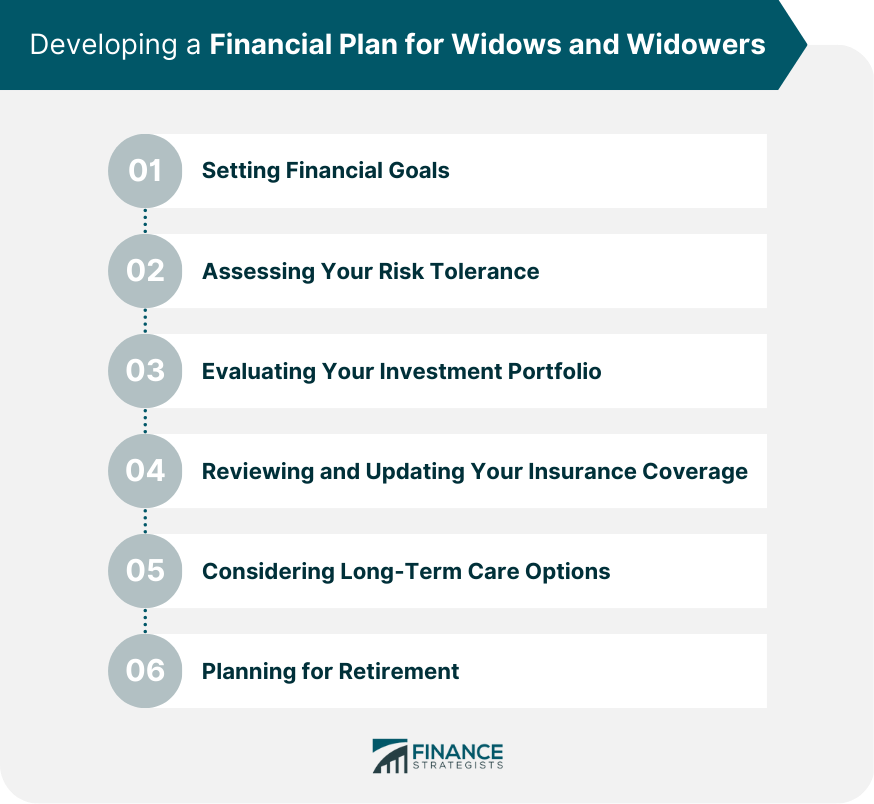

Developing a Financial Plan for Widows and Widowers

Setting Financial Goals

Assessing Your Risk Tolerance

Evaluating Your Investment Portfolio

Reviewing and Updating Your Insurance Coverage

Considering Long-Term Care Options

Planning for Retirement

Dealing With Debt and Expenses for Widows and Widowers

Prioritizing Debt Repayment

Managing Monthly Expenses

Understanding Your Tax Obligations

Seeking Professional Advice

Building a Support System for Widows and Widowers

Building a Team of Advisors

Finding a Financial Planner

Joining a Support Group

Building a Network of Trusted Friends and Family Members

Staying on Track With the Financial Plan

Reviewing Your Plan Regularly

Making Adjustments as Needed

Staying Educated on Financial Matters

Seeking Professional Advice When Needed

Conclusion

Financial Planning for Widows and Widowers FAQs

Financial planning for widows and widowers is a process of evaluating their current financial situation and developing a plan to ensure their future financial security. This process takes into account the individual's current financial status, goals, and risk tolerance to create a comprehensive plan for the future.

A spouse's death can significantly impact an individual's financial situation, and proper planning is essential to ensure that their future is secure. Without a plan, individuals may face financial difficulties and be forced to make difficult decisions about their future.

The objectives of financial planning for widows and widowers include gathering financial information, assessing the current financial situation, setting financial goals, dealing with debt and expenses, building a support system, staying on track with the financial plan, and seeking professional advice when necessary.

The steps involved in financial planning for widows and widowers include gathering financial information, assessing the current financial situation, setting financial goals, evaluating investment portfolios and insurance coverage, dealing with debt and expenses, building a support system, and seeking professional advice when necessary.

Resources available for financial planning for widows and widowers include financial planners, tax professionals, insurance professionals, books, articles, seminars, workshops, and support groups. It is important to seek professional advice and build a support system to ensure that you are able to navigate this challenging time and secure your financial future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.