Benefits planning is an essential process that involves the design, implementation, and management of employee benefit programs within an organization. These programs encompass a wide range of offerings intended to support employees' health, financial stability, work-life balance, and professional growth. Effective benefits planning is crucial for organizations seeking to attract, retain, and engage top talent while remaining competitive in their respective industries. Medical insurance is a fundamental component of employee benefits packages. It helps employees cover the cost of medical care, including doctor visits, hospitalizations, and prescription medications. Employers can offer various health plan options, such as HMOs, PPOs, or high-deductible plans paired with health savings accounts (HSAs). Dental and vision coverage are additional health benefits that provide employees with access to routine dental care, orthodontics, eyeglasses, and contact lenses. These coverages may be included in the primary medical plan or offered as separate policies. Wellness programs promote healthier lifestyles and can include initiatives such as gym membership reimbursements, health screenings, smoking cessation programs, and weight management resources. These programs encourage employees to prioritize their well-being and can contribute to improved productivity and reduced healthcare costs for employers. Employers often offer retirement plans, such as 401(k)s, 403(b)s, or pension plans, to help employees save for their post-work years. These plans may include employer-matching contributions or profit-sharing arrangements, providing additional financial incentives for employees to participate. Life and disability insurance policies provide financial protection for employees and their families in the event of death or long-term disability. Employers can offer group policies, often at more affordable rates than individual coverage, or provide employees the option to purchase additional coverage through payroll deductions. Employee stock options or other equity-based compensation programs can help align employee interests with those of the company and create a sense of ownership. These programs may include stock options, restricted stock units (RSUs), or employee stock purchase plans (ESPPs). Flexible work arrangements, such as remote work, flexible hours, or compressed workweeks, allow employees to better balance their professional and personal lives. These arrangements can lead to increased job satisfaction, reduced stress, and higher retention rates. Paid time off (PTO) and vacation policies provide employees with designated periods of rest and relaxation, contributing to improved mental health and overall well-being. Employers may offer traditional vacation and sick leave or combine these into a single PTO bank. Childcare and eldercare assistance benefits can include on-site daycare facilities, referral services, or financial subsidies. These benefits help employees manage their family responsibilities, reducing stress and promoting a healthy work-life balance. Tuition reimbursement programs support employees' educational pursuits by covering a portion of tuition costs for college courses, certification programs, or other professional development opportunities. These programs can help employees enhance their skills, improve job performance, and advance their careers. Employers may offer training and development programs, such as workshops, seminars, or e-learning courses, to help employees expand their knowledge and skills within their roles. These programs contribute to a culture of continuous learning and improvement. Support for professional memberships allows employees to join industry organizations, attend conferences, and network with peers. This support can help employees stay current with industry trends, learn new skills, and advance their careers while also enhancing the organization's reputation and professional connections. To create a comprehensive benefits package, organizations should first assess their needs and objectives. This process involves identifying the organization's goals, such as attracting top talent, improving employee retention, or promoting a healthy work-life balance. Aligning benefits offerings with these objectives ensures that the benefits package supports the organization's overall strategy. Gathering employee feedback through surveys, focus groups, or one-on-one conversations can help organizations understand which benefits are most valued by employees and where improvements may be needed. This feedback is essential in creating a benefits package that meets employees' diverse needs and expectations. To remain competitive in the job market, organizations should benchmark their benefits offerings against industry standards and competitor practices. Comparing benefits packages can help organizations identify gaps or opportunities for improvement, ensuring that they offer a competitive and attractive package to current and prospective employees. Working closely with benefits providers and consultants can help organizations design and implement a comprehensive and cost-effective benefits package. These professionals can offer insights into the latest trends, regulatory requirements, and best practices in benefits planning. When employees feel valued and supported through a comprehensive benefits package, they are more likely to be satisfied and engaged in their work. This engagement can lead to increased productivity, innovation, and a more positive work environment. Offering a well-rounded benefits package can help employees achieve better work-life balance and maintain good physical and mental health. These factors contribute to increased productivity and overall job performance. A competitive benefits package can help organizations attract and retain the best talent in their industry. Prospective employees often consider benefits as a crucial factor when evaluating job offers, and current employees may be more likely to stay with an organization that offers a comprehensive and competitive benefits package. By investing in effective benefits planning, organizations can save on costs associated with employee turnover, absenteeism, and low productivity. Additionally, understanding which benefits are most valued by employees can help organizations allocate resources more effectively and prioritize the offerings that will have the most significant impact. Organizations must ensure that their benefits offerings comply with federal and state laws and regulations. This includes adhering to requirements under the Affordable Care Act (ACA), the Employee Retirement Income Security Act (ERISA), the Family and Medical Leave Act (FMLA), and other applicable legislation. Employers should be aware of the tax implications of their benefits offerings, including the tax treatment of certain benefits, such as retirement contributions and health insurance premiums. Employers should consult with tax consultants or benefits consultants to ensure compliance and optimize tax benefits for the organization and its employees. Organizations should regularly monitor changes in laws and regulations affecting employee benefits to ensure ongoing compliance and adapt their benefits packages as needed. A well-crafted communication strategy can help employees understand and appreciate the full value of their benefits package. This strategy should include clear, concise messaging and utilize multiple communication channels, such as emails, intranet resources, and in-person meetings or seminars. Employers should leverage various communication channels to ensure that employees receive consistent and accessible information about their benefits. This may include digital platforms, such as email or a dedicated benefits website, as well as print materials and in-person events such as benefits fairs or workshops. Promoting employee participation in benefits programs, such as retirement plans, wellness initiatives, or professional development opportunities, is essential for maximizing the value of these offerings. Employers can encourage participation through regular communication, education, and incentives. To evaluate the success of benefits planning efforts, organizations should establish key performance indicators (KPIs) related to their specific objectives. These may include metrics such as employee satisfaction, retention rates, benefits utilization, or cost savings. Regular benefits audits and evaluations help organizations assess the effectiveness of their benefits programs and identify areas for improvement. This process may involve analyzing benefits costs, utilization rates, employee feedback, and industry benchmarks. Based on the results of audits and evaluations, organizations should adjust and improve their benefits offerings to better align with their objectives and employees' needs. This may involve modifying existing benefits, introducing new offerings, or reallocating resources to prioritize the most impactful programs. Effective benefits planning is a vital component of organizational success, as it encompasses a wide range of offerings that support employees' health, financial stability, work-life balance, and professional growth. By carefully designing, implementing, and managing a comprehensive benefits package, organizations can attract and retain top talent, enhance employee satisfaction and engagement, and optimize their resources. Key strategies for effective benefits planning include assessing organizational needs and objectives, gathering employee feedback, benchmarking against industry standards, and collaborating with benefits providers and consultants. It is essential for organizations to remain compliant with legal and regulatory requirements, communicate and promote benefits offerings effectively, and regularly measure the effectiveness of their benefits planning efforts.What Is Benefits Planning?

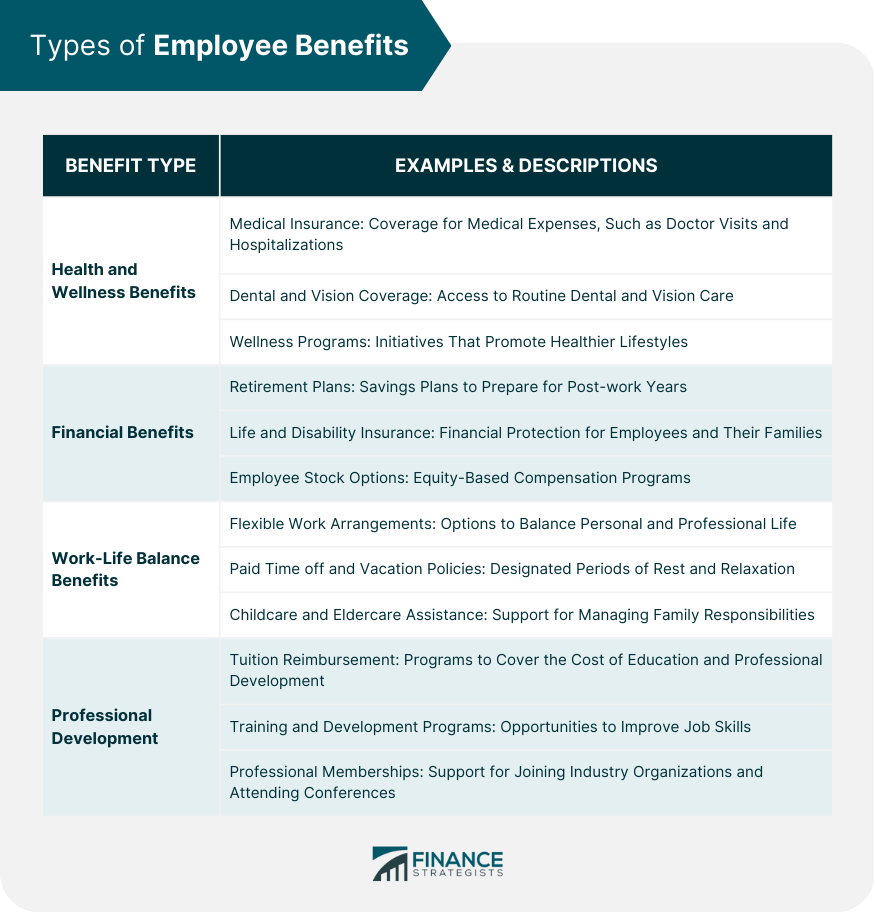

Types of Employee Benefits

Health and Wellness Benefits

Medical Insurance

Dental and Vision Coverage

Wellness Programs

Financial Benefits

Retirement Plans

Life and Disability Insurance

Employee Stock Options

Work-Life Balance Benefits

Flexible Work Arrangements

Paid Time off and Vacation Policies

Childcare and Eldercare Assistance

Professional Development Benefits

Tuition Reimbursement

Training and Development Programs

Professional Memberships

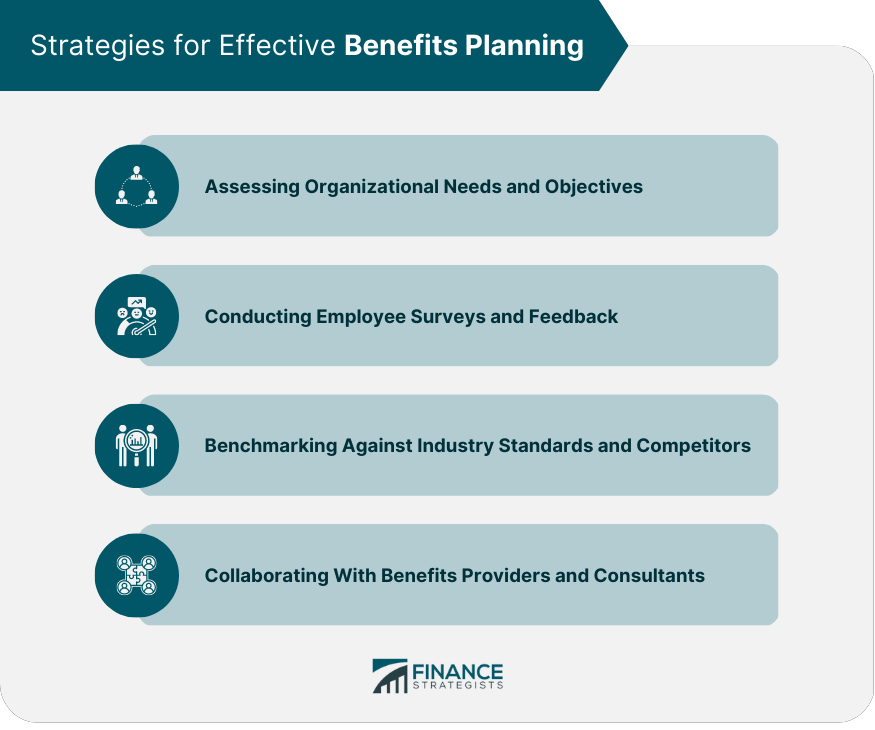

Strategies for Effective Benefits Planning

Assessing Organizational Needs and Objectives

Conducting Employee Surveys and Feedback

Benchmarking Against Industry Standards and Competitors

Collaborating With Benefits Providers and Consultants

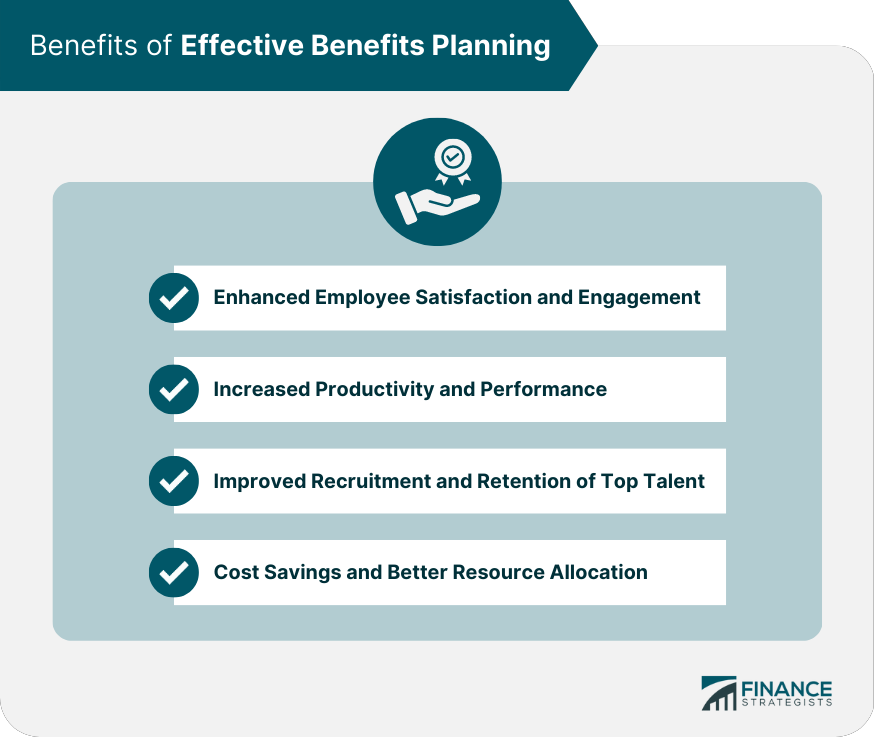

Benefits of Effective Benefits Planning

Enhanced Employee Satisfaction and Engagement

Increased Productivity and Performance

Improved Recruitment and Retention of Top Talent

Cost Savings and Better Resource Allocation

Key Considerations for Benefits Planning

Compliance With Federal and State Laws

Understanding Tax Implications

Monitoring Changes in Regulations and Requirements

Communicating and Promoting Benefits to Employees

Developing a Comprehensive Benefits Communication Strategy

Utilizing Multiple Communication Channels

Encouraging Employee Participation and Utilization of Benefits

Measuring the Effectiveness of Benefits Planning

Establishing Key Performance Indicators (KPIs)

Conducting Regular Benefits Audits and Evaluations

Adjusting and Improving Benefits Offerings Based on Results

Conclusion

Benefits Planning FAQs

Benefits Planning is the process of identifying, analyzing, and selecting employee benefits programs that meet the needs of both employers and employees. It involves assessing the current benefits package, researching and comparing options, and making recommendations for changes or improvements.

Benefits Planning is important because it helps employers attract and retain talented employees, improve employee morale and productivity, and stay competitive in the job market. By offering attractive benefits packages, employers can differentiate themselves from their competitors and create a positive workplace culture.

Common employee benefits include health insurance, retirement plans, paid time off, flexible work arrangements, life and disability insurance, wellness programs, and employee assistance programs. These benefits can vary depending on the industry, company size, and employee demographics.

To determine which benefits to offer, employers should conduct a needs assessment to identify the needs and preferences of their employees. They should also consider the cost and feasibility of each benefit option, as well as the impact on the overall budget and business goals.

Employers should review and update their benefits package on a regular basis, typically every one to three years. This allows them to stay current with industry trends, comply with regulatory changes, and respond to the evolving needs of their employees. It's also important to communicate any changes or updates to employees in a timely and transparent manner.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.