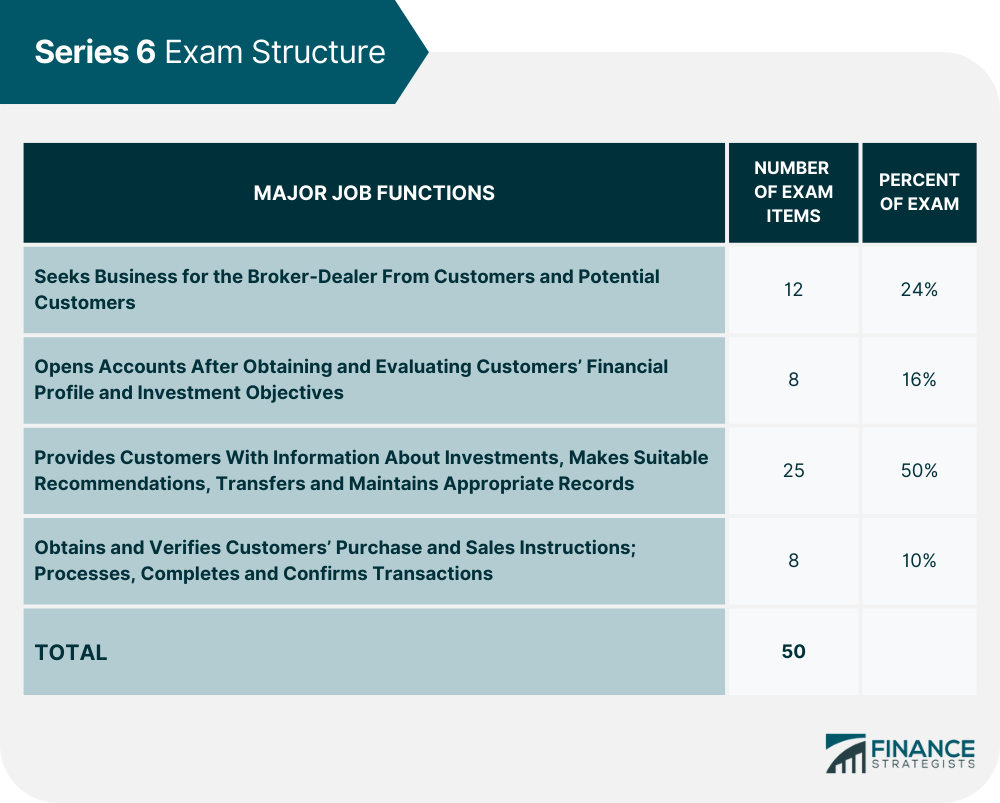

A Series 6 license is a securities license that enables the holder to register as a company's representative and sell packaged securities. The Series 6 exam is administered by FINRA, which is the government-authorized, non-profit organization responsible for administering all securities licensing procedures and requirements testing. Achievable’s FINRA Series 6 course guides you through a personalized learning experience, reinforcing what you’ve learned and giving you certainty that you’re ready to pass your exam. Achievable FINRA Series 6 is all you need to pass, and include an easy-to-understand online textbook, dozens of videos on key topics, 1,600+ chapter review questions backed by their memory-enhancing algorithm, and 35+ full-length practice exams. Achievable’s course content is produced by Brandon Rith, who was formerly Fidelity’s top instructor nationwide. Achievable has industry leading pass rates on all of their FINRA courses, and they will give you a full refund if you don’t pass on your first try. FINRA tests on behalf of the North American Securities Administrators Association (NASAA)--the group of state and provincial regulators tasked with protecting investors. In order to sit for the Series 6 exam, candidates for a Series 6 license are required to have a sponsor from a FINRA-member firm or a self-regulatory organization. Other exams that require a sponsor include the following: Someone who holds a Series 6 license is known as a "limited representative" —they are limited in the sense of what securities they are licensed to sell. This stands in contrast with the Series 7 license, which enables the license holder to trade in all securities except commodities and futures. Someone who holds a Series 6 license is qualified for the solicitation, purchase and/or sale of the following securities products: The following is a breakdown of the exam: Candidates for the Series 6 exam must also pass the co-requisite Securities Industry Essentials (SIE) and Series 63 exams to be fully eligible to buy and sell securities. The SIE exam covers concepts fundamental to working in the industry and the Series 63 is a state-level exam that ensures brokers have covered state securities regulations and rules prohibiting dishonest or unethical practices. Kaplan, the publisher of the most widely adopted textbook on the Series 6 license, recommends taking exams in the following order:What Is Series 6?

Our Trusted Partner

Achievable

Qualifications for a Series 6

Permitted Activities

Series 6 Exam Structure

Co-requisites: Series 6, Series 63, and SIE Exam

Recommended Order for Taking Securities Tests

Series 6 FAQs

A Series 6 license is a securities license which enables the holder to register as a company’s representative and sell packaged securities.

In order to sit for the Series 6 exam, candidates for a Series 6 license are required to have a sponsor from a FINRA-member firm or a self-regulatory organization.

Someone who holds a Series 6 license is known as a “limited representative”—they are limited in the sense of what securities they are licensed to sell.

The Series 6 stands in contrast with the Series 7 license, which enables the license holder to trade in all securities except commodities and futures.

Candidates for the Series 6 exam must also pass the co-requisite Securities Industry Essentials (SIE) and Series 63 exams to be fully eligible to buy and sell securities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.