An investment license is a document that explains to investors what kind of securities they must be selling and how it compares to other financial instruments. Given the fact that there are different types of licenses, such as corporate and individual ones, an investment license can give more information on both parties. It will also report the presence of any restrictions given the particular kind of license. The Financial Industry Regulatory Authority (FINRA) issues these licenses. They are the main regulators of financial companies and exchanges in the United States. Have questions about getting an Investment License? Click here. Without an investment license, there is a chance for fraud or misrepresentation. Rules and regulations vary depending on the type of investment instrument and individual state laws can further complicate things. Therefore, by issuing certain rules and guidelines of what is acceptable and not acceptable in the financial markets, investors will have a quick reference guide to ensure that they do not unknowingly invest in anything that is fraudulent. Another reason to get an investment license is that it will give the investor a detailed view of how such a market works and what they should expect. It will also help investors understand any risks involved when they decide to invest in the markets. For example, when you purchase a home in the United States, there are disclosure rights that will outline any risks or issues with the property. There are four main types of investment licenses in the financial market: Individual or Personal Investment, Corporate Financial Investment, Investment Banking License, and Legal Entity Investment. Individuals who have an investment license are considered to be acting in a fiduciary capacity. This means that you will have more responsibility for your actions on top of being held legally accountable. Investment bankers are not always licensed on their own. Sometimes they use corporations or LLCs to fulfill their licenses, which is why you see that they work for major companies. Individuals who have a corporate investment license are considered to be acting in their business capacity, rather than as an individual or fiduciaries. This means that they will not be held legally accountable and they will not be liable for any action that occurs. For example, a major corporation may have a license, but the president is not necessarily going to be held responsible for any activity. Investment banking licenses are a form of financial licensing that deals directly with securities. This means that they will work in the field of buying and selling stocks or bonds on behalf of clients or companies. This type of license is very specific in terms of what it entails. For example, the individual holding this form of license has to hold a bachelor's degree in one of these fields: This type of license applies to corporations that issue securities. It also applies to individuals who own up to 10 percent or more of the total shares of a corporation. This will allow companies to raise funds for their operations and help them grow. The Securities and Exchange Commission (SEC) issues these licenses. They make sure that financial markets in the US remain fair and transparent. Now that we have a general idea about the different types of licenses, let's take a look at some specific licensing requirements: In order to obtain an individual investment license, you will have to pass the Series 7, Series 63, Series 66, or Series 9 exams. Each test is specific to the type of license that you are seeking. Series 7 - General Securities Representative Examination This exam is an entry-level test for anyone who wants to sell or deal with securities on behalf of their clients. This includes stocks, bonds, commodity futures, mutual funds, and more. It is great if you want to pursue a career in this field because it helps you build the foundation that will help you get your next level of certification. Series 63 - Uniform Securities Act Examination If you are an agent who sells investments in securities, then this test is a must. It will help you verify that transactions go smoothly and legally. Additionally, it also helps agents identify conflicts of interest and determine how to resolve them. Series 66 - Uniform Combined State Law Examination This test is the newest exam offered by the Financial Industry Regulatory Authority (FINRA). It is one of the most important exams that you can pass if you are in this field. It will give you a general overview of all financial regulations that are put into place to protect investors. This includes things like issuing investment securities, underwriting deals, and handling mergers and acquisitions. Series 9 - Financial Services Representative Examination for Brokers If you want to trade or conduct limited activities with securities, then series 9 is the right test for you. It helps you operate as a securities broker by giving you the authority to buy and sell securities. To obtain a corporate financial investment license, you will have to submit your articles of incorporation or certificate filing with the SEC. You must also file specific forms, such as Form SB-1 and Form F-1. In addition, the CFI license also requires that you meet certain capitalization requirements. This means that you must have enough money to operate your business. If not, then you might apply for a licensing exemption with the SEC. If you want to be employed as an investment banker, then you will have to pass the Series 7, Series 63, and Series 86 exams. The first two tests are required for all agents who trade with securities. Not only that but the Series 7 exam is also a required text for those looking to become corporate financial investment representatives. Series 86 - Research Analyst Qualification The Series 86 exam is used to determine your eligibility for employment as an investment banker. It focuses on the areas of investments and securities, corporate finance, risk management, securitization, financial services regulation, derivatives analysis, among others. If you want to receive a legal entity investment license, then you will have to pass the Series 65 or 66 exams. Both of these exams are used to determine eligibility for employment as an investment representative. Series 65 - Uniform Investment Adviser Law Examination The Series 65 exam focuses on corporate finance. This includes issues related to mergers and acquisitions, public offerings, underwriting equity securities, private placements, and all other corporate financing options. If you are interested in getting your license, then it is best that you become familiar with the different types of investment licenses. They all have their own requirements and reasons for being required. Once you learn more about what you need to do to obtain one, you can better determine which license will help you get your next certification.What Is an Investment License?

Why Do I Need an Investment License?

What Are the Different Types of Securities Licenses?

Individual or Personal Investment Licenses

Corporate Financial Investment Licenses

Investment Banking Licenses

Legal Entity Investment Licenses

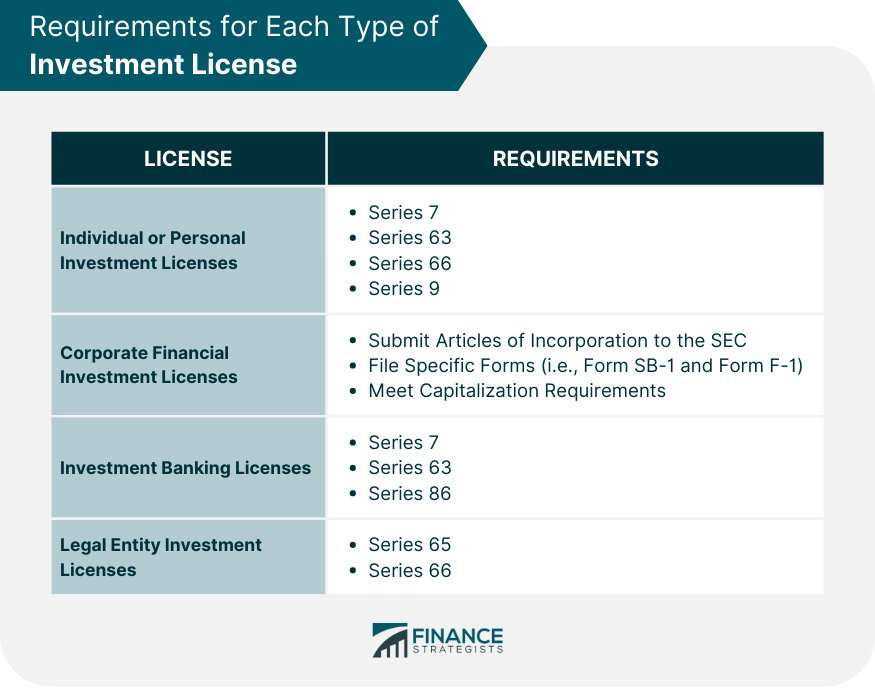

Requirements for Each Type of Investment License

Individual or Personal Investment Licenses Requirements

Corporate Financial Investment Licenses Requirements

Investment Banking Licenses Requirements

Legal Entity Investment Licenses Requirements

Final Thoughts

Investment Licenses FAQs

An investment license is the authority given to certain individuals or institutions so they can transact legally with securities. These licenses are used for approval on all types of transactions, including buying and selling securities. It also covers people who want to act as brokers in purchasing financial assets for investors.

Before you can engage in any kind of deal or transaction with securities, it must first be approved by the appropriate department. These departments are usually found within the SEC. Your application will require a specific type of investment license depending on your reason for using the security.

Securities licenses are broken down into four different types. Each of these licenses is designed to ensure that your transactions with securities meet all the necessary guidelines and regulations. These include Individual or Personal Investment, Corporate Financial Investment, Investment Banking License, and Legal Entity Investment.

Before you can apply for any securities licenses, then you will have to meet all the corresponding requirements. These include forms that must be filled out, background checks that are completed, financial reports that are submitted, etc.

Yes. It is also important to take note that investment licenses are not one and the same. Some licenses, such as individual licenses, can be obtained at a low cost for recreational use. Other places require much higher standards. For instance, in order to provide yourself with financial security and safety, you will have to apply for an investment banking license. So, if you want to avoid the trouble of applying for multiple types of licenses, then it is best that you do some research first about what they are and how they can help you with your specific needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.