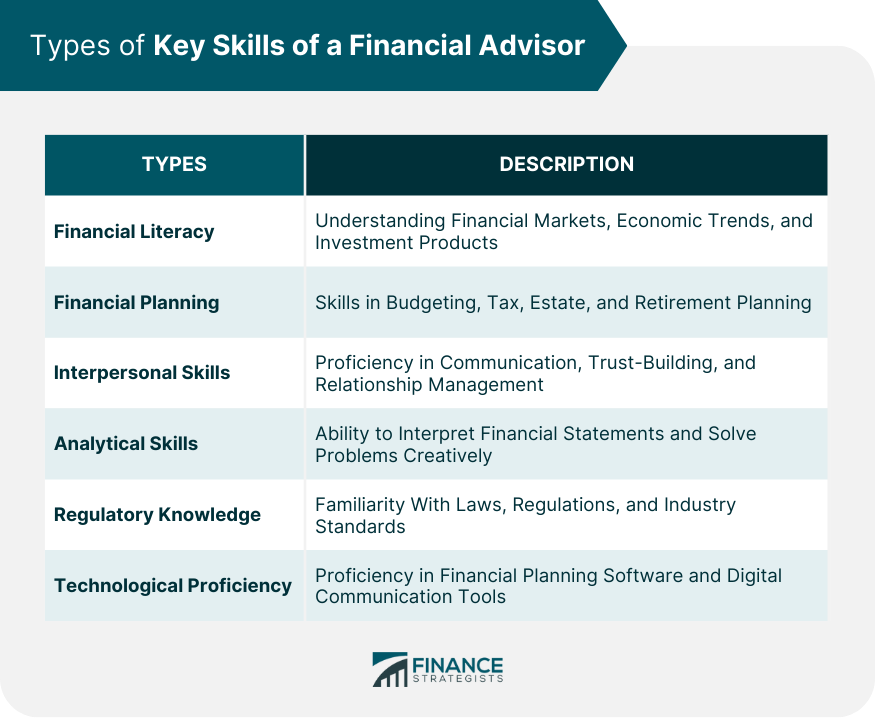

Financial advisors require a set of key skills to guide clients effectively in their financial journey. First, financial literacy is paramount, including understanding financial markets, economic indicators, and various investment products. Next, financial planning skills, like budgeting, tax, estate, and retirement planning, are crucial. Interpersonal skills play a pivotal role, especially in communication, trust-building, and relationship management. Financial advisors must articulate complex financial concepts simply and foster trust and strong relationships with clients. Analytical skills enable them to interpret financial statements and devise creative solutions to problems. Regulatory knowledge ensures compliance with laws and industry standards. Finally, technological proficiency enhances efficiency, with proficiency in financial planning software and digital communication tools becoming increasingly essential. These key skills equip financial advisors to navigate the evolving financial landscape and deliver effective advice to clients. A financial advisor should have a robust understanding of financial markets, economic indicators, and various investment products. This foundation allows advisors to make informed recommendations and help their clients navigate their financial journey effectively. Another crucial skill is financial planning, which involves proficiency in budgeting, tax, estate, and retirement planning. These skills enable the advisor to develop customized strategies for each client, ensuring they can meet their unique financial goals. Financial advisors also need to have strong interpersonal skills. This category includes communication skills, trust-building, and relationship management. These skills help build strong advisor-client relationships, as the advisor needs to communicate complex concepts clearly, act with integrity, and manage relationships effectively. The ability to interpret financial statements and creatively solve problems is also vital. Analytical skills allow advisors to understand a client's current financial health and make sound investment recommendations. Problem-solving skills come into play when identifying financial challenges and developing effective solutions. A financial advisor should also have a thorough knowledge of the laws and regulations related to the financial services industry, as well as compliance management. This ensures they perform their duties ethically and legally, protect clients' interests, and provide advice and services that comply with the law. Finally, in today's digital world, financial advisors need to be technologically proficient. This includes familiarity with financial planning software, database management systems, digital communication tools, and effective use of social media platforms. This can greatly enhance the efficiency and effectiveness of their services and help them communicate effectively with their clients and reach a wider audience. The role of a financial advisor involves more than just crunching numbers. It also involves communicating complex financial information in a way that clients can understand. They should listen attentively to their client's financial goals, needs, and concerns. Effective communication also involves the ability to explain complex financial concepts and strategies clearly and simply. The goal is to ensure clients understand their financial situation, the decisions they are making, and the potential impact of these decisions on their financial future. Trust is an essential component of the relationship between a financial advisor and their client. The clients are entrusting their hard-earned money and their financial futures to the advisor. Thus, advisors must display honesty and integrity in all their dealings. They should also ensure confidentiality. The information shared by a client with their advisor is often sensitive and personal, and advisors should treat this information with the utmost care. A financial advisor should also have strong relationship management skills. These skills include being able to maintain and strengthen existing client relationships, and also develop new ones. The ability to provide excellent service and exceed clients' expectations is crucial for client retention. Advisors should also focus on building their professional network. The stronger the network, the better they can serve their clients. This network may include accountants, lawyers, and other professionals who can provide valuable advice and services to the clients. Financial advisors need to be able to review and analyze financial statements to understand a client's current financial situation and future projections. They should be able to interpret these documents to assess a client's financial health and make sound investment recommendations. They should have the ability to assess the performance of various investments, compare them, and choose the best one based on a client's financial goals, risk tolerance, and investment timeline. Advisors need to have excellent problem-solving skills. They should be capable of identifying financial issues or challenges that a client might face and developing creative, effective solutions. Part of problem-solving also involves stress and crisis management. Financial advisors may have to handle unexpected financial crises or market downturns, and they should be able to stay calm under pressure, reassure their clients, and develop strategies to mitigate the effects of these crises. Financial advisors should have a thorough understanding of the laws and regulations related to the financial services industry. This includes understanding securities laws and the regulatory requirements of various financial institutions. This knowledge is not only important for the advisors to perform their duties legally and ethically, but it also helps them protect their client's interests and make sure they are providing advice and services in compliance with the law. Compliance with laws, regulations, and industry standards is crucial in the financial services industry. Financial advisors should always conduct themselves ethically, ensuring they adhere to both the letter and the spirit of the laws and regulations that govern their profession. This includes knowing and adhering to the best practices in their industry, such as the standards for privacy and data protection, and the ethical guidelines established by professional organizations. In today's digital age, financial advisors need to be technologically proficient. They should be familiar with financial planning software, and database management systems. The use of such tools can significantly enhance the efficiency and effectiveness of their services. In addition, technological tools can help financial advisors analyze vast amounts of data, identify patterns and trends, and make more informed financial decisions for their clients. As more clients prefer digital interactions, financial advisors should be proficient in digital communication tools. Whether it's through email, video conferencing, or social media, advisors should be able to communicate effectively with their clients using these tools. Social media platforms can also be leveraged for client engagement, providing updates on financial trends, and sharing useful financial advice. Being able to use these platforms effectively can help financial advisors reach a wider audience and engage with their clients in a more personal and convenient way. A successful financial advisor embodies a variety of key skills. Their financial literacy allows them to understand and navigate the ever-changing financial landscape, while their adeptness in financial planning ensures they can provide tailored strategies for clients' unique goals. Crucial interpersonal skills, such as effective communication, trust-building, and relationship management, underpin successful client-advisor relationships. These professionals also leverage their analytical abilities to interpret financial data, facilitate effective decision-making, and craft solutions to financial challenges. Compliance with laws and regulations safeguards both the advisors' practice and their client's interests. Finally, in an increasingly digital world, technological proficiency enhances service delivery, client communication, and engagement. Therefore, these key skills are not only beneficial, but they are also indispensable for financial advisors aiming to provide competent and comprehensive financial advice to their clients.What Are Key Skills of a Financial Advisor?

Types of Key Skills of a Financial Advisor

Financial Literacy

Financial Planning

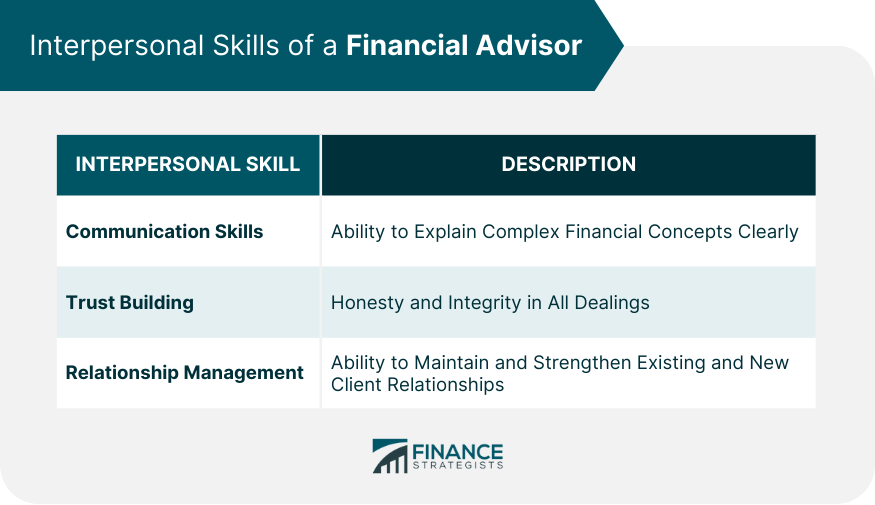

Interpersonal Skills

Analytical and Problem-Solving Skills

Regulatory Knowledge

Technological Proficiency

Interpersonal Skills of a Financial Advisor

Communication Skills

Building Trust

Relationship Management

Analytical and Problem-Solving Skills of a Financial Advisor

Financial Analysis

Problem-Solving Ability

Regulatory and Compliance Skills of a Financial Advisor

Knowledge of Laws and Regulations

Compliance Management

Technological Proficiency of a Financial Advisor

Technical Skills

Digital Communication

Conclusion

Key Skills of a Financial Advisor FAQs

The key skills of a financial advisor include financial literacy, understanding of financial planning, strong communication skills, trust-building, relationship management, and problem-solving ability. In addition, regulatory knowledge, compliance management, and technological proficiency are also crucial.

Communication skills are vital because a financial advisor must explain complex financial concepts in an easily understandable way. They need to listen to clients' financial goals, needs, and concerns effectively. The ability to communicate well ensures that clients understand their financial situations and the implications of their financial decisions.

Financial literacy is a foundational skill for a financial advisor. It includes understanding financial markets, economic trends, and various investment products. This knowledge allows advisors to make informed recommendations to clients and helps them navigate their financial journey.

Compliance management and understanding of laws and regulations are essential skills for financial advisors. They need to conduct their duties ethically and legally, protecting clients' interests and ensuring the advice and services provided comply with the law.

Technological proficiency allows financial advisors to enhance their efficiency and effectiveness. They can leverage financial planning software and database management systems to provide better service. Additionally, digital communication tools help them communicate more effectively with clients, and social media platforms can be used for client engagement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.