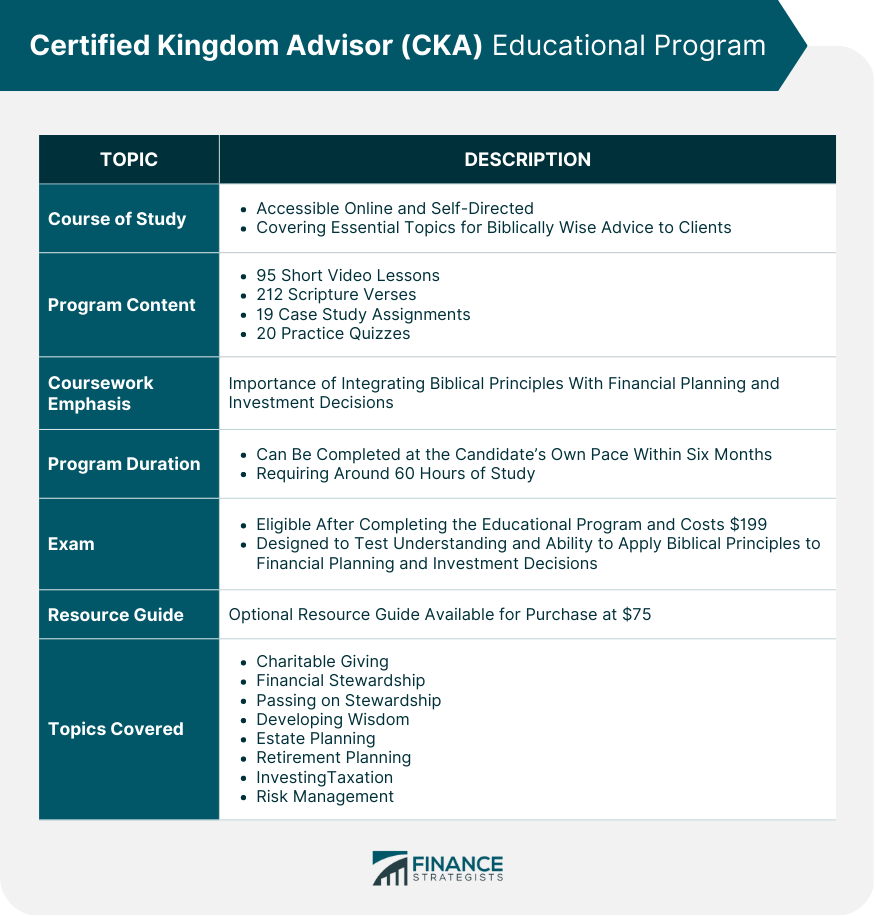

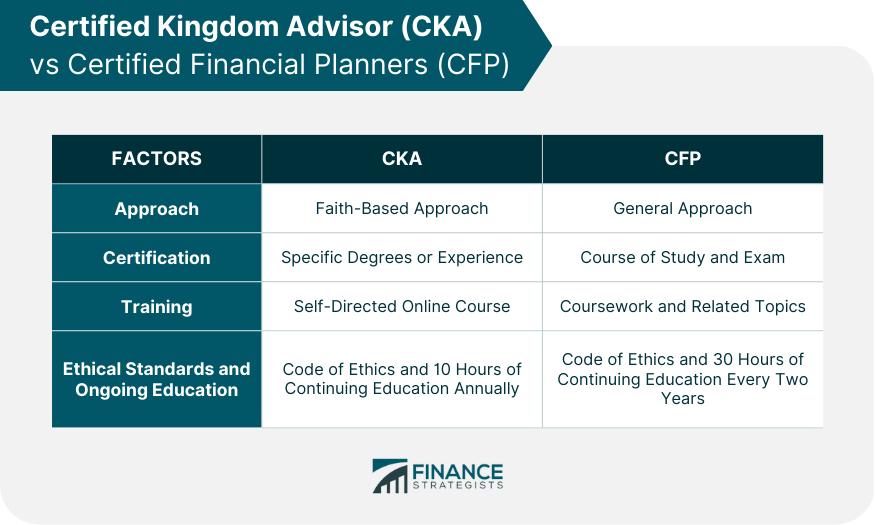

A CKA is a financial professional who has earned a certification designed for professionals serving Christian clients and taking a values-based approach to financial matters. The CKA designation is offered by Kingdom Advisors, an organization that provides advocacy, education, and networking for financial professionals who want to offer biblically wise advice to their clients. CKAs frame their financial expertise within a worldview consistent with Christian teachings, integrating biblical principles with core financial advisory training. To earn the CKA designation, financial professionals must meet a set of professional requirements that are similar to those of other financial certifications. Specifically, applicants must hold certain approved degrees or certifications such as JD, CPA, CFP, and ChFC or have at least 10 years of experience in their designated field. In addition to these professional requirements, Kingdom Advisors requires applicants to provide three letters of reference, one of which must come from a church leader. Applicants must also demonstrate their commitment to biblical stewardship and Christian values by signing a statement of faith and obtaining two client references. The CKA certification is designed for experienced professionals who are committed to offering biblically wise advice to their clients. The rigorous certification process ensures that only the most qualified professionals earn the designation. While the coursework and requirements can be time-consuming and resource-intensive, the certification provides a unique opportunity to demonstrate their commitment to integrating their faith into their practice and offering advice that aligns with Christian principles. By earning the CKA designation, financial professionals can differentiate themselves in the marketplace and demonstrate their expertise in providing biblically wise advice to their clients. The designation can also provide clients with peace of mind, knowing that their financial advisor is knowledgeable and understands their specific religious values, and can offer advice that aligns with those values. The course of study is accessible online and self-directed, making it ideal for working professionals. The program is administered by Indiana Wesleyan University and covers a range of topics that are essential for financial professionals who want to provide biblically wise advice to their clients. The CKA educational program is a self-directed online course that is designed to help financial professionals integrate biblical principles with core financial advisory training. The program includes 95 short video lessons, 212 scripture verses related to money, 19 case study assignments, and 20 practice quizzes. The video lessons are taught by experts in the field of faith-based financial planning, including Ron Blue and Kingdom Advisors’ faculty. The coursework emphasizes the importance of integrating biblical principles with financial planning and investment decisions. The program is accessible to working professionals and can be completed at their own pace within six months. Candidates are typically expected to invest around 60 hours of study in completing the program. The CKA educational program covers charitable giving, financial stewardship, passing on stewardship, developing wisdom, estate planning, retirement planning, investing, taxation, and risk management. The coursework emphasizes the importance of integrating biblical principles with financial planning and investment decisions. In addition to the coursework, candidates can purchase an optional CKA Educational Program Resource Guide for $75. The guide includes additional study resources and tips to help candidates prepare for the CKA exam. Once candidates complete the educational program, they are eligible to sit for the CKA exam, which is proctored online. The exam fee is $199. The exam is designed to test candidates' understanding of the material covered in the educational program and assess their ability to apply biblical principles to financial planning and investment decisions. CKAs provide individuals with several benefits, including: Expertise in Biblically Wise Financial Planning. CKAs have undergone rigorous training and certification to provide biblically wise advice to their clients. They deeply understand financial planning and Christian values and can help individuals make financial decisions that align with their religious beliefs. Holistic Approach to Financial Planning. CKAs take a holistic approach to financial planning by considering all aspects of an individual's life, including financial goals, personal values, and beliefs. By considering all of these factors, CKAs can help individuals create a financial plan that is tailored to their unique needs and goals. Sense of Purpose and Meaning. Faith-based financial planning can provide individuals with a sense of purpose and meaning in their financial decisions. By aligning their financial goals with their religious values, individuals can find fulfillment and contentment in their financial decisions rather than simply seeking financial gain. Peace of Mind.Working with a CKA can provide individuals with peace of mind, knowing that their financial advisor has the necessary expertise and understands and shares their religious values. This can help individuals make confident and informed financial decisions that align with their religious beliefs. If you are interested in finding a CKA, there are several resources available to help you locate one. Here are some steps you can take to find a CKA: Kingdom Advisors is the organization that administers the CKA certification process. On their website, you can search for advisors who hold the CKA designation. Simply enter your location and search criteria, and the website will provide you with a list of advisors who meet your specifications. If you have friends or family members who have worked with a CKA in the past, ask them for a referral. They may be able to provide you with valuable insights into the advisor's expertise and approach to financial planning. Many professional organizations, such as the National Association of Personal Financial Advisors (NAPFA) and the Financial Planning Association (FPA), have directories of certified financial planners, including CKAs. These directories can be helpful resources when searching for a CKA in your area. You can also conduct your own research online by searching for CKAs in your area. Look for advisors with a strong online presence, website, and social media accounts. You may also want to read reviews and testimonials from past clients to get a sense of the advisor's approach to financial planning. When choosing a CKA, it is important to consider several factors, including their experience, qualifications, and approach to financial planning. You will want to choose an advisor with the necessary expertise and experience to help you achieve your financial goals and someone who shares your values and approach to financial planning. By taking the time to research and choose a CKA, you can find an advisor who can provide you with the guidance and support you need to make informed financial decisions. When it comes to financial planning, advisors can earn several different certifications, including the CKA and the Certified Financial Planner. While both certifications demonstrate that an advisor has undergone rigorous training and has the necessary expertise to provide financial advice, they have some key differences. CKAs takes a faith-based approach to financial planning, integrating biblical principles with core financial advisory training. They emphasize the importance of financial stewardship and charitable giving and aim to help clients align their financial decisions with their religious values. In contrast, CFPs take a more general approach to financial planning, offering advice on a range of topics, including retirement planning, estate planning, taxation, and risk management. To become a CKA, applicants must have certain approved degrees or certifications, such as JD, CPA, CFP, ChFC, and CPA, or 10 years of experience in their designated field. They must also complete the CKA educational program, which includes coursework on faith-based financial planning, and pass the CKA exam. To become a CFP, applicants must complete a course of study in financial planning, including courses on retirement planning, estate planning, and taxation. They must also pass the CFP exam and meet ongoing education requirements. The CKA educational program is a self-directed online course that is designed to help financial professionals integrate biblical principles with core financial advisory training. The program includes 95 short video lessons, 212 scripture verses related to money, 19 case study assignments, and 20 practice quizzes. In contrast, the CFP course of study includes coursework in financial planning and related topics, such as investments, tax planning, and estate planning. The course of study typically takes 18 to 24 months to complete. CKAs and CFPs are held to ethical standards and must meet ongoing education requirements. CKAs must adhere to the Code of Ethics and Professional Practice Standards set forth by Kingdom Advisors and take ten hours of continuing education annually. CFPs must adhere to the Code of Ethics and Standards of Conduct set forth by the Certified Financial Planner Board of Standards, Inc. and take 30 hours of continuing education every two years. CKAs undergo rigorous training and certification and deeply understand financial planning and Christian values. They provide a holistic approach to financial planning and can help individuals create a financial plan tailored to their unique needs and goals. To find a CKA, individuals can visit the Kingdom Advisors website, ask for referrals, check with professional organizations, and conduct online research. When choosing a CKA, it is important to consider their experience, qualifications, and approach to financial planning. CKAs differ from Certified Financial Planners (CFPs) in several ways, including their approach to financial planning, certification requirements, training and education, ethical standards, and ongoing education. CKAs offer several benefits, including expertise in biblically wise financial planning, a holistic approach to financial planning, a sense of purpose and meaning, and peace of mind. Individuals can find a CKA by visiting the Kingdom Advisors website, asking for referrals, checking with professional organizations, and conducting online research. It is important to choose a financial advisor that aligns with their values and approach to financial planning.What Is a Certified Kingdom Advisor (CKA)?

Have a financial question? Click here.Certified Kingdom Advisor (CKA) Certification Requirements

What Certified Kingdom Advisor (CKA) Educational Program Covers

Why Choose a Certified Kingdom Advisor?

How to Find a Certified Kingdom Advisor

Visit the Kingdom Advisors Website

Ask for Referrals

Check With Professional Organizations

Conduct Online Research

CKAs vs Certified Financial Planners (CFPs)

Approach to Financial Planning

Certification Requirements

Training and Education

Ethical Standards and Ongoing Education

Final Thoughts

Certified Kingdom Advisor (CKA) FAQs

A CKA is a financial professional who has earned a certification designed for professionals serving Christian clients and taking a values-based approach to financial matters.

To become a CKA, applicants must have certain approved degrees or certifications or at least 10 years of experience in their designated field. They must also complete the CKA educational program, which includes coursework on faith-based financial planning, and pass the CKA exam.

The CKA educational program covers a range of topics that are essential for financial professionals who want to provide biblically wise advice to their clients. The coursework includes 95 short video lessons, 212 scripture verses related to money, 19 case study assignments, and 20 practice quizzes.

CKAs take a faith-based approach to financial planning, integrating biblical principles with core financial advisory training. In contrast, CFPs take a more general approach to financial planning, offering advice on various topics, including retirement planning, estate planning, taxation, and risk management.

You can find a CKA by visiting the Kingdom Advisors website, asking for referrals from friends and family members, checking with professional organizations, or conducting online research. When choosing a CKA, it is important to consider their experience, qualifications, and approach to financial planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.