Probate is a legal procedure through which a deceased individual's estate is administered and distributed. The probate process commences when the deceased individual's representative, known as the executor, files a petition with the probate court. The process encompasses several stages including validating the will, identifying and inventorying the estate’s assets, settling the debts and taxes, and finally distributing the assets to the heirs or beneficiaries as per the will or state law, if no will exists. Probate serves a critical role in providing a structured and lawful means of distributing a deceased individual's property. It ensures that all valid claims against the estate are settled and the remaining assets are distributed to the rightful beneficiaries. Larger and more complex estates, particularly those with a wide array of assets like stocks, real estate, personal belongings, and business interests, typically require a more intricate process of valuation, management, and distribution. These steps involve multiple tasks and parties like appraisers, realtors, and tax professionals, and hence, more time. A well-drafted and valid will can simplify probate by providing clear instructions on the distribution of assets. On the contrary, the absence of a will, or intestacy, may lead to extended probate as state laws dictate the distribution of assets, which often leads to additional legal proceedings to establish heirs and their respective shares. If the deceased owned properties or assets in different states or countries, each jurisdiction might have its own unique probate laws and processes. As such, multiple probate proceedings or an ancillary probate may be required, leading to more time-consuming and complex probate proceedings. The executor must notify all potential creditors, who are then given a specified time period to file their claims against the estate. This process can be time-consuming, especially if the deceased had significant debts or if disputes arise over the validity of the claims. Challenges to a will can stem from alleged undue influence, lack of capacity of the testator, or dissatisfaction with the division of assets. Such contests often lead to litigation, which can delay the closure of the estate by months or even years. The executor’s experience and diligence significantly influence the duration of probate. An executor unfamiliar with the probate process or one who fails to perform their duties in a timely manner can slow down the process. Depending on the court's workload, staffing, and operational efficiency, getting necessary approvals and appointments can take longer than expected. Especially in larger jurisdictions or during peak times, the courts may experience backlogs that can slow down the probate process. An extended probate process can significantly delay beneficiaries from receiving their inheritance. This can create financial hardship for beneficiaries who may be relying on their inheritance for support. The longer the probate process, the higher the potential costs. These costs can include attorney's fees, court costs, and other administrative expenses that can significantly deplete the estate’s assets. A drawn-out probate process can lead to heightened tensions and increased potential for disputes among beneficiaries, especially in situations where communication is poor or conflicts already exist. For estates that include real property or business interests, a lengthy probate process can have significant implications. For example, real estate may fall into disrepair, or business operations may be disrupted if there is uncertainty about ownership or control. This includes a well-drafted and up-to-date will, a comprehensive inventory of the deceased's assets, and any other documents related to financial matters or debts. Clear and organized estate documents not only make it easier for the executor to identify and manage the assets, but also reduce the likelihood of disputes among beneficiaries, thus saving considerable time. Appropriate beneficiary designations on specific types of assets can bypass probate altogether. This strategy primarily applies to assets such as life insurance policies, retirement accounts, and payable-on-death accounts. By correctly naming beneficiaries on these accounts, the assets can be transferred directly to the beneficiaries upon the owner's death, without going through probate. An experienced probate attorney can provide valuable guidance at every step of the process, helping avoid common pitfalls and ensuring all legal requirements are met in a timely manner. They can assist in document preparation, court filings, asset management, dispute resolution, and many other aspects of probate, all of which can contribute to a quicker and smoother process. Mediation, a form of alternative dispute resolution, involves a neutral third party who facilitates negotiation and consensus among the disputing parties. It can be a quicker, less contentious, and more cost-effective method of dispute resolution than going through litigation in court. By resolving conflicts quickly and amicably, mediation can help keep the probate process on track and avoid unnecessary delays. While probate can be long and costly in some cases, it's not always the case. The duration and cost of probate vary greatly depending on the complexity of the estate, the effectiveness of the executor, and whether there are any disputes over the will or estate. Not all assets need to go through probate. Assets such as jointly held property, life insurance or retirement accounts with a named beneficiary, and assets held in a living trust are typically exempt from probate. Even if the deceased left a will, the estate generally still has to go through probate. However, having a well-crafted will can help streamline the process. While it’s commonly assumed that spouses automatically inherit all assets, this isn't always the case. The distribution of assets depends on several factors, including whether there's a valid will, the type of property involved, and state law. Understanding why probate takes so long is crucial for those going through it or preparing for it. Factors such as the complexity of the estate, the presence of a will, geographic spread of estate assets, outstanding debts, potential disputes, the role of the executor, and court system delays all contribute to the length of the probate process. A prolonged probate process can have serious implications, including delays in beneficiaries receiving assets, increased costs, increased potential for disputes, and negative impacts on real property and business operations. To expedite probate, strategies like early document preparation, appropriate beneficiary designations, consulting with a probate attorney, and using mediation for disputes can be effective. Myths around probate, while common, can lead to misunderstandings and further complications. In sum, being informed and prepared can ease the probate process and potentially reduce the time it takes.Overview of Probate

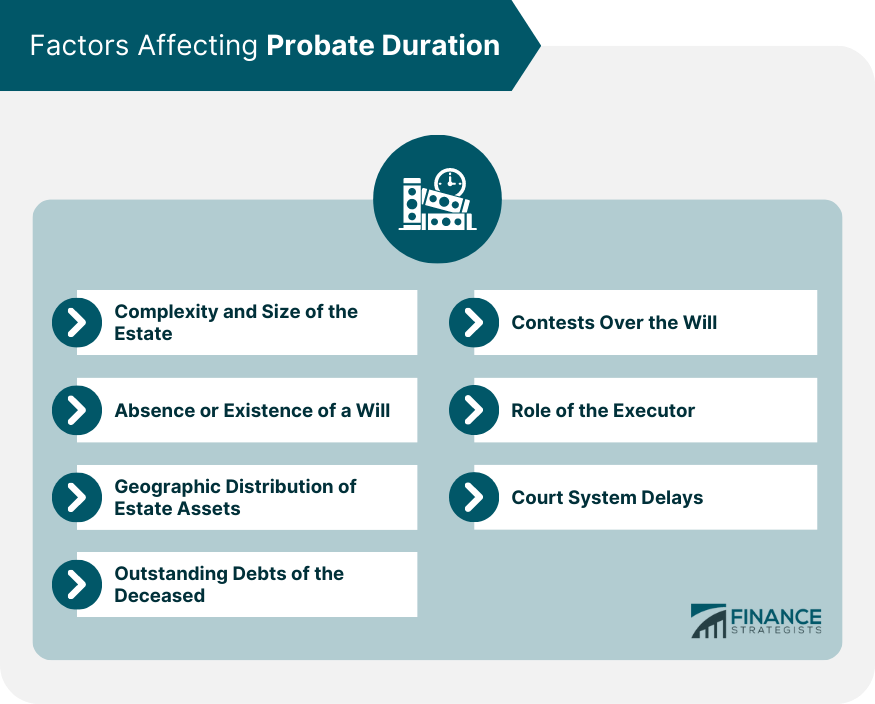

Factors Affecting Probate Duration

Complexity and Size of the Estate

Absence or Existence of a Will

Geographic Distribution of Estate Assets

Outstanding Debts of the Deceased

Contests Over the Will

Role of the Executor

Court System Delays

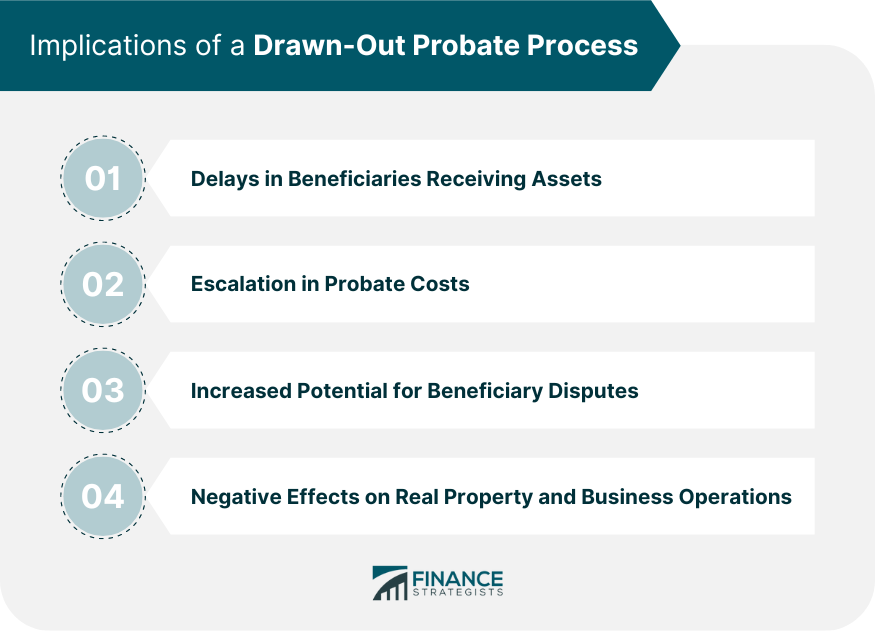

Implications of a Drawn-Out Probate Process

Delays in Beneficiaries Receiving Assets

Escalation in Probate Costs

Increased Potential for Beneficiary Disputes

Effects on Real Property and Business Operations

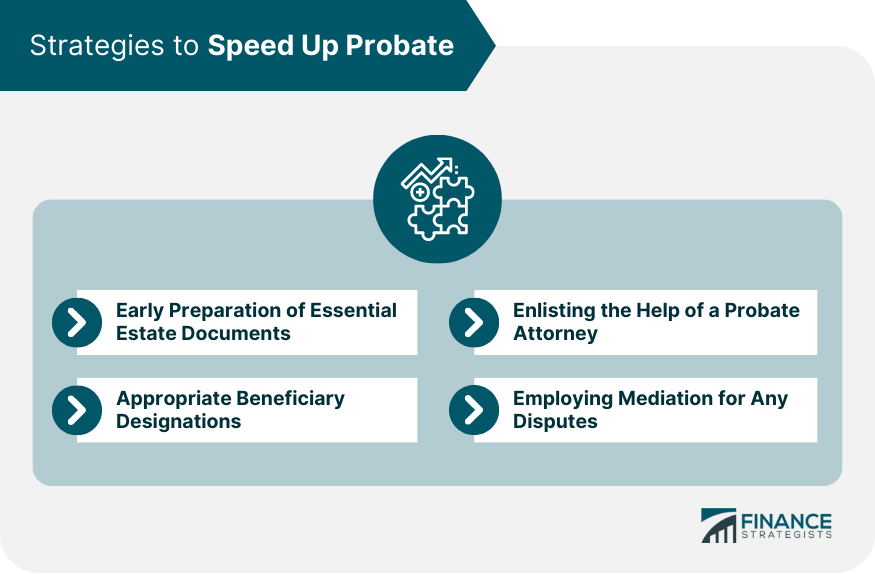

Strategies to Speed Up Probate

Early Preparation of Essential Estate Documents

Appropriate Beneficiary Designations

Enlisting the Help of a Probate Attorney

Employing Mediation for Any Disputes

Debunking Probate Myths

Myth 1: Probate Is Always Lengthy and Expensive

Myth 2: All Assets Must Go Through Probate

Myth 3: Possession of a Will Bypasses Probate

Myth 4: Spouses Automatically Inherit Everything

Final Thoughts

Why Does Probate Take So Long? FAQs

Probate can take a long time due to several factors, including the complexity of the estate, potential disputes among beneficiaries, and the court's caseload. The process involves various legal requirements, such as validating the will, identifying assets and debts, and distributing the estate, which can contribute to delays.

Yes, some common reasons for probate delays include disputes over the validity of the will, challenges to the appointed executor, difficulties in locating and valuing assets, unresolved tax issues, and disputes among beneficiaries over asset distribution.

Yes, the size of the estate can impact the duration of probate. Larger estates tend to have more complex financial holdings, numerous beneficiaries, and potential tax implications. Resolving these complexities often requires additional time and meticulous attention to ensure a fair and lawful distribution of assets.

Disagreements among beneficiaries, such as disputes over asset distribution or challenges to the executor's decisions, can significantly prolong the probate process. These conflicts may lead to litigation, requiring court involvement and potentially lengthening the time it takes to settle the estate.

While the probate process is generally dictated by legal requirements, a few steps can help streamline it. These include having a clear and valid will, maintaining well-organized financial records, promptly addressing any disputes or challenges, and working with an experienced probate attorney who can guide you through the process efficiently.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.