Yes, typically, inheritance tax is often paid during the probate process but before the final distribution of the estate to the beneficiaries. The executor or administrator of the estate, who is responsible for managing the deceased's affairs, usually handles the payment. They use the funds from the estate itself to settle any inheritance tax due. However, the specific timing can depend on several factors, including the type of assets involved, local tax laws, and the specifics of the probate process. Certain types of assets might bypass probate and, therefore, not be immediately subject to inheritance tax. Probate is the legal procedure of validating a will, assessing the estate's value, settling any debts, and distributing the remaining assets to the beneficiaries. In contrast, inheritance tax is the tax imposed on the value of assets inherited from a deceased person. The relationship between them lies in the fact that the inheritance tax is often paid during the probate process, typically before the estate's final distribution. The executor or administrator is usually responsible for this payment using the estate's funds. The purpose of this relationship is to ensure that all tax obligations are fulfilled before the beneficiaries receive their inheritance, thereby adhering to the legal requirements and maintaining fairness in the asset distribution process. 1. Locating the Will: The probate process begins with locating the deceased person's will, which outlines their wishes regarding the distribution of their assets. 2. Appointing an Executor/Administrator: An executor, as designated in the will, or an administrator, appointed by the court when there is no will, is responsible for managing the probate process. 3. Valuing the Estate: The executor or administrator must determine the total value of the deceased's estate, including all assets and liabilities. 4. Paying Debts and Taxes: Before distribution to the beneficiaries, the executor or administrator must use estate funds to settle any outstanding debts and taxes, including inheritance tax. 5. Distributing the Remaining Estate: The remaining estate is distributed to the beneficiaries as per the will or state law if there's no will. Probate serves as a crucial step in managing the transfer of assets upon a person's death. It provides legal validation to the distribution process, ensuring that the deceased's wishes are honored, and legal obligations met. Inheritance tax is customarily settled using the resources of the deceased's estate. The executor or administrator - the individual overseeing the estate's distribution - typically takes on the responsibility of paying this tax before the beneficiaries receive their portions. The computation of inheritance tax hinges on multiple factors. These include the total value of the assets to be inherited and the specific tax laws and rates applicable in the jurisdiction where the estate is being administered. Some jurisdictions may also provide specific exemptions or offer decreased tax rates under distinct circumstances, further influencing the calculation. Each jurisdiction determines its own deadlines for the payment of inheritance tax. These deadlines can vary significantly, often ranging from a few months to a year or more post the individual's death. Failure to adhere to these timelines can lead to substantial penalties. Procrastination in paying inheritance tax can trigger penalties such as accruing interest charges and additional fines. Moreover, in certain situations, such delays could impede the probate process and obstruct the timely distribution of assets to the beneficiaries, causing further complications in the estate settlement process. While the general process involves paying inheritance tax during probate, certain situations might change this order. For instance, some types of assets, such as jointly held property or life insurance payouts, might bypass probate and, therefore, might not be subject to inheritance tax. The specific laws and regulations regarding probate and inheritance tax can vary significantly between jurisdictions. These differences can affect many aspects of the process, including the order of payment, the calculation of taxes, and the penalties for non-compliance. Failure to properly manage the probate process and pay inheritance tax could have serious legal consequences, including penalties, lawsuits from creditors or beneficiaries, and even criminal charges in some cases. In addition to legal penalties, mishandling the probate process or the payment of inheritance tax could result in substantial financial losses. These could come from unnecessary tax payments, interest, and penalties, legal costs, or reduced inheritance for the beneficiaries. Given the complexities and potential consequences involved, it's often advisable to seek legal advice when dealing with probate and inheritance tax. A knowledgeable lawyer can help navigate the process, ensure compliance with all legal requirements, and minimize the tax burden on the estate. For executors, preparation can include getting an early start on valuing the estate, planning for tax payments, and understanding all legal obligations. For beneficiaries, it can be beneficial to understand the process and to communicate effectively with the executor or administrator. The processes of probate and inheritance tax are closely intertwined, with inheritance tax generally being paid during probate before the final distribution of assets. Understanding this relationship is crucial, as it aids in ensuring the accurate fulfillment of tax obligations and an equitable transfer of assets. Navigating these complexities, from the valuation of the estate to understanding jurisdictional variations and potential exemptions, demands due diligence and a clear comprehension of legal requirements. Failure to appropriately handle these tasks can lead to severe legal and financial repercussions. Therefore, expert legal advice can be invaluable, offering guidance throughout the process, ensuring legal compliance, and potentially reducing the tax burden. Thus, for executors and beneficiaries alike, understanding and effectively managing the probate process and inheritance tax obligations are essential steps toward a smooth, fair, and lawful inheritance process.Do You Pay Inheritance Tax Before Probate?

Relationship Between Probate and Inheritance Tax

Understanding the Process of Probate

Steps Involved in Probate

Importance of Probate in the Process of Inheritance

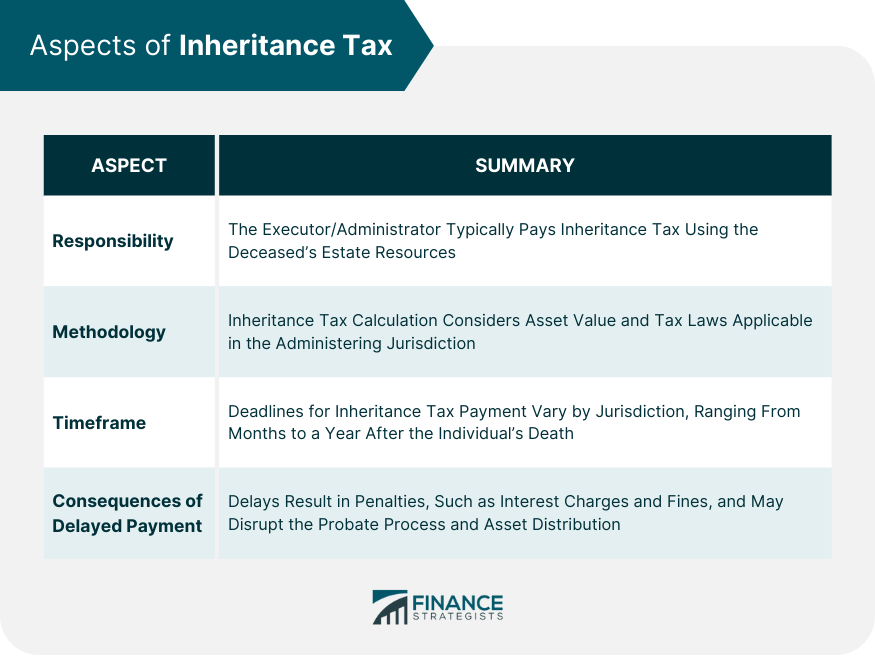

Inheritance Tax: Obligations and Responsibilities

Responsibility for Inheritance Tax Payment

Methodology Behind Inheritance Tax Calculation

Timeframe for Inheritance Tax Payment

Consequences of Delayed Inheritance Tax Payment

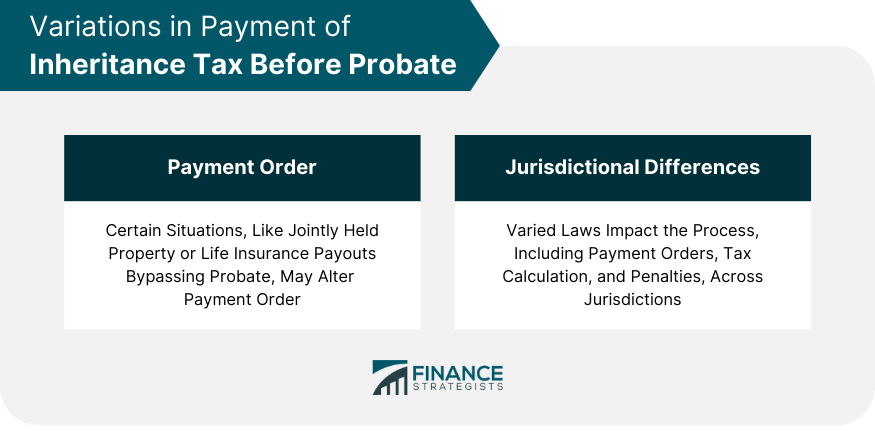

Exploring Exceptions and Variations

Circumstances That May Change the Order of Payment

Impact of Local and State Laws

Legal and Financial Consequences of Not Adhering to the Process

Possible Legal Implications

Financial Repercussions

Practical Advice and Expert Tips

Importance of Legal Advice

Tips for Executors and Beneficiaries

Conclusion

Do You Pay Inheritance Tax Before Probate? FAQs

Probate is a legal process that involves validating a deceased person's will, appraising the estate, paying off debts and taxes, and distributing the remaining assets to the beneficiaries. Inheritance tax, on the other hand, is a tax levied on the value of the property inherited from a deceased person, typically paid by the person inheriting (beneficiary) or from the estate itself.

The executor or administrator of the estate usually pays the inheritance tax. The funds for this tax are often taken from the estate itself before the remaining assets are distributed to the beneficiaries.

Failure to pay the inheritance tax within the prescribed deadline can result in penalties, including interest charges and additional fines. In severe cases, it could also delay the probate process and distribution of assets to the beneficiaries.

Yes, there can be exceptions. For example, certain types of assets, like jointly held properties or life insurance payouts, might not go through probate and, therefore, might not be subject to inheritance tax. Also, local and state laws can cause variations in the process.

The process of managing probate and paying inheritance tax can be complex, with serious legal and financial consequences if mishandled. Therefore, seeking legal advice can help navigate the process, ensure compliance with all legal requirements, and potentially minimize the tax burden on the estate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.