UTMA accounts are custodial accounts that allow adults to transfer assets to minors without the need to establish a formal trust. These accounts are designed to provide a straightforward and cost-effective way to transfer assets to minors while ensuring they are managed responsibly until the minor reaches the age of majority. UTMA was created to expand upon the Uniform Gifts to Minors Act (UGMA), providing a more flexible framework for transferring various types of assets to minors. The purpose of UTMA is to simplify the process of transferring assets to minors while ensuring they are managed prudently by a designated custodian. UTMA accounts are established in the name of a custodian who holds the assets on behalf of the minor beneficiary. The custodian has a fiduciary duty to manage the assets in the best interests of the minor until the account terminates and the assets are transferred to the beneficiary. UTMA accounts offer a wide range of investment options, including stocks, bonds, mutual funds, and real estate. This flexibility allows custodians to build a diversified investment portfolio tailored to the minor's needs and financial goals. The custodian of an UTMA account has the authority to make investment decisions, manage the assets, and use the funds for the benefit of the minor. The custodian must act prudently and in the best interests of the minor when making these decisions. Income and gains generated by UTMA accounts are typically taxed at the minor's tax rate. However, some portion of the income may be subject to the "kiddie tax," which taxes unearned income at the parent's tax rate, depending on the age of the minor and the amount of income generated by the account. UTMA accounts terminate when the minor reaches the age of majority, which varies by state. At this point, the assets in the account are transferred to the beneficiary, who then assumes full control over the assets. One key difference between UTMA and UGMA accounts is the age at which the accounts terminate. UTMA accounts generally terminate at a later age than UGMA accounts, providing custodians with more time to manage the assets on behalf of the minor. While UGMA accounts are limited to certain types of assets, such as cash, stocks, and bonds, UTMA accounts allow for a broader range of assets, including real estate, art, and intellectual property. Not all states have adopted UTMA, and some still use UGMA as their governing legislation for custodial accounts. It is important to understand the laws in your state when considering an UTMA or UGMA account. UTMA accounts provide an effective way for adults to set aside assets for the future financial needs of minors, such as education expenses or a down payment on a home. By transferring assets to an UTMA account, individuals can reduce the size of their taxable estate and potentially minimize estate tax liability. UTMA accounts can be used to save for a minor's educational expenses, providing a flexible alternative to other savings vehicles, such as 529 plans. The assets in UTMA accounts can be used for any purpose that benefits the minor, including education expenses, medical bills, and everyday expenses. This flexibility allows custodians to manage the account in a way that meets the minor's unique needs and financial situation. Assets held in UTMA accounts can impact a minor's eligibility for financial aid, as they are considered when determining the Expected Family Contribution (EFC) for college funding. Once assets are transferred to an UTMA account, they become the property of the minor beneficiary, and the transfer cannot be revoked. This can limit the flexibility of the transferor in managing their assets. UTMA accounts rely on the custodian to manage the assets in the best interests of the minor. In some cases, custodians may misuse the funds or fail to act in the minor's best interests, highlighting the importance of carefully selecting a custodian and regularly monitoring the account's management. UTMA accounts can be established at most financial institutions, including banks, credit unions, and investment firms. It is important to research the different options available and choose a reputable institution that offers competitive fees and investment options. The custodian of an UTMA account must be an adult over the age of 18 and cannot be the minor beneficiary. It is important to choose a trustworthy and responsible custodian who is committed to managing the assets in the best interests of the minor. The custodian of an UTMA account has the responsibility to invest and manage the assets in a way that is prudent and in the best interests of the minor. This may involve diversifying the investment portfolio, regularly monitoring the account's performance, and making adjustments as needed. Custodians of UTMA accounts are responsible for reporting any income or gains generated by the account to the IRS and may be required to file a tax return on behalf of the minor. UTMA accounts provide a flexible and cost-effective way to transfer assets to minors, allowing adults to provide for the financial needs of minors while ensuring responsible management of the assets until the minor reaches the age of majority. UTMA accounts offer a wide range of investment options, tax advantages, and estate planning benefits. UTMA accounts are an important tool in financial planning for minors, allowing adults to set aside assets for their future needs and providing a flexible way to manage and invest those assets. While UTMA accounts offer many benefits, it is important to weigh the potential drawbacks, including the impact on financial aid eligibility and the irrevocable nature of transfers. By carefully considering these factors and choosing a reputable custodian, adults can effectively manage UTMA accounts and provide for the financial needs of minors.What Are Uniform Transfers to Minors Act (UTMA) Accounts?

Key Features of UTMA Accounts

Custodial Ownership

Investment Options

Control and Management by the Custodian

Taxation of UTMA Accounts

Termination of the Account

Differences Between UTMA and UGMA Accounts

Age of Termination

Assets Allowed in UTMA and UGMA Accounts

State Adoption of UTMA and UGMA

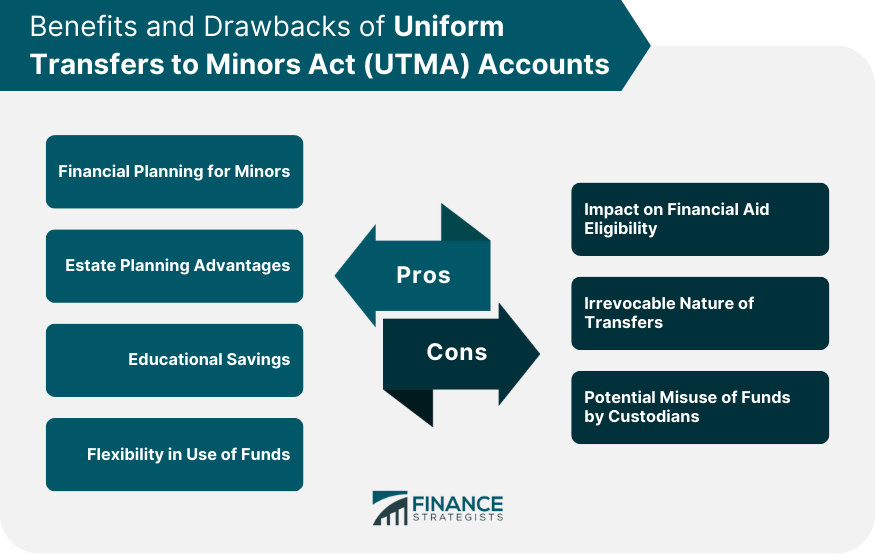

Benefits of UTMA Accounts

Financial Planning for Minors

Estate Planning Advantages

Educational Savings

Flexibility in Use of Funds

Potential Drawbacks of UTMA Accounts

Impact on Financial Aid Eligibility

Irrevocable Nature of Transfers

Potential Misuse of Funds by Custodians

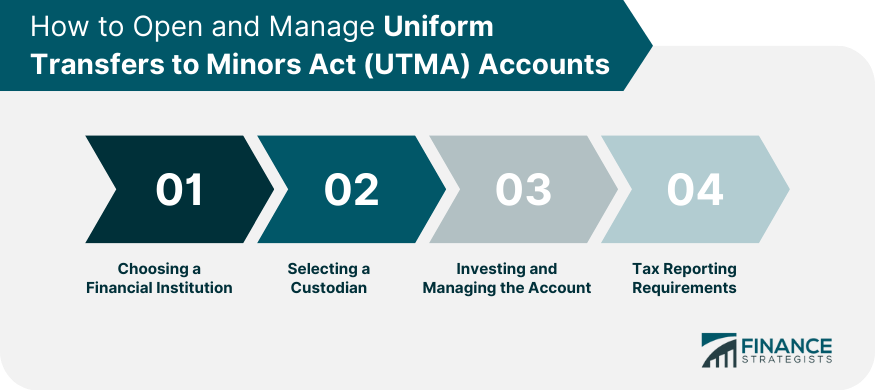

How to Open and Manage an UTMA Account

Choosing a Financial Institution

Selecting a Custodian

Investing and Managing the Account

Tax Reporting Requirements

Conclusion

Uniform Transfers to Minors Act (UTMA) Accounts FAQs

A UTMA account is a custodial account established under the Uniform Transfers to Minors Act. It is a way for adults to transfer assets, such as money or securities, to minors without the need for a trust or other complex legal arrangements. The assets in the account are managed by a custodian until the minor reaches the age of majority in their state.

Any adult can establish a UTMA account for the benefit of a minor, such as their child or grandchild. The adult must transfer the assets to the account and name a custodian to manage the assets until the minor reaches the age of majority.

UTMA accounts provide a simple way to transfer assets to minors without the need for a trust or other complex legal arrangements. The assets in the account are managed by a custodian, who has a fiduciary duty to act in the best interests of the minor. Once the minor reaches the age of majority, they gain control of the assets in the account.

One limitation of a UTMA account is that the assets in the account become the property of the minor once they reach the age of majority, which is typically 18 or 21 depending on the state. This means the minor can use the assets for any purpose they choose, even if it is not what the adult intended. Additionally, the assets in the account may impact the minor's eligibility for financial aid for college.

A UTMA account can hold any type of asset that can be legally transferred to a minor, such as cash, stocks, bonds, and real estate. However, it is important to consider the tax implications of transferring certain assets, such as appreciated securities, as the minor may be responsible for paying taxes on any gains when they sell the assets. It is recommended that individuals consult with a financial advisor or tax professional before establishing a UTMA account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.