A co-signer's primary role is to back the borrower's financial obligation, making their credit score a pivotal consideration for lenders. Typically, a co-signer is expected to have a credit score of 700 or higher, reflecting their financial reliability and creditworthiness. However, the exact score requirement can differ depending on the lender and the nature of the loan. For substantial commitments like mortgages, a co-signer might even need a superior score. Moreover, the co-signers credit score serves as a testament to their ability to manage debt and make timely payments. As a result, lenders perceive high-scoring co-signers as an added layer of security, increasing the likelihood that the loan will be repaid without complications. Certainly, co-signing a loan has direct implications for the co-signer's credit profile. When you co-sign, the loan is recorded on both the primary borrower's and co-signer's credit reports. As a result, the management of that loan—whether good or bad—affects both parties. Timely payments can positively reflect on the co-signer's credit score. However, any missed payments or defaults by the primary borrower will also negatively impact the co-signer's credit rating, potentially reducing their score and tarnishing their credit history. Moreover, co-signing increases the co-signers credit exposure, influencing their credit utilization ratio, which is especially relevant for revolving credits like credit cards. An elevated credit utilization or outstanding debt can affect the co-signers perceived creditworthiness. Additionally, the initial loan application itself often involves a hard inquiry on the co-signer's credit report, which might cause a temporary dip in their credit score. Therefore, while co-signing is a gesture of trust and support, it carries tangible financial responsibilities and risks for the co-signer. A co-signer serves as a safety net for lenders when they are evaluating a loan application from a borrower who may not have a strong credit history or sufficient income. Here's a detailed look into the pivotal role of a co-signer: The primary role of a co-signer is to act as a guarantor for the loan. If the borrower fails to make timely repayments, the co-signer is legally obligated to cover the outstanding amounts. This means that the co-signer promises the lender they will ensure the loan gets repaid, one way or another. Often, potential borrowers might have low credit scores or a thin credit file, making it hard for them to obtain loans. Introducing a co-signer with a strong credit score and a robust credit history can make the borrower more attractive in the eyes of lenders. Essentially, the co-signer’s creditworthiness can help offset the borrower's financial weaknesses. From the lender's perspective, having a co-signer reduces the risk associated with the loan. Two people are now accountable for the borrowed amount instead of one. This double assurance makes lenders more confident in recovering their money, even if the primary borrower defaults. With a co-signer on board, borrowers might be able to negotiate better loan terms. Given the reduced risk for lenders, they might offer lower interest rates or more flexible repayment terms, benefiting the primary borrower. It's crucial for co-signers to understand that co-signing isn't just a signature on paper. It's a commitment. The loan they co-sign will appear on their credit report, and their score will be affected by how the loan is managed. If the borrower manages the loan well, it can reflect positively on the co-signer's credit report. Conversely, any missed payments or defaults will negatively impact the co-signer's credit score. When considering a co-signer for a loan, lenders will scrutinize several key aspects to ensure that the co-signer is financially capable of backing the borrower. Here's a breakdown of the main requirements a co-signer must fulfill: While requirements can vary by lender and loan type, a co-signer is generally expected to have a credit score of 700 or above. Some high-value loans or premium credit products may demand even higher scores for co-signing. Proof of Income: Lenders want to ensure that the co-signer has a consistent source of income to cover loan repayments if needed. This can be proven with recent pay stubs, tax returns, or employment verification letters. Debt-to-Income Ratio: It's not just about earning money but also how much of it is already committed to other debts. Lenders will assess the co-signer's DTI ratio. Financial Statements: Bank statements or other financial documents might be requested to provide a clearer picture of the co-signer's financial health and spending habits. Primary ID: This could be a government-issued photo ID, such as a driver's license or passport. It establishes the co-signer's identity. Secondary ID: Some lenders might require a second form of identification, like a Social Security card or birth certificate, for added verification. Residential Proof: This is to confirm the co-signer's current address. Commonly accepted documents include utility bills, lease agreements, or mortgage statements. If you can't find a willing co-signer, there are several alternatives to consider and steps to take to secure a loan or improve your financial standing: Credit Unions: These are member-owned financial institutions that often have more flexible lending criteria than traditional banks. Joining a credit union might increase your chances of getting a loan without a co-signer. Online Lenders: Some online lenders specialize in working with individuals who have limited or challenged credit histories. Do thorough research, read reviews, and ensure you're not falling for predatory lending tactics. Secured loans require collateral—like a car or property—against the borrowed amount. These loans present less risk to lenders since they can take possession of the collateral if you default. Because of this reduced risk, they may be more accessible without a co-signer. If you're trying to build or rebuild credit, start with a secured credit card. These cards require a security deposit, which usually determines your credit limit. Responsible usage and timely payments can help boost your credit score over time. If you can't secure a loan now, take steps to improve your creditworthiness: Regularly Check Your Credit Report: Ensure there are no errors or discrepancies that might be pulling down your score. Pay Bills On Time: This is the simplest way to positively impact your credit score. Reduce Debt: Try to lower your debt-to-income ratio by paying off existing debts, which can make you a more attractive borrower in the future. A financial counselor or advisor can offer tailored advice on improving your credit and financial health, making it easier to secure loans in the future without needing a co-signer. Co-signers play a crucial role in the lending process, acting as a safety net for borrowers with weak credit histories or insufficient income. For lenders, the co-signer's credit score is a pivotal consideration, with a typical requirement of 700 or higher, though it can vary based on the loan and lender. Co-signing has direct implications for the co-signer's credit profile, as the loan appears on both their and the primary borrower's credit reports. While co-signing provides support and may lead to better loan terms, it comes with tangible financial responsibilities and risks. Any missed payments or defaults by the primary borrower will negatively impact the co-signer's credit rating. Understanding the role and requirements of a co-signer and carefully managing the associated financial responsibilities can lead to successful loan outcomes and a stronger credit profile for both parties involved.What Credit Score Does a Co-signer Need?

Does Co-signing Affect Your Credit?

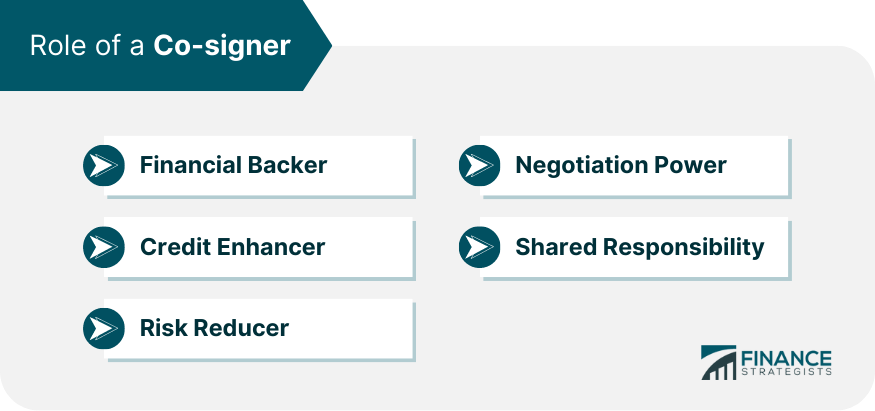

Role of a Co-signer

Financial Backer

Credit Enhancer

Risk Reducer

Negotiation Power

Shared Responsibility

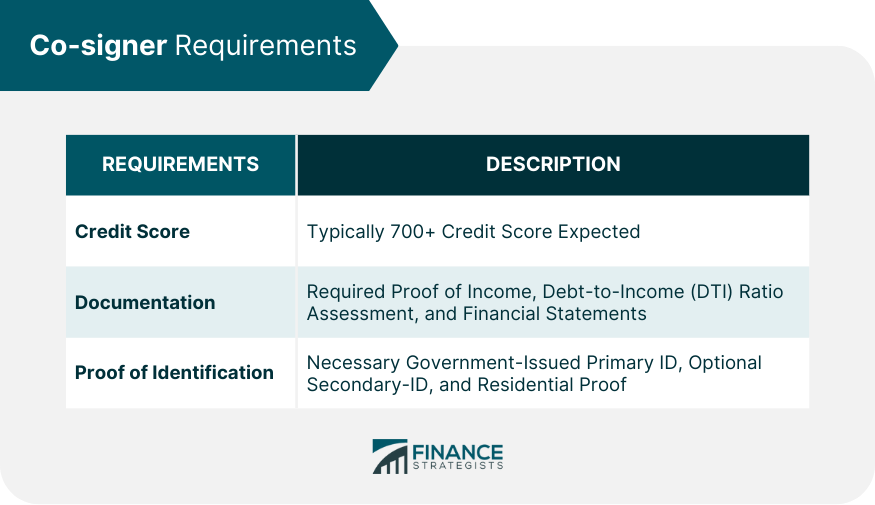

Co-signer Requirements

Credit Score

Documentation

A lower DTI (typically below 35%) indicates that the co-signer has a good balance between income and existing debt.Proof of Identification

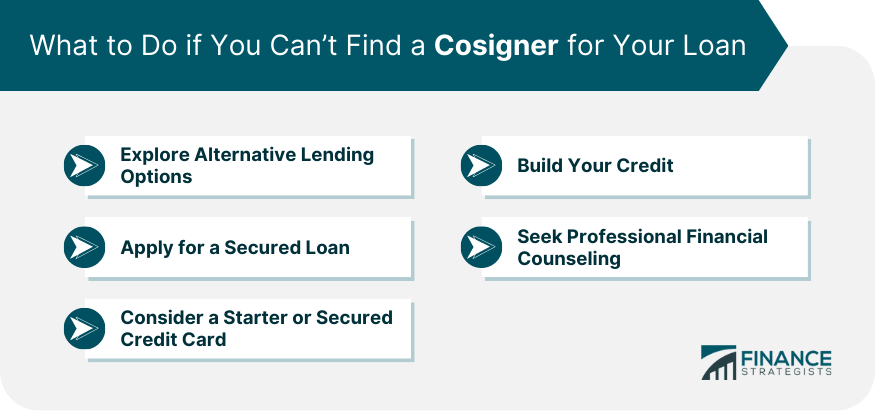

What to Do if You Can’t Find a Cosigner for Your Loan

Explore Alternative Lending Options

Apply for a Secured Loan

Consider a Starter or Secured Credit Card

Focus on Building Your Credit

Seek Professional Financial Counseling

Conclusion

What Credit Score Does a Co-signer Need? FAQs

A co-signer typically needs a credit score of 700 or higher, but it can vary depending on the lender and loan type.

Some lenders may accept co-signers with slightly lower credit scores, but it's generally recommended to have a score of at least 700.

Yes, for substantial commitments like mortgages, a co-signer might need a superior credit score than the typical 700 requirement.

Yes, co-signing has direct implications for the co-signer's credit profile. The loan will appear on their credit report, and missed payments by the borrower can negatively impact their score.

A co-signer with a strong credit score and credit history can make the borrower more attractive to lenders, increasing the chances of loan approval and potentially securing better loan terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.