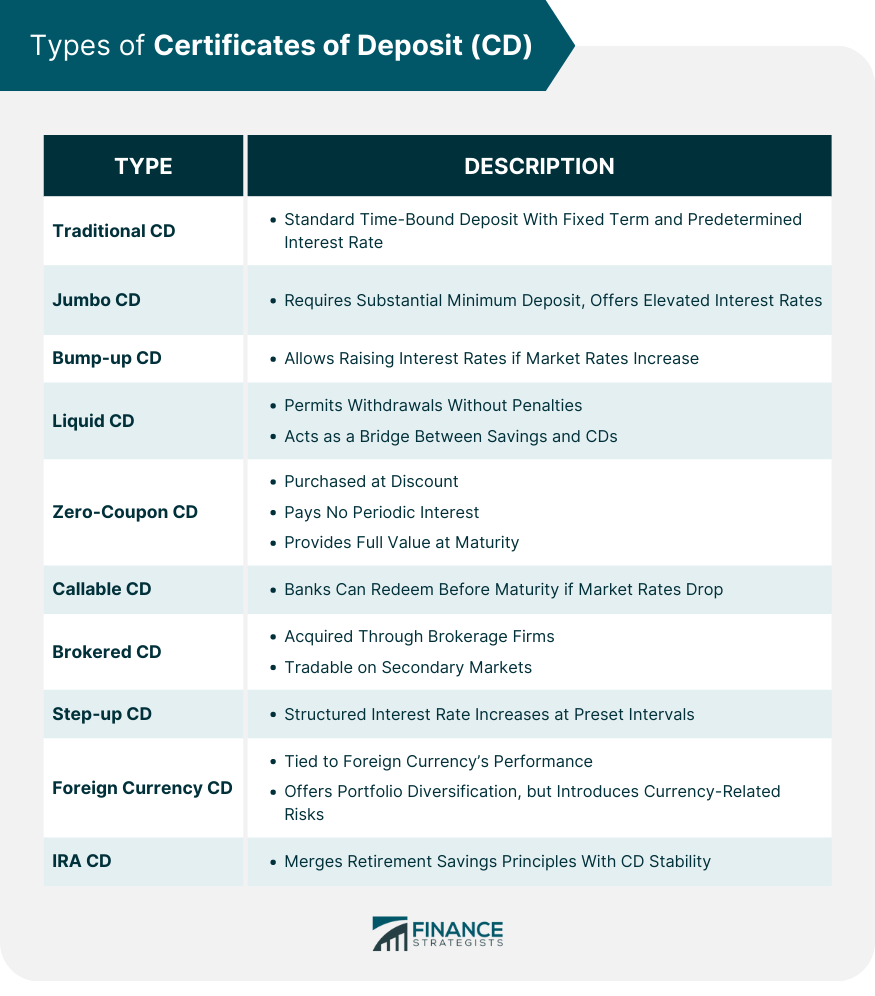

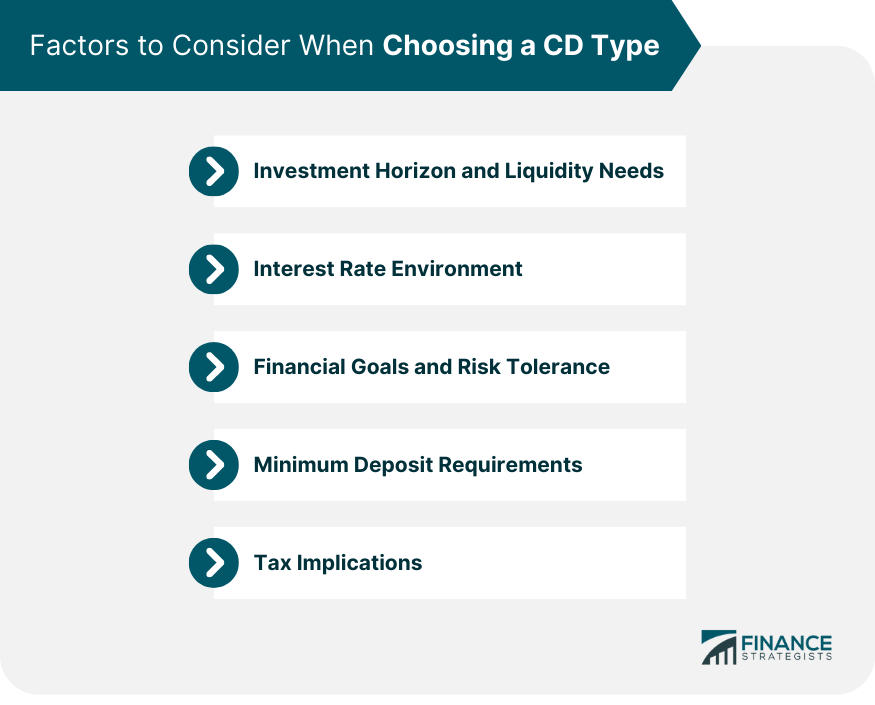

A Certificate of Deposit, commonly referred to as a CD, represents a financial product offered by banks and credit unions where an individual agrees to deposit a specified sum of money for a predetermined period. In exchange, the financial institution guarantees a fixed interest rate on the deposited amount for the duration of the term. Upon maturity, the individual receives both the initial deposit and the accrued interest. CDs play a crucial role in both banking and personal finance. For banks, they act as a stable source of funds, allowing institutions to invest or lend the pooled money further, driving economic activities. For individual investors, CDs offer a low-risk investment avenue. They serve as a tool for preserving capital while earning a predictable return, making them especially attractive during volatile market conditions or for those nearing retirement. Furthermore, their varied types and terms provide flexibility, allowing individuals to tailor their investments according to their financial goals and risk appetite. Each type of CD offers unique benefits and potential drawbacks, so investors should evaluate their financial goals, risk tolerance, and market conditions before making a choice. The Traditional CD is a standard, time-bound deposit tool where funds are deposited for a fixed term, earning a predetermined interest rate. It's one of the most common savings instruments provided by banks and credit unions. This CD type offers a reliable and predictable return on savings, often presenting higher interest rates than regular savings accounts. Its straightforward nature makes it easy for most investors to understand and incorporate into their portfolios. However, access to the funds is restricted until the maturity date, and withdrawing before this time typically incurs penalties. This could limit an investor's financial flexibility in case of unforeseen expenses. A Jumbo CD is characterized by its substantial minimum deposit requirement, often starting at $100,000 or more. In return, it typically provides an elevated interest rate compared to smaller deposit CDs. The significant deposit leads to higher interest earnings, and these CDs sometimes come with additional perks or services from the bank. Their large denominations can also make them attractive for wealth management and estate planning purposes. However, the high minimum deposit requirement can tie up substantial sums of money, limiting opportunities for diversification. Additionally, like other CDs, there are penalties for early withdrawals. Bump-up CDs grant investors the option to raise their interest rate during the CD's tenure if market rates increase. This feature is typically limited to once or twice during the term. These CDs provide a safeguard against being locked into a lower rate when market rates are climbing. They offer a blend of predictability and adaptability, making them suitable for uncertain interest rate environments. However, the starting interest rates for Bump-Up CDs are generally lower than those of Traditional CDs. Additionally, if market rates don't rise significantly, investors might miss out on better long-term rates elsewhere. The Liquid CD is a variation that permits one or more withdrawals during its term without incurring standard penalties. This contrasts with most CDs where early access to funds attracts penalties. It offers increased financial flexibility, allowing savers to address unexpected financial needs. It's a fusion of growth and accessibility, often acting as a bridge between regular savings and fixed-term CDs. However, in exchange for the added flexibility, Liquid CDs usually offer lower interest rates than more restrictive CD types. This can result in lesser earnings over the same period. Purchased at a significant discount to its face value, the Zero-Coupon CD pays no periodic interest but instead provides the full value (principal + imputed interest) at maturity. It mirrors the mechanics of zero-coupon bonds. These CDs can be ideal for individuals targeting a specific future financial need or goal, capitalizing on the compound interest effect. They're also simple to manage as there's no need to reinvest periodic interest payments. However, without periodic interest payouts, investors don't receive a steady income stream. Additionally, even though the interest is paid at maturity, the imputed interest might be taxable annually. The Callable CD comes with a provision that allows the issuing bank to "call" or redeem the CD before its scheduled maturity date. This is often executed when prevailing market interest rates drop below the CD's rate. They typically offer a higher initial interest rate to attract investors and compensate for the callable feature. This can lead to better short-term yields compared to other CD types. The primary risk is the CD being terminated before its original maturity date, which can disrupt an investor's financial plans. Also, if called, reinvestment might be at lower prevailing market rates. Acquired through brokerage firms rather than directly from banks, Brokered CDs can be traded on secondary markets. They're more flexible in terms of availability and tenure. The potential for liquidity before maturity is a distinct advantage, as they can be sold on secondary markets. Their rates and terms can be more varied, offering potential opportunities for higher yields. However, they're subject to market-driven price fluctuations, which can affect their value. Investors also need to consider broker fees and the creditworthiness of multiple issuers. The Step-up CD promises a structured increase in interest rates at preset intervals throughout its term. For example, the interest might rise annually over a five-year period. Investors gain the advantage of potentially higher interest rates in the future, aligning with positive market shifts. It provides an automatic adjustment mechanism without needing to shift funds or renegotiate terms. However, the starting interest rates are usually lower than fixed-rate CDs, betting on anticipated future rate hikes. If market rates don't increase as expected, these CDs might underperform compared to fixed-rate alternatives. This CD is tied to the performance of a foreign currency, contrasting with the standard U.S. dollar-based CDs. Its value will fluctuate based on currency exchange rates. Investors get a chance to tap into the potential of foreign currency appreciation, diversifying their portfolio beyond domestic assets. In favorable exchange rate scenarios, returns can be significant. However, currency markets can be volatile, and the risk of currency devaluation is real. This introduces a layer of complexity and unpredictability, making it suitable for investors with a higher risk tolerance. This type of CD is held within the tax-advantaged framework of an Individual Retirement Account (IRA). It combines the principles of retirement savings with the stability of a CD. It offers dual advantages of potential tax benefits and the stable growth associated with CDs. This can be a strategic tool for retirement planning, especially for conservative investors. However, access to funds is generally restricted until retirement age, with penalties for early withdrawals from the IRA. This makes it less flexible compared to other CD types, tying up funds potentially for decades. Here are five important factors to consider when deciding on the type of CD that's right for your financial needs. Investment Horizon and Liquidity Needs: Consider how long you're willing to leave your money invested without accessing it. If you anticipate needing the funds in the near future, opt for shorter-term CDs or those with more flexible withdrawal options, like Liquid CDs. Interest Rate Environment: Understanding the current and predicted direction of interest rates can guide your CD choice. If rates are expected to rise, Bump-Up or Step-Up CDs could be beneficial. Financial Goals and Risk Tolerance: Align your CD choice with your overall financial objectives and comfort level with risk. If you're risk-averse, traditional or IRA CDs might suit you, while those comfortable with currency fluctuations might explore Foreign Currency CDs. Minimum Deposit Requirements: Assess your available funds and compare them to the minimum deposit requirements of various CD types. Jumbo CDs, for instance, require a substantial initial deposit. Tax Implications: Some CD types, like Zero-Coupon CDs, have unique tax implications even if you don't receive the interest income until maturity. Always factor in tax considerations when estimating the net return on your investment. A Certificate of Deposit (CD) is a pivotal financial tool with diverse types and benefits. CDs offer stability for banks, enabling economic growth, while providing low-risk investment opportunities for individuals. Traditional CDs provide a reliable return, while Jumbo CDs cater to substantial deposits and Bump-up CDs balance adaptability and predictability. Liquid CDs offer flexibility, Zero-Coupon CDs target specific goals, and Callable CDs come with interest rate call options. Brokered CDs offer market tradeability, Step-up CDs align with rising rates, and Foreign Currency CDs diversify portfolios. IRA CDs combine tax benefits with retirement planning. Factors like investment horizon, interest rates, financial goals, risk tolerance, minimum deposits, and tax implications should guide CD selection. Choosing the right CD aligns financial strategies with individual preferences, contributing to sound and diversified investment portfolios.What Is a Certificate of Deposit (CD)?

Types of Certificates of Deposit (CD)

Traditional CD

Jumbo CD

Bump-up CD

Liquid CD

Zero-Coupon CD

Callable CD

Brokered CD

Step-up CD

Foreign Currency CD

IRA CD

Factors to Consider When Choosing a CD Type

Conclusion

Types of Certificates of Deposit (CD) FAQs

There are several types of Certificates of Deposit (CD) including Traditional CDs, Jumbo CDs, Bump-up CDs, Liquid CDs, Zero-Coupon CDs, Callable CDs, Brokered CDs, Step-up CDs, Foreign Currency CDs, and IRA CDs.

A Traditional CD is a standard time-bound deposit with a fixed term and predetermined interest rate. It offers predictable returns and is easy to understand, but access to funds is limited until maturity.

A Jumbo CD requires a substantial minimum deposit (often $100,000 or more) and offers higher interest rates than regular CDs. It's suitable for larger investments but limits diversification opportunities.

A Bump-up CD allows investors to raise their interest rate during the CD's term if market rates increase, offering a blend of predictability and adaptability.

A Zero-Coupon CD is purchased at a discount and provides no periodic interest. It pays the full value at maturity, ideal for specific financial goals but lacking regular income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.